Retirement Tips from World-Famous Authors to Live Happily Ever After

Want a long, secure and joyful retirement? Take inspiration from some of your favorite writers. Here are 10 strategies renowned authors use when writing their books that can help you along the way to the retirement you’ve dreamed of.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

This is a story about dreams and money.

After all, financial planning starts with one personal question: What is your vision of an ideal life? To rewrite that question in more affecting way: What would you most regret not having done if you were to die tomorrow?

In the book The Top Five Regrets of Dying, Bronnie Ware writes the most common regret of patients she has spoken with was: “I wish I’d had the courage to live a life true to myself, not the life others expected of me.”

What story do you ultimately want to tell about your life? What events and characters would make up your idea of a “rich life”?

Maybe you’ve dreamed of visiting every continent or opening your own business after you retire. Or maybe you dream of finally sitting down to write that book you’ve been thinking about for years.

You might be on to something there, because there’s a lot we can learn from the habits of notable authors who excel in the craft of telling stories. Read on to discover 10 quirky writing methods famous authors are known for and see how following their lead can help you build your wealth and craft a happy retirement.

1. Commit to a Consistent Schedule

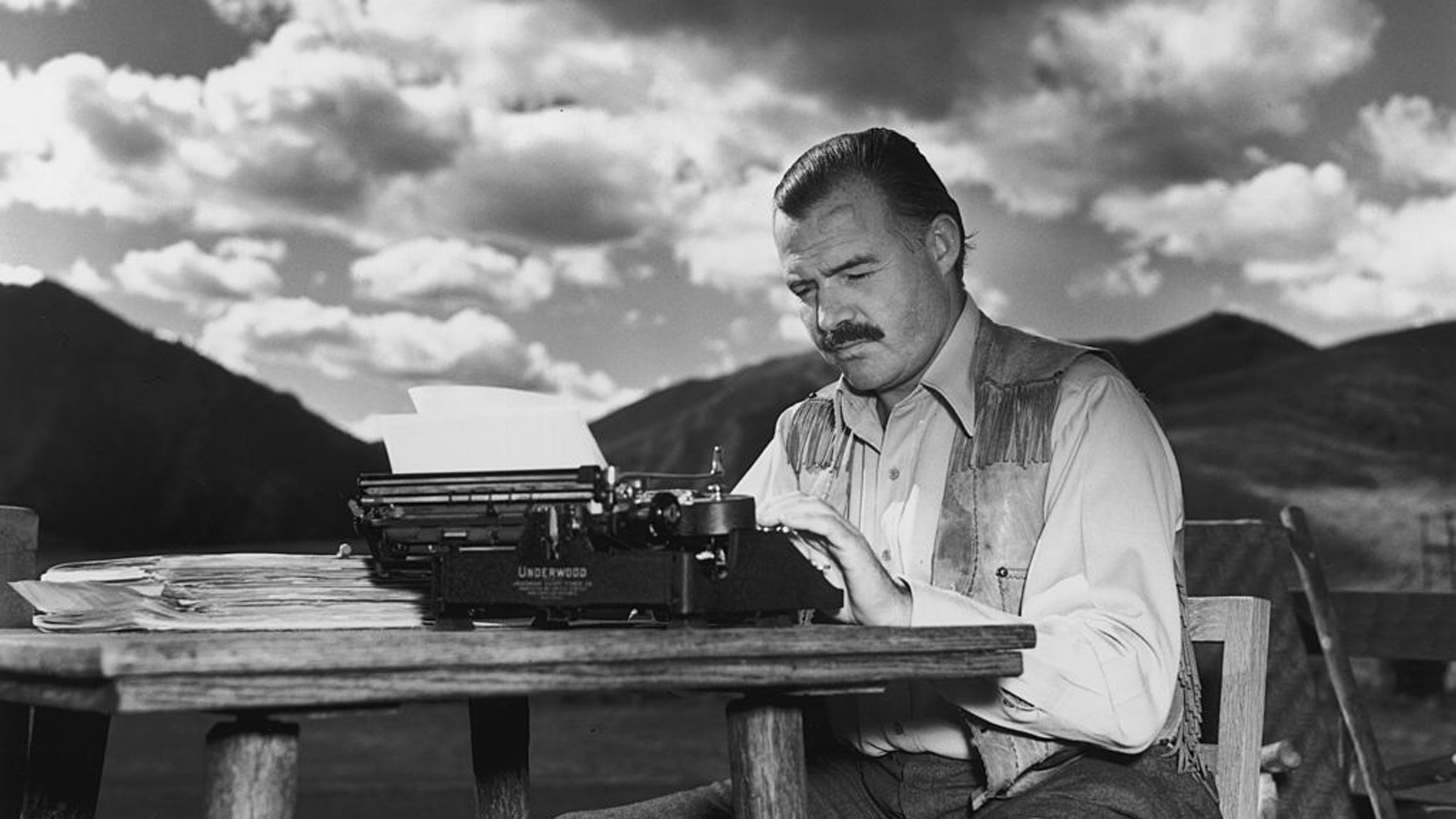

When working on a novel, the author Haruki Murakami wakes at 4 a.m. and writes for five to six hours every day. Ernest Hemingway was a morning writer, too, toiling at his standing desk until he could put 500 good words down on the page. Stephen King aims for 2,000 words.

What separates good writers from bad isn’t so much talent as it is consistency. Good writers show up to work whether inspiration strikes or not.

E.B. White put it this way: “A writer who waits for ideal conditions under which to work will die without putting a word on paper.”

The moral of the story: There are no shortcuts. Consistency is also a necessary part in creating the financial conditions for pursuing your dreams. You can’t just bank on a large financial windfall to become financially independent and time rich.

Taking consistent financial steps is the only proven method that works for everyone. Consider that Americans who follow a financial plan have almost double the savings than those without a plan ($460,000 average savings vs. $239,000), according to TD Ameritrade’s Goal Planning Survey.

