Fill Your Retirement Income Gaps – and Then Some

When drawing up your retirement income plan, you need to be prepared to cover these three different income gaps. If you don’t, you’d better be ready to cut back on your lifestyle or your legacy plan.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I have some friends who developed a wonderful estate plan for their kids that involves the purchase of a large survivorship life insurance policy. However, because of today’s lower interest rates, the projected premiums on their policy have increased significantly. That means some of the money they were putting into a 529 plan might have to be diverted to pay those rising premiums.

This raises a common question about future legacy vs. finding money for shorter-term needs: Which one should take priority? (They are both important; there will have to be some trade-offs, but thoughtful planning can lead to less disruption than you might assume.)

You could describe this as a problem for the 1%, but most of us — not just our estate planning friends — need income for legacy planning, gifting, bucket list items or essential living expenses, and we need to address these potential retirement income gaps either now or in the future.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Longevity — An Unplanned-for Income Gap

If you are in or near retirement you should start planning to live longer. A 2018 study showed that men ages 60 to 79 had a biological age four years less than the men in an earlier generation, in part because of improvements in lifestyle and medications. This suggests that not only is this group living longer, but they’re also staying healthier longer. (This experience is in contrast to a reduction in overall life expectancy from communities hit hard by COVID, opioids and extreme poverty.)

If you’re in the 60 and older group highlighted in that 2018 study, these developments may mean that many of you will need more money than your current plans permit. I have pointed out before that traditional retirement planning often advises retirees to simply spend less when their savings are diminishing because of market corrections or greater longevity. Maybe you can fend off outright disaster that way, but does it offer the best peace of mind or happiness? It certainly results in a smaller financial legacy to your heirs.

As a cautionary example, the retiree I profiled in my previous column, “How to Generate an Extra $20,000 a Year in Retirement,” created an income plan that would pay her $160,000 a year at age 70. To maintain her lifestyle and income value, even with modest inflation, she will need to generate $250,000 at age 95. Cutting back to make up any shortfall eventually means she may have to give up her lifestyle and legacy plans during the last years of her long life. That’s not her goal.

Fifty percent of us live beyond the life expectancy for the group we belong to. And failure to plan beyond life expectancy creates the Longevity Income Gap. Perhaps you have planned for living longer than your life expectancy. But ask yourself, will your income sustain itself or decline during that period?

Two Other Types of Income Gaps to Prepare for

Besides the Longevity Income Gap, which derives from a combination of good news, (living longer and healthier lives) and poor planning (not planning for lifetime income), there are two other income gaps to consider:

- Your Total Income Gap: This is the difference between your income goal (designed to cover both your essential living expenses, and your bucket list expenses) and the amount of guaranteed lifetime income you’ve earned during your employment, including Social Security, pension benefits and any deferred compensation. For our example retiree — who receives $62,500 per year from her Social Security and pension and who wants $160,000 per year to maintain her lifestyle, adjusting upward for inflation — her Total Income Gap is nearly $100,000 per year. She needs to generate nearly 5% per year from her $2 million in retirement savings, plus growth, to meet her income goal.

- Your Planning Income Gap: The final gap represents the portion of her income goal not met by her planned-for income. In our friend’s situation a traditional plan using asset allocation delivers only $72,000 per year from her savings in today’s market, meaning she has a Planning income Gap of over $25,000 per year. To fill that gap, she immediately has to start her plan by drawing down on her capital.

As I have stated before, as time passes the two typical choices for our retiree when “bad things happen” to her plan (like low interest rates or a stock market meltdown) are spending less or drawing down even more of her savings. Drawing down your savings runs the risk of forcing a major mid-course correction, which is the last thing she or her kids want to do when she’s healthy and enjoying her life.

How to Bridge Income Gaps with a Smarter Plan

Consider an alternative to the traditional retirement plan: an Income Allocation plan recommends that you allocate your income among interest, dividends, annuity payments and IRA withdrawals. And in some cases, drawing down or extracting equity from a primary residence.

The solution is pretty straightforward:

- Add annuity payments with a portion starting today and another portion starting in the future, with both continuing for your life. They will replace a healthy portion of the income on your bond investments in your personal savings accounts. The allocation of a portion of savings to lifetime income annuities produces more income and tax benefits.

- Invest in high-dividend, value-oriented ETFs that deliver increasing income, potential for growth in share value, low fees and lower taxes. Add some fixed-income ETFs with management that deploys artificial intelligence for securities selection.

- Manage your IRA withdrawals from an account invested in a balanced portfolio of low-fee growth and fixed-income ETFs. Under this approach the amount of the withdrawal is set (managed) to produce a steadily increasing level of income rather than simply meeting RMDs. This management works together with an allocation of a portion of these savings to QLAC — a tax-advantaged deferred income annuity – described above.

- If the above steps don’t eliminate the Planning Income Gap, consider a modest drawdown of equity in a primary residence until age 85. Although the usual form is a reverse mortgage, there are other home equity extraction products coming to market. By pairing the drawdown with longevity protection, she protects her income and limits the drawdowns only to age 85.

- In our example, our friend was able to eliminate the Planning Income Gap, and actually created a surplus averaging around $6,000 per year – without any capital withdrawals or drawing down from her home equity.

We’re convinced that this approach will produce the smartest retirement income plan — and make your planning decisions easier when you must balance long-term and short-term cash flow needs like our estate planning couple above.

What About Capital Withdrawals to Fill the Gap?

In this article, we discuss the risk of capital withdrawals when retirees face a deficit between their income goal and withdrawals from their IRA, dividends and interest. If they don’t follow an income allocation approach with annuity payments or home equity extraction, they are faced with a dilemma: (1) reduce their goal, (2) rely on capital gains or (3) withdrawal capital. The first option requires a change in lifestyle, the second involves taking market risk, and leaves the retiree with the risk of running out of savings.

