Roth IRA Conversions: Pay Now, Live Tax-Free Later

Why now may be the time to convert your traditional IRA to a Roth to avoid future taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There was a lot of discussion around tax increases in the run-up to the election. On one side, raising taxes on corporations and on ultra-high net worth individuals. The other side focusing on foreign taxes and tariffs. The one thing everyone can agree on is that taxes are going to go up in the future.

The United States has over $27 TRILLION in debt, which is climbing rapidly. The government has issued billions in Coronavirus stimulus packages, and unemployment hit 13% in May, the second highest rate since World War II. We also have a Social Security system that is quickly running out of money. There is a clear need for more tax dollars.

No matter where the focus (corporations, ultra-high net worth individuals or foreign countries), there is always a tax burden that falls on everyday Americans. It is fair to assume that burden will likely grow in the future. So how can you set yourself up now for what may lie ahead?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How Do Roth IRA Conversions Work?

Roth conversions are the best way to take a little pain today to give yourself options in the future. A Roth conversion is when you take money out of a traditional IRA and transfer it directly into a Roth IRA. When you do this, the amount converted IS taxable. You pay income tax on the entire amount moved into your Roth IRA.

Once it is in the Roth IRA, the growth is tax-free. As long as you have had the account for five years and you are 59½ or older, you can take the entire amount of a Roth IRA out tax-free.

What Are the Benefits?

Tax-Free Growth

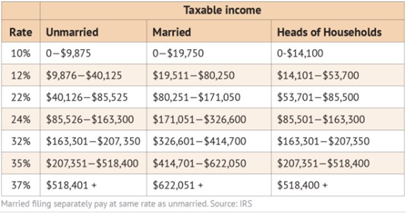

If we are under the assumption that taxes will go up in the future, it makes sense to pay taxes on some of your money now to avoid taxes at higher rates in the future. For example, according to U.S. Census Bureau, the median household income in 2019 was $65,712. The standard deduction this year for a married filing jointly household is $24,800. That leaves an adjusted income amount of $40,912. Based on 2020 tax brackets (see chart below), this places the median household in the 12% tax bracket. This bracket goes up to $80,250 worth of income.

So, there is room for nearly another $40,000 before the median household moves up to the 22% bracket. That is $40,000 of opportunity. Opportunity to convert $40,000 from traditional IRA monies to a Roth IRA. You pay 12% in federal income taxes to move this money, but the way I see it that could be a steal in the future.

Lower RMDs on Your Traditional IRAs in the Future

Required minimum distributions (RMD) are due in April the year following your 72nd birthday. An RMD is a set percentage of your traditional IRA that you must withdraw for that given year. The percentage you must take out also increases over time. One hundred percent of required minimum distributions are taxed like income, and you cannot convert RMDs. These required withdrawals may be more money than you can spend, but it doesn’t matter, they are REQUIRED. By doing Roth IRA conversions in your 50s and 60s, you are reducing the value of your traditional IRAs. Therefore, when your 70s come around, your RMD amounts will be smaller. This will minimize the taxation on your traditional IRA in the future and make tax-free dollars available in your Roth IRA for supplemental income.

The Ability to Leave a Tax-Free Estate

One of the biggest negatives to the SECURE Act is the rules on inheritances. Before the SECURE Act, beneficiaries could stretch inherited IRAs over their entire lifetime. Now, with only a few exceptions, beneficiaries have 10 years to withdraw the entire amount of inherited IRAs and inherited Roth IRAs. That means 10 years to pay the taxes on inherited IRAs.

Typically, when you’re inheriting an IRA from Mom or Dad, you are in your prime working years, making more money than you ever had. Now, when you take that money from the inherited IRA you’re paying taxes at your high, working tax rate. This can end up with Uncle Sam getting 40% of your IRA through taxes. On the flip side, inherited Roth IRAs remain tax-free for the beneficiary. Paying taxes on your IRA in your 50s and 60s can help save taxes for you in retirement AND your children after you die.

Some People Who Should Think Twice before Doing a Roth IRA Conversion

The idea of doing a Roth conversion is to have a little pain now by paying the tax to have no pain or tax-free dollars in the future. Therefore, if you are a high-income earner now, a Roth conversion may not make sense for you. This is the case for many who will be in a lower tax bracket in the future. If you were to make a large conversion now, you would pay taxes at your high rate to not pay taxes at your lower future retirement rate. In this scenario, it wouldn’t make sense to utilize Roth conversions. (For more, please see 6 Reasons You Should NOT Do a Roth Conversion.)

The Bottom Line on Roth IRA Conversions

Nobody enjoys paying taxes. However, it may be in your best interest to pay more in taxes now to set yourself up to have tax-free income in the future. Giving Uncle Sam nickels and dimes today can keep dollar bills for you and your family in the future.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Phil Huff is the vice president and investment adviser representative licensed with Independence Wealth Advisors LLC, a registered investment adviser. As a former offensive lineman for Kent State University, he excels at protecting people. His focus is on optimizing his clients’ life savings throughout retirement by taking a holistic approach to planning, developing and implementing personalized investment plans, retirement income planning and risk management.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.