What’s Your Retirement Number? Don’t Just Go by the 4% Rule

To help make sure your retirement income covers your needs and lasts for a lifetime, you need a custom plan. The 4% rule of thumb is a handy starting point, but it’s too general. Get specific to find your very own retirement number.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Numbers rule our retirement decisions, and we usually have questions about them. At what age will we stop working full time? How long of a retirement should we plan for? What do today’s low interest rates mean to our future income? Can we count on a reasonable dividend yield from our stock portfolio? What percentage of our income should be guaranteed for life, through Social Security, pension income and annuity payments?

Dollars or Percentages

We also look at retirement income as both dollar amounts and percentages. Should we try to replace 100% of our former income during retirement? Or should we set a fixed budget and find a way to meet that amount? You can determine which approach appeals to you by thinking about your last mortgage refinance. Did you congratulate yourself for shaving a percentage point or two off the mortgage rate, or plan for ways to spend the extra $300 you saved every month?

Common Retirement Measure: 4% Rule of Thumb for Starting Income Percentage

The 4% rule of thumb is another percentage, and it looms over the majority of retirement decisions. This is the rule that says people with a reasonable amount of savings when they retire should be able to make that pot of money last for 30 years even as they remove 4% of the total each year for living expenses. Studies have shown that three-quarters of all financial advisers rely on the 4% rule when offering guidance to their clients.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There’s just one problem. Baby Boomers retired last year at the rate of about 8,800 a day, or 3.2 million a year. And one size does not fit 3.2 million people. In fact, it is reasonable to think that every one of those retirees will seek a number that is right for them as they customize their retirement income plan to their specific needs. Further, the number is dependent on market conditions. When Wade Pfau, a financial academic, was asked whether the 4% rule of thumb still applies, he suggested that while it worked historically, it never dealt with the current low interest rates and high stock market valuations at the same time.

Your Starting Income Percentage is Unique to You

No ordinary rule based on averages can replace the factors you need to consider when figuring out how much income your savings can generate. Those factors include:

- Your age, gender and marital status, all of which impact the life expectancy of your plan.

- Market returns, interest and dividend rates, and inflation expectations.

- Your legacy objectives for your kids and grandkids.

- The amount of retirement savings you have accumulated.

- Where your savings are invested: rollover IRA versus personal (after-tax) savings or even equity in your home.

- Your attitude toward taxes, both current and proposed.

