Retirees Can Live Comfortably for Under $2,000 a Month in This Charming Country

This Central American country offers stability, urban amenities and a chill lifestyle for ex-pats. It's also wildly affordable.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Panama may not be at the top of most retirees' favorite destinations. However, Americans searching for a retirement port of call should look closer at the Latin American country that serves as a “crossroads of culture” connecting North America to South America.

Why Panama? First, its track record is excellent; a survey by Expat Insider found that Panama was the most popular country among expats for a second year in a row. Second, travel and retirement experts point to this country's unique geographical setting. At its narrowest point, the Isthmus of Panama separates the Pacific Ocean from the Caribbean Sea. Yet Panama connects more than it separates, and it's more than happy to welcome American retirees.

“Panama is a great living option because it has warm weather, friendly communities, and a lower cost of living than many U.S. cities,” says Melissa Harms, a travel expert and founder of the Everyday Family Travel blog. “The Pensionado program offers some great financial perks, but what really makes Panama special is the mix of modern conveniences and cultural experiences families can enjoy together. Spots like Boquete and Coronado have strong expat communities, good schools, and many outdoor activities, making it easier for retirees and their families to adjust and feel at home.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Retired Americans living in Panama

Americans who have moved to Panama say they’ve never looked back.

“I moved from Dallas, Texas, to Panama in 2010 and found a home here,” says Jackie Lange, owner of Panama Relocation Tours, a local travel and real estate company that started when Lange’s real estate friends visited. She had to hire a bus to drive them around.

After 15 years in the country, Lange views Panama as an ideal landing spot for US retirees.

“Panama is a favored destination for retirees for many reasons,” Lange says. “Panama uses the US dollar [in addition to the Panamanian balboa], so there’s no exchange rate. Plus, the cost of living in Panama is much less than the US, and there are no hurricanes.”

In Panama, Lange says retirees can pick their ideal temperature based on the elevation.

“At the coast, it's about 90 degrees, on average,” she notes. “Yet for every 1,000-foot increase in elevation, the temperature drops four degrees. I live in Boquete, in the highlands, where you don't need an air conditioner or a heater. The $20 electric bills are nice.”

As with any foreign country, look up its U.S. Government travel warnings before you go. In the case of Panama, the State Department recommends avoiding parts of the Mosquito Coast and the Darién region due to crime. According to the 2024 Global Peace Index, however, Panama is more peaceful than the U.S., so there's no need to be alarmed.

An inside look

As a retiree or someone nearing their post-working years, is Panama a great landing spot? Here’s a closer look at the country and the potential upsides and downsides of making the country your retirement home.

Health care in Panama

The most pressing healthcare issue for older US ex-pats when retiring in Panama is getting health insurance.

“For example, if you have pre-existing conditions, like high blood pressure, Panama insurance will exclude the existing condition for at least two years and then only cover it at 50% thereafter,” Lange says. “And if you are over 74, most health insurance companies will not write a new policy. And if you’re diabetic, you cannot get Panama health insurance.”

Fortunately, retirees can easily use the nation’s public health system.

“There’s no monthly fee, age restrictions, or pre-existing condition restrictions,” Lange notes. “It's $2 to see a doctor or $5 for a specialist.”

Medicare Advantage also covers urgent care and emergencies at private hospitals. “Some hospitals offer direct billing with the Medicare Advantage insurance company,” Lange adds. “But some hospitals require you to pre-pay and then file your own claim.”

Panama’s medical centers offer good, quality service. “Plus, they cost much less than U.S. private hospitals,” says Paul Fournier, a travel writer and Founder of Journey Compass, an in-depth, online travel guides platform. “In Panama City, for instance, you’ll find some of the best, and many doctors speak English, so communication isn’t a problem.”

Medicare Advantage is likely the best bet for a U.S. retiree seeking health care in Panama, but it’s likely not enough.

“Advantage may offer great emergency coverage for stays outside the U.S. for either six months or up to one year,” says Wes Chapman, Founder of Fortende Health, a Medicare plans advisory firm that specializes in helping retirees who spend time outside the U.S. navigate healthcare benefits. “Many Medicare Advantage plans offer excellent coverage for emergency care and 'in-network' rates for participating beneficiaries, but once you’re stabilized in the hospital, if you are moved to inpatient or require advanced care, you risk significant financial exposure.”

That means getting additional healthcare coverage. “Consider GeoBlue for post-ER and continued inpatient and advanced care if you don’t intend to pay out of pocket,” Chapman says.

How to get a retirement visa in Panama

Retiring in Panama isn’t just about saving money — it’s about enjoying a better lifestyle.

“The low cost of living, warm weather, and amazing views make it a top choice for U.S. retirees,” Fournier notes. “Panama’s Pensionado Visa program makes moving there simple and even gives retirees discounts on daily expenses, which makes life more affordable.”

