With High Yields, Do Treasury Bonds Belong in Your Retirement Portfolio?

How Treasury bonds can protect your retirement nest egg. The upside, risk and low-down on T-bonds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

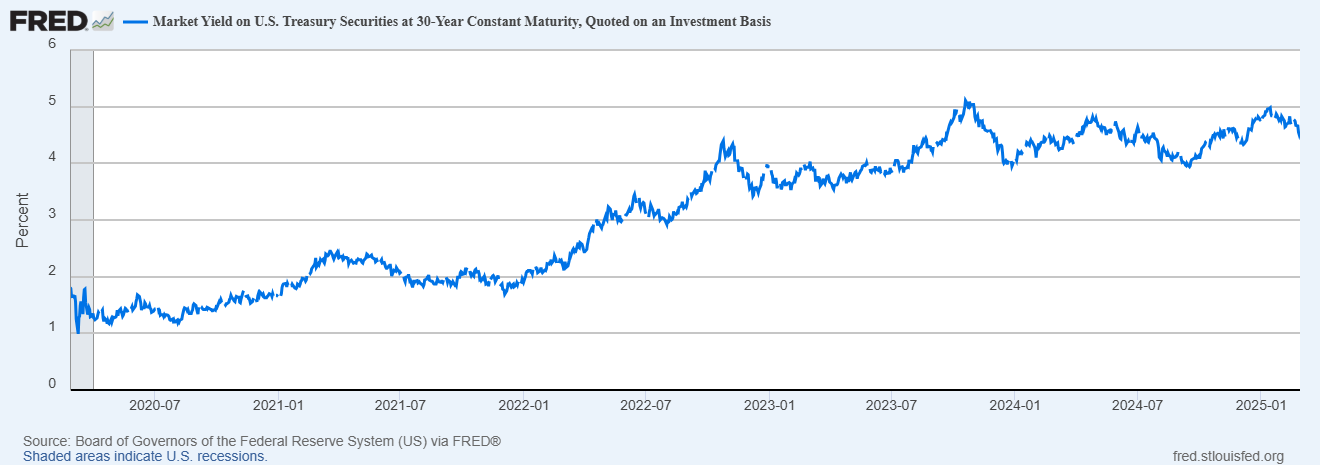

Amid heightened inflation and economic uncertainty, the 10-year Treasury yield is about 4.22% and has inched close to 5% in recent months. This means that Treasury bonds are paying their highest rates in years. And buying Treasury bonds could provide a safe and steady income stream for retirement savers.

Treasury bonds are considered among the safest investments around because they are backed by the full faith of the U.S. government, which has never defaulted on its debts.

“There are a lot of concerns about the amount of debt the U.S. has, but even with that sentiment, it is still regarded as one of the safest investments,” said Austin Brown, Chartered Financial Consultant (ChFC) and senior financial advisor at CG Financial Services.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Market Yield on U.S. Treasury Securities at 30-Year Maturity Over the Past Five Years

What are Treasury bonds and how do they work?

Treasury bonds have many advantages, but it's important to understand how these securities work before you decide to invest. So let’s take a closer look.

Treasury bonds are essentially loans you extend to the government so it can fund its operations. In return, the bond pays a fixed interest rate or coupon payment every six months. Treasury bonds come in durations of 20 years and 30 years. At the end of that term — when the bond reaches maturity — you’ll get back your initial investment, also called its face value.

Suppose you buy $20,000 worth of Treasury bonds with yields of 5%. Your annual interest payment would be $1,000, or $500 every six months. And when the bond matures, you’ll get your $20,000 back as well. You can use that money to reinvest in Treasury bonds or move funds to different parts of your retirement nest egg.

And if you need your funds before the maturity date, you can sell your Treasury bonds on the secondary market.

This may be a good idea if you need the money when interest rates fall. That’s because your Treasury bond, with its higher yield, could be more attractive in an environment where newly issued bonds have smaller yields. However, those near or in retirement may be more interested in a safe and predictable income stream than in speculating on interest rates.

“Although the value of the actual bond can fluctuate as the interest rate market changes, the interest you receive and the principal you receive are known on the front end," Brown said. “So if you hold to maturity, the outcome is defined and known.”

Generally, the value of Treasury bonds goes down when interest rates go up and vice versa.

