A COVID Storm Hits Senior Living

The pandemic has created significant challenges for all types of senior living communities. Because of that, it's more important than ever to review a facility's financial stability and quality of life before making a move.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In late 2019 Jack and Peggy Devine, of Spring Lake, N.J., and Aiken, S.C., reserved a new apartment at Falcons Landing Life Plan Community, a continuing care retirement community, or CCRC, for former military officers and high-level federal employees in Sterling, Va. The CCRC was home to Peggy’s aunt, and the couple had visited the community many times and made friends there. Now, however, the DeVines are wrestling with whether to proceed. The pandemic has forced the community to curtail group activities and socializing.

The closure of places where residents congregate and restrictions on interaction would diminish the very things they love most about the senior living community: the opportunity to connect with old friends and make new ones, to do things and go places together. “Although I realize it’s temporary, the looming question in my mind is what is the new normal after this is all over?” says Jack.

When their apartment is ready, probably in mid-March, the DeVines will have 90 days to execute their contract and move in. CCRCs are essentially insurance companies. They promise you priority access to a continuum of care for the rest of your life in exchange for an entrance fee and monthly rent.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Depending on how long it takes for the vaccine to roll out and any other surprises COVID has in store, Jack believes this spring could be the worst possible time to make a move from two states. He’s also concerned the community will face strategic challenges ahead. Falcons Landing has assured him it will try to be flexible. But “if I’m not confident we can make this a smooth move, I’ll be biased toward saying no,” says Jack. If the DeVines decide to postpone the move for now, they will sacrifice a small part of their deposit, lose the “primo” unit they originally chose and return to the end of the waitlist.

Vaccination provides a light at the end of the tunnel for senior living communities (including independent living, assisted living, memory care, skilled nursing and CCRCs), but it’s unclear how long the tunnel is. Even after widespread vaccination, no one expects an immediate return to normalcy. It will be some time before masking and social distancing aren’t required and family members and other visitors can come and go freely.

All senior living communities face financial challenges now—more so if they came into the pandemic that way. So whether you’re considering a move to a senior living community by choice or necessity, it’s more important than ever to assure yourself of its financial viability and the quality of life you can expect. In many communities, the pandemic has tested both.

COVID's Impact

The virus hit nursing homes and health centers within senior living communities hardest because they care for those most vulnerable—the oldest and sickest seniors. As of late January, the Centers for Medicare and Medicaid Services reported nearly 550,000 confirmed cases among residents of nursing homes and more than 107,000 deaths since the pandemic began.

Tragically, many residents have died without family members present. Pandemic-related government or community restrictions prohibited visitors, although CMS recommends that nursing homes allow visits for compassionate care, including at the end of life, subject to social distancing and other guidelines.

Many communities disclose the number of COVID cases, recoveries and deaths among residents and staff daily and post updates about restrictions on their websites. Look for senior living communities that make this data available. “[It’s] about transparency. Are they treating their residents like partners during a really tough time?” says Justine Vogel, CEO and president of the RiverWoods Group, which has three CCRC campuses in southeastern New Hampshire. Many current residents of CCRCs appreciate that they are “in this together” as a community of friends, adds Brad Breeding, president and founder of myLifeSite.net, a resource for CCRC shoppers.

Illness and death from COVID have been lower in CCRCs because the majority of residents live independently and are healthier, while those who need assistance or nursing live apart with separate staff, which makes containing the virus easier, according to a recent report by “The Senior Care Investor” newsletter. Under normal circumstances, when you need more care than you’re receiving currently, some communities allow private caregivers to help you in your home, but others may require you to move to assisted living or skilled nursing. During the pandemic, sometimes that meant one spouse moving to assisted living or skilled nursing while the other couldn’t visit because of COVID restrictions.

In fact, socializing for everyone living at these communities has been a challenge during the pandemic, with visits from outsiders and other community members not allowed even for healthy residents. Isolation accelerates mental and physical decline in seniors. Some communities have beefed up internet service and Wi-Fi capability for virtual visits with family members and provided tablets or other devices to residents who need them, as well as instruction and technical support. Some memory care and nursing centers have scheduled regular video calls between residents and their families. For in-person gatherings, communities have offered “closed-window visits” and created visitation booths, where people can see and hear each other, or using plastic sleeves, hug through a plastic barrier.

