Why I Love Roth IRAs and Roth Conversions

Roth IRAs truly are a gift from the government, and now is a great time to take Uncle Sam up on them. Here’s why.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I love blueberries. I also am frugal and love saving money. Because of this, when I go to the store and blueberries are not on sale, I will not buy them. Although, if blueberries are on sale, then you know I am stocking up. My freezer and refrigerator are full during those times.

Like when I buy blueberries, taxes are “on sale” right now, and you should be stocking up by opting for Roth IRAs, Roth 401(k)s and Roth conversions. Taxes are at near-record lows, and they are only expected to go up.

There is a window of time before the Tax Cuts and Jobs Act (TCJA) sunsets and tax rates revert to their previous, higher levels. If you are like me and like saving money, then this tax sale will save you more money than any blueberry sale.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Taxes are on sale

We already know that tax rates are set to go up in the short term, but what about the long term? We can only guess, but many experts think tax rates will rise, and few people believe taxes will decrease over time.

Also, our country has more than $36 trillion in debt. My question is, how does our country earn revenue to pay off that debt? There are a few ways — including raising taxes.

Because of the above, my favorite investment is a Roth IRA — a true gift from the U.S. government. I often ask people where they would put all their money if they had a magic wand.

The obvious answer is a Roth IRA, but most of the money U.S. savers have in retirement accounts is not in Roth IRAs. Even worse, only 24% of households owned a Roth IRA in 2023, according to the Investment Company Institute.

Joe has built a comprehensive retirement planning company focused on helping clients grow and preserve their wealth. Under his leadership, a team of experienced financial advisers use tax-efficient strategies, investment management, income planning and proactive health care planning to help their clients feel confident in their financial future — and the legacy they leave behind.

But I am here to tell you about a powerful strategy that anyone can use to get a Roth IRA (assuming you have a tax-deferred investment). It doesn’t matter your income, age or employment status. This strategy is a Roth conversion, and anyone can use it if they have an IRA.

Also, there are no limits on how much you can convert. You could even convert every IRA dollar you have, although we typically do not recommend doing so. I have done Roth conversions for people for as little as $1,000 to well above $300,000. It just depends on your situation!

Roth conversions are one of the more popular tax planning strategies that many people should be doing right now to take advantage of lower tax rates before the expiration of the TCJA.

This is simply the act of moving your tax-deferred investments (IRA, 401(k), etc.) to a tax-free investment (Roth IRA). Just be aware that there are special planning considerations, so ensure you are doing it correctly and not forcing yourself to pay penalties or more taxes than you should.

