Social Security Is Taxable, But There Are Workarounds

If you're strategic about your retirement account withdrawals, you can potentially minimize the taxes you'll pay on your Social Security benefits.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When you claim Social Security, up to 50% to 85% of your benefit is taxable, depending on your overall income level. You may find that the combination of Social Security benefits, withdrawals from tax-deferred IRAs and other sources of income results in a tax bill higher than you anticipated.

The years leading up to retirement are some of the best times to get a handle on what your post-retirement tax picture will look like. After all, it isn’t how much income you’re getting in retirement that’s important — what’s important is how much of that income you keep to fund your lifestyle and other retirement goals.

Once you understand how various retirement accounts are taxed and how those taxes will affect other retirement benefits, like Social Security, you can make informed decisions about how to position your finances in retirement to help mitigate taxes.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In this article, I’ll explain which of your retirement income streams are likely to be taxed, and the steps that you can take to potentially minimize those taxes.

Taxes in retirement

Here’s a brief summary of how different types of retirement accounts and income are taxed in retirement:

- Social Security: Up to 50% to 85% taxable

- Traditional IRA accounts: Taxable at individual income tax level when withdrawn in retirement

- Roth IRA accounts: Tax-free when withdrawn after a five-year holding period

The degree to which Social Security is taxed depends on your individual income and filing status. If you align your income appropriately, you can potentially pay no taxes on your Social Security benefits and reduce your tax bill significantly.

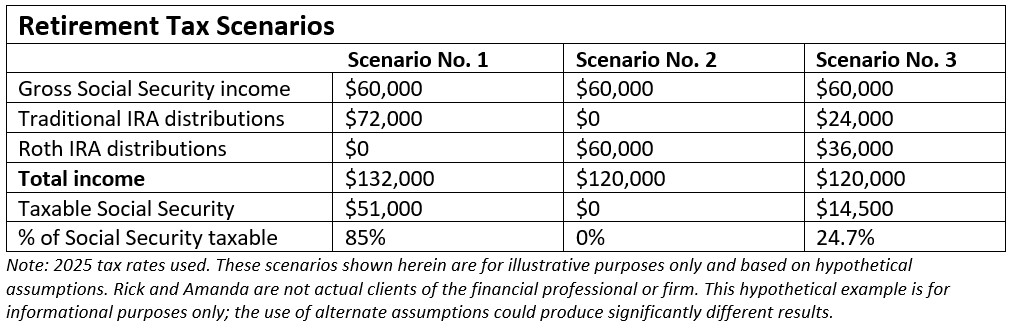

The case studies below show you an example of how this can work.

Case study facts

Meet Rick and Amanda, a retired couple in their early 70s. They file their taxes as married filing jointly and need $120,000 a year to fund their lifestyle. They receive $60,000 a year in Social Security benefits and source the rest of their income from their investment accounts.

Here’s how different withdrawal strategies affect their taxes:

Scenario No. 1: Pulling from IRA triggers big tax bill

Rick and Amanda receive their $60,000 a year in Social Security benefits. To get the remaining $60,000 to meet their income needs (net of federal taxes), they withdraw $72,000 from their traditional IRA.

Because traditional IRA withdrawals count as fully taxable income, their Social Security benefits are subject to taxation.

Based on the IRS formula for Social Security taxation, 85% of their Social Security — $51,000 — becomes taxable income. This means their total income for tax purposes is $123,000 ($72,000 IRA distribution plus $51,000 in taxable Social Security benefits).

After applying the $33,200 standard deduction, their final taxable income is $89,800, which results in a total federal tax bill of $10,299.

So, they needed a total income of $132,000 to pay the federal tax bill and have enough left to fund their living expenses.

Scenario No. 2: Pulling from Roth delivers big savings

Rick and Amanda receive the same amount of Social Security, which is $60,000. To meet their income needs, they take a $60,000 distribution from their Roth IRA, which is tax-free.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

Because they are not tapping a taxable traditional IRA, it reduces the tax on their Social Security to zero and their overall tax liability to zero.

While this approach reduces their tax bill to zero, it isn’t sustainable unless they have a large balance in their Roth.

Scenario No. 3: Pulling from both offers sustainable savings

Rick and Amanda receive the same $60,000 in Social Security benefits. To fund their income needs, they take a distribution from their traditional IRA of $24,000. To meet the rest of their income needs, they take a $36,000 tax-free distribution from their Roth IRA. This combination results in a tax bill of $530.

This approach maximizes their situation by reducing their withdrawal from their Roth while reducing their tax bill to close to zero.

Takeaways

