How to Grow Your IRA in Retirement Rather Than Spend It Down

You really can defer RMDs and lower taxes while at the same time increasing the long-term growth of your IRA. Here's how.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Almost everyone has an IRA, 401(k) or similar retirement savings account. The purpose is to have that money available when you stop working. But what if you don’t need it right away?

This question was prompted by readers who want to know how to create options with the income from their IRA to minimize taxes and maximize liquidity — rather than merely taking the required minimum distributions (RMDs) each year. Their primary goals are about longer-term liquidity and legacy, instead of just income.

In my last article, How Combining Your Home Equity and IRA Can Supercharge Your Retirement, I wrote about how most retired families own an IRA and a home, but very few are considering how they could work together in a plan for retirement income. The retiree we frequently cite as an example — 70-year-old Sally — used the combination of her home and her IRA to generate immediate income equal to 6.5% of her $1 million in IRA savings.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This article focuses on a version of this IRA/home combination that defers distributions and lowers taxes and at the same time increases the long-term growth in the account value, liquidity and legacy.

How an IRA/home plan meets liquidity and tax objectives

Sally’s twin sister, Susan, is concerned about costs for long-term care and other health-related events and wants to maximize liquidity so she can pay for these costs in coming years — and not be a burden for her kids. She does not own long-term care insurance.

She has several children and grandchildren and wants to leave a large legacy. In addition, she’s concerned that she may have to help with funding the grandkids’ college education. To do all of this, she needs to lower her IRA distributions and her taxes.

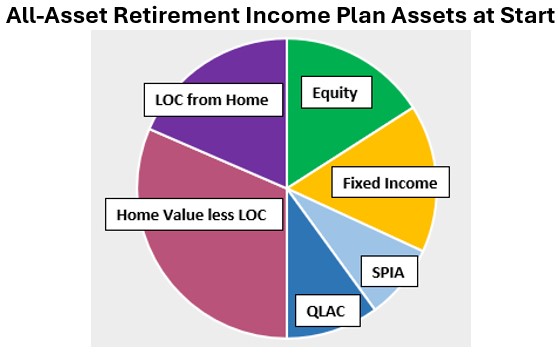

Susan and Sally share the same adviser, who recommends an allocation of their identical resources — $1 million in their IRAs and $1 million in the value of each of their homes — in the same set of planning components below.

Home equity can serve several functions during your retirement. Learn more about that program, called H2I, in my article How to Add Home Equity to Your Retirement Income Planning.

Susan’s objectives are different than Sally’s

- Starting income. Sally wants and needs $65,000 per year to start and to have income grow at 2% per year. Sally has LTC insurance and is paying those premiums. Susan has a higher pension and Social Security benefit. Plus, she wants to minimize taxable income and is OK with a lower starting income.

