The Seven Worst Assets to Leave Your Kids or Grandkids

Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

Kathryn Pomroy

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When planning your legacy, it's likely that one of your first concerns is ensuring your children or grandchildren inherit assets that enrich their lives. Unfortunately, certain inheritances can be a tremendous burden on your loved ones.

A 2025 survey by Empower found that 14% of Americans expect an inheritance, with higher expectations among Gen Z and younger Millennials (27%) compared to those between the ages of 35–54 (11%) and over 55 (7%). A Choice Mutual survey from 2025, focusing on younger Americans aged 18–44, showed that 68% of participants have either received or expect to receive an inheritance, with an average expected amount of $335,000. But let's face it, some assets are better than others to leave behind. Did you know your home could be a terrible inheritance for your kids?

The total value of an inheritance isn't just a dollar figure — what’s actually in an estate plan can matter significantly. Thanks to the Great Wealth Transfer, trillions of dollars will transfer from one generation to the next in the decades ahead, but not everyone will see their inheritance as a help; for some, it may be a headache.

Certain assets can cause arguments between family members or may have hidden costs. And sometimes, let’s face it, your kids just don’t want your stuff. With thoughtful estate planning, however, you can prevent these issues from happening.

“A lot of people leave estate planning to the last minute, or they don’t get to it,” said Neil V. Carbone, trusts and estates partner at Farrell Fritz in New York. “For family harmony and efficiency, start your planning early with an attorney or other estate plan expert. They can get to know your assets and, in doing so, identify what might be an issue.”

Carbone finds that children and other young family members are more likely to respect a parent’s wishes if they hear them in person, even if it’s something they don’t like, versus finding out from a document when they’re also grieving. A professional can also help you start adjusting your assets to those that are more effective to leave.

“In my experience, the best asset to leave behind: cash,” said Michael Romero, president of Argent Trust Oklahoma. He said brokerage accounts are good too because they’re so easy to value and divide. Everything else gets a little more complicated.

Here are seven of the worst assets to inherit (as opposed to some of the best assets to inherit) and what you can do to help manage them before you are gone. Read on for advice on how to make sure your estate doesn't add to your heirs' grief and what to do if you inherit something you don't want.

1. Timeshares

A timeshare is a long-term contract where you agree to rent out an annual trip to a resort or vacation property. These contracts last for decades, sometimes for life, and are notoriously difficult to get out of. Even if you love your timeshare, think it’s a great deal and have had plenty of amazing memories, be very cautious about leaving it to the next generation.

“If you pass away and your kids inherit the timeshare, they’ll be on the hook for the ongoing — and ever-increasing — contract costs,” said Carbone. “Some sellers even encourage buyers to put their young family members on the deed when they sign up for that very reason.”

That’s a bad idea, Carbone said, and he advised that the decision should be left to the kids — after your death — whether they want to take over the contract. They can refuse to accept at this point, even if your will left them the property, by making a formal disclaimer of the timeshare. During probate, they will need to send a written document to the executor of your estate and to the timeshare company saying they do not accept the property.

If your heirs are on the fence, Carbone warned, they must be very cautious not to use the property after you’re gone, such as a last memorial trip, because this could prevent an effective disclaimer or count as taking over the timeshare contract.

If your family has decided they don’t want to inherit the timeshare and you no longer want it, you can try to get rid of it while you’re alive. How difficult this will be depends on the company. Some will simply buy you out and take it back. If not, you could also try to sell the contract to someone else or work with a timeshare exit company that specializes in getting people out of these arrangements.

Don’t try to hold out for much, advised T. Eric Reich, a Kiplinger contributor and president/founder of Reich Asset Management. He noted that there are also companies that resell timeshares. “I tell clients to sell it for basically nothing if they have to, just to get rid of it.”

If you simply decide to abandon your timeshare, the company might send letters threatening legal action, but in Carbone’s experience, they usually don’t follow through. “Most companies will not take legal action against elderly customers if the timeshare is paid off, and most elderly customers won’t be concerned about damage to their credit rating.”

