What’s the Best Medigap Plan?

The 10 Medigap plans offer different levels of benefits that pay for expenses, such as co-payments, not covered by original Medicare.

Kathryn Pomroy

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Older Americans have important decisions to make each year regarding their Medigap and Medicare coverage. Although there is no annual open enrollment period for Medigap insurance, you may want to change your Medigap policy to accommodate any changes to original Medicare. During the annual Medicare Open Enrollment period, which runs from October 15 to December 7, all Medicare participants can switch to a new Medicare Advantage plan or return to Original Medicare.

The best time to buy a policy is during your only Medigap open enrollment period, when you first become eligible for Medicare. Under federal law, you have a six-month Medigap open enrollment period that starts the first month you have Medicare Part B and you’re 65 or older. Insurance underwriting is suspended during your open enrollment period, making it cheaper and easier to enroll in the policy of your choice.

After this period, if you have any pre-existing conditions, you may not be able to buy a Medigap policy, or it may cost more to buy a policy. I want to stress that your Medigap open enrollment period is a one-time opportunity that doesn’t repeat annually. But as with most rules, there are exceptions. We discuss these in more detail below.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why you need Medigap

- Medicare coverage does not cover gaps in coverage

- Part B of Medicare only covers 80% of your medical expenses after hitting your deductible

- Medicare Part A covers inpatient hospital stays, but you’re responsible for your deductible and daily coinsurance after a certain number of days

- Medigap is designed to help pay the out-of-pocket costs that original Medicare (Parts A and B) does not cover, such as copays, co-insurance and deductibles