To measure the potential risk from capital withdrawals we developed a planning model to measure how withdrawals impact the value of the retiree’s portfolio or liquidity. Using capital withdrawals to meet an income goal may be appropriate when the income deficit is reasonably small or when the retiree may not expect an average lifespan. In our retiree’s case above the income deficit was small enough to meet her income goal through age 95.

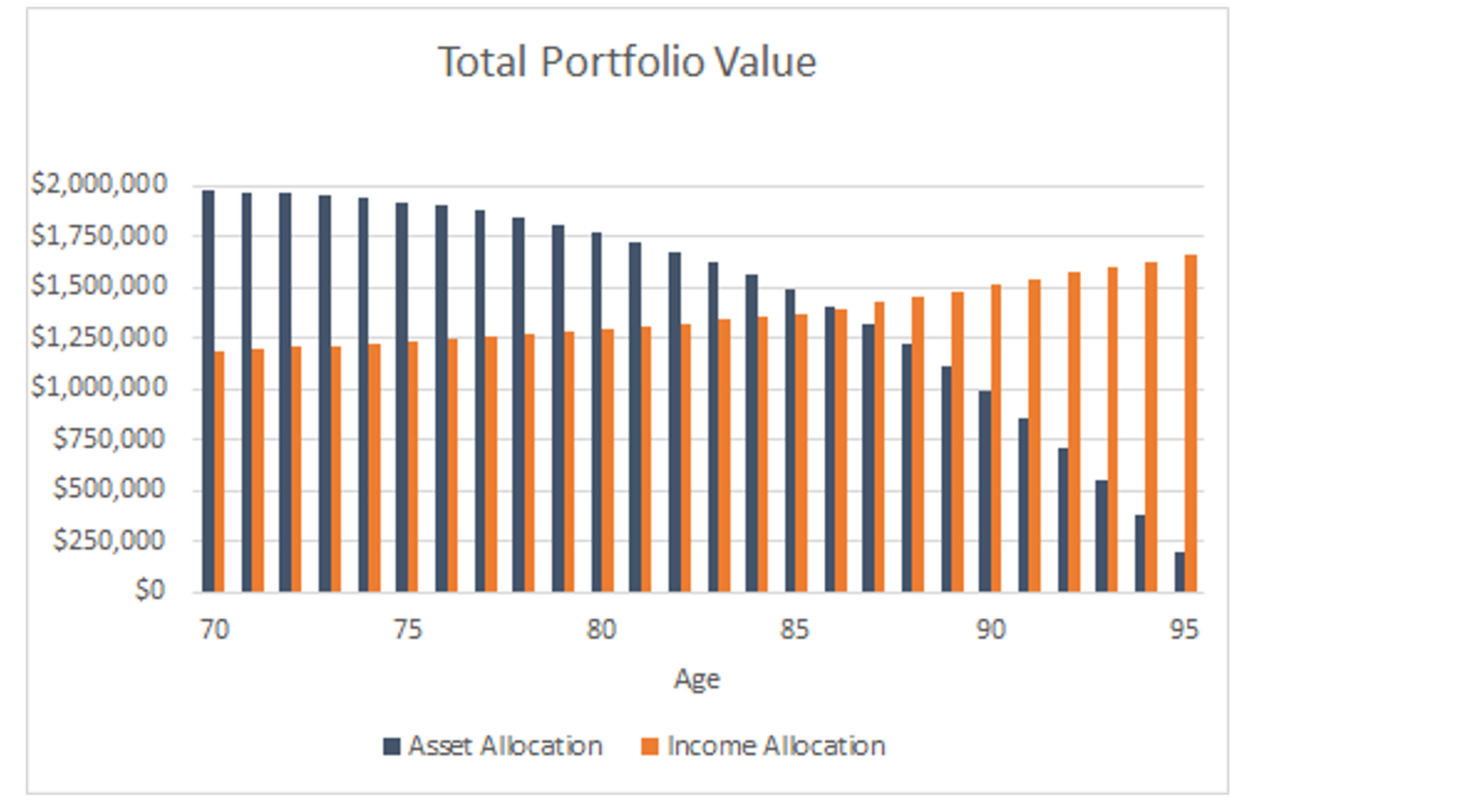

However, the capital withdrawal strategy left her with a lower margin for adverse events. And it left her with virtually no legacy at her passing at age 95. See chart below that compares the total portfolio value between the asset allocation (capital withdrawals) and Income allocation (annuity payments) planning.

Bottom line, using Income Allocation planning with annuity payments can provide lifetime income and more long-term legacy, provided your willingness to give up liquidity in your early years. In our retiree’s case she increased her legacy at age 95 by nearly $1.5 million.

A new difference

If you have been reading my blogs for a while, you will recognize the advice I consistently impart: Develop guaranteed lifetime income from your savings to supplement Social Security and any pension, take advantage of low-fee and low-tax investment strategies, and readjust your plan along the way to maintain your advantage without cutting back on your lifestyle. Income Allocation simply delivers more income with less risk.

So, what’s different about my advice today? We now can deliver holistic planning that considers your income goal and your employment-related guaranteed income, plus demonstrates the impact of withdrawing capital to manage any Planning Income Gap.

Our goal is to fill your income gaps, and to meet a stretch income goal going beyond simply meeting your essential expenses— without stretching your risks.

Are you a DIY investor who just wants some guidance to make sure you are on the right track with your income plan? Go2Income helps you build a retirement based on your specific needs and wants. Go2Income supplies the information and options; you make the decisions. To discuss more, contact me at Ask Jerry, and we will look at your personal situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.