Nonetheless, Treasury bonds also enjoy distinct tax advantages.

“A key advantage is that the interest income is tax exempt on the state and local level, which is a huge benefit for high-income investors in states and cities with high taxes,” said Bobbi Rebell, certified financial planner (CFP) and personal finance expert at BadCredit.org.

However, the interest would be taxed at the federal level.

You can buy Treasury bonds in increments of $100 directly from the government through TreasuryDirect, though moving them into an IRA could be cumbersome. You could also purchase Treasury bonds through a brokerage account.

“For many investors who already have brokerage accounts, it makes sense to purchase them through the account they already have open, even if there are some fees involved at times,” Rebell said. “It will be easier to get started, and they will also have an easier time if they want to sell them on the secondary market, so it gives them easier access to liquidity.”

Risks of Treasury bonds

Although Treasury bonds offer many advantages for retirement savers, they also come with some risks. For starters, Treasury bonds are susceptible to inflation risk. When the rate of inflation is higher than your yield, the purchasing power of your interest payments could be significantly eroded. This could be especially troublesome when you’re in retirement.

“If we do see more inflation, the return will remain steady and will not increase with inflation and could lock an investor into returns that aren’t keeping up with increasing costs driven by inflation,” Rebell said.

Another potential pitfall is interest rate risk. If interest rates rise, your Treasury bond could lose value in the secondary market. That’s because newly issued bonds with higher yields could be more attractive to investors.

“There can also be an opportunity cost because historically, other investments like equities have produced better returns,” Rebell said. For retirees trying to manage longevity risk, overinvesting in Treasury bonds might render your portfolio too conservative.

Treasury ETFs for those near retirement

You can also gain exposure to Treasury bonds by investing in Treasury exchange-traded funds (ETFs). Treasury ETFs are professionally managed baskets of Treasury securities with different yields and durations. These ETFs can also hold intermediate-term Treasury notes or T-notes, and short-term Treasury bills or T-bills. These ETFs may also be a defensive play in our current trade-war environment.

This provides diversification and bypasses the leg work of buying individual Treasury securities.

Moreover, Treasury ETFs pay interest in the form of monthly or quarterly dividends. For those near or in retirement, this offers a more frequent stream of income than individual Treasury bonds, which pay interest every six months. You can also buy and sell shares of Treasury ETFs throughout the trading day.

“This is often a great solution for most people because it is easier to adjust your exposure over time,” Brown said.

Still, Treasury ETFs come with potential disadvantages.

Although generally small, Treasury ETFs do charge management fees or expense ratios. If you buy individual T-bonds through TreasuryDirect, you won’t face any fees or commissions.

And because they hold Treasury securities, these ETFs are also subject to inflation and interest rate risk.

However, you could also diversify your portfolio with Treasury inflation-protected securities or TIPS, which are designed to keep pace with inflation.

So, should you invest in Treasury bonds for retirement?

If you’re in or near retirement, you may be interested in Treasury bonds. With durations of 20 or 30 years, these securities make fixed interest payments every six months. And with the backing of the U.S. government along with tax advantages, Treasury bonds are considered among the safest investments available. But they do run inflation and interest rate risks. Still, these bonds, as well as Treasury ETFs, could provide downside protection in your retirement portfolio.

Whether and to what extent you should invest in T-bonds ultimately depends on your individual investment goals and risk tolerance. When in doubt, talk to a trusted financial adviser.

Treasury bonds can be “part of a diversification strategy to reduce risk against the often volatile equity market," explained Rebell. That strategy "is a key consideration for retirement savings as someone gets closer to retirement.”

Read More

- How to Add Treasury Bonds, Bills and Notes to an IRA

- The Average IRA Balance by Age

- Retirement Income Strategies for the Long Haul

- Treasury Bills vs. Treasury Bonds: Know the Difference

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Javier Simon is a freelance retirement writer with Kiplinger. He’s experienced in covering various personal finance topics including investing, taxes, homebuying, fintech and crypto. His work has been featured by major outlets like Fox Business, The Motley Fool, Money Magazine and Yahoo Finance. His passion is breaking down the complexities of finance into actionable content that anyone can use to achieve financial wellness and build wealth.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?

Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?Quiz If you are 50 or older and a high earner, these new catch-up rules fundamentally change how your "extra" retirement savings are taxed and reported.