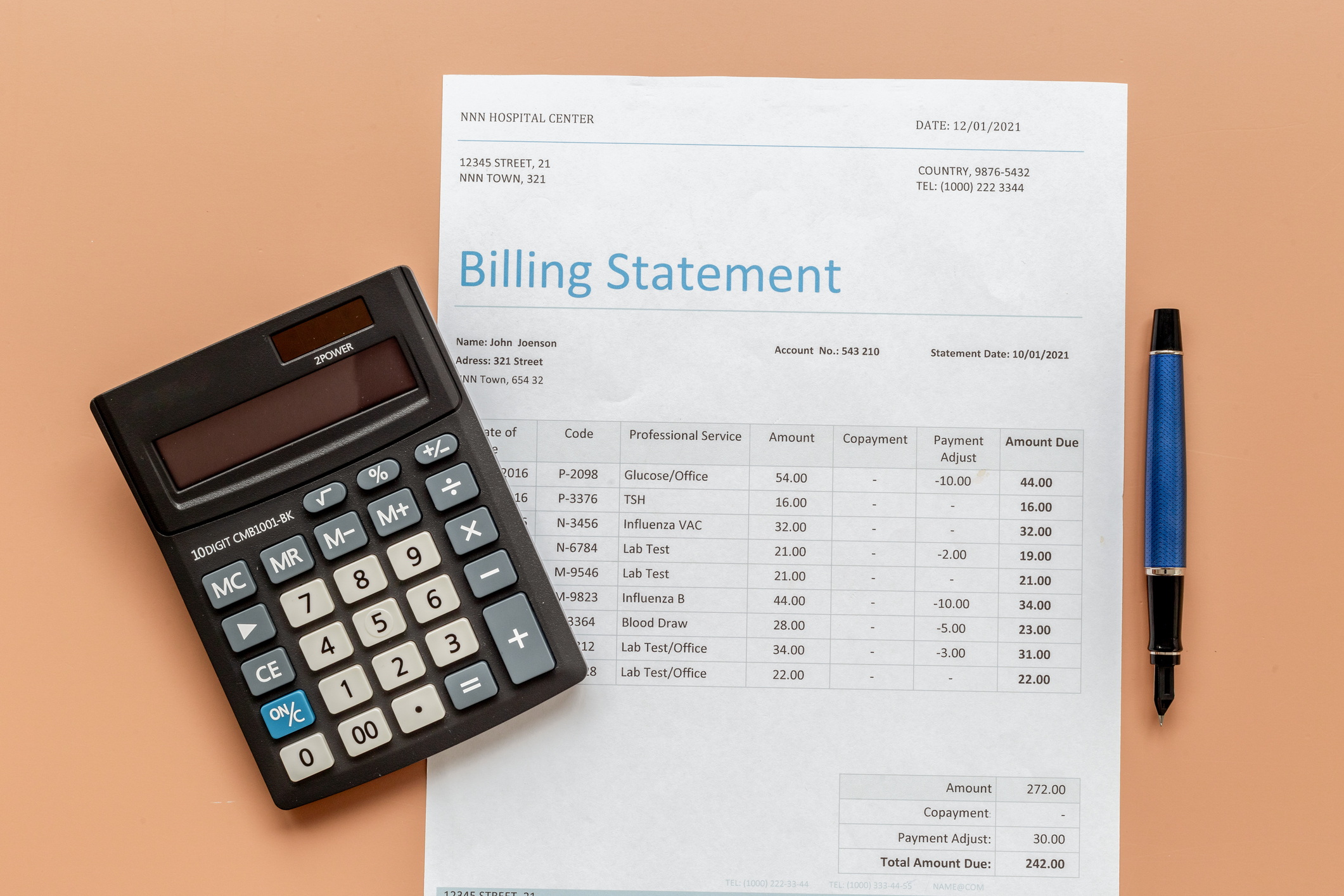

Original Medicare provides a number of great benefits to enrollees, but this coverage does have some gaps. For instance, Part B will cover only 80% of your medical expenses, after you hit the deductible, with no out-of-pocket maximum. That means you could be on the hook for a significant bill if you become gravely ill. Part A will only pay for the first 60 days you spend in the hospital after a deductible is met, before you must start paying co-insurance.

Medigap plans generally help cover your share of costs for services that are covered by original Medicare Parts A and B. These policies help cover out-of-pocket costs, such as copayments, coinsurance, and deductibles. Because of these gaps in original Medicare coverage, many beneficiaries choose to enroll in either a Medicare Advantage plan or a supplemental policy to help cover those costs.

(For more on Medicare Advantage, see Is a Medicare Advantage Plan Right for You?)

What is Medigap insurance?

- Medigap is private insurance that helps pay the out-of-pocket costs that original Medicare (Parts A and B) doesn't cover

- Medigap works only with original Medicare

- Medigap plans come in 10 letter designations: (A through D; F; G; and K through N)

- Not all states treat Medigap insurance the same

If you opt to enroll in original Medicare, you will have some expenses in addition to your Medicare Part B and Part D premiums. Medigap policies help cover your out-of-pocket costs associated with original Medicare, which include your copayments for doctor visits and prescriptions, coinsurance, and deductibles.

While Medigap plans are there to cover what your original Medicare plan doesn't, they generally don’t cover long-term care, private-duty nursing, vision or dental care, hearing aids, or eyeglasses.

If you decide to go with a Medicare supplement policy (or more commonly called Medigap), you then must select which plan you want. Medigap plans are administered by private insurance companies. These plans come in 10 letter designations (A through D; F; G; and K through N). All plans with the same letter have the same coverage, but prices can vary based on the insurance company.

Three states where Medigap policies are standardized in a different way. If you live in Massachusetts, you only have two plans to choose from. In Minnesota, there are three plans. In Wisconsin, Medigap plans offer additional benefits such as coverage for certain preventive services, according to Medigap.com

The 10 different types of Medigap insurance

- The Medigap plan that is best for you depends on how much medical care you think you may need in a year, as well as your personal preferences

- Some Medigap plans (F and G) let you pay a higher deductible in exchange for lower monthly premiums

- Plans C and F are no longer available to you if you became eligible for Medicare after January 1, 2020

- Unlike Medicare Advantage plans, all Medigap plans (including F and G) do not include an out-of-pocket maximum

Which plan is right for you depends on your personal preferences and how much medical care you expect to need that year. The plans offer a range of benefits, with some covering many of your Medicare costs while others require more cost-sharing. Some plans offer a high deductible option, and others have out-of-pocket maximums that will pay 100% of your costs for approved services after meeting your maximum and Part B deductible.

The range of options gives you some flexibility to find an option to fit your needs, budget, or both.

Plans C and F. Plans C and F are no longer available to those who became eligible for Medicare after Jan. 1, 2020. Why? Medigap plans are no longer allowed to cover Part B deductibles. Since both of these plans provide coverage for that expense, insurance companies can no longer offer them to new beneficiaries. Fortunately, those already enrolled in those plans can keep that insurance. Premiums, however, are likely to rise as these plans can no longer accept new enrollees.

Plan F became the most popular plan because of its generous benefits. It covers the Medicare Part A hospital deductible and co-payments, the Part B deductible, and some emergency care outside the U.S.

Plan C covers many of the same benefits as Plan F, except it won’t pay for the Part B excess charge. This happens when a provider charges Medicare more than the amount approved by the program. The beneficiary is then responsible for that excess amount.