2. Make It a Priority

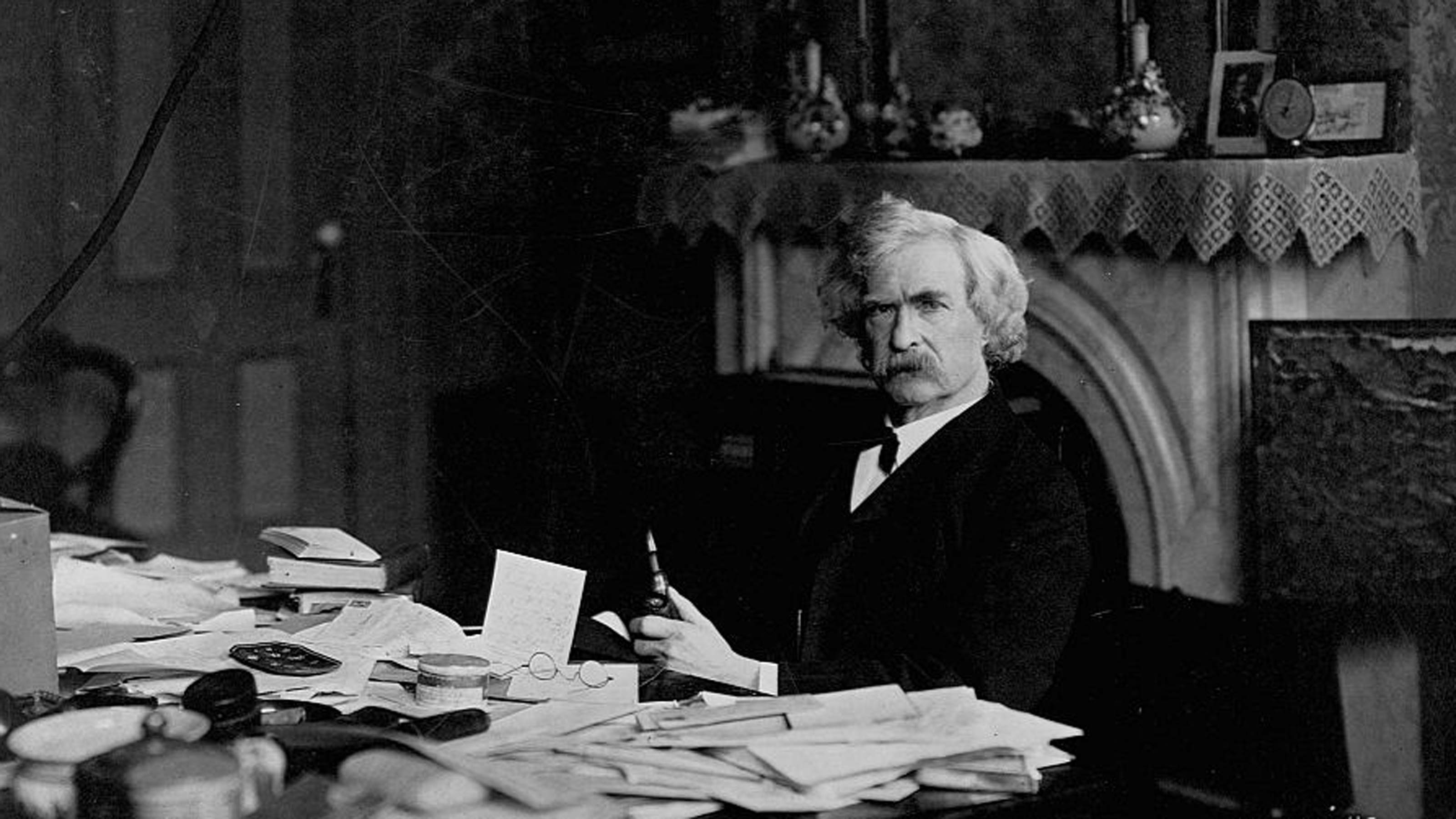

It’s not a coincidence many household-name writers worked in the morning. They prioritized writing over all other daily distractions. Mark Twain, for example, woke up early, ate a large breakfast and then worked without interruption until dinner. Should his family need something, they blew a loud horn to call him.

The moral of the story: Whatever you’re passionate about should be relatively nonnegotiable. Of course, that’s challenging when you have a family, full-time job, other interests, etc.

The trick is to prioritize. Track how you spend your time and money, then reallocate them based on what matters most to you. That could even mean adjusting your lifestyle — driving a less fancy car, moving closer to your office or switching to a more flexible job.

Such a calculated approach allows you to focus your finite resources on the things you truly value, which can lead to an improved quality of life. In a study from the University of Arizona, people who followed a budget and were more conscious of their spending reported higher levels of happiness and less stress.

Simply put, what you value and genuinely know makes you happy is worth making a priority.

3. Optimize Your Efforts

With any big dream, it helps to have some luck. But taking care of the things you can control goes a long way toward success.

In every city Maya Angelou lived, she rented a hotel room nearby for the sole purpose of writing in an undisturbed space. Neil Gaiman, as told on the Tim Ferris podcast, works under a self-imposed rule that he can sit down at his desk and write or do nothing else other than stare out the window. Eventually writing becomes more attractive than watching grass grow.

Paradoxically, restrictions often unleash your creativity. It’s all about implementing controls that put you in the right mindset and keep you focused.

The moral of the story: Whatever your dream, think of ways you could optimize your efforts. And apply the same tactics to your money. One method is taking yourself out of the equation by automizing your finances. For example, automatic deductions from your paycheck into a retirement account and/or savings account.

One study compared 401(k) participants and found target-date investors could potentially realize up to 50% more retirement wealth relative to non-target date investors over a 30-year time period. Essentially, being restricted in their investment decision-making kept target-date investors from making costly mistakes, such as choosing the wrong asset allocation at the wrong time.

4. Don’t Start Without a Story Idea

Nobel Prize winner Toni Morrison, speaking of her writing process, said, “I always know the ending; that’s where I start.”

When you know where you want to go, you can develop the actions to get you there. In a novel, it’s the characters, scenes, themes, etc., that all lead to your catharsis and conclusion.

The moral of the story: The story you want to tell about your life should guide your choices. How else can you make the right decisions if you don’t know what outcome you’re working toward?

Which is why you shouldn’t make financial decisions without first establishing financial goals. They determine how much money you need, when you need it, how much risk you can take, and so on.

Open-ended conclusions are acceptable in literature, but not so much when it comes to your money.

5. Keep It Simple

You won’t find many books about writing that don’t include Mark Twain’s famous rule: Don’t use a five-dollar word when a fifty-cent word will do.

Good writing is clear and concise. Yet many aspiring writers think they must write flowery prose on the level of Shakespeare or Proust. This notion of perfection though can do more harm than good.

