Investing in Dual Citizenship for a Secure Retirement: How the Portuguese Golden Visa Opens Up New Horizons

With the US election nearly upon us, more Americans than ever are exploring options to secure a second passport. The concept of dual citizenship is no longer just for the ultra-wealthy or jet-setting entrepreneurs – it’s becoming a smart, strategic move for anyone looking to create a Plan B for themselves and their families.

Learn how you can benefit from a second passport.

Why more Americans are seeking dual citizenship

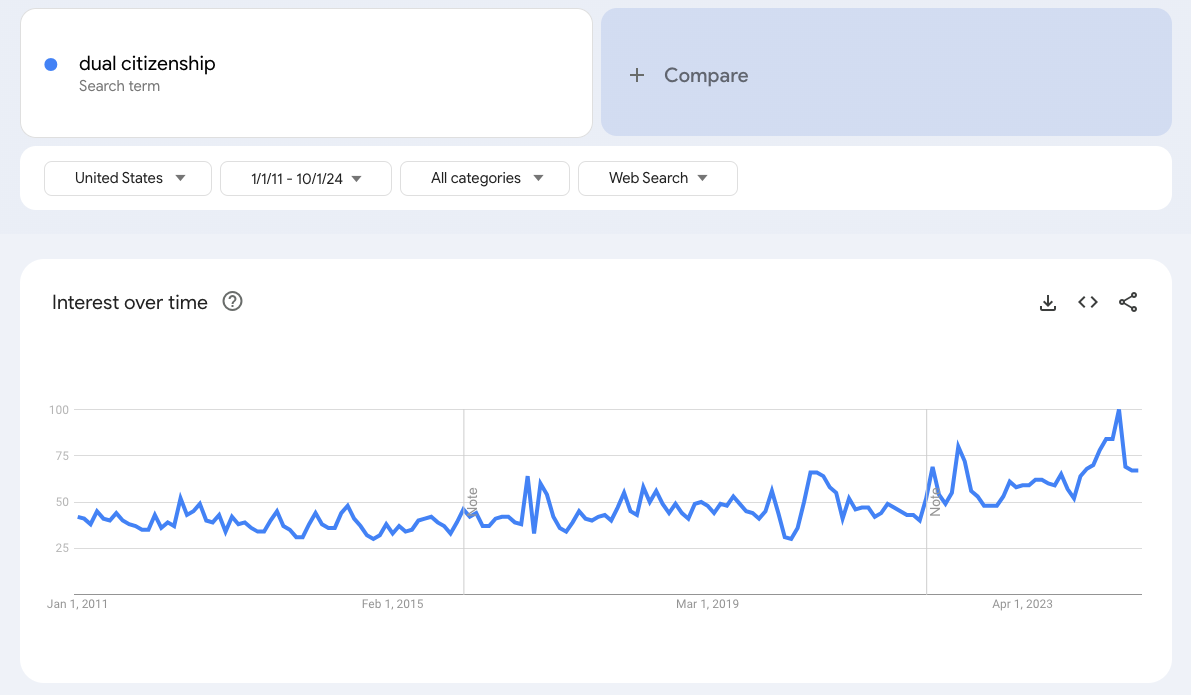

Google searches for “dual citizenship” tell an interesting story of America’s recent political history. Search volume has been on the rise since November 2016, reaching the highest levels yet in July 2024.