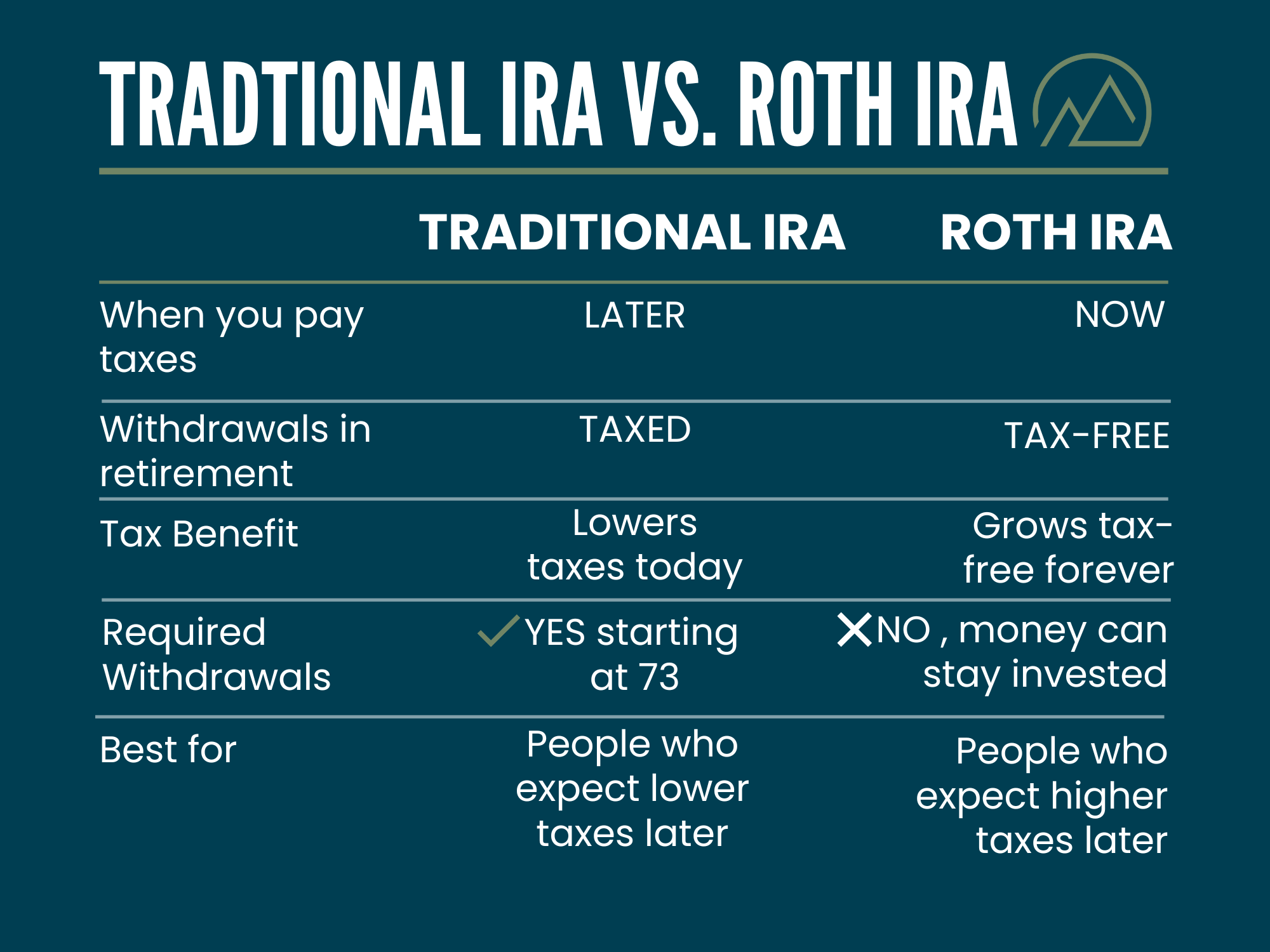

Why a Roth IRA?

The main reason why a Roth conversion makes sense can be understood by answering the following question: Would you rather pay taxes on the seed or the harvest?

I am from Carroll, Ohio, a rural farming community outside Columbus. My best friend is a farmer and has an apple orchard. I asked him, “Would you rather pay tax on the apple seeds you plant or the harvest of those apples?”

His answer was obvious — the seed. Roth conversions operate on a similar principle. For example, if you have $100,000, then you can pay taxes on that money now by doing a Roth conversion at a low tax rate, or you can wait until harvest and every dollar of growth during the intervening years would be taxable in an IRA.

Many clients also choose Roth conversions because, unlike a traditional IRA, with a Roth they do not have to take money out for required minimum distributions (RMDs).

A traditional IRA requires you to pull out money starting in the year after you turn 73 or 75 (if you were born in 1960 or after), but some people may not need that money at that time and would rather continue growing it tax-free for their beneficiaries, surviving spouse, emergencies and more flexibility in the future.

Be prepared for the tax bill of a Roth conversion

We can’t forget our least favorite word: taxes. If you do a Roth conversion, then you must pay tax on that money today. Nobody likes paying taxes, but remember, taxes are on sale now, and you either must pay the taxes on your IRA now or later.

So, next time you look at your IRA or 401(k) statement, remember that there is a name missing next to yours: Uncle Sam.

When doing Roth conversions, it is important to seek advice from a tax professional and financial professional. A small mistake can make a big impact.

When deciding how much to convert, it depends on your specific situation. One thing to consider is: Do you think you will be in a lower tax bracket in retirement, or do you think you’ll be paying taxes at a higher rate in the future?

The answers to those questions could help determine whether a conversion is right for you.