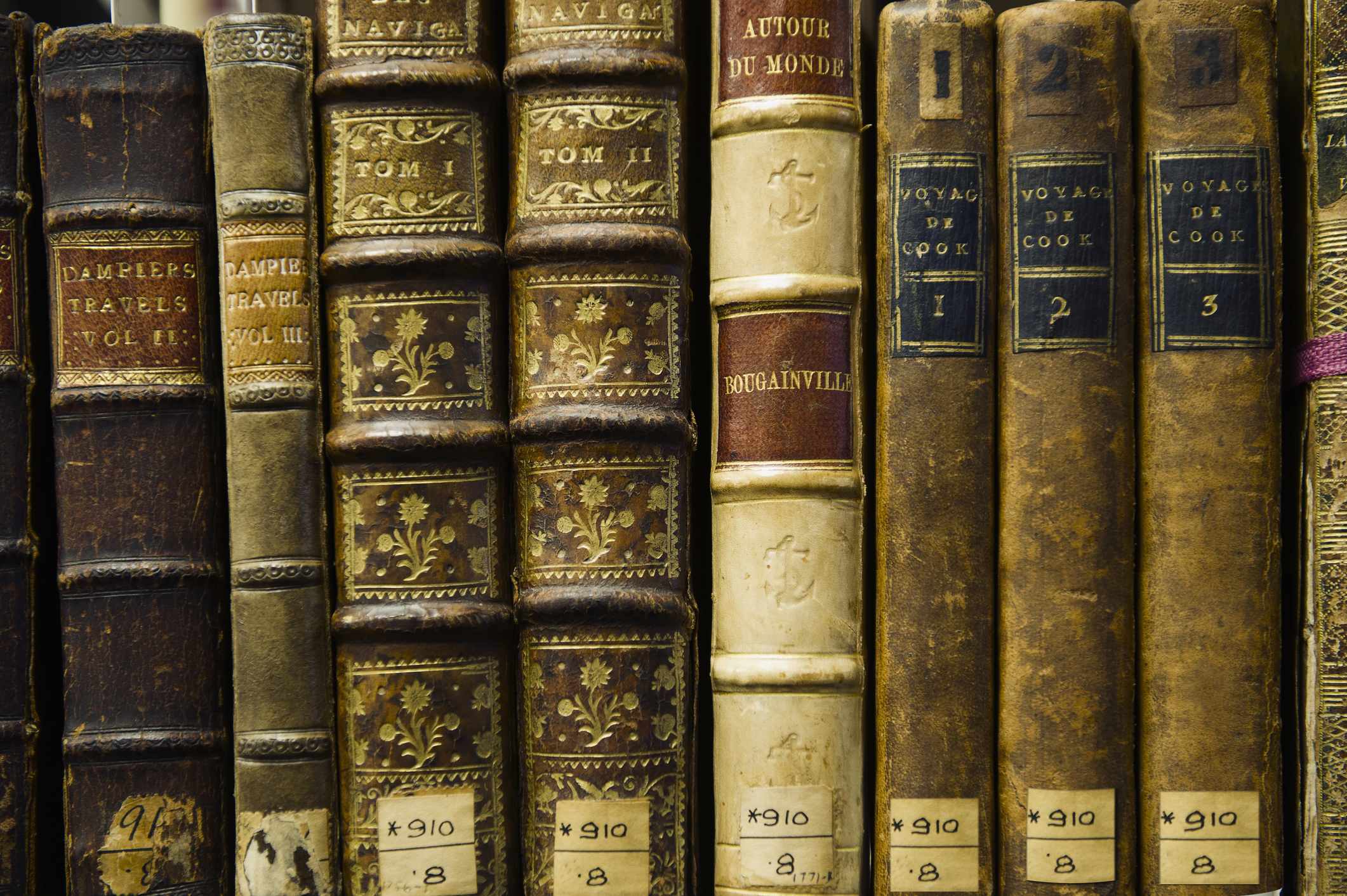

2. Potentially valuable collectibles

Whether it’s gold coins, rare out-of-print books, or a fine piece of artwork, there’s something special about seeing your wealth in a beautiful physical form and then imagining handing it off to your loved ones so they can enjoy it too. Another advantage of leaving collectibles as an inheritance is that it can help with taxes.