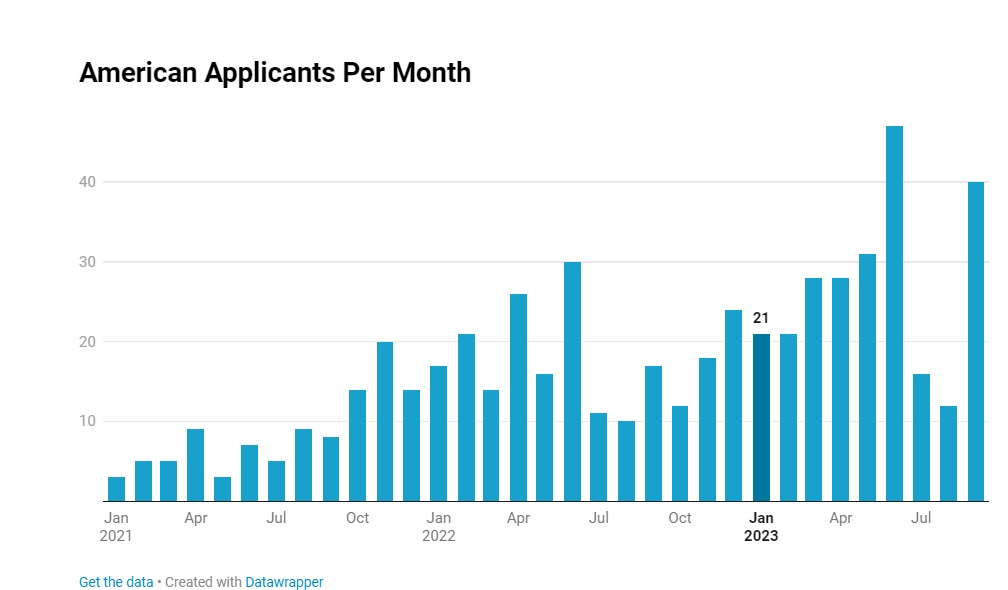

And Portugal seems to be the preferred destination for most U.S. citizens. In 2023 alone, over 567 Americans applied for Portugal’s Golden Visa, making it one of the most sought-after residency programs worldwide:

Data Credit: IMI Daily

Why consider the Golden Visa?

