Soon-to-Be Retirees, Beware: Small-Caps Are Cheap for a Reason

Higher interest rates make debt more expensive for smaller companies, and that could become challenging for them if we head into slower economic times.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

We’re well into the new year now, and investors are naturally wondering which investments will prosper in the months ahead. With the Magnificent 7 stocks (that is, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla) making up the bulk of 2023’s market gains, many are expecting broader participation from the rest of the market.

Small-caps in particular seem overdue to outperform. Their rally at the end of the year might seem to be confirmation of that idea, but even with the year-end push, small-cap stocks are trading at a significant discount.

I know it’s tempting to dive in. But investors should always be aware of risk. That’s particularly true if you’re retired or close to retirement. Simply put, you don’t have much time to make up for mistakes. And getting overly excited about small-caps could be a mistake.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Cheap stocks are often cheap for a reason. That certainly appears to be the case with small-cap stocks today.

Larger companies more likely to have lower rates locked in

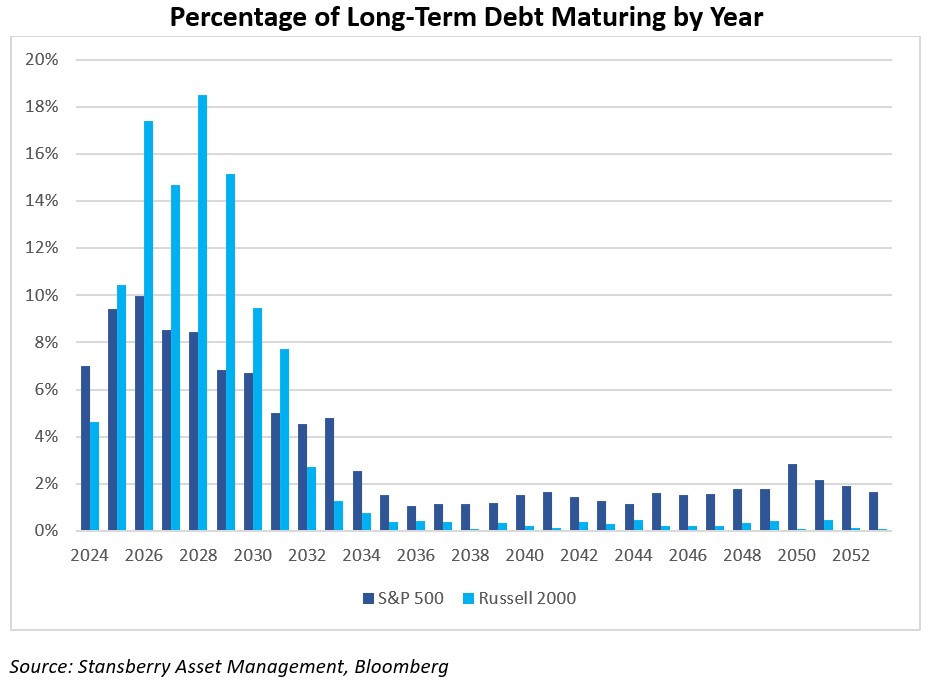

For starters, there’s debt. Generally, bigger companies have much less debt maturing in the near future. Over the past few years, the majority of U.S. homeowners locked in low-rate mortgages. They will enjoy the benefits of that decision for years to come. It’s the same with large companies that have locked in long-term debt at favorable rates.

Smaller companies, on the other hand, don’t have the same access to bond markets for raising long-term debt. They generally use bank lines of credit and shorter-term sources of liquidity. That means their debt is being repriced at substantially higher interest rates, which is a headwind to profits.

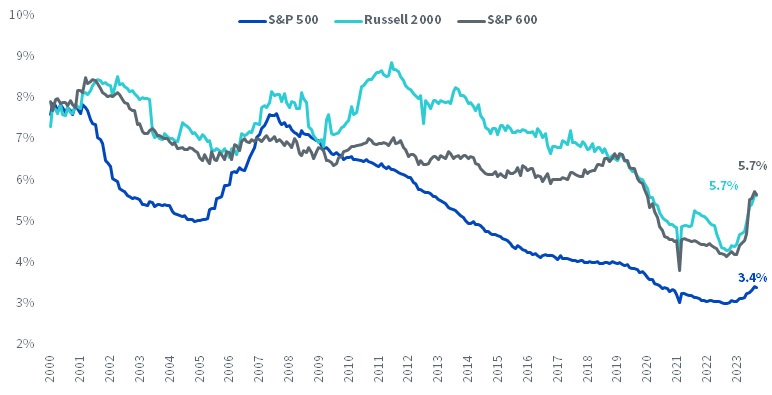

Average Interest Rate Paid on Debt

Source: Wisdom Tree, FactSet, MSCI, as of 9/30/2023. Excludes financials sector.

As shown in the chart above, the interest cost over the past year for large-cap companies (S&P 500) is notably lower than for small-cap companies in the S&P 600 and Russell 2000. For weaker companies, higher rates could mean the difference between being profitable or in the red, especially in a recession.

Many smaller companies are unprofitable

Speaking of in the red, did you know that 40% of companies in the small-cap Russell 2000 index are unprofitable today? And that’s with a pretty strong economy. For now. Consumer credit card delinquencies and auto loan defaults are spiking. Bankruptcies are on the rise, as are delinquent commercial real estate loans. These are certainly signs that we may be in for more challenging times, if not an outright recession.

Higher rates plus a slowing economy could mean a spike in bankruptcies in the small-cap universe. But there’s good news: There are some great small-cap stocks out there! Not every small-cap company is drowning in debt, and in some niche areas, smaller companies can be industry leaders. They’re often overlooked — especially in an environment like today when the biggest stocks are getting all the attention.

If you are a roll-up-your-sleeves investor (or have a financial adviser who is), you may be able to find some wonderful businesses at attractive prices. However, if you or your adviser are the type to buy mutual funds and ETFs that own hundreds of positions, be careful. If those funds are broadly invested across the small-cap universe, you may be exposed to a collection of unprofitable and highly levered companies. If we head into slower economic times, what looks cheap today may cost you dearly.

Related Content

- Stock Picks That Billionaires Love

- Warren Buffett Stocks: The Berkshire Hathaway Portfolio

- Best Dividend Stocks for Dependable Dividend Growth

- Kiplinger Interest Rates Outlook: Short-Term Rate Decline May be Pushed Back to June

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael is a Portfolio Manager and Deputy Chief Investment Officer at SAM, a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. He sources investment opportunities and conducts ongoing due diligence across SAM’s portfolios. Michael co-manages SAM’s Income and Tactical Select strategies. Prior to joining SAM, Michael worked with high-net-worth private clients for the largest independent wealth management firm in the United States. He was also a senior analyst for one of the largest investment-grade bond managers in America. Michael joined SAM in 2017.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.