Is Your IRA an IOU to the IRS? Three Retirement Tax Strategies

These steps, including converting to Roth IRAs, using a Roth 401(k) and leveraging life insurance and annuities, can help reduce your taxes in retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Chances are your retirement nest egg is worth less than you think.

For example, if you and your spouse have $1 million in retirement savings tucked away in traditional IRAs, 401(k)s or 403(b)s, your nest egg is likely to be worth $760,000 at the 24% marginal federal tax bracket.

Combine the bite that federal taxes will take out of your retirement savings with the potential additional hit of state and local income taxes and inflation, and you may already be seeing your retirement goals getting harder to reach.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why taxes hurt in retirement

Taxes have the potential to hit you hard in retirement due to the way the retirement savings and tax systems are set up. If you are a Baby Boomer or Gen Xer, you’ve spent most of your life saving within traditional retirement savings vehicles because that’s all that was available for many decades. And even though Roth IRAs and Roth 401(k)s have been around for a while, they aren’t nearly as widely used as traditional IRAs, 401(k)s and 403(b)s.

The tax deductions that traditional retirement savings vehicles offer upon contribution are popular, which is one reason why contributions into Roth accounts lag behind traditional accounts. The downside of those deductions means that taxes must be paid when you withdraw your appreciated savings in retirement.

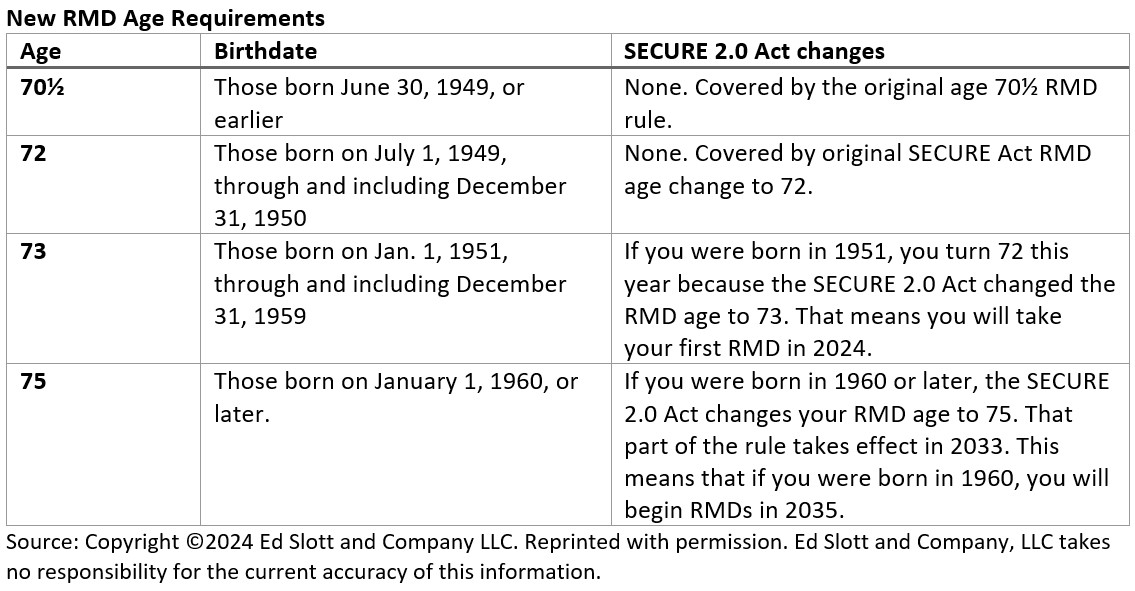

And those withdrawals are not optional. When you turn 73 — or 75, if you were born in 1960 or later — you must take what is known as required minimum distributions (RMDs) each year based on your life expectancy as calculated by the IRS. It doesn’t matter if you don’t need the money for your living expenses — you must take RMDs or face IRS penalties.

You may need to withdraw more than the RMDs required to fund your standard of living in retirement, which means — you guessed it — more taxes.