The moral of the story: Take it from American novelist Anne Lamott, who said: “I think perfectionism is based on the obsessive belief that if you run carefully enough, hitting each stepping-stone just right, you won’t have to die. The truth is that you will die anyway and that a lot of people who aren’t even looking at their feet are going to do a whole lot better than you, and have a lot more fun while they’re doing it.”

It is a relevant metaphor for many things we do.

Case in point: investing. Who wouldn’t want a perfect portfolio that earns a maximum return every time? The problem is that chase for perfection, unless you can predict the future, will inevitably set you up for failure.

A Morningstar study found the average investor underperformed the funds they invested in over multiple 10-year periods. It was a result of chasing performance. Many investors succumb to greed and fear, buying high and selling low. Whereas, setting a diversified asset allocation and just sticking to it can produce better results over time.

6. Develop Your Own Voice

One of the most important qualities of a writer is their voice. It encompasses the way you put words together and your outlook of the world. It is what makes your writing stand out.

A writer’s voice is wholly unique. So, it’s not worth trying to write in the same voice of another writer.

It’s equally as unproductive to compare your success to others. Prolific short story writer and novelist Joyce Carol Oates put it this way: “Writing is not a race. No one really ‘wins.’ The satisfaction is in the effort, and rarely in the consequent rewards, if there are any.”

The moral of the story: You may share dreams or goals with others, but all our situations are unique. If you are constantly comparing your life to others, you could find yourself on the dreaded hedonic treadmill. Always striving for bigger and better to keep up.

Consider that personal savings rates remain lower than a few decades ago. A paper from a team of economists posits one significant contributor is the propagation of media. We are now more exposed than ever to how other people spend money. Subsequently, we spend more and save less.