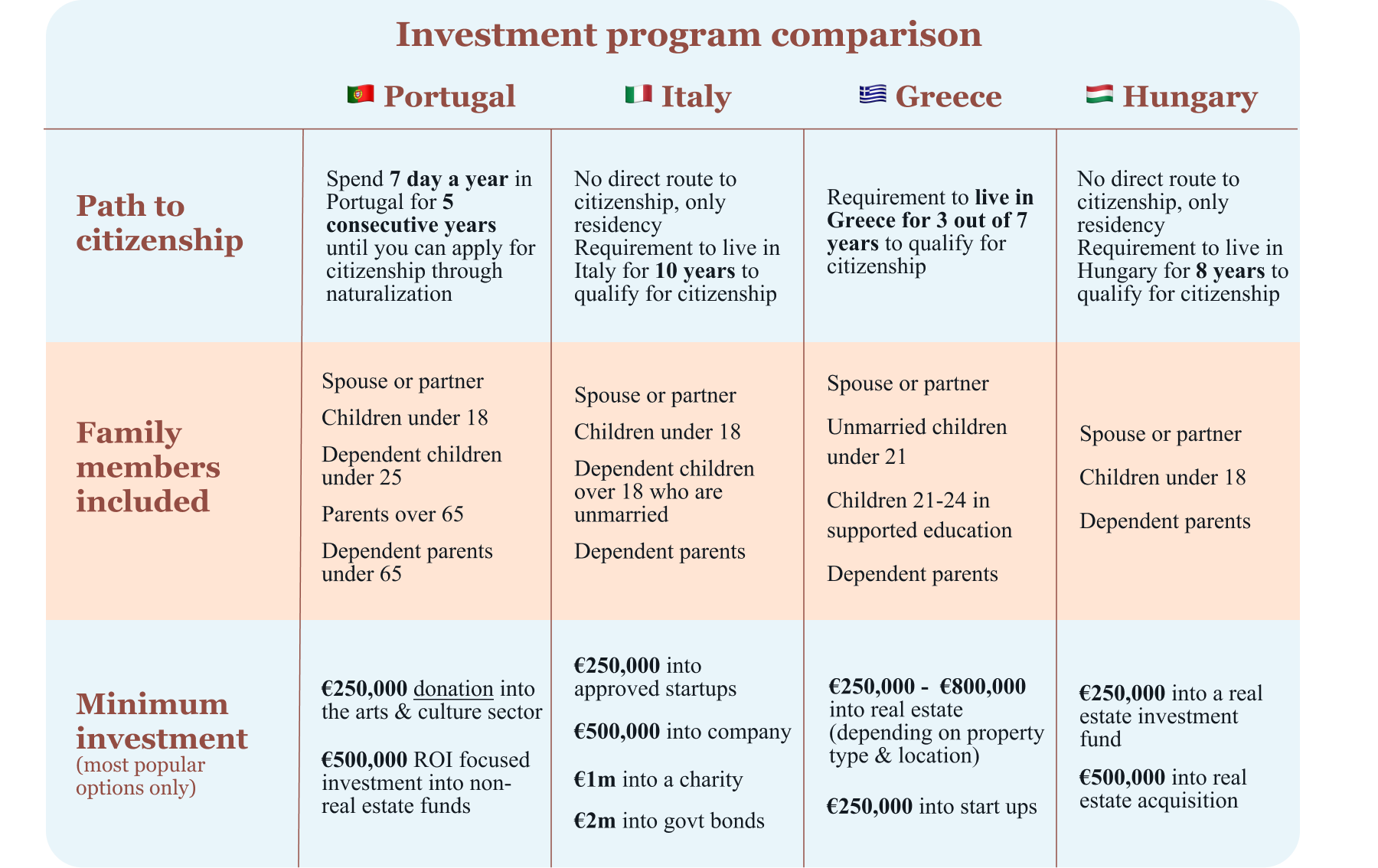

When you look more closely at the details of the Portuguese Golden Visa program, its increasing popularity with U.S. citizens is unsurprising. The program offers a unique pathway to qualifying for citizenship in one of the safest, most welcoming countries in Europe - all without having to leave home.

Following an investment of €500,000 into a qualifying fund, you enter a residency period of five years, during which you only need to visit for one week each year. Once completed, you’re eligible to apply for the Portuguese passport (the fourth most powerful passport in the world), which gives you the right to live, work and travel in any of the 27 European countries - forever. What’s more, you can include other family members on your application, all under the one investment.

With Portugal also ranking fourth on the Global Peace Index and boasting a public healthcare system ranked fourth globally for quality (never mind the stunning beaches of the Algarve!), the program really does live up to its name as a truly golden opportunity.

Click here to discover more about the benefits of the Golden Visa.

The Golden Visa and retirement planning: A perfect match

The Portuguese program has found particular resonance with retirement planners in the U.S. Aged between 45 and 58, they cite future travel freedom and easy access to a second home in Europe, as the major motivations for investing. A smaller segment are more focused on smoothing the path for a complete relocation to Europe, following their last day at work.

“We visited Portugal last year and just fell in love”, say John and Cynthia, who recently invested. “We’ve always known we wanted to spend significant time in Europe after our retirement, and when we found out about the Golden Visa program, it just made sense for us. This way, by the time we reach retirement we’ll already be European citizens and able to buy a second home hassle free, wherever we want.”

Does it make financial sense?

For some affluent Americans planning their retirement, the benefits of the Golden Visa are just about priceless. But for others - especially those with retirement on the horizon - the investment still has to “stack up” financially in order to make sense.

Like any investment, you’ll need to make a choice between speculative returns and risk. But pick the right fund to partner with, and you can enjoy inflation beating annual returns set against an attractive risk-profile and excellent capital preservation prospects. Pela Terra for instance, which is Portugal’s largest and oldest agricultural fund, targets a 7% IRR with its asset backed investments into Iberian farms.

Can you use your IRA for a Golden Visa?

The financial model makes even more sense if you’re able to invest into the Golden Visa via your IRA. While this is possible, it is not straightforward.

“You’ll need to use a self-directed IRA, which means that finding a good custodian who is operationally sound is crucial,” says Alex Caswell CFP, of RHS Financial. “You’ll also need to make sure that the custodian’s fees are reasonable and don’t wipe out the margin you’re saving on tax.”

Explore how the Golden Visa can enhance your retirement.