If you were considering Plan F, then take a look at Plan G. It provides the same coverage as Plan F except for the Part B deductible.

Plan G. Plan G is now the plan of choice for many because it includes most of the same coverage as the popular Medigap Plan F, which is only available to those who became eligible for Medicare before January 1, 2020.

Plan G comes closer than any other policy in matching Plan F's coverage. The glaring difference is that Plan G does not cover the Part B deductible, which is $257 in 2025.

Plan G covers “excess charges” charged by doctors who don’t accept the full Medicare-approved amount as full payment. These doctors can charge you up to 15% over the Medicare-approved amount for services or procedures. Notably, Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island and Vermont have banned excess charges.

Plan D. Plan D is similar to Plan G as it covers more than most Medigap plans, but unlike Plan G, it does not cover excess charges.

Plan M. Plan M is nearly identical to Plan D, but while Plan D covers the full Medicare Part A deductible, Plan M covers only half.

Plans K and L. Medicare Supplement Plan K and Plan L are cheaper than other Medigap policies. These two plans have a lower monthly cost because you’ll share the cost of coinsurance for your Plan K and L bills (50% for K and 25% for L) up to an annual out-of-pocket limit.

Your cost-sharing ends once you reach that annual Plan K or L out-of-pocket limit. The 2025 out-of-pocket (OOP) limits for Medigap plans K and L are $7,220 and $3,610, respectively.

If you don’t anticipate having many doctor visits, consider Plan N, which usually has lower premiums in return for some cost sharing.

Plan N. Plan N is the third most popular plan type, covering about 10% of all Medigap members. Plan N has lower premiums than other popular options like Plan G and Plan F. Plan N pays 100% of the costs of Part B services, except for copayments for some office visits and some emergency room visits.

In 2025, Plan N copays are up to $20 for doctor visits and up to $50 for emergency room visits after the Part B deductible is met. Plan N also covers the Part A deductible, which is $1,676 in 2025. Plan N doesn't cover Part B excess charges.

Plans A and B. Plan A is ideal if you don’t plan to use a lot of healthcare services. Plan A includes only the basics for Medigap plans — the benefits that every Medigap plan covers. Plan A doesn't pay anything towards your Part A deductible or Part B excess charges. It does cover Part B coinsurance and copayments.

Plan B provides the same benefits as Plan A, plus coverage for hospitalization by paying the Part A deductible. The premiums are lower for Plans A and B, and while you won’t pay for extra coverage you might not use, you may have some occasional extra out-of-pocket costs.

High deductible plans. Medigap Plans F and G can be sold with a high deductible option. High-deductible Plan G is available to anyone enrolled in original Medicare, while the high-deductible version of Plan F is only available to those who signed up for Medicare before January 1, 2020. And, before June 1, 2010, Medigap Plan J could also be sold with a high deductible.

The annual deductible amount for these three plans is $2,870 in 2025. The deductible amount for the high deductible version of plans G, F, and J represents the annual out-of-pocket expenses (excluding premiums) that you must pay, at which point your coverage will kick in.

Guaranteed issue rights

- You have guaranteed-issue rights to buy a Medigap policy without medical underwriting during your six-month open enrollment starting at age 65 (and Part B), or within 63 days of losing certain other coverage

- Guaranteed-issue rights mean insurers cannot deny you a Medigap policy or charge you more because of your health, but must sell it to you at the lowest available rate offered to everyone

- Under Federal law, you have guaranteed-issue rights if you meet certain requirements

Outside of your six-month open enrollment period that begins the month you turn age 65, you also have a guaranteed issue right within 63 days of when you lose or end certain kinds of health coverage. When you have a guaranteed issue right, insurance companies can't use underwriting to evaluate your health and determine your eligibility and costs, and must sell you a Medigap policy at the best available rate. Guaranteed issue rights also prevent companies from imposing a waiting period for coverage of pre-existing conditions.

Read Watch Out for the ‘Medigap Trap’ to fully understand the consequences if you choose Medicare Advantage and plan to switch to traditional Medicare later as your needs change.