The capital gains tax rate on collectibles can go up to a maximum of 28%, significantly higher than the maximum 20% long-term gains rate on other investments. When you die, your heirs receive a step-up in basis, meaning when they sell, they receive tax-free what the collectible was worth on the day you die.

Still, there are some substantial risks to leaving valuable collectibles as an inheritance. First, there’s a much higher chance that your heirs could overlook or lose these valuable assets, especially if you’ve hidden them. “If you’ve sewn diamonds in the couch cushions, you better let your heirs know so they don’t toss them out in a yard sale,” said Carbone.

Another problem with collectibles is that they’re tougher to value. It’s not like a bank or brokerage account where your heirs can just see the balance. Instead, they’ll need to go to a dealer and if they meet up with the wrong person, they can be taken for a ride. You may also have items in your home you don't know are worth big bucks, like these ten old things in your home that can be worth a fortune.

Romero shared a story where he got caught off guard. “A client who passed away was a musician and had a collection of violins. I took a particularly impressive one in thinking it might have value. The dealer said the violin itself was worthless, but the bow? $20,000.”

If you do have any valuable collectibles, be sure to let your heirs know where they are, what they’re worth (appraisals are best, but a rough estimate will do), and suggest dealers they should work with after you’re gone.

3. Guns

Guns can present considerable problems as inheritances. They aren’t the kind of property you can just hand over to another person without, in certain cases, the proper registration or permit. The rules vary significantly depending on your state of residence and the type of firearm.

For example, in New York, when someone dies, their executor can possess their guns for up to 15 days without incurring criminal liability, a very short window, Carbone said. “At this point, the will probably hasn’t even gone through probate yet.”

What usually happens is the heirs or the executor will call the police to inventory and store the guns for up to a year during probate. The heirs can’t legally transport the guns themselves, so the police must come pick them up. If certain firearms, like fully automatic weapons and short-barreled rifles or shotguns, were not properly registered during the decedent’s lifetime, they can’t be registered after the fact or passed down to the heirs and will have to be abandoned.

If you’d like your kids or other family members to inherit guns, start that planning as soon as possible. The heir may need to set up the proper firearm permits for themselves to accept the property. You can check out gun laws by state through the Giffords Law Center to Prevent Gun Violence.

You could also work with a gun dealer so they could store your guns and then sell them after you pass away. The key is to plan early so you avoid a scenario where you’ve left guns in your car trunk or garage. That can complicate matters for your heirs. Not to mention, it's a safety risk.

4. Operating businesses

Most business owners spend a good bit of time on their succession plans. But not all. You may have neglected planning the succession of your family business, assuming it can be passed on like a brokerage account or classic car. Bad idea, advised Connecticut attorney Marissa Dungey, a partner in Dungey Dougherty.

“It can be difficult for founders to let go,” Dungey acknowledged. But, “if they don’t, a business will often lose value and may even collapse in the wake of the founder’s death.”

If your family members can’t realistically be expected to carry on the business, she said, “It’s advisable to plan for the sale while the founder is alive and can provide the hands-on transition that’s important for the continued success of the business that will maximize the sale price.”

If you have partners in the business, you should have a “buy-sell or shareholders agreement to address what happens on the death of a partner,” Dungey added. “These are negotiated between business partners … often providing for an orderly buy-out funded at least in part from life insurance” upon the death of an owner.

But even if family members do seem willing to take over the business, that’s not the end of the conversation. “That does not necessarily avoid conflict,” Dungey said, “especially where some but not all family members are in the business and it is the predominant asset. There is an inherent conflict for those in the business who are compensated and may want to grow the business, and those who are passive owners and want to monetize.”