Lastly, I want to tell you a story about my nephew. Every year for his birthday, I do not give him a physical gift. I’m not the favorite uncle right now.

Instead, I put money toward an investment for him. He is not old enough to understand how beneficial this is for him yet, but when he turns 21, he and I will be best friends. He will be taking me out for steak dinners and driving me around in his sports car, right?

We apply the same concept with Roth conversions. Yes, you must pay the tax now, and it isn’t as enjoyable as getting that deduction when you file your taxes at year’s end, but remember how much you can save and how much better it will feel to have control of your taxes in the future.

A Roth conversion can save you more money than any blueberry sale!

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Related Content

- Here's Why You Shouldn't Put All Your Money Into Roth IRAs

- Is It Too Late to Do a Roth Conversion if You're Retired?

- Five Windows of Opportunity for Roth Conversions

- Backdoor Roth IRAs: Good for Wealthy Retirees?

- Roth IRA Conversions: Benefits and Considerations Beyond Taxes

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

Women Are Strong Savers. So, Why Do Their Balances Often Lag Behind?

Women Are Strong Savers. So, Why Do Their Balances Often Lag Behind?Many women are consistent savers, but long-term balances don't always reflect those habits. Here's what's behind the gap — and what can help change it.

-

The Average Retirement Withdrawal Rate by Age

The Average Retirement Withdrawal Rate by AgeClinging to 'safe' income and hoarding your principal isn't protecting your wealth; it's shortchanging the retirement you earned.

-

A Costly To-Do: Is It Time to Delegate Investment Decisions?

A Costly To-Do: Is It Time to Delegate Investment Decisions?While some DIY investors are happy to be hands-on with their portfolio, others can only dip in and out. When is it time to start delegating those decisions?

-

The To-Do That's Costing You: A Financial Professional Makes the Case for Delegating Your Investing Decisions

The To-Do That's Costing You: A Financial Professional Makes the Case for Delegating Your Investing DecisionsWhile some DIY investors are happy to be hands-on with their portfolio, others can only dip in and out. When is it time to start delegating those decisions?

-

The 5 W's of a Successful Estate Planning-Focused Family Meeting, From a Wealth Adviser

The 5 W's of a Successful Estate Planning-Focused Family Meeting, From a Wealth AdviserGood family meetings bring clarity to estate plans and strengthen bonds. Poor ones turn into ugly battles. This simple tool will help you avoid the drama.

-

Are You Ready to Merge Finances With Your Significant Other? We Need to Talk

Are You Ready to Merge Finances With Your Significant Other? We Need to TalkMerging your money as a couple requires an honest conversation that clarifies what you're both walking into — and prevents bigger problems down the line.

-

4 Strategies for Parents to Help the Class of 2026 in a Tight Job Market

4 Strategies for Parents to Help the Class of 2026 in a Tight Job MarketDespite a weak entry-level job market, the college degree's return on investment is still achievable for this year's grads. Here's how parents can help them.

-

It's Time to Redefine Retirement for Retirees With $500,000 to $5 Million: Here's How

It's Time to Redefine Retirement for Retirees With $500,000 to $5 Million: Here's HowRetirees with $500,000 to $5 million in assets need a different approach to keep their house and cover ever-increasing health care expenses, including long-term care, without taking too much risk and paying too much in taxes.

-

5 Mistakes to Avoid in Oil and Gas Investing (Plus, 6 Ways to Stay Focused)

5 Mistakes to Avoid in Oil and Gas Investing (Plus, 6 Ways to Stay Focused)The nature of energy markets exacerbates unhelpful behaviors. Understanding the psychology of oil and gas investing can help you make smarter decisions.

-

Fee-Only Financial Advice: Do You Really Know What It Means?

Fee-Only Financial Advice: Do You Really Know What It Means?How does fee-only financial advice differ from fee-based or commission-based advice? Knowing the difference is a critical step toward receiving unbiased help.

-

Risk-Averse But OK With More Risk Than a CD? These 2 Options Could Work for You

Risk-Averse But OK With More Risk Than a CD? These 2 Options Could Work for YouInvestors looking for higher yields might want to consider these hybrid products, which blend the possibility of better returns with less downside risk than traditional investing.