Insuring Your Plan for Retirement Income

‘Longevity insurance’ ensures you don’t run out of money in retirement. How to figure out how much you need, the types of annuities to use and when the income should kick in are tricky questions, though.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As the saying goes, the best insurance is the kind you don’t use. That is certainly the case with auto and home insurance. When you insure your income for a long, healthy life, however, it is possible to acquire the peace of mind of protection and create a major source of your retirement income as well.

In my last article, Are You Worried About Running Out of Money in Retirement?, I showed how adding income annuities could prevent you from running out of money in your plan for retirement income even in a scenario where there was no increase in the share price of stocks over your entire retirement. In contrast, the plan without annuities in this scenario ran out of money at age 91. That meant no income from savings and no portfolio of stocks and bonds to fund unplanned expenses. (These and other calculations are based on the Go2Income planning method to develop plans, estimate annuity rates and prepare comparisons.)

Insuring your plan

Ensuring the outcome from a plan for retirement income reminds me of a need that new homeowners have when they take out a mortgage to purchase that first home. It was originally called mortgage protection life insurance — and it fostered the growth of the private home market in the ’40s and ’50s.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Well, the same is true of the retirement market. To minimize the risk of running out of money, retirees may need what is known as “longevity insurance.” Fortunately, this type of protection is offered by highly rated insurance companies, provides unique tax benefits and, subject to your own evaluation of suitability, is available without underwriting. Also, payment rates are up 20% to 45% from the start of 2022.

But the term “longevity insurance” does not fully convey what income annuities can do and how to structure them. The question is how much, which types of annuities to use and when to have the income kick in. The way to decide when and how much is to test various configurations in your plan for retirement income.

Types of income annuities

Here’s a primer on the three basic forms of income annuities:

- A single premium immediate income annuity, or SPIA, is purchased with a lump sum, often upon retirement, and as its name suggests, payments start immediately or at least within 13 months. If you buy it with money that has already been taxed, i.e., personal savings, you pay taxes only on the previously untaxed portion of your payments.

- A deferred income annuity, or DIA, has annuity payments starting in the future and is purchased from your personal savings. You might have several DIAs, in fact, that add to your lifetime income stream at different ages. IRS rules allow you to exclude a portion of your DIA payments from taxes as well.

- A qualified longevity annuity contract, or QLAC, is purchased from your IRA and begins payments in the future, not later than 85, to supplement income when health care and similar high costs might be expected. As a special tax benefit, a QLAC permits you to defer taxable RMDs, or required minimum distributions, from a portion of your IRA account until payments start.

Besides the structure above, each of these annuity types can continue annuity payments for the life of a spouse, or if no spouse, for the life of a beneficiary, until the purchase price is recovered. Of course, understanding what the annuities can do is only the start.

Basics of planning with income annuities

Now, here are some decisions to consider when you plan for life-long income with these annuities:

- How much of your savings to allocate to the purchase of income annuities? You make the decision, but the model used in the example below calls for a maximum of 40% to all annuities, with a maximum of 12.5% of your savings to a DIA and a QLAC.

- What is the allocation of 12.5% between a DIA and a QLAC? One model assumes you take the fullest advantage of QLAC’s rules and allocate to a QLAC first, up to the maximum allowed of $200,000 but no more than 25% of your IRA account. The other divides it evenly between the two.

- When does income start under the DIA and QLAC? The best way to decide this is to review a few options and to see the impact on your plan — both in terms of income and liquidity/legacy as measured by your portfolio value. (See charts below.)

Two types of plans to consider

There are virtually an infinite number of “income start” options to consider based on your personal objectives. Here are two of the most frequently requested, using plan results for our investor at age 70 with $2 million in savings to evaluate.

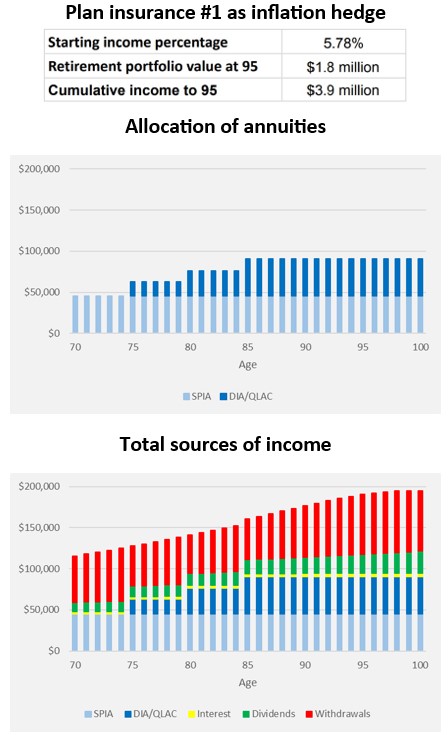

Plan insurance #1. Ladder income starting at age 75 for both a DIA and a QLAC and consider that lifetime income as an inflation hedge.

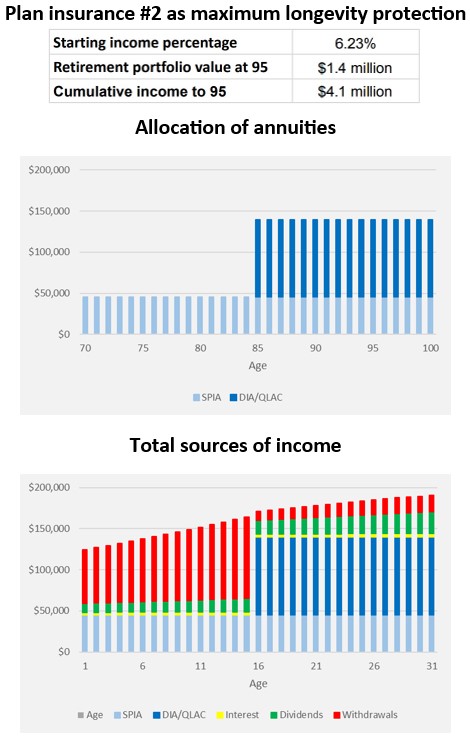

Plan insurance #2. Defer income under both to age 85 and build the largest amount of income protection.

Set out below are the results for Plan #1 and Plan #2 using 12.5% (or $250,000) from the $2 million in savings to purchase plan insurance. Note the impact under Go2Income planning on starting income, cumulative income and portfolio value.

Plan #1 above uses the laddered annuity income to fund the increasing income in part, requiring a smaller amount of IRA withdrawals at the start and which in turn allowed our investor to maintain more of her portfolio value. Note that even with a starting income percentage of nearly 5.8%, her portfolio climbs to nearly her current level of savings.

Plan #2 below is the one to choose when you want more income earlier in retirement and will accept a slightly lower long-term liquidity or legacy. Note that her starting income percentage is over 6.2%.

Picking the best plan insurance for you

Higher income or greater legacy?

Plan #1 preserves most of the IRA/401(k) savings, allowing you to leave a larger legacy. Plan #2 creates more income by pulling from your IRA and 401(k) accounts earlier in retirement, with a DIA and QLAC supplying income later, for a combination that produces greater income.

There is always a tradeoff, but you can choose the plan that works best for you and your family. The right approach will help you ensure the success of the plan you choose.

A Go2Income plan can help you choose not only the right products you’re your specific situation, but the right way to insure your income throughout retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.