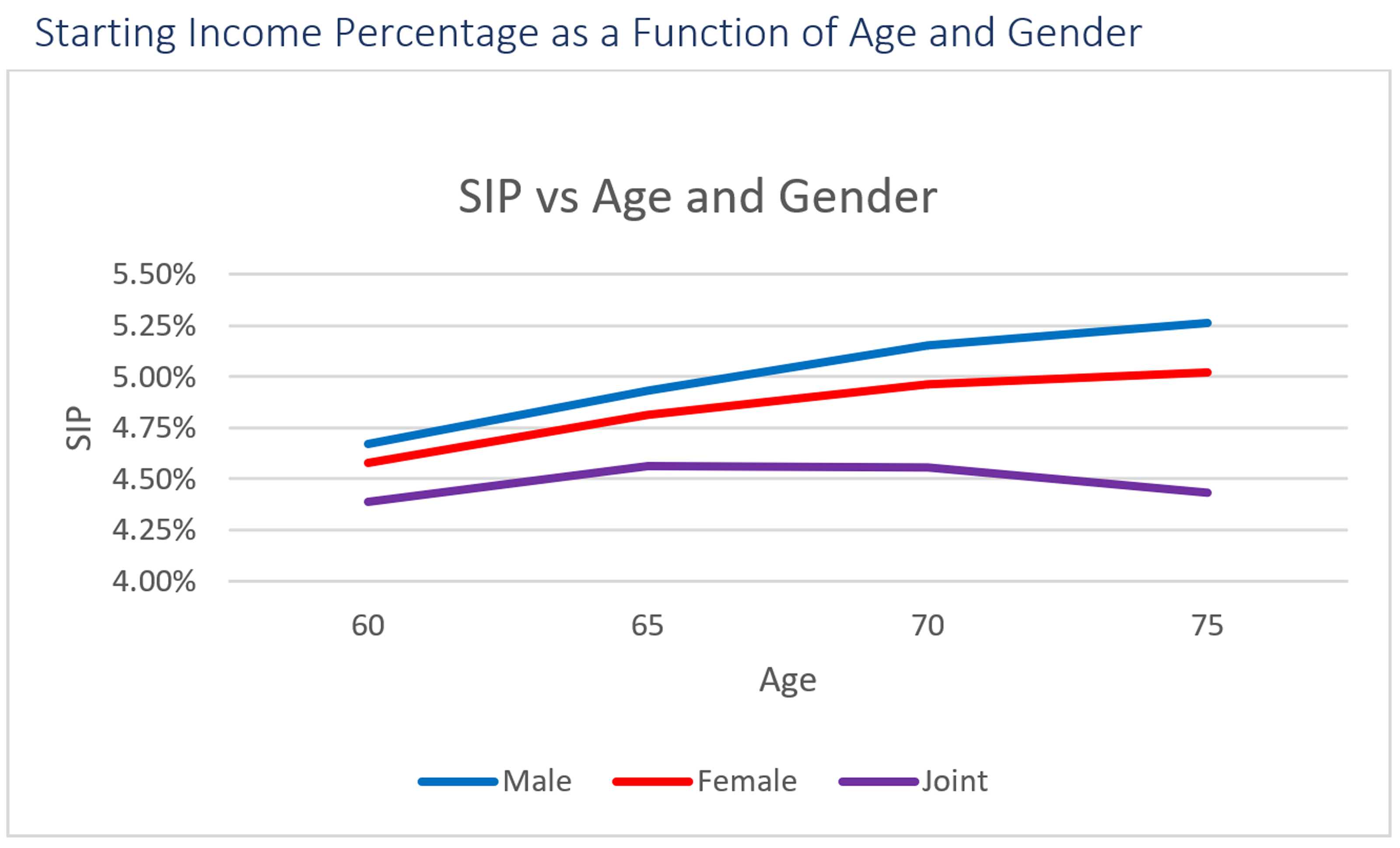

To illustrate, the chart below shows the impact of just three variables — age, gender and marital status — on what a viable starting income percentage could be for you using the Income Allocation planning method and typical savings makeup and legacy objectives.

You can see that, unlike the general 4% rule of thumb, a recommended SIP can vary from a high of 5.26% to a low of 4.39%, even before we take other factors into account. Our point is not that it’s higher than the 4% rule, it’s that it’s personalized to the individual. Further, even though it’s more customized, you need to drill down and find out what’s behind the Income Allocation numbers.

What’s Behind the SIP?

Analyzing the SIP and getting the most out of it can make a significant difference in your retirement. For example, if a plan customized for you delivers just 1% more in income per year from your $1 million in savings, that’s $10,000 more to spend in your first year of retirement, or — with 2% annual increase — an additional $337,000 over 25 years.

And it’s not enough to select a plan based on whether the number is higher or lower. What you need is a plan that provides you information as an informed investor:

- What is my projected income, and what are the sources of that income?

- What percentage of my income is safe and not dependent on market returns?

- What are my projected savings, how much liquidity do I have, and what’s the legacy?

- What are the economic assumptions underlying these projections?

Don’t be put off by the technical-sounding nature of these questions. It’s important that you get a report on your plan, review it yourself or review it with an adviser. That review can give you confidence — or not — in your number.

Do want to get your number? Using our Go2Income Guide you can answer a few questions and get your Starting Income Percentage. You can do it on your own and get an instant idea of what an SIP specific to you might be. At the same time you can order a full report with projected income and savings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.