Outside of your initial enrollment period, you may have a guaranteed issue right if:

Your coverage: | When you have federally qualified guaranteed issue rights: | When you do not have federally qualified guaranteed issue rights: |

Enrolled in only original Medicare | In first 6 months of enrolling in Medicare Part B at age 65 or older | After the first 6 months of enrolling in Medicare Part B |

Enrolled original Medicare and an employer group retiree health plan or union coverage | When an employer cancels their retiree coverage | 1) If your employer changes (but does not drop) retiree benefits |

Enrolled in original Medicare and Medigap | 1) If you are dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you've been in the plan less than a year, and want to switch back. (Called 'Trial Right') | 1) If you voluntarily drop your Medigap coverage 2) If current Medigap policyholders try to switch Medigap plans |

Enrolled in a Medicare Advantage Plan | 1) If you joined a Medicare Advantage Plan when you were first eligible for Medicare Part A at 65, and within the first year of joining, you decide to switch to original Medicare. (This is called 'Trial Right') | After one year of enrollment in any Medicare Advantage plan |

States that have their own Medigap rules

- Four states prohibit insurers from denying Medigap policies to eligible applicants, including people with pre-existing conditions

- Some states are required to issue Medigap policies at any time during the year

- Some states let you switch Medigap plans without medical underwriting at specific times (like your birthday month or annually)

Four states, Connecticut, Massachusetts, Maine and New York, prohibit insurers from denying a Medigap policy to eligible applicants, including people with pre-existing conditions.

In Connecticut, Massachusetts and New York, insurers are required to issue Medigap policies at any time during the year. Maine, which has a one-month guaranteed issue period each year, only requires insurers to offer Medigap Plan A policies. And Minnesota has enacted legislation to institute annual guaranteed issue protections, which are set to go into effect on August 1, 2026.

The birthday rule. Other states waive underwriting requirements and permit you to change plans at certain times. For example, if you live in California, you can select a different Medigap plan that has the same or fewer benefits if you make a decision to change within 30 days after your birthday each year.

In addition to California, there are eleven other states that have a Medigap birthday rule: Idaho, Illinois, Kentucky, Louisiana, Maryland, Nevada, Oklahoma, Oregon, Utah, Virginia and Wyoming all have a form of the birthday rule. In 2026, a birthday rule will take effect in Indiana.

Medicare Select

- Medicare Select is a Medigap policy similar to an HMO: You must use specific network hospitals and doctors (except in an emergency)

- Because of the restrictions, these plans may offer lower monthly premiums than non-network Medigap policies

- Medicare Select is available only in certain states

In some states, it's possible to buy another type of Medigap policy called Medicare SELECT.

Medicare Select is a type of Medigap policy that requires insureds to use specific hospitals and, in some cases, specific doctors (except in an emergency) in order to be eligible for full benefits, similar to an HMO. Other than the limitation on hospitals and providers, Medicare Select policies must meet all the requirements that apply to a Medigap policy. Medicare Select policies may have lower premiums because of this requirement.

If you use a Medicare Select plan, how your medical bills are paid depends on whether you stay in-network.

In-Network: Medicare pays its share of the approved charges, and your insurance company covers all supplemental benefits outlined in your plan.

Out-of-Network (non-emergency): While Medicare will still pay its share of the approved charges, your Medicare Select plan is not required to pay any benefits.

The availability of Medicare Select coverage is limited to the geographic areas of the state served by the particular policy’s network of hospitals and doctors.

This type of policy lets you switch to a standard Medigap policy within 12 months if you change your mind and no longer want this type of coverage.

Help choosing the right Medigap plan

- The Medicare website allows you to compare Medigap plans and plan coverage

- The site also offers a tool to help you compare plans in your area

- When you visit the site, you can also find the price range for each available plan and a list of insurers who offer the coverage

The Medicare website provides a chart that outlines what each Medigap plan covers. You can see which plans provide skilled nursing facility care coinsurance, a blood benefit and offer some foreign travel emergency health coverage.

Medicare also has a tool that allows you to compare different Medigap plans available in your area. Enter your zip code, age, gender, and whether you smoke, and Medicare will provide a price range for each available plan and a list of insurers who offer the coverage.

We curate the most important retirement news, tips and lifestyle hacks so you don’t have to. Subscribe to our free, twice-weekly newsletter, Retirement Tips.

Related Content

- What You Will Pay for Medicare in 2026

- Seven Medicare Changes Coming in 2026

- How Medigap Insurance Is Affected by Preexisting Conditions

- Medicare Premiums 2026: IRMAA Brackets and Surcharges for Parts B and D

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jackie Stewart is the senior retirement editor for Kiplinger.com and the senior editor for Kiplinger's Retirement Report.

- Kathryn PomroyContributor

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.He wants a vacation home, but she wants a 529 plan for the kids. Who's right? The experts weigh in.