Watch Out! RMDs Can Trigger Massive Medicare Means Testing Surcharges

Saving too much in tax-deferred retirement accounts could mean you’ll pay hundreds of thousands more than necessary on Medicare premiums in retirement. For some couples, the hit could even top $1 million. Here’s what you need to know.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor’s note: This is part three of a seven-part series. It dives more deeply into how high income from required minimum distributions (RMDs) can cost retirees hundreds of thousands of dollars in Medicare surcharges. If you missed the introductory article, you may find it helpful to start here.

No one wants to pay hundreds of thousands of dollars or even over $1 million more than they have to for Medicare in retirement. But due to means testing, that’s what could happen if you’re a diligent saver who stashes every penny you can into your 401(k) or other pre-tax retirement savings account.

This article is a summary of a ground-breaking white paper I published in 2019, in case you want to dive deeper into the history and mechanics of Medicare means testing. All general data cited in today’s article about Medicare can be found in the 2019 paper.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How Medicare Premiums Work

Traditional Medicare services consist of Part A (hospital care), Part B (doctor) and Part D (prescription drug) coverage. Many retirees mistakenly think Medicare is free because they’ve been paying Medicare taxes into the system for their working lives. But for most retirees, only Part A is free, while Part B and Part D have monthly premiums, usually deducted from retirees’ Social Security checks.

As my white paper indicates, Medicare Part B costs rose 8.8% annually from 1970 to 2019, a shockingly high rate over an extended period. That’s similar to the inflation rates we’ve been experiencing in 2022, but instead over a 49-year period. High compound inflation rates like this can have a devastating impact over time.

The government subsidizes Medicare costs by setting the base premium equal to 25% of projected per capita costs, meaning the government is covering the other 75% for most (but not all) retirees. Despite the subsidies, significant cost increases have been passed on to retirees. Base Medicare Part B premiums rose 7.5% annually from 1966 to 2019 (from $3.00 a month to $135.50 a month). In comparison, the core annual inflation rate (at least through 2019) has been about 2.3%.

Medicare itself faces solvency questions even more severe than Social Security. The only way to improve the solvency of Medicare is to raise taxes, reduce benefits or incur larger deficits. That’s not a political statement. It’s math. And it’s why, as of 2019, the Medicare trustees expected Medicare Part B premiums on average to rise 5.17% annually from 2020 to 2027.

What Is Medicare Means Testing?

Following 2003 legislation, the government started reducing the subsidy for high-income individuals, forcing them to pay higher premiums on Part B and Part D beginning in 2007. These higher premiums are known as Income-Related Monthly Adjustment Amount (IRMAA) surcharges or “means testing.” I think of them as avoidable taxes, provided you do some long-term planning.