These taxes can have a cascading effect in retirement. Not only do they reduce the amount of assets you have to spend on maintaining your lifestyle and all the potential health care expenses that retirement brings, but they can also increase other costs, such as the tax on your Social Security benefits and the amount you pay in Medicare premiums.

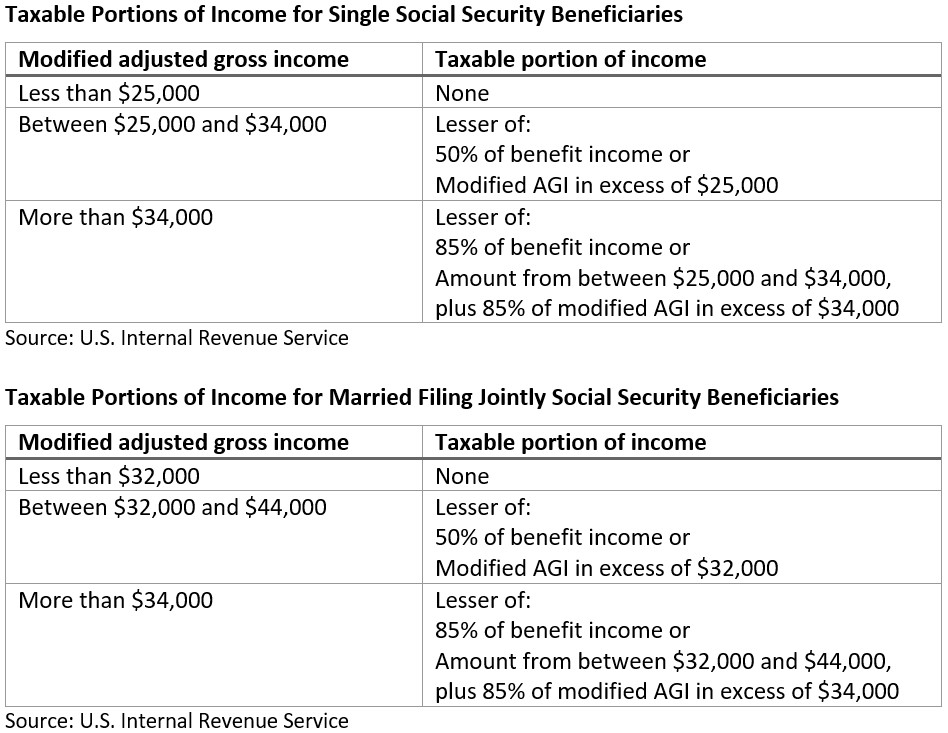

If you are married and have a combined income of more than $32,000 a year in retirement, 85% of your Social Security benefits will be taxed; if you are single and your combined income exceeds $25,000, that same tax rate applies. Combined income includes your adjusted gross income from your federal tax return, tax-exempt interest and half of your Social Security benefits.

Because Medicare premiums are income-based, as your taxable retirement income rises — through a combination of your Social Security benefits, RMDs, other withdrawals from traditional IRAs and any other sources of income, such as rent from rental properties or Airbnbs, an annuity, taxable interest and dividend income or a defined benefit pension — your Medicare premiums may increase.

If you are married and your modified adjusted gross income is less than or equal to $206,000 a year, your total individual Medicare Part B coverage is $174 a month. If your income jumps to more than $206,000 but less than $258,000, your monthly premiums will increase to $244.60. In 2024, Medicare Part B premiums top out at $594 for couples with modified adjusted gross income of greater than or equal to $750,000 a year.

There is also the potential that taxes could increase during your retirement. It’s no secret that the U.S. budget deficit is rising at a time when spending on entitlements such as Social Security, Medicare and Medicaid is also rising. That means you could be on the hook for an unknown higher amount of taxes at some point during your retirement.

Finally, there’s the fact that you’re usually living on a fixed income in retirement. When you’re working, there’s always the potential to make more money — but when you’re retired, what you have saved is all you are ever going to have.

Fortunately, there are three steps you can take to help mitigate your taxes in retirement, including converting traditional IRA assets to a Roth IRA, contributing to a Roth IRA or 401(k) if you are still working or utilizing tax-advantaged annuities or certain cash value life insurance policies.