7. Be Patient

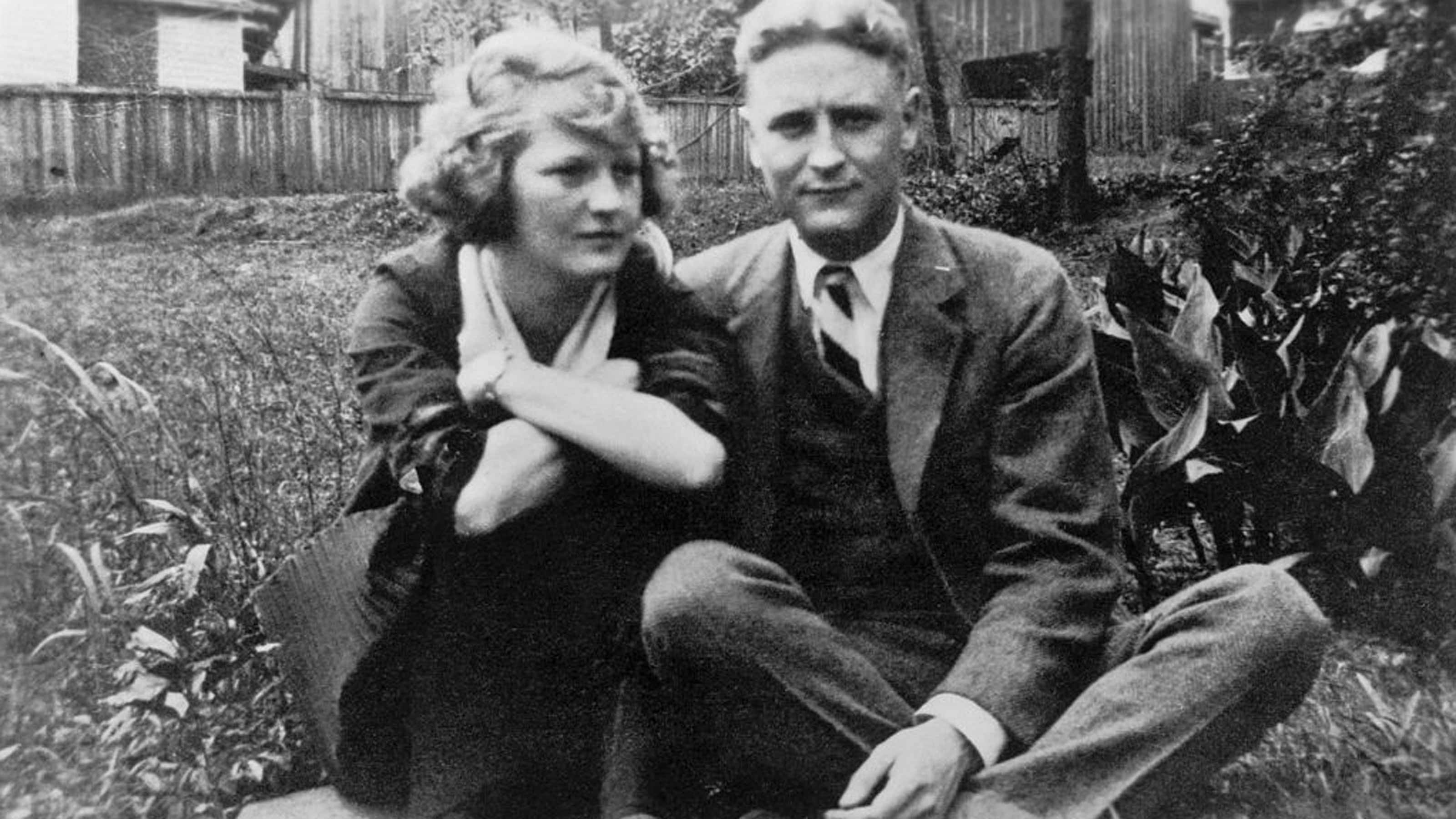

F. Scott Fitzgerald’s great American novel, The Great Gatsby, took 2½ years to write. J.K. Rowling worked on the first Harry Potter book for six years. Meanwhile, J.R.R. Tolkien spent 16 years writing The Lord of the Rings.

Rarely are masterpieces created in a day. So be patient and use your time wisely.

The moral of the story: Time is a powerful tool, especially when working toward long-term goals. Your skills can improve, your habits can sharpen. For building your financial resources, the effect of compounding cannot be overstated. The money you invest can earn and return, and that return can earn and return, and so on. This snowball effect can produce exponential growth over time, if you remain patient and disciplined with your portfolio.

8. Never Think It’s Too Late

Raymond Chandler was 51. Annie Proulx was 57. Frank McCourt was 66. These are the ages each respective author published their first book. The point is that it’s never too late to get started.

If you have a dream, there are ways to make it possible.

The moral of the story: Even people who are behind on saving for retirement can get there. You can delay Social Security, work a few years longer and start maxing out your retirement accounts. Hypothetically, you could start saving at age 50, maximize your 401(k) with catch-up contributions and end up with more than $1 million by age 70 (assuming an 8% annual return).

9. Live a Life Worth Writing About

Some writers are known to carry around pocket-sized notebooks or index cards to write down daily observations that could be used in a story. Life is rich with inspiration, if you know where to look.

It could be argued then that the more enriching your personal experiences, the greater the material you’ll have for writing a book. Essentially, your well-being is improved by what you do rather than what you own. Research suggests people feel more satisfied and happier when spending money on experiences than material things.

