When It Comes to Your RMDs, Be Very, Very Afraid!

If you’ve saved heavily in a traditional IRA or 401(k) you may feel great about your retirement savings now, but your required minimum distributions can be frighteningly large in retirement. And the tax bill they generate can be even scarier.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor’s note: This is part two of a seven-part series on retirement tax bombs. It dives more deeply into how required minimum distributions (RMDs) from tax-deferred savings can become a snowballing tax liability in retirement. If you missed the introductory article, you may find it helpful to start here.

For the remaining articles in this series, I’ll use a case study of a couple aged 40 who has saved $500,000 combined in pre-tax retirement accounts. Presumably, this couple is tracking well for a secure retirement. After maxing out their retirement plan contributions, they may not have much cash flow left over and may feel like they’re barely making ends meet. I meet couples like this all time. They aren’t rich, they’re simply good savers doing exactly what conventional wisdom has taught them to do.

The couple keeps making the maximum contribution each year ($20,500 each through age 49, then $27,000 from age 50 to 64, which are the current maximums), and each get a $6,000 employer match. I assume contribution limits rise by 2% annually. The couple’s contributions are in growth allocations that earn an annual 7% return. By the time they retire on their 65th birthdays, their retirement accounts will have grown to an impressive $7.3 million! They’re in great shape, right?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Snowballing RMD Income

