Even After a Year Like 2022, Your Retirement Income Plan Can Stay on Course

Predictions about what the markets will do or how the economy will perform are often wrong. That’s why it’s better to “prepare” rather than “predict,” and that requires establishing some basic assumptions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A good plan for retirement income relies on assumptions about future economic results like stock market performance, interest and dividend yields and inflation. In case you were wondering, sometimes assumptions run off the tracks. Just to confirm my theory, I scrolled back to December 2021 for the predictions for 2022.

Prediction: The Dow Jones will reach 38,000 for the first time.

What happened: The Dow hit its market-close high of 36,799 on Jan. 4, went as low as 28,725 on Sept. 30 and lately has been bouncing between 32,000 and 35,000.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Prediction: The market will get a handle on inflation, with a “manageable rise” of 2% to 3%.

What happened: Inflation is considered now “under control” — at 7.1% for the year ending November 2022.

Prediction: The Fed will not raise rates significantly.

What happened: In December, the Fed raised rates for the seventh time this year.

Jeff Sommer, a financial columnist for The New York Times, made a similar point about market forecasts: “No doubt, enormous changes that aren’t visible yet are coming in 2023. Inflation and interest rates preoccupy financial markets now, but there is no assurance that will be the case a year from now.”

I agree with him. That’s why Go2Income doesn’t predict but does prepare you for the future.

In this article, I’m going to focus on how to get comfortable about the assumptions underlying your plan. We’ll be looking at the changes to the Go2Income planning model just made on Dec. 1. Importantly, you will also see how to stay the course even after a year like 2022.

What You Need to Understand About Assumptions

Even if you studied English instead of economics, you can learn how to plan for your financial future. When designing a plan for your retirement future, you should understand the following:

- Which market assumptions are being used in your retirement income planning model, and how do they impact your plan in terms of income, liquidity and legacy?

- How the volatility in the market impacts your plan, and the plan adjustments you can make in response. (And specifically, how much of your income is subject to market volatility.)

- The ways that a plan primarily based on withdrawals and resultant sale of securities could also cause you to underperform the market — through not being in the market at the right times.

Let’s look at how assumptions might affect your income.

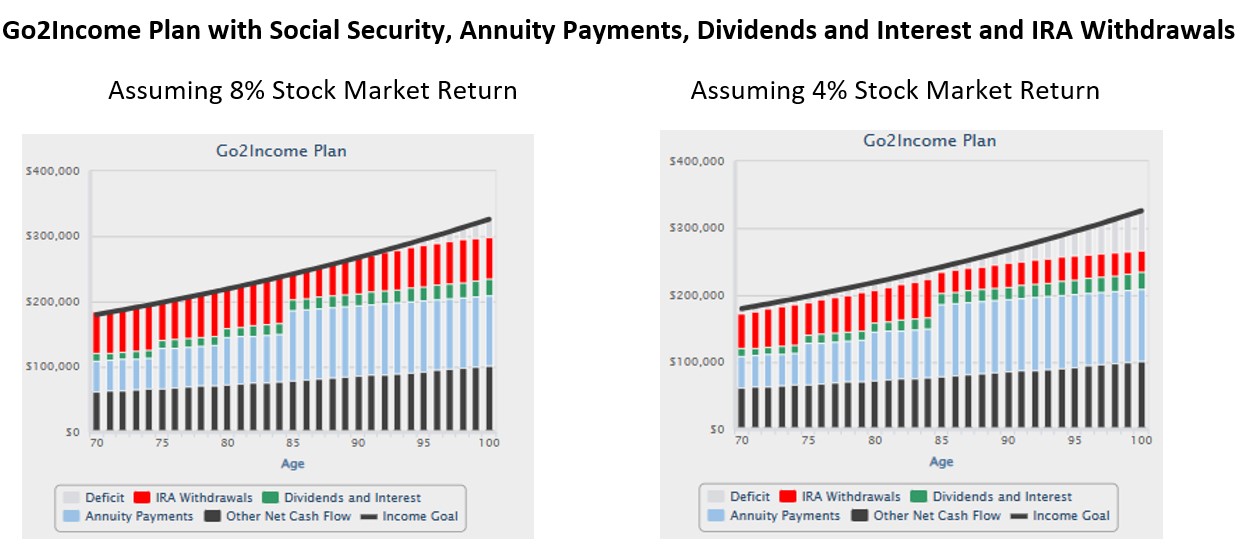

Picking Assumptions Regarding Stock Market Returns

For our typical investor invested in a Go2Income plan representing a combination of Social Security, annuity payments, interest and dividends and IRA withdrawals, only 20% to 25% of her planned income is subject to market volatility. The graphs below show a projection of her plan income assuming an 8% long-term stock market return vs. a 4% stock market return.

Assumptions are critical in your planning. As you see, a 4% return provides lower income for 25 years. But you can also tell that it’s not catastrophic — because so much of our Go2Income investor’s income is “safe,” coming mainly from sources other than IRA withdrawals.

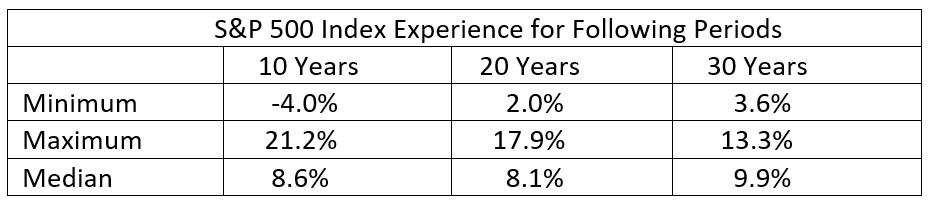

What Stock Market Returns Should You Assume in Designing Your Plan?

