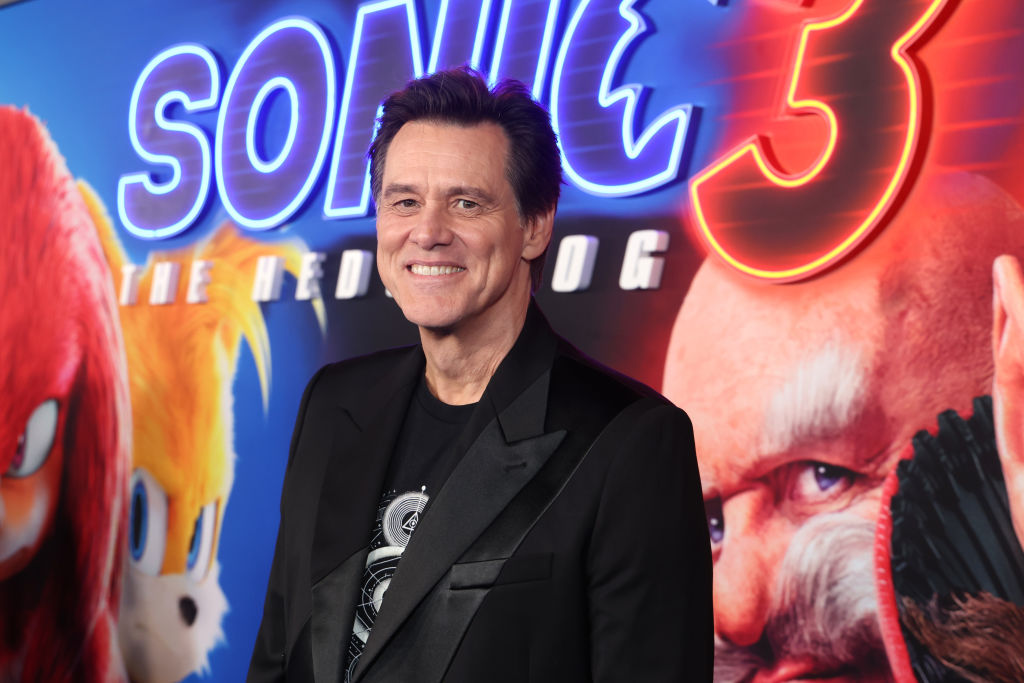

Jim Carrey Ran Out of Money in Retirement. Will You?

Celebrities from Jim Carrey to Al Pacino have come out of retirement because they needed the cash. Here’s how to avoid a similar situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Retirement can last 20-plus years, but without planning, those days of traveling, pursuing hobbies or visiting grandchildren may be short-lived.

Just ask Jim Carrey, an A-list celebrity who came out of retirement because he needed money. He’s not alone. Harrison Ford, who recently made his Marvel Cinematic Universe debut in "Captain America: Brave New World" at age 82 said it was an easy decision because of the money. Meanwhile, Nicolas Cage, Hugh Grant and Al Pacino all said they had taken on new roles because they ran out of cash.

But celebrities aren’t the only ones. A recent survey of retired adults by Resume Builder found that 13% of retirees say they are likely to start working again this year, with many citing an increased cost of living as the reason.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Add a recent sell-off in the markets, concerns about tariffs and trade wars and the pruning of the Federal workforce, and it's not surprising retirees' budgets are being squeezed.

A recent National Council on Aging study found that close to 50% of adults 60+ have household incomes below the standard needed to afford basic needs.

But unretiring doesn’t have to be a foregone conclusion for you. There are ways to avoid the mistakes of retirees before you, including celebrities who were once worth hundreds of millions of dollars, and it all starts with proper retirement planning.

“When you want to build a house you don’t go out and buy a bunch of materials,” says Paul Camhi, vice president and senior financial advisor at The Wealth Alliance in Melville, NY.

“You meet an architect, draw up plans, hire a contractor and hopefully everything goes to plan and you have a beautiful house.”

The same goes for retirement. You can’t just start living off the pile of money you have saved and see what happens. That could be a recipe for disaster if you blow through your savings too quickly.

Be realistic about your retirement plan

Your retirement plan also has to be realistic, considering all the income you will have access to and weighing that against your daily and monthly expenses, and hobbies and travel you want to pursue.

“Celebrities often spend their oversized paychecks on things that actually cost them more money. Right now, they have the funds to buy that mansion or that mega yacht, but they don’t have the ongoing income necessary to keep and maintain the purchase,” says Christopher R. Manske, a certified financial planner and president of Manske Wealth Management in Houston.

“Houses require insurance, taxes, and maintenance, and the bigger the house, the higher these bills are. Regular folks can avoid celebrity-style problems if they take into account the amount of income needed every month to keep and operate their boats, cars, and homes.”

Retirement planning should also consider how inflation will impact your purchasing power and what would happen if any unexpected illnesses or emergencies were to occur.

After all, any unexpected illness can be a significant hit to your savings balance. A 65-year-old individual may need as much as $165,000 in after-tax savings to cover medical expenses, according to the 2024 Fidelity Retiree Health Care Cost Estimate. Don’t forget to consider longevity. The longer you’re likely to live the more cash you’ll need in retirement.

Armed with a plan, Camhi says he encourages his clients to “save until it hurts.” That doesn’t mean you shouldn’t enjoy your life while you are working but it does mean you need to strike a balance between saving and spending with abandon.

It’s also a good idea to start planning for retirement while you’re still working. That will help you identify any cash flow shortfalls and give you time to save more or to extend your retirement date.

“When you no longer have a paycheck, having a plan in place is the key to a successful retirement,” says Camhi.

“If you wake up at 65 years old and start planning your retirement, you don’t have time to put yourself in a successful position to enjoy retirement and the lifestyle you are accustomed to.”

Limit your withdrawals

If you are already retired and considering returning to work because of a shortfall, Jackie Fontana, certified financial planner at FBB Capital Partners in Bethesda, Maryland, recommends first looking at your withdrawal rate.

If you retire at 65 and expect to be in retirement for twenty-plus years, Fontana says the rule of thumb is to withdraw about 4% of your retirement savings each year.

She says that if you work until you are 75, the withdrawal rate may increase to between 6% and 7%, she says. If you are withdrawing 10% of your savings annually, that should raise a red flag that it's time to rein it in a bit.

In that instance, reducing your withdrawal rate may be all it takes to remain retired. If figuring it out on your own seems too overwhelming, Fontana says a trusted, licensed and vetted financial adviser can help you plan and keep you on track.

“Not everyone is going to be like Jim Carrey, who can return to the workforce and make a couple of million dollars. 99.9% of us don’t have that luxury so we need to have a roadmap,” says Fontana.

Want more guidance on retirement savings? Sign up for Kiplinger's six-week series, Invest for Retirement.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna Fuscaldo is the retirement writer at Kiplinger.com. A writer and editor focused on retirement savings, planning, travel and lifestyle, Donna brings over two decades of experience working with publications including AARP, The Wall Street Journal, Forbes, Investopedia and HerMoney.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?

Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?Quiz If you are 50 or older and a high earner, these new catch-up rules fundamentally change how your "extra" retirement savings are taxed and reported.