Name Your Plan – Select Both Retirement Income & Legacy Target

You know how much income you need and what kind of legacy you want to leave, but what you don’t know is if you might be able to hit those targets. Here’s one way to find out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Everyone has retirement goals, but the big question is, are they attainable?

Take the 70-year-old woman I wrote about recently. She has $2 million in retirement savings, and she’d like to use those savings to generate $70,000 in annual income increasing by 2% a year early in retirement, but still be able to leave her heirs a $2 million legacy at age 90. Can she do it?

That’s a question many financial advisers might have trouble answering, but after seeing the results of many, many plans over the years, I believe I’ve created a method that can answer her question using Income Allocation planning. While her legacy results will depend on market returns, this planning method incorporates annuity payments into the mix and lowers costs and taxes to deliver reliable income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Happily, with technology and experience, that analysis is now available to you, too. After considering your personal and plan data, my team will enable you to Name Your Plan by using our tools at Go2Income to solve for the plan design and market return that achieves both your income and legacy objectives.

Our Retiree Names Her Plan

How does it work? To begin, you provide plan data, including your age and gender, marital status, your retirement savings, percentage of savings in your rollover IRA, desired inflation protection and your risk tolerance as measured by the percentage to be invested in stocks. Then we sift through (electronically, that is) the millions of possibilities.

The key driver of achieving both of your objectives is the long-term return in the stock market.

Now we zero in on the plan that will get you what you want. And you may be surprised that the stock market returns affect your results less than you might expect. When they do affect the plan, the impact will be on the legacy you leave, instead of your annual income.

How We Enable You to Name Your Plan

Here is how our retiree refined her objectives to set her twin goals for income and legacy:

- She revealed that 50% of her $2 million in savings is in a rollover IRA, and the balance is in personal after-tax savings.

- With her annual income goal of $70,000 growing by 2% per year, together with a Social Security check that also grows, she believes she will be able to live comfortably.

- Regarding her $2 million legacy goal, she understands that market results and plan design may prevent her from achieving that goal in every year and so is setting that legacy target at her approximate life expectancy of 90.

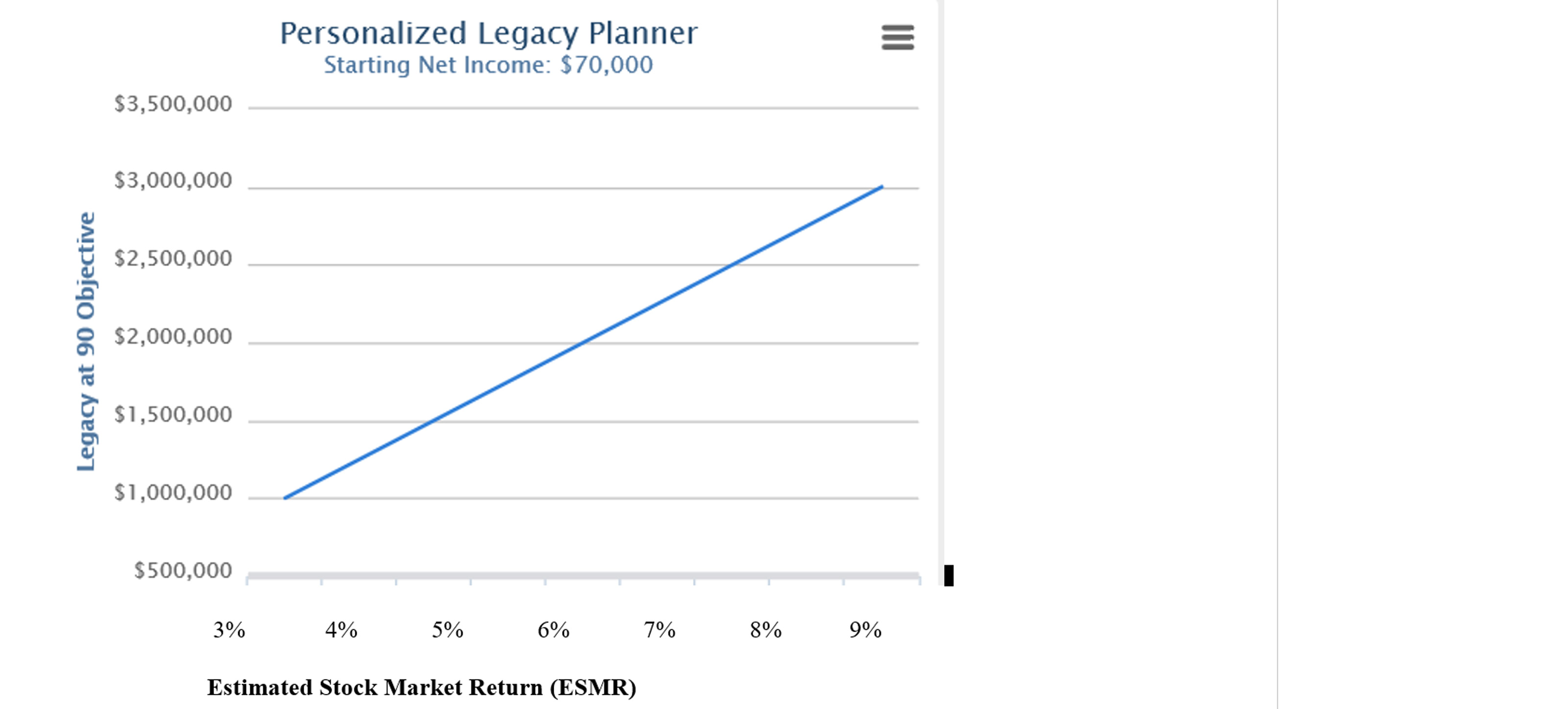

Recent studies would suggest that her twin goals are just not possible in today’s market. However, after using the Go2Income Income Allocation tool to create her income plan, she can now use the Legacy Planner below to estimate what stock market return it would take to deliver both her income and legacy targets.

Keep in mind that because her personal situation and plan objectives are unique to her, the Legacy Planner is personalized and developed results just for our retiree. (Sharing a “one-size-fits-all” planning tool just can’t get the best results for you.)

ESMR is based on a sampling of plan. A counselor can create your plan.

Balance Your Needs

The Legacy Planner shows that it would take a long-term stock market return of between 6% and 7% to meet her legacy objective — and maintain her income goal. If returns fall short by the time of her passing, remember that her kids/grandkids will have their lifetimes for markets to recover.

In other words, my legacy-income planning method matched the targets of a “live off interest and leave the principal” plan from yesteryear — one that no longer works, given today’s low interest and dividend rates — without putting her retirement at risk.

You can do the same. Visit Go2Income for more information on how Income Allocation can help you reach your income and legacy goals, or contact me to discuss your situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.