Communities also have gotten creative by brainstorming new ways to hold activities. One community in Florida launched virtual birthday parties, book clubs, continuing education lectures and wellness classes, museum tours, art classes and other programming. Communities have live-streamed religious services. The RiverWoods held socially distant outdoor events, including happy hours with individually packaged wine and cheese and a cornhole tournament. Other examples include hallway exercise or bingo with residents participating from their doorways, virtual cooking classes led by the head chef, and residents walking outdoors or riding adult tricycles. “You can have fun in a pandemic,” says Vogel.

When visitation isn’t permitted in assisted living or skilled nursing, staff members have done the best they can to keep residents engaged with one-on-one visits and activities, says Debra Feldman, a senior care manager in suburban Chicago.

Safety, of course, remains paramount, and all communities should be able to demonstrate that they have a solid plan for early detection and prevention of not just current but also future outbreaks of disease. Along with reassuring you, those plans serve as an important marketing and sales tool, says Breeding, who is also the author of What’s the Deal With Retirement Communities.

“Operators have responded aggressively and proactively to turn the tides,” says Beth Burnham Mace, chief economist of the National Investment Center for Seniors Housing and Care. They’ve implemented extensive and thorough sanitation, contagion protection, infection control, health screenings and testing protocols. But the cost has been high, including expenses for extra personal protective equipment, testing and well-deserved “hero” pay for staff members.

Labor costs were rising before the pandemic, given low unemployment and a shortage of skilled workers. Communities were having difficulty attracting and retaining qualified people. COVID made the situation worse, as staff members left or were absent due to illness, lack of child care or fear of infecting their families. Employers filled the gaps temporarily with expensive agency help.

For residents, the loss of familiar faces meant other hardships. “Temporary staff may take care of the individual physically, but they have no idea about the little things that person likes. When those niceties can’t be provided, it makes life miserable,” says Feldman.

If you’re considering one of these communities now, you’ll want a sense of what the quality of life is like even at its worst, when residents can’t visit with one another or enjoy group activities in quite the same way as before. Virtual tours, which many communities introduced during the pandemic, are a good first step and should continue to be offered even after communities reopen fully. “I doubt anyone would move in without ever actually seeing the community with their own eyes, but a quality virtual tour can get you a long way through the process and answer many of your questions,” says Breeding.

Normally, prospective residents are invited to attend community events, a great way to get a good feel for the community and to know people. Ask if you can attend any virtual community events, a substitute for now. Try to speak with a resident, if possible, too.

Occupancy Rates Under Pressure

Another challenge has been occupancy rates, which had slipped industry wide before the pandemic because of overbuilding. Occupancy fell further throughout 2020 as governments and communities imposed moratoriums on move-ins; families chose to care for loved ones at home, at least temporarily; and prospective residents took a wait-and-see attitude.

Throughout the pandemic, CCRCs have had the highest occupancy rates across all levels of care and the smallest year-over-year drops in occupancy compared with other types of senior living. Unlike the Great Recession, the pandemic economy hasn’t been a barrier to prospective residents, who have had no difficulty selling their homes or cashing out their equity and paying an entrance fee. Chances are their investment portfolios have been rising in value, too.

Lower occupancy means lost revenue, which has forced many communities to tap reserves. By December, those reserves were starting to be tapped out, says James Balda, president and CEO of Argentum, an association of senior living communities. A community that is part of a larger system that can help it weather the storm is likely to be better off than a “single-shingle” organization with no one to help save the day, says Lisa McCracken, director of senior living research and development at Ziegler Investment Banking.

Rents have been rising about 2% to 3% annually for the past several years, according to Burnham Mace. Given the overall economy, raising rents may not be possible now. As of late last year, many senior living communities in the U.S. were offering rent concessions and other incentives to attract new residents. Some incentives include assistance with moving costs, discounts on entry or monthly fees, and deferred or waived payments, says McCracken. Once the vaccine rolls through and occupancy is up, those incentives will diminish or disappear.

But communities may begin charging à la carte for ancillary services, including some new ones introduced during the pandemic. Many communities, for instance, launched concierge services to take orders for meals and groceries, get takeout delivered, and more. Now that many residents have become accustomed to the concept, the services most likely will be expanded post-pandemic, says Breeding.