The program is beneficial for saving on healthcare, transportation, and entertainment.

“After five years, it also gives retirees permanent residency, which makes settling down much easier,” Fournier adds.

U.S. Retirees can get a Pensionado Visa if they make at least $1,000 monthly in lifetime income (Social Security). “You can add $250 for your spouse,” Lange says. “When you apply, you’ll initially receive a temporary visa. But within six months, you'll get your permanent visa, which allows you to live in Panama indefinitely.”

Once you get your permanent visa, you qualify for specific Pensionado discounts, such as 50% off on recreation and entertainment, including movies, theaters, and sports; 50% off hotels Monday through Thursday (30% off on weekends); and 30% off public transportation like buses, trains, and boats. “You can also get 25% off on airfare to anywhere in the world,” Lange notes. “You’ll also get 20% off restaurants, 25% off electrical, telephone, and water service, and 20% off doctors and specialists, among other perks.”

If moving costs are a concern, the Pensionado visa offers any incoming citizen tax-free importation of household goods up to $10,000, tax-free importation of a vehicle, or tax-free purchase of a local vehicle. “You’ll still have to pay fees to import a car,” Lange notes. Those fees can cost $2,000 and upward.

Panama has a low cost of living

Price-wise, Panama is an affordable destination for both remote workers and retirees.

Depending on location, rental prices for a two-bedroom home usually range between $750 and $1,500 per month, while purchasing one ranges between $150,000 and $300,000.

“Eating out is affordable too,” says Wayne Kask, a Tampa, Fla.-based travel writer and the founder and CEO of Discover West Central Florida. “You can get a nice meal for about $15 to $25. Monthly groceries usually cost around $300, and utilities usually max out at $200 per month, or much less.”

U.S. retirees can catch further tax breaks when relocating. “Panama doesn’t tax foreign-earned income, so your U.S.-based earnings stay untouched,” Harms says.

While Panama’s cost of living is low, retirees should plan ahead financially before moving.

“Devise a budget accounting for potential currency fluctuations and consider opening a local Panamanian bank account,” says Joe Cronin, President of International Citizens Insurance in Boston, Mass. (Cronin has spent 20-plus years helping expatriates and travelers make sound financial decisions while moving and traveling abroad.) “Retirement savings can be further utilized by obtaining additional services through the Pensionado Program.”

Best places for retirees in Panama

Your Panama landing spot depends on whether you favor those urban amenities in Panama City, prefer beach living, or want a slower pace and cooler weather inland.