Step 1: Convert part of your traditional IRA to a Roth IRA.

When you convert all or part of your traditional IRA to a Roth IRA, you pay taxes now so that you won’t have to pay taxes in the future or be subject to RMDs. While that can seem painful, if you’ve got the cash available elsewhere, you will be paying taxes now so you can avoid paying more taxes later. It’s important not to pay taxes with money you withdraw from your traditional IRA, because that will just increase your tax bill.

It’s important to approach this process intelligently, so you should speak to a tax adviser or accountant about how much you are likely to earn in the tax year you want to convert and how much “room” there is in that tax bracket to potentially convert some of your traditional IRA.

For example, if you are in the 24% tax bracket and you are married filing jointly with a taxable income of $250,000, you have $133,900 of “room” in the tax bracket before you would hit the next bracket, which is 32%. That means you would want to convert less than that amount to avoid kicking yourself into a higher tax bracket.

If you chose to convert $120,000 at the 24% federal rate, you would owe $28,880 in federal taxes and would also owe state taxes if you live in a state with a state income tax, although your specific tax bill will depend on your individual tax situation. Roths are subject to other rules that you should discuss with your tax adviser.

Ideally, you would work with your accountant to create a strategy over a number of years to gradually convert all of your traditional retirement assets to a Roth, while keeping yourself from being kicked into a higher tax bracket. (For more about this topic, see the article Roth Conversions: Convert Everything at Once or as You Go?)

Step 2: Contribute to a Roth 401(k) at work.

Nearly 90% of employers who offer employees a 401(k) account also offered the Roth 401(k)in 2023. By switching your contributions from a traditional 401(k) to a Roth 401(k), you will lose the immediate tax deduction that you would have otherwise received, but you will then reap the benefits in retirement.

You will also continue to reap the benefits of any employer match that you are currently getting by contributing to your company-sponsored retirement account. You will also be creating tax diversification within your retirement assets, which will give you more choices in retirement about how to take the tax hit from traditional retirement accounts.

Imagine a retirement free from at least some RMDs and taxes — that is what ongoing contributions to a Roth 401(k) or 403(b) will get you.

Step 3: Leverage life insurance and annuities.

If you don’t have money outside of a traditional IRA to pay conversion taxes but still want to minimize your taxes in retirement, or exceed the earnings limitations for a Roth account, don’t fret. You can take advantage of specific types of annuities and life insurance to get the job done.

You can purchase whole life insurance and use the cash value to pay the taxes on a series of conversions over time with a goal of converting all of your traditional IRA assets to a Roth. If you die before the full conversion of your traditional IRA assets occurs, your heirs can use the life insurance to pay the taxes that are due within 10 years of inheriting a traditional IRA.

The second strategy is to purchase a bonus annuity, which is a type of annuity contract that provides an upfront bonus upon purchase. The bonus increases your account value. You can then make partially taxable withdrawals from that annuity to pay for the taxes due on a Roth conversion.

A final word

Minimizing your taxes with a well-thought-out strategy is a gateway to a more confident retirement. It’s how you can potentially have the lifestyle you want, while paying as little in taxes as possible.

Licensed Insurance Professional. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice.

The information contained herein is based on our understanding of current tax law. The tax and legislative information may be subject to change and different interpretations. We recommend that you seek professional tax advice for applicability to your personal situation.

Related Content

- How the IRS Taxes Retirement Income

- Are You Ready to ‘Rothify’ Your Retirement?

- IRA vs Roth vs 401(k): Which Do You Pick?

- Five Ways to Catch Up on Retirement Savings

- How to Open a Roth IRA in Five Simple Steps

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the Lead Advisor at Navigating The Retirement Red Zone, I bring over 12 years of expertise to guide individuals in understanding and navigating strategies for a secure and confident retirement. I possess the necessary credentials and competencies to offer independent and fiduciary advice, focusing on your unique values and goals rather than promoting internal or incentivized products. My primary mission is to assist you in crafting distribution and tax strategies tailored to your retirement savings and investments. These strategies are designed to ensure the maintenance of your desired lifestyle and goals while safeguarding against the risk of outliving your assets.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.