Consider agriculture - a low-risk sector for your investment

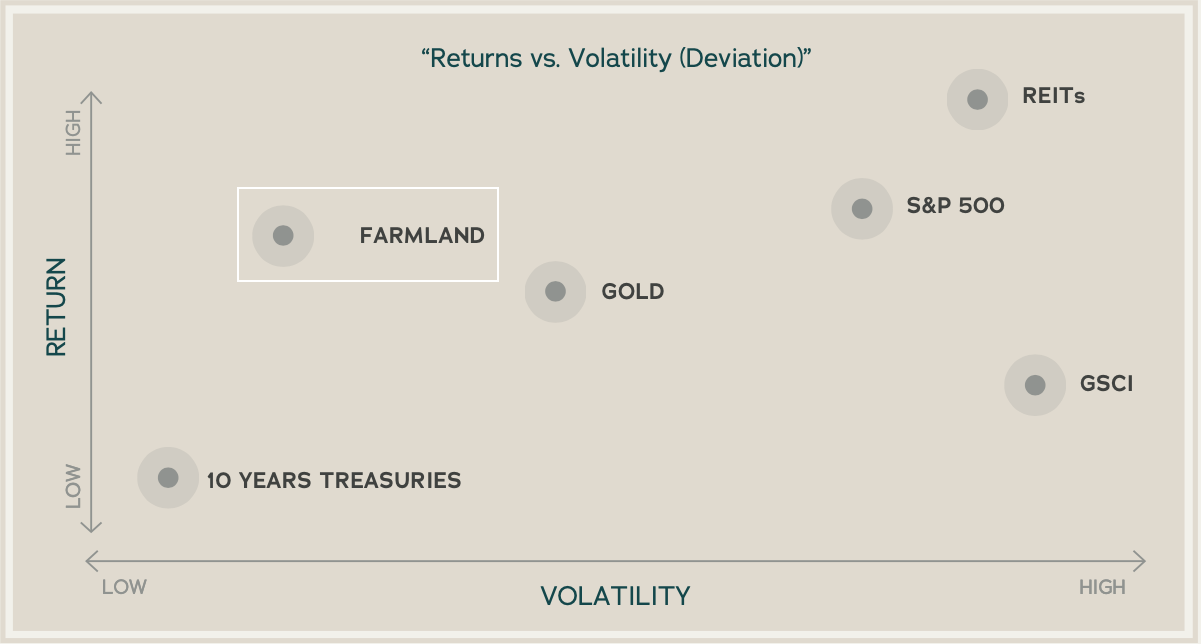

It is a little known fact that some of the world’s most successful investors, such as Warren Buffet and Bill Gates, have been steadily increasing their holdings in farmland for many years now. With an ever-decreasing amount of water-secure farmland in the world and an ever-increasing demand for food, irrigated farmland is becoming a sought-after asset.

And consider this analysis from Nasdaq and the S&P 500, which plots volatility against the strength of returns in various asset classes. Agriculture outperforms gold, real estate and U.S. equities, amongst others:

As Warren Buffet famously quipped: “It doesn’t matter how hard you row if you’re in the wrong boat.” With institutional investment into Iberian farmland increasing by 120% from 2021 to 2023, it sure seems like Portuguese farming is a sound boat to invest into.

Introducing Pela Terra: The low-risk, sustainable path to your Golden Visa

Alex Lawry-White and Nathan Hadlock, Pela Terra Managing Directors

If you’re more inclined towards the lower-risk end of the market, then the Pela Terra fund is worth considering. Set up in 2020, they focus on acquiring large-scale farms in the Iberian peninsula, aiming to implement regenerative farming practices to improve soil health and crop quality.

Discover why Pela Terra is the ideal choice.

The simple model works because the fund’s assets are both operational and appreciating. This means that the farms are generating an annual olive and almond harvest from their orchards, which allows the fund to target an annual dividend to investors. But the land is also appreciating in the background, as demand for Iberian farmland grows. The fund aims to deliver an inflation-beating 7% investment ROI against a low-risk profile.

The fund even has an in-house Concierge Team to make the application process easy, helping you do everything from setting up your Portuguese bank account to filling out the application forms.

Golden Visas won’t last forever

If you’re considering investing in a second passport but delaying pulling the trigger, it’s good to be aware that the EU is putting pressure on European countries to shut down their programs. With the UK, Ireland, Spain and Netherlands all shutting their programs recently, those looking at Portugal would be advised to move fast to avoid disappointment in the future.

“Although we have no idea when things might change, one thing is for sure,” observes Pela Terra's Managing Director Alex Lawry-White, “the opportunity to gain a European passport will never be as attractive as it is today.”

How to get started

If you’re interested in learning more about the Golden Visa program in Portugal, then why not book a call with one of Pela Terra’s investment & immigration advisers today? They’re a friendly team who can talk you through the outline of the visa program, as well as getting you comfortable with the investment requirements.

Book a call today to begin your journey.

This content was provided by Pela Terra. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

This content is part of a paid partnership

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.