Defaults and bankruptcies didn’t rise in 2020, says McCracken. But nursing homes hit record-low occupancy in December, and many are poised to fail. Some nursing homes have already closed their doors.

When a senior living community fails, generally it is sold. Every change of ownership, for any reason, has the potential to disrupt the community. If the previous owners outsourced the community’s operation to another company, the new owners often keep the same operating company to increase continuity and stability, says McCracken.

Waiting lists are a good sign of a stable CCRC, as is a large share of units that have presold in a new community. If you’ve chosen a CCRC but are considering whether to delay moving in, ask how long the waitlist is and if you can go back to the end of the line in case you’re not ready when a unit becomes available. If you delay, keep in mind that a change in your health status could prevent your entry into independent living.

Assessing a Facility's Financial Health

When researching a community, always express interest in learning more about its financial well-being. Ask for any information that will help give you confidence that it is well-managed financially today and has planned to meet its longer-term obligations, says Breeding. It’s a good sign if staff members are open to and well-prepared for the discussion.

The higher a community’s occupancy, the greater its revenue, so start there. Historically speaking, occupancy of at least 90% is ideal, says McCracken. Ask for the current occupancy rate and several years of historical averages to determine the pre-pandemic trend. Also, what is the community or organization doing to enhance and market itself?

In a CCRC, 95% occupancy is considered full; some units will always be empty for refurbishment. Plus, you don’t necessarily want to see full occupancy in a CCRC’s assisted living facility or skilled nursing unit because the space may not be available when a resident needs it, according to the National Continuing Care Residents Association.

If a community is for-profit and part of a publicly traded company, you can obtain an annual report and other financial disclosures. If it’s privately owned, those disclosures probably won’t be available, but in all cases, you can ask whether the facility is profitable and how many times it’s been sold. Nonprofit communities must file a Form 990 annually with the IRS. Search by community name at ProPublica’s Nonprofit Explorer, a database of tax-filing documents from tax-exempt organizations.

Credit ratings agency Fitch Ratings says the outlook for nonprofit CCRCs in 2021 is stable. Most CCRCs are nonprofits, and state transparency laws often require CCRCs to provide financial information if you ask for it. Many communities post their most recent audited financial statement on their website, but it can be difficult to interpret. Ask a trusted financial adviser to review the contract and financial disclosures with you.

Breeding says you really want to know if projected monthly fees will cover operating expenses with a reasonable rate of inflation. Will pricing and reserves cover future obligations to residents? Any level of debt the community carries should be reasonable relative to total assets. To learn about the financial ratios that answer those questions, download the “Guide to Evaluating the Financial Viability of a CCRC." Visit mylifesite.net for useful tools and CCRC information.

Another resource, the “Consumer Guide,” published by the National Continuing Care Residents Association, includes information about determining a CCRC’s long-term financial strength. You can join NaCCRA for $25 and get access to the guide, as well as member forums, where current and prospective residents share information and advice.

An actuarial study, which will factor in the impact of mortality and morbidity of residents, is the only way for a CCRC to know whether it can meet its expenses and other long-term contractual obligations to residents, including care and a partial refund of the entrance fee when a resident departs. One should be performed every two to three years. Ask when the most recent one was done and whether the community is on track to keep its promises.

No Regrets

If you need a continuing care community now, don’t let the pandemic deter you. In early 2020, Steve and Joan Holmes visited the new campus of the RiverWoods Group in Durham, N.H. The couple was motivated to move there by Joan’s increasing lack of mobility, which forced her to stay “cooped up inside” for a good bit of the year even before the pandemic struck. The Holmeses also wanted to secure the care they may need in the future without burdening their three children. They thought the campus was beautiful, and an apartment was available.

No sooner had the Holmeses listed their home for sale, then COVID struck and they had to take the property off the market. They relisted it in May, and it sold within a week for a bit under full price. They were able to move into their one-bedroom apartment with a covered patio in mid-July.