The bottom line, Dungey said, is that “planning ahead to address the issue can mitigate conflict.”

5. Vacation properties

Inherited vacation properties are another potential financial and emotional landmine, especially if you’re leaving one to multiple family members. “Kids behave when the parents are still alive, but once they’re gone, that’s when the fighting really starts,” said Carbone. “I’ve seen siblings stop speaking to each other due to fights over an inherited vacation property.”

Disagreements can pop up over how often each can use the property, who owes what for the repairs, whether they should sell, and whether they should buy one of them out and at what value, especially if one heir lives far away and doesn’t want their share.

Even if everyone is on good terms, a vacation property does come with considerable expenses like maintenance, property taxes, insurance and any remaining mortgage. These costs could outweigh the value of the vacation property to your heirs. This is especially true if you’re leaving behind undeveloped land where they still need to build a home or a property with environmental problems, like a spill from an oil tank, or if you're leaving behind a property in a location prone to natural disasters, like floods and hurricanes.

If you have a vacation home, start the inheritance discussion early with your heirs. Do they even want the property? If they want it, can you get them to agree on the terms? You could put together and have them sign a written co-tenancy after death agreement, which would legally lay out the rights and responsibilities of each heir after they take ownership of the property when you pass away.

Dungey suggested leaving liquid assets to pay the ongoing costs associated with keeping the vacation property “so that no one is required to chip in. While this does not address all potential conflicts among family members, it helps when no one has to come out of pocket to keep a property they are not using.” This could include HOA fees, taxes, insurance, and maintenance costs, including landscaping, while no one is using the property.

If it’s starting to look complicated and they can’t agree, the solution may be to sell. Yes, you’d owe capital gains taxes on any appreciation (because it's not your primary residence), but that could be a worthwhile investment to avoid a big fight.

6. Any physical property (especially with sentimental value)

Fights don’t just happen over rare and valuable collectibles. When it comes to family arguments, Romero finds they can happen with any type of physical property. Household and personal items can carry more sentimental value than money does, which adds more emotion to disagreements. They’re also harder to divide. “Let’s say there are three kids,” Romero asked. “Who's going to end up with Mom’s wedding ring?”

Another problem with physical property is that it’s harder to tell what it’s worth. For jewelry and antiques, Romero finds that people tend to overestimate what they’re leaving behind, perhaps building up unreasonable expectations. “Jewelry is usually very expensive to buy, but loses its value quickly when you try to sell.” He also noted that antiques aren’t as popular as they used to be.

On the other hand, certain items might be unexpectedly worth a lot. He had another client with a wardrobe full of women’s designer suits that they were able to sell for a considerable amount. If Romero hadn’t thought to check, the client may have just given everything away to Goodwill.

To avoid trouble, start planning early on who will receive what to prevent arguments. If possible, try selling what you don’t need while alive. That way, you’ll be leaving more of the simplest, most effective inheritance of all: cash.

7. Cryptocurrency

If you are a Crypto enthusiast, you may think passing along these holdings to your heirs is a good idea. However, if you die without a will or fail to give your heirs instructions on accessing these holdings, they may be lost forever. Vanished. Forever lost.

Data from 2025 studies from sources like Chainalysis and CoinLedger suggest that 3 to 4 million BTC, or about 15% to 20% of the current mined Bitcoin supply, may be permanently lost. At today’s price of about $94,000 per BTC, this represents a staggering value of $280 to $380 billion — a massive fortune.

Additionally, the IRS does not treat cryptocurrency like cash, so the process of inheriting crypto can be more complex. That’s because the government views crypto as digital assets and, more specifically, personal property, similar to stocks or tangible property. For this reason, your crypto holdings may be subject to capital gains taxes.

For instance, when the designated heirs of your crypto exchange them for currency or use the tokens as a payment method, it will often trigger a tax event. When that happens, they may need to calculate capital gains or losses. Crypto is also subject to different transfer and estate taxes. On the other hand, if you give crypto as a gift, it isn’t recognized as income until it's sold or exchanged.

