How to Jump-Start Your Kids’ Retirement Savings

Helping your kids fund a Roth IRA can both get them started early on saving for retirement and show them the importance of saving early and often.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I want to share a strategy that can help your children get a huge jump start on their retirement. Many clients I work with wish they’d started saving at a much younger age, and they worry their children may make the same mistakes. So, many of them hope to teach their children how to manage their own money.

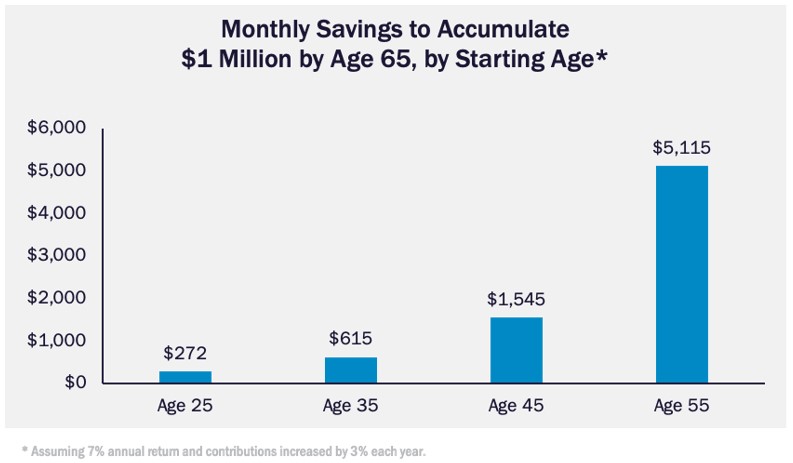

One of the most important lessons to teach is how important it is to save. Most people don’t realize how much they need to save for retirement. For instance, using a common 4% sustainable withdrawal rate in retirement, you’d need to save $1 million by retirement in order to have $40,000 of sustainable annual income in retirement.

That savings goal can feel pretty daunting, especially for younger people. But the biggest advantage young people have when it comes to retirement is that they have a lot of time for their savings to grow. The earlier they start saving and investing, the more wealth they’ll build.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But let’s get real… I’ve yet to meet the teen who is thinking about their retirement. A simple strategy that parents can implement to jump start their children’s retirement savings is to help them fund a Roth IRA.

Say your kid earns $3,000 from a job in 2023. If the income is W-2, they can contribute 100% of their earned income up to $6,500 to a Roth IRA, or $3,000. If income is 1099, the contribution limit is reduced by 7.65% (half of the self-employment tax) or $229.50 and can contribute $2,770.50 to the Roth IRA.

They probably won’t have the cash to make contributions themselves (even if they wanted to), but this is where parents can step in by giving them a tax-free cash gift (up to $17,000 per person for 2023) that can be used to fund the Roth IRA. In most states, if the child is a minor, you’d have to start with a minor Roth IRA where the parent is the custodian of the account, and then you can convert the account to a regular Roth IRA owned by the child once they are legally an adult.

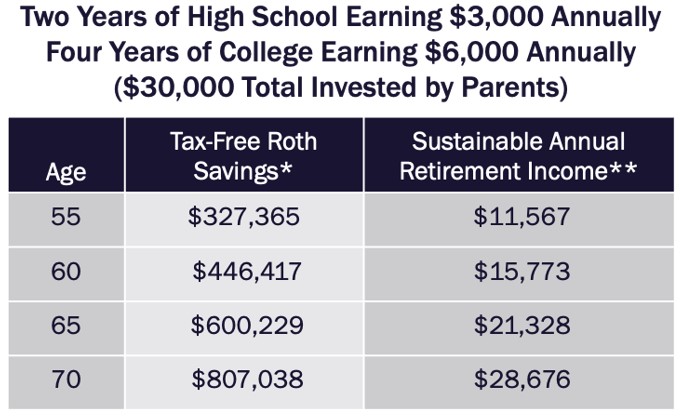

How big an impact can this have on your kids’ lives? Assume they contribute $3,000 a year as a high school junior and senior, and $6,000 a year during all four years of college (so $30,000 in total contributions). If they earn a 6.8% annual return from ages 16 to 40, 6.4% from ages 41 to 60 and 6.1% after age 60 (the expected returns from 80% stock, 70% stock and 60% stock allocations, respectively), they’d have more than $600,000 of tax-free retirement savings by age 65, which could yield more than $21,000 of sustainable tax-free income throughout retirement.

* For simplicity, invested accounts assume following: 80% stock allocation from ages 16 to 40 earning 6.8% annually net of fees, 70% stock allocation from ages 41-60 earning 6.4% annually net of fees, 60% stock allocation after age 60 earning 6.1% annually net of fees. All numbers shown are in future dollars and net of 1% advisory fee. ** Sustainable annual retirement income assumes 4% annual withdrawal rate.

In addition, this creates an opportunity to teach your kids some basic investing concepts, such as what retirement accounts are and the time value of money. Hopefully, they’ll become accustomed to the annual contributions and carry those good habits forward into their adult lives.

That’s a legacy you can be proud of.

related content

- 2 Ways Retirees Can Defuse a Tax Bomb (It’s Not Too Late!)

- Will Your Kids Inherit a Tax Bomb from You?

- Four Ways Parents Can Help Kids Be First-Time Home Buyers

- Leaving an Inheritance? Is It Better to Give to Kids Now or Later?

- Should You Help Out Your Adult Kids Financially?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David McClellan is a partner with Forum Financial Management, LP, a Registered Investment Adviser that manages more than $7 billion in client assets. He is also VP and Head of Wealth Management Solutions at AiVante, a technology company that uses artificial intelligence to predict lifetime medical expenses. Previously David spent nearly 15 years in executive roles with Morningstar (where he designed retirement income planning software) and Pershing. David is based in Austin, Texas, but works with clients nationwide. His practice focuses on financial life coaching and retirement planning. He frequently helps clients assess and defuse retirement tax bombs.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.