Now, Joan can walk everywhere in the community without impediments. A classically trained pianist, she enjoys playing the grand piano in the music room, and she loves not having to cook. Steve enjoys the community’s woodshop. They miss the opportunity to socialize, and their friends and family members haven’t been able to visit. But they know the situation is temporary. “When we can take the masks off, we’ll be really surprised to see what people really look like,” says Steve.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

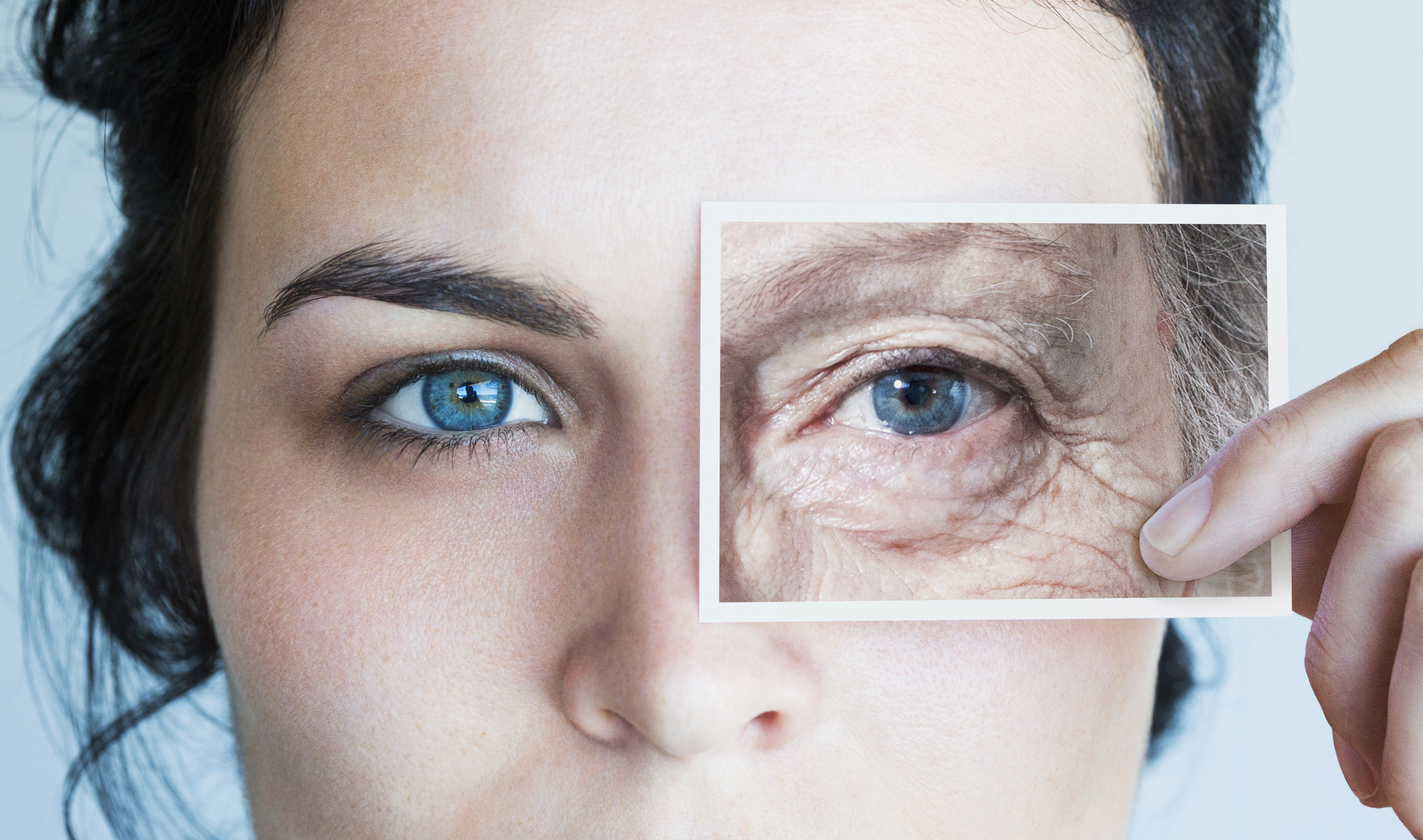

COVID Aged Your Brain Faster, Even if You Didn't Get Sick

COVID Aged Your Brain Faster, Even if You Didn't Get SickWhether you contracted COVID or not, your brain took a hit. Here's what that means for your health and what you can do about it.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.