The moral of the story: Pursuing experiences that are worth writing about is money well spent.

Listen to writer Colum McCann: “Step out of your skin. Risk yourself. This opens up the world. Go to another place. Investigate what lies beyond your curtains, beyond the wall, beyond the corner, beyond your town, beyond the edges of your own known country.”

10. Remember What’s Really Important: Relationships

Writing is a solitary endeavor. But publishing a book is a group effort. To make it all possible, you generally have to rely on the efforts of a publisher, editor, publicist, booksellers and, of course, readers. Not to mention supportive spouses and family who give you the space to chase your dreams.

Whatever you dream of doing, don’t neglect the people around you. It is through the company we keep that we find the most meaning in life.

As Lydia Denworth, author of the book Friendship, told The Wall Street Journal about a major Harvard happiness study tracking the lives of men from age 20 to 80: The best predictor of their health and happiness by age 80 was not their wealth or careers. It was their relationships at age 50.

The moral of the story: The fact is time with your loved ones is a limited resource. You can never earn it back. All the books you’ve written, accolades you’ve received, places you’ve gone, will mean little without the people you love.

Ultimately, creating a plan can increase the chances of turning your dreams into reality. And the things you do in your financial life can help facilitate that.

Part of the financial planning process is to put your dreams to paper.

So, what would you most regret not having done if you were to die tomorrow?

Now, start writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.