Most investors are aware of the risks of investing in the stock market – and the rewards. Besides the actual market returns, there is also a risk of your bailing out of a well-constructed plan just because the latest market results look bad. Let’s look at how the stock market has performed over 10-, 20- and 30-year periods as measured by the S&P 500 index.

In the Go2Income planning model, our default assumption is 8% (after asset management fees and before adviser fees). An adviser can assume between 3% and 9% in his planning. Of course, the only type of portfolio used in planning for the riskier IRA withdrawals is a balanced portfolio of equities and fixed income.

How to Select Market Assumptions Regarding Fixed-Income Portfolio and Dividend Yields

In a Go2Income model, we review the fixed-income market assumptions at least quarterly; annuity rates are reviewed monthly. Assumptions related to fixed-income and dividend yields are set by us; others, like stock market outlook and inflation rate, can be set by your adviser after consultation with you. In addition, assumptions selected or recommended by an adviser will be influenced by the design of the plan, particularly the allocation to equities and annuities.

After reviewing the data and consulting with FolioBeyond, we made the following changes in the Go2Income model effective on Dec. 1.

- Dividend yield: Increased from 3.25% to 3.5%.

- Interest yield: Increased from 2.5% to 3.5%.

- Total return on fixed income: Increased from 3.5% to 4.5%.

While not an assumption per se, we determined that, on average, annuity payment contracts were being credited with a lifetime interest rate of 5.25% as of Dec 1. Some were higher; others were lower. Of course, you’ll be able to select the company with the best rates when you implement a plan. To get a quote based on current rates, complete the widget on our welcome page.

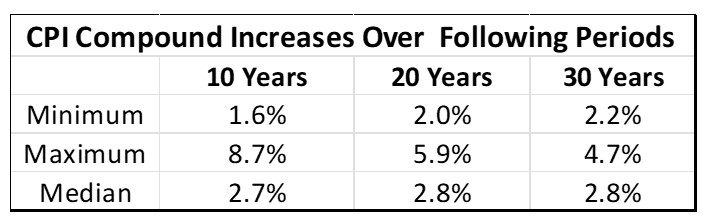

And What About Inflation?

With the investment assumptions in place, we need to select assumptions as to long-term inflation.

Here are the results over the past 30 years of the Consumer Price Index (CPI), looking at all 10-year and 20-year periods using the compound rate of inflation over the period.

Despite 2022, the median long-term inflation rate still hovers around 2.75%. Our default assumption for the future continues to be 2%, but with your income goal adjusted for recent inflation. Of course, you and your adviser can select your own assumption as to inflation, recognizing your Social Security benefits will track inflation. Inflation is another example of adjusting your current income goal in real time but making sure your long-term assumptions are neither too aggressive nor too conservative.

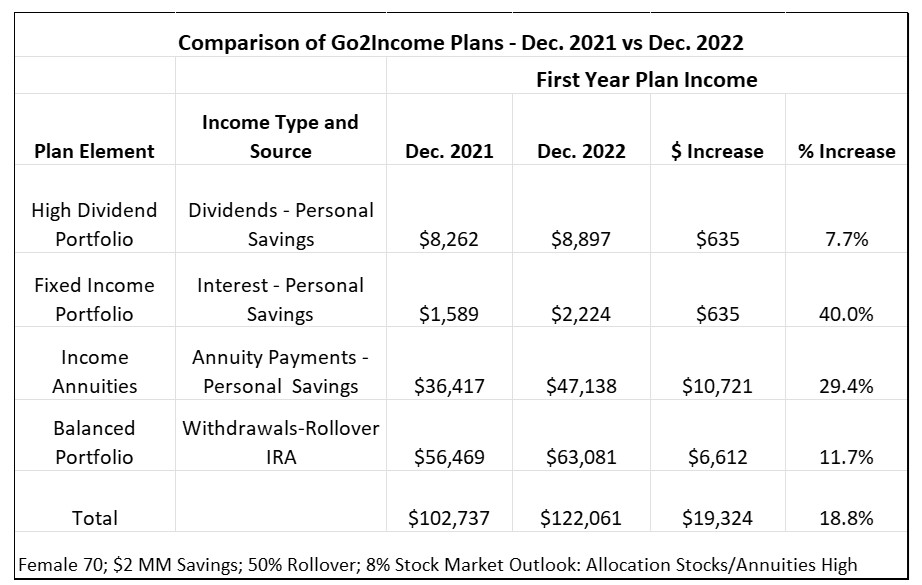

Finally, What Did the Updated Assumptions Do to My Plan Income?

With the plan assumptions in place and with the allocation by income source unchanged, we can create your December 2022 plan and compare it to one from a year ago. So, the new plan is generating plan income that is nearly 19% higher, and if your market losses were 20% or less, you are whole.

But Do You Implement Now?

This end-of-the-year article is meant to help you think about your plan for retirement income — with updates to reflect current market assumptions. But do you implement now? Do you implement in part with, say, the rollover IRA portion only? Do you purchase the annuities in one or both accounts? Or maybe the investment portfolios?

One thing to definitely include on your to-do list: Re-evaluate your plan at the end of 2023.

My January 2023 article will offer information to help you act on your assumptions and execute a plan personalized to best benefit you and your family.

Get the numbers for your own retirement. Visit Go2Income, answer a few simple questions and start working on your own retirement plan. This service is a complement to our other services, and you can ask for a Go2Specialist to help answer your questions on planning. We also have advisers available who can help with the next steps to refine and then implement your plan.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.