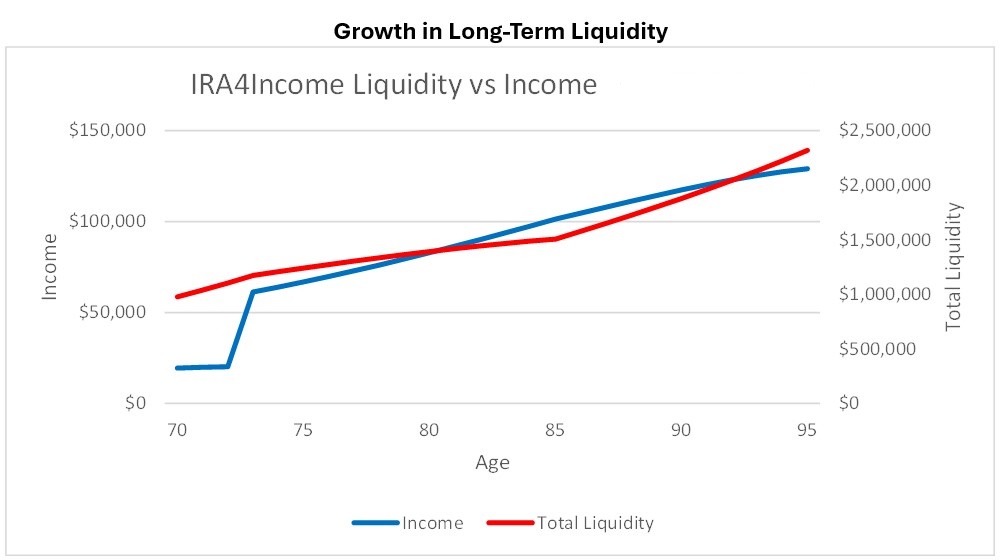

- Liquidity at age 85. Sally is OK with having $1 million in liquidity at 85; Susan wants more like $1.5 million because of her concern about the costs of health-related events and long-term care.

- Legacy at age 95. Both sisters have longevity in their genes, and Sally is OK with a $2.5 million goal at age 95; Susan wants more like $3 million for her family, which is larger.

So, with the same resources and planning components but with different retirement objectives, how do they meet retirement goals and satisfy RMD rules in both cases?

How to meet objectives and satisfy RMD rules

Well, Sally’s primary goal is high starting income, and the plan pays that out. Thus, her income will be larger than her RMDs, and no special RMD planning is required.

In Susan’s case, her goal is to minimize income and taxes, but she still has to comply with RMD rules. Her plan takes the following steps:

- Allocation to a qualifying longevity annuity contract (QLAC), which defers distributions. Susan is going to increase her QLAC from Sally’s $150,000 to the maximum of $200,000.

- Lower allocation to a single-premium immediate annuity (SPIA) since Susan doesn’t need or want the higher starting income.

- Susan plans for her IRA payouts to start at age 73, permitted under RMD rules.

- Finally, Susan’s adviser is aware of a rule adopted in the SECURE Act of 2019 that includes the market value of her SPIA in her IRA account value. Seems counterintuitive, but the new rule reduces the required withdrawals from her investment portfolios.

Defer income and minimize taxes

Susan starts with $1 million in her IRA, and she spends the maximum $200,000 to purchase a QLAC. The value of her account after the QLAC is $800,000 at the start, including her investment account value and the SPIA ($162,500). To use the combined value going forward, she will need to get the market value of the SPIA from the annuity company or an actuary.

She will not need this value until age 73, when she takes her first RMD. At that age under the plan assumptions, the total value is now $1,002,000, and the RMD is $40,600. She satisfies the RMD payment with the $13,100 SPIA payment and a smaller (than previously planned) withdrawal of $27,500 from her investment account. In addition, she is getting tax-free drawdowns from her H2I program of $20,500, and thus less than 65% of her income is taxable at age 73.

Her sister Sally’s plan is different. Sally is receiving a smaller H2I payment, starting distributions at age 70 and keeping the SPIA separate from her account value. For her, the first-year income is $65,000, over $50,000 is taxable, and more than $31,000 is coming out of her investment account.

Increase liquidity and legacy

With lower withdrawals from her investment account, Susan is on track to meet her liquidity goal of $1.5 million at age 85 (see graphic below). And her legacy nearly reached her $3 million goal. Bottom line: Susan was able to achieve her long-term objectives, and Sally was able to meet her starting income goal.

Different plans, but both sisters are happy because they achieved their respective objectives.

You can build a plan to meet your own objectives by visiting here to get started with no obligation. Consult with your own qualified adviser, find an analytical tool to provide some guidance or talk to a Go2Specialist.

Related Content

- How Combining Your Home Equity and IRA Can Supercharge Your Retirement

- How to Create a Retirement Income Plan to Cover Caregiver Costs

- How to Create a Retirement Plan That Checks All Your Boxes

- Is Your Retirement Solution Hiding in Plain Sight?

- How Your Home Can Fill Gaps in Your Retirement Plan

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.