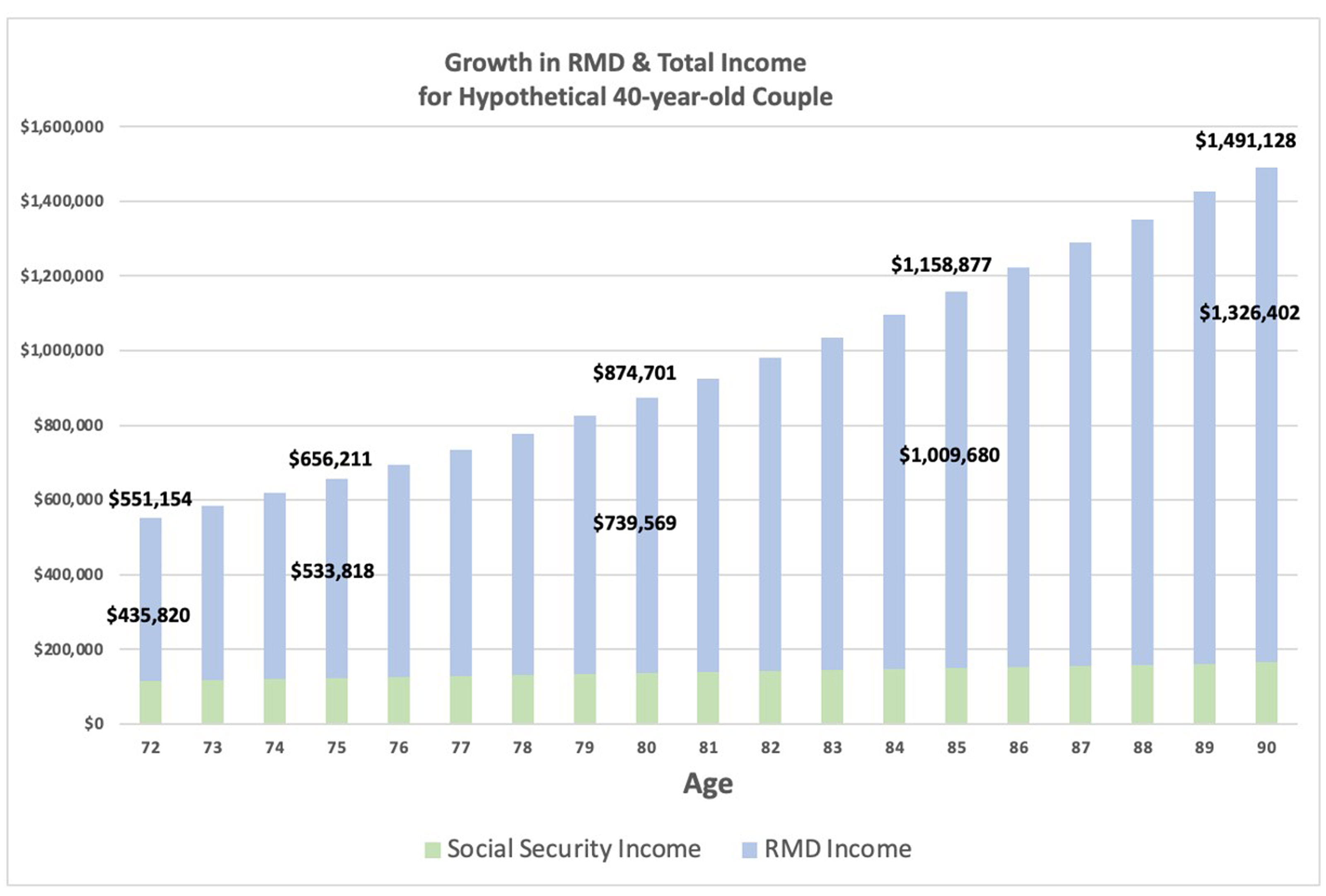

For simplicity, let’s assume they don’t draw down their pre-tax savings early in retirement, so their tax-deferred savings grows to about $11.9 million by age 72, when they must take their first RMD, which is $435,820. The RMD is 100% taxable, at their ordinary income rate, and by itself may put them in a high tax bracket. As you can see in the chart below, the RMD grows to $533,818 at age 75, $739,569 at age 80, $1 million at age 85 and $1.3 million at age 90.

The RMD income dwarfs their annual Social Security income, which I assume at $36,000 each at age 67, with a 2.0% annual cost of living adjustment.

Most people assume their taxable income in retirement will be very low because they’re not working, and will be receiving only Social Security benefits and perhaps some interest and dividend income. But clearly, if you’ve saved a lot in tax-deferred accounts, your RMD income can be frighteningly large. Meet your retirement tax bomb.

Even though the couple would take $15.6 million in total RMDs from age 72 to 90, their tax liability keeps growing, although at a decreasing rate as the RMDs gets larger. It’s not until age 89 that the RMD exceeds the projected portfolio growth and the tax liability starts shrinking.

Future Tax Rates

As scary as this sounds, think about where future tax rates may be headed. Current tax rates are near historical lows and may be the lowest we'll see for the rest of our lives. Consider solvency issues with Social Security and Medicare, chronic infrastructure issues, exploding deficits, climate change and pandemics. Each of these issues in isolation will require a lot of money to solve. And that doesn't even account for potential policy changes that would tax the wealthy more.

Simply put, paying taxes at today’s low rates may be a bargain compared to deferring, and growing, your tax liabilities into the future.

My next article focuses on problem No. 2: Medicare means testing surcharges.

- Part 1: Is Your Retirement Portfolio a Tax Bomb?

- Part 2: When It Comes to Your RMDs, Be Very, Very Afraid!

- Part 3: RMDs Can Trigger Massive Medicare Means Testing Surcharges

- Part 4: Will Your Kids Inherit a Tax Bomb from You?

- Part 5: How to Defuse a Retirement Tax Bomb, Starting With 1 Simple Move

- Part 6: Using Asset Location to Defuse a Retirement Tax Bomb

- Part 7: Roth Conversions Play Key Role in Defusing a Retirement Tax Bomb

- Bonus article 1: 2 Ways Retirees Can Defuse a Tax Bomb (It’s Not Too Late!)

- Bonus article 2: Can My Pension Trigger a Retirement Tax Bomb?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David McClellan is a partner with Forum Financial Management, LP, a Registered Investment Adviser that manages more than $7 billion in client assets. He is also VP and Head of Wealth Management Solutions at AiVante, a technology company that uses artificial intelligence to predict lifetime medical expenses. Previously David spent nearly 15 years in executive roles with Morningstar (where he designed retirement income planning software) and Pershing. David is based in Austin, Texas, but works with clients nationwide. His practice focuses on financial life coaching and retirement planning. He frequently helps clients assess and defuse retirement tax bombs.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.