How to ensure your will is appreciated

You want your beneficiaries to appreciate their inheritance, not feel burdened by it. How can you ensure that? While it’s tough to discuss death, leaving behind certain assets without a plan beforehand can add to your loved ones’ grief. As financial expert Robert Reich advises, open conversations about your estate plan are essential to ease their burden and honor your legacy.

“The best advice I can give is for the owners of any property they might want to pass on to their heirs is to have an honest conversation about it first,” he said. “Many times, the heirs will express that they simply don’t want the property and in those cases, the owner should sell it while they are still alive.”

Dungey has some additional suggestions. For one thing, reconsider selling your assets while you’re alive, she said.

“Rather than selling an asset during lifetime and triggering capital gain, where an asset is to be sold rather than inherited, in the interest of family harmony, I recommend including a direction to the executor or trustee to sell the asset in the course of the estate administration,” she said. “The property would benefit from the step-up in tax basis on the owner’s death, and directing the sale will allow the costs of sale to be administration expenses that may be tax deductible.”

She also suggested you anticipate disputes over the value of some property, noting that estate values are different from insurance values, which, of course, are different from sentimental value.

“In addition,” she said, “a non-cash asset is not going to have the practical value of the equivalent cash amount. I advise executors to get an appraisal for estate tax purposes from a reputable appraiser with experience valuing the type of asset.”

Finally, look beyond the specific terms of your will. “Leaving a letter of wishes can be very helpful in reducing conflict because loved ones are likely to honor a decedent’s wishes,” Dungey said. “In my experience, while beneficiaries may not want a particular asset, they do want the value associated with it and so are unlikely to walk away unless the asset is underwater or the costs of ownership exceed the sale value (e.g. a timeshare).”

What to do if you inherit something you don't want

Let’s say you’re the unlucky heir of someone who didn’t take this advice. Now you’ve got a timeshare in a place you’ll never visit, the German army pistol grandpa got in Europe or Great Aunt Louise’s Bösendorfer (and you live in an apartment and don’t even play piano). You don't even have a yard big enough for Grandpa’s strangely valuable assortment of garden gnomes.

Do you have to accept your unwanted inheritance?

Well, no, although your refusal may create a headache for the executor of the estate. You could refuse an inheritance, also known as disclaiming it. Dungey said disclaiming “would cause the property to pass to the next taker in line and does not relieve the executor of the asset if probate has been initiated.”

Consequently, "a comprehensive will should give the executor the power to abandon any estate property, including the power to abstain from payment of associated fees and letting property be foreclosed upon or sold for nominal consideration.”

Reich said his advice “depends on the property, but in the past, I have had clients try to donate the asset in the case of property and in some cases, even collectibles. I try to get them to sell the collection as a whole to a dealer if possible.”

Reich pointed out that the price the collection fetches from a dealer “will be far less than the actual retail value.” But the seller would avoid the hassle of selling off each piece individually, especially if they’re not experts in the worth of the items.

Pass on a legacy without unnecessary complications

In the end, the goal of any inheritance isn’t just to pass on assets or wealth, but to pass on a legacy without unnecessary hardship. Assets timeshares, bitcoin and depreciating collectibles can turn a loving bequest into a costly burden for your heirs.

By taking the time now to simplify your estate, you protect your loved ones from financial stress and emotional strain during an already difficult time. A thoughtful inheritance reflects love and care, giving your kids and grandkids the freedom to grieve, heal and move forward.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is a financial freelance writer based out of Delaware. He specializes in making investing, insurance and retirement planning understandable. He has been published in Kiplinger, Forbes and U.S. News, and also writes for clients like American Express, LendingTree and Prudential. He is currently Treasurer for the Financial Writers Society.

Before becoming a writer, David was an insurance salesman and registered representative for New York Life. During that time, he passed both the Series 6 and CFP exams. David graduated from McGill University with degrees in Economics and Finance where he was also captain of the varsity tennis team.

- Kathryn PomroyContributor

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.