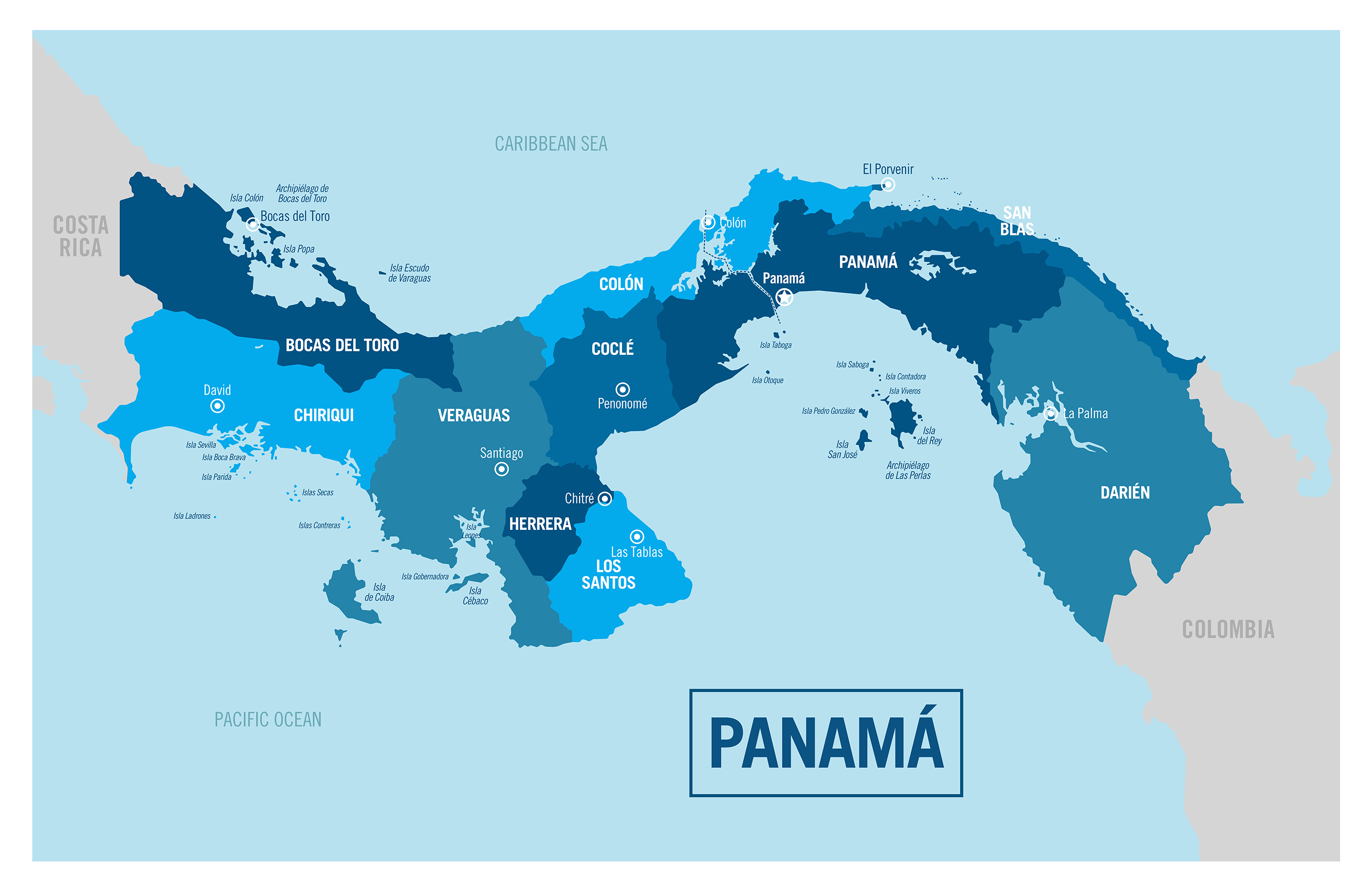

If it’s the latter, Harms advises checking out three locations: Pedasí, in the Los Santos province; Santa Fe, in the Varaguas Province; and El Valle de Antón, in Coclé province.

“Affordable housing and a relaxed atmosphere characterize Santa Fe, a sleepy mountain hamlet,” she says. “Beautiful scenery, a wealth of outdoor activities, and a friendly community make El Valle a great place to call home. Families seeking a gentler pace by the sea will love Pedasí, a quaint seaside town with a laid-back vibe.”

Big city living is available, too.

“Panama City is a thriving, modern metropolis with an impressive skyline, fine dining, and cultural attractions, while the historic Casco Viejo district offers charm with its cobblestone streets and colonial architecture,” says Victoria Levitam, managing partner at the real estate company The Agency Panama. “For those seeking more exclusivity, areas like Punta Pacifica and Santa Maria provide high-net-worth individuals with luxury residences, top-tier amenities, and excellent healthcare.”

Island living is also available in Panama, with cool breezes and stunning views.

Sited on a man-made island in the Pacific, “Ocean Reef Islands offers a unique island lifestyle with a private marina featuring over 150 moorings up to 60 meters, just minutes from Panama City," according to Levitan. "Pearl Island provides a pristine barefoot luxury escape with more than seven beaches and 60 islands to explore,” Levitam adds. “Both developments offer retirees an exceptional maritime lifestyle, with direct access to world-class fishing.”

Non-stop direct flights to and from the US at Panama City’s Tocumen International Airport on major airlines like Delta, United, and Panama’s Copa Airlines make it easy to connect with major cities like Atlanta, New York City, Chicago, and many more,

“I just took a non-stop 4-hour flight from Panama City to Austin, Texas,” Harms says.

More On Where To Retire Abroad

- Where to Retire 2025: Puerto Rico

- Where to Retire: Living in Portugal as a US Retiree

- Where to Retire: Living in the Dominican Republic

- Retire in Thailand, Where 'The White Lotus' Was Filmed

- Retire in New Zealand for Lush Landscapes and a Relaxed Vibe

- Retire in Italy for Culture and Beauty

- Retire in Greece for Relaxed Living With a Cinematic Backdrop

- How To Manage Retirement Savings When Living Abroad

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

A former Wall Street bond trader, Brian O’Connell is the author of two books: “The 401k Millionaire” and “CNBC’s Creating Wealth.” He's written for national finance publications such as TheStreet.com, CBS News, The Wall Street Journal, U.S. News & World Report, Forbes, Fox News and others. With 20 years of experience covering business news and trends, he believes education is the best gift a financial consumer can receive – and brings that philosophy to his work. Brian is a graduate of the University of Massachusetts, and currently resides in Palmas del Mar, Puerto Rico during the winter, and in Bucks County, Pa., when Mother Nature cooperates.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?

Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?Quiz If you are 50 or older and a high earner, these new catch-up rules fundamentally change how your "extra" retirement savings are taxed and reported.