What’s Your ‘Money Type’? Knowing It Could Help You Avoid a Financial Blunder

Financial advisers are seeing some interesting stress responses to financial uncertainty. With that in mind, here are some practical tips for three of the most common money behaviors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As a wealth adviser, I’ve witnessed the various ways people react to financial stress. While I’m sometimes surprised at an individual’s response, I remind myself that people have deeply ingrained beliefs and patterns about money.

There is a large body of research that explores the relationship between money and emotions, financial archetypes, and money psychology. The Money Coaching Institute® holds that there are eight “money types” or archetypes:

- The Innocent

- The Victim

- The Warrior

- The Martyr

- The Fool

- The Creator/Artist

- The Tyrant

- The Magician

Though not specifically included in this list, I’d add one more as a common financial archetype among investors: The Saver/Conservative.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

During the COVID-19 pandemic, I’ve seen clients acting in ways consistent with many of these financial archetypes. It’s a universal truth that we learn things about ourselves during difficult times. So, perhaps now is the time to better understand your relationship with money so you do not let your own stress behaviors derail your financial game plan.

Below are the three most common behaviors I have observed in the wake of COVID-19, as well as the respective financial archetype for each stress response:

- Increasing risk within an investment portfolio in hopes of a large payoff (The Fool/ Pleasure Seeker)

- Selling investments in favor of cash (The Saver/Conservative)

- Refusing to inspect your financial situation or make changes (The Innocent)

Are You a Fool/Pleasure Seeker? Here are Some Tips for You

After the best 50-day rally in history for the Standard & Poor's 500 Index — which occurred in April and May — many investors are experiencing FOMO (fear of missing out). Some people are now looking for a quick profit by going all in on one or a handful of stocks.

If you find yourself fighting the urge to do this, or day trade your accounts, perhaps you fall into this archetype … and you are not alone. In fact, Barstool Sports founder Dave Portnoy has amassed a social media following for his stock picks and daily trades. If you are not familiar with Barstool Sports, Wikipedia describes it as a sports and pop culture blog, not an investment adviser!

If you are going to engage in speculative investing, consider limiting your bets — and remember, they are bets — to no more than 5% of your portfolio. If your bets don’t play out, you can at least write off your losses through tax-loss harvesting if the losers were purchased within a taxable account, not an IRA or 401(k).

Are You a Saver/Conservative? Keep These Considerations in Mind

It sounds counterintuitive, but a bear market is a good thing for long-term investors, because you are buying investments at discounted prices. If you ever consider moving your investments into cash during these periods, consider the following information:

Dating back to the early 1970s, a portfolio consisting of 60% stocks and 40% bonds (60/40) experienced a negative return 9.5% of the time when looking at rolling-year returns. A less aggressive portfolio, 40/60, only lost money 3.3% of the time when looking at rolling three-year returns. However, when looking at rolling five-year returns for the same portfolios, both had a positive return 99% of the time*.