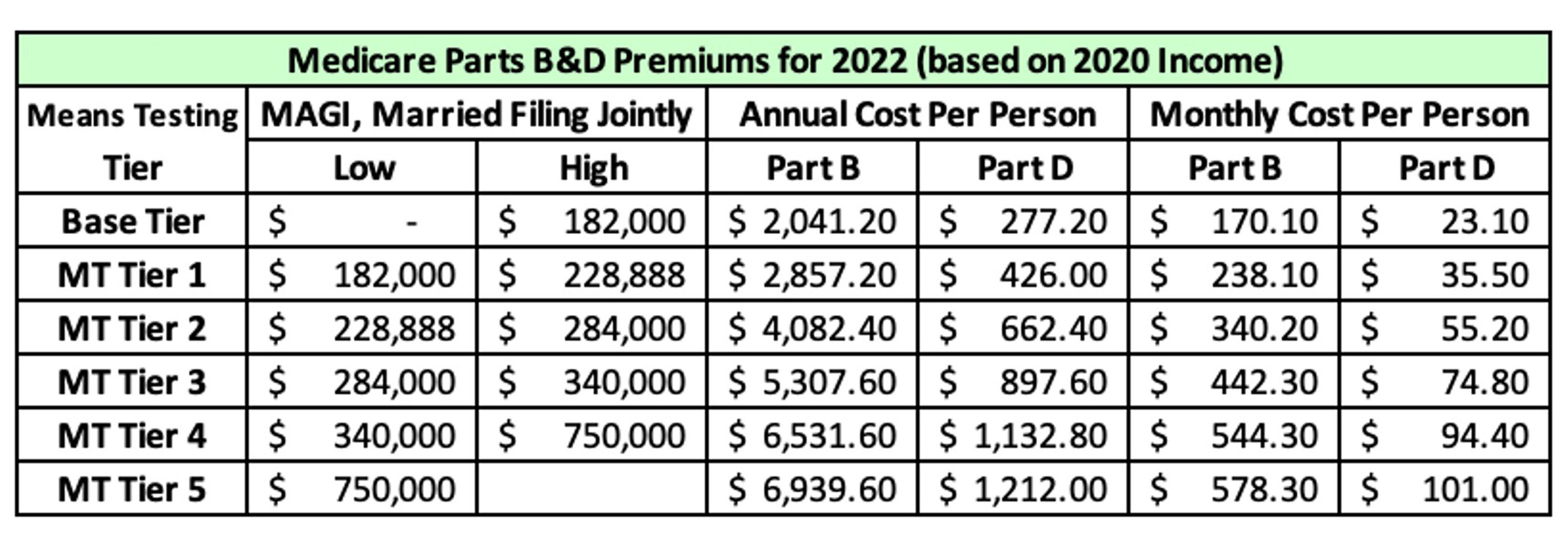

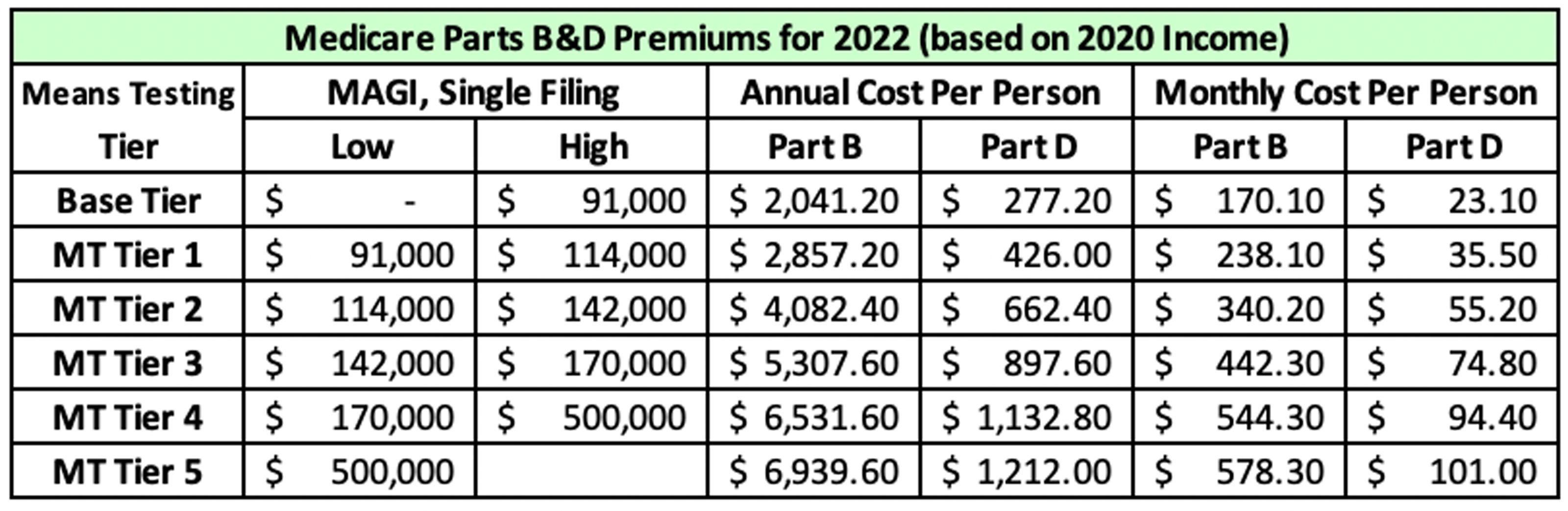

The charts below show Part B and Part D premiums for 2022 (the Part D premiums are for a plan in Austin, Texas). Premiums are tied to modified adjusted gross income from two years prior, so 2022 rates use income from 2020. Premiums for the highest earners compared to the lowest earners are 3.4 times higher for Part B and 4.4 times higher for Part D.

Premiums for couples filing jointly

Premiums for those filing as singles

At higher income levels the government reduces the per capita federal subsidy, causing retirees to bear a greater portion of the cost. From 2007 to 2019, the base premium increased by 3.1% annually, while premiums for means testing tiers increased from 5.0% to 8.6% annually.

The concept of means testing shouldn’t be a big surprise because the most politically acceptable way to improve Medicare’s finances is to make wealthier people pay more. All the signs suggest means testing will become more severe over time.

From 2009 through 2019, income brackets were not indexed for inflation, and in some years, the government even reduced income brackets. So over time, more people have been getting snared by means testing. Starting in 2020, income brackets were indexed for inflation, which was good news for retirees, but the government could easily halt inflation adjustments to help balance the Medicare books.

RMDs and Medicare Means Testing

Recall from last week’s article on RMDs, the case study of a 40-year-old couple who saved $500,000 combined in pre-tax retirement accounts and continue to max out pre-tax contributions until retirement at age 65.

The couple’s tax-deferred retirement accounts grow to $11.9 million by age 72, when they take their first taxable RMD of $435,820. The RMD snowballs, growing to $1.3 million of taxable income at age 90.

In the table above, the couple is projected to be in means testing tier three from age 74-76 and tier four from age 77 to 90. Their total “base” Medicare Part B and Part D premiums from age 65 to age 90 are projected at $856,526 (in future dollars, with each income bracket inflated using the historical Medicare inflation rate of 5.17% as of 2019). However, the couple will face an additional $1.5 million in Medicare means testing surcharges through age 90.

So far, this series has looked at how tax-deferred saving can create problems with RMD income and Medicare means testing surcharges. My next article focuses on problem No. 3: inherited tax liabilities.

- Part 1: Is Your Retirement Portfolio a Tax Bomb?

- Part 2: When It Comes to Your RMDs, Be Very, Very Afraid!

- Part 3: Watch Out! RMDs Can Trigger Massive Medicare Means Testing Surcharges

- Part 4: Will Your Kids Inherit a Tax Bomb from You?

- Part 5: How to Defuse a Retirement Tax Bomb, Starting With 1 Simple Move

- Part 6: Using Asset Location to Defuse a Retirement Tax Bomb

- Part 7: Roth Conversions Play Key Role in Defusing a Retirement Tax Bomb

- Bonus article 1: 2 Ways Retirees Can Defuse a Tax Bomb (It’s Not Too Late!)

- Bonus article 2: Can My Pension Trigger a Retirement Tax Bomb?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David McClellan is a partner with Forum Financial Management, LP, a Registered Investment Adviser that manages more than $7 billion in client assets. He is also VP and Head of Wealth Management Solutions at AiVante, a technology company that uses artificial intelligence to predict lifetime medical expenses. Previously David spent nearly 15 years in executive roles with Morningstar (where he designed retirement income planning software) and Pershing. David is based in Austin, Texas, but works with clients nationwide. His practice focuses on financial life coaching and retirement planning. He frequently helps clients assess and defuse retirement tax bombs.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.