How to Add Home Equity to Your Retirement Income Planning

Home equity is sometimes overlooked as a viable resource in retirement. You don’t have to sell your home to find income and liquidity.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

With more retirees than ever choosing to age in place, the idea of selling your home to downsize may no longer be part of your plans.

That’s smart, because you don’t have to sell the homestead to produce retirement income and help cover the costs associated with a critical health crisis, or just the effects of aging that require outside care.

In the New York Times article The High-Class Problem That Comes With Home Equity, author Ron Lieber, the NYT’s Your Money columnist, suggests that reverse mortgages could be a good product for some retirees who want to tap the equity in their home without selling. We agree, and the Go2Income planning method can now incorporate a reverse mortgage.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

I have found that lifetime income, liquidity for unplanned expenses, lower taxes and a financial legacy are the objectives most retirees seek. When they also want to stay in their homes or age in place, I propose that annuities and home equity, added to traditional savings and investments, will best meet their retirement goals.

In our previous article, The (R)evolution of Retirement Income Planning, we presented the advantages of a plan based on investments, annuities and a home equity conversion mortgage, or HECM. Let’s dig deeper into that plan for our sample investor. You’ll see the key elements and how they can be customized to your personal objectives.

Sally’s case

Sally, 70, is focused on starting income. She has $1.5 million in savings (50% in a rollover IRA account) and $1 million in the value of her house (without any mortgage). She understands that with income annuities added to her plans, she can be a little more aggressive and wants starting income of $96,000 a year — translating to 6.4% of her retirement savings, or 60% higher than the 4% rule. (Together with her $62,000 in Social Security benefits and pension, she’s up to $158,000 in starting income.)

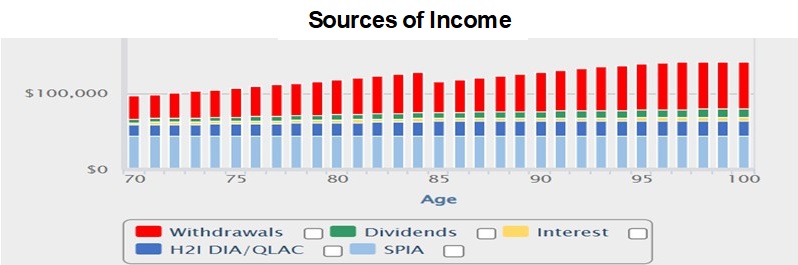

The following charts tell her story.

The first is her sources of income chart with Go2Income split into three sources:

- Investment portfolios: Dividends and interest from personal (after-tax) savings, RMDs and withdrawals from her rollover IRA account

- Annuities: Single-premium immediate annuity that provides lifetime annuity payments generated from personal (after-tax) savings for tax efficiency

- Home Equity2Income (H2I): HECM drawdowns until 85; QLAC lifetime annuity payments less HECM interest after 85

The product elements are allocated to accounts based in part on tax efficiency, and for Sally’s plan, less than 40% of the first-year income is taxable, with over $92,500 of the $96,000 becoming her spendable income. Also, a very large percentage of income is safe, meaning she doesn’t have to liquidate securities to realize the cash flow. Nearly 60% is safe over her lifetime.

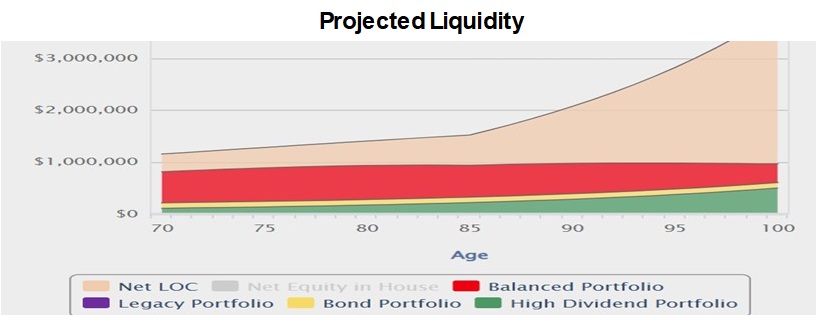

The second chart is her projected liquidity, which may be the biggest surprise, with liquid funds to cover planned and unplanned expenses, like long-term care, modifying the house for aging-in-place necessities, etc. These funds are made up of the following:

- Investment portfolios: High-dividend portfolio (personal savings), fixed income portfolio (personal savings) and balanced portfolio (rollover IRA account)

- Home Equity2Income: HECM net line of credit

This plan meets Sally’s objectives for lifetime income, but also provides substantial liquidity for late-in-life spending — both planned and unplanned.

A reminder of the world before the evolution of retirement

It wasn’t so long ago when almost all retirees could be comfortable with income from Social Security benefits, savings and perhaps a pension or an IRA.

For most of us, pensions are now unattainable. Happily, Social Security is designed to be lifetime income, and if you worked 40 years and paid into the program, it will provide a good chunk of safe income. Your savings also might provide significant income, but investments in stocks and bonds can vary from year to year. In our prior article, we showed how each product element improved the results, in terms of income, liquidity, taxes and safety.

Another application of H2I

It doesn’t appear that we will ever go back to the days when we could retire without thinking too much about the income that we knew would flow in each month from a pension and Social Security. The (R)evolution of Retirement article, however, provides the information to help you make the decisions required by today’s environment.

When I was running the product area of a life insurance company, I knew that customers liked the lifetime protection of annuities. But some didn’t want to give up access to their funds. Back then, I got a patent on something called the Income Manager, which enabled the annuitant to cash in future payments and get access to some funds. While I can’t violate the patent, there is a need there that might be fulfilled somewhat differently:

By combining an HECM with annuities in different proportions, consumers get lifetime income (although at lower levels than Sally chose) and still maintain a large portion of savings as liquid. The available line of credit from HECM nearly matches the premium for the annuity and thus maintains most of your liquidity while gaining the annuity’s lifetime protection. We’ll explain in more detail in the next article.

Visit Go2Income Personal Planning to start a plan risk-free. You can ask one of our analysts to help you make adjustments. And then decide whether you want the peace of mind that lifetime income and greater liquidity can provide.

Related Content

- Is Your Retirement Solution Hiding in Plain Sight?

- How to Cut Your Taxes as Short-Term Interest Rates Come Down

- For Longevity Protection, Consider a QLAC

- How a Fixed Index Annuity Can Manage Retirement Income Risks

- Retirees: Worry Less About Markets, Long-Term Care and Taxes

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.