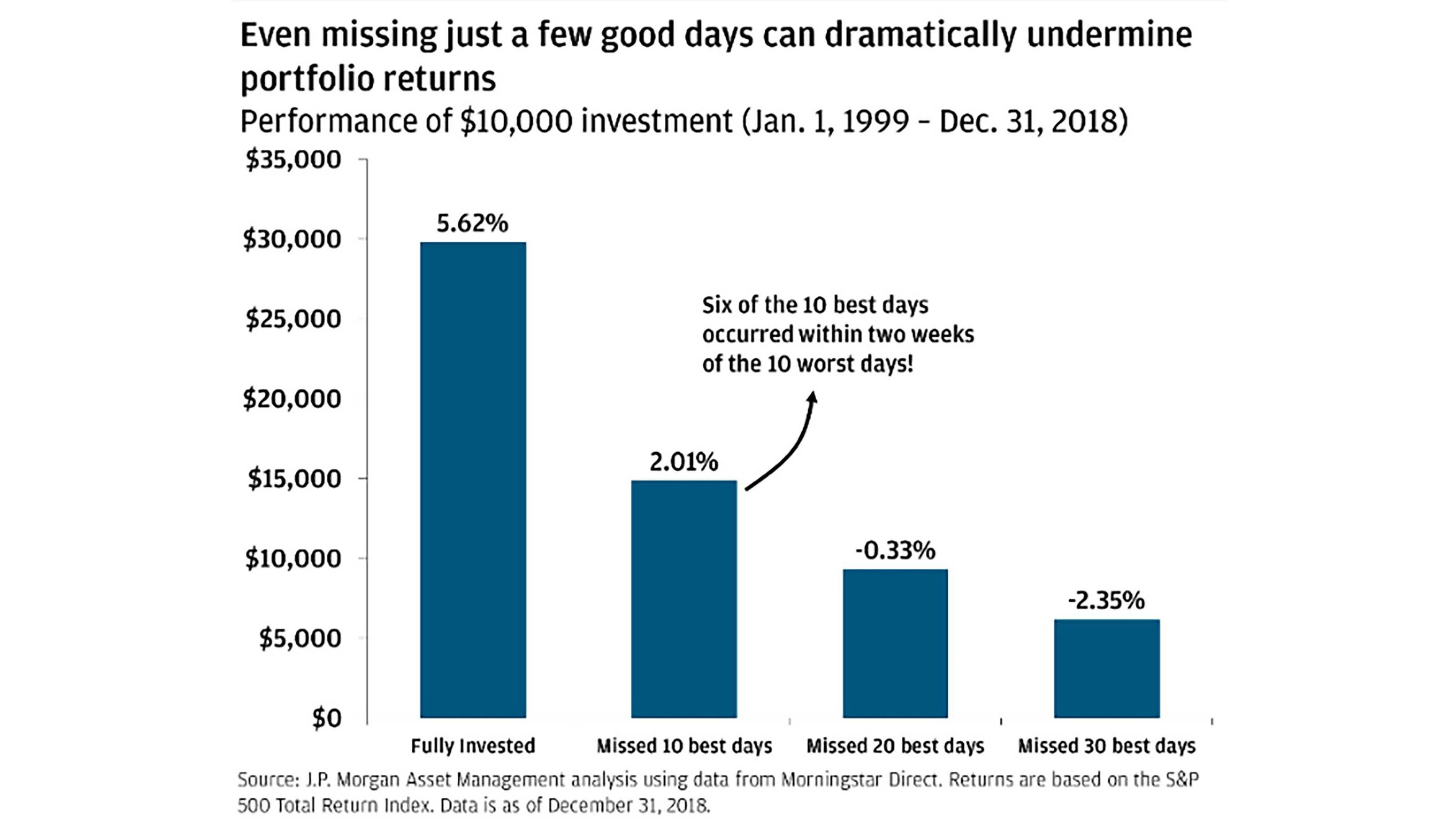

Moreover, a JP Morgan Asset Management study shows that missing 10 of the best stock market days can reduce your return by over 3.5%, and most of the best days follow the worst days, which is typically when investors throw in the towel.

So, if you are more than five years away from needing to tap into your investments, do not let your emotional desire for stability and certainty cloud your judgment when times get tough. Going to cash may give you certainty in knowing your investments will not lose any more money in the short term, but it can also lock in significant losses.

For the clients who cried uncle in March of this year, some have locked in losses of 20% or more!

An Innocent? Here’s What You Should Consider

For those investors who couldn’t bring themselves to look at their investments when things went haywire earlier this year, they actually did themselves a favor, because the stock market has skyrocketed after falling over 30% in a little over a month.

Studies show that the less frequently you look at your investments, the better your accounts typically perform. Taking the “ostrich approach” (burying your head in the sand) may work from time to time and spare investors some heartburn, but it does have the potential to do lasting harm, specifically for retirees.

If you are withdrawing from your accounts, any downturn will be exacerbated by selling investments at low prices. For this reason, it is important for retirees to keep ample cash on hand to prevent from having to sell investments during a downturn. When you need to take money out of your accounts, consider selling bonds during a stock market sell-off and trimming stocks during a bull market.

Taking the ostrich approach may have worked for retirees over the past decade, but not monitoring your withdrawal rate is a recipe for disaster. Assuming no change to your annual withdrawals, a 30% decline in portfolio value would increase your withdrawal rate by ~43%, potentially taking years off your portfolio’s longevity.

Understanding why people react in different ways can help you be a more compassionate spouse, parent, friend or business partner. Once you become more aware of your “money type,” you can leverage the positive traits to empower you to achieve your goals and dreams, while preventing the negative consequences from derailing your financial game plan.

Finally, if you would like to find out more about your own money type, take The Money Coaching Institute’s free online quiz.

*Information based on Ibbotson Large Cap Stocks and Corporate Bond historic performance. The three-year rolling return data dates back to 12/31/1972 and the five-year rolling returns date back to 12/31/1974.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Thomas Farmer is a partner and wealth adviser at McGill Advisors, a division of CI Brightworth. He obtained the CERTIFIED FINANCIAL PLANNER™ certification in 2011, the Certified 401(k) Professional designation in 2014 and is a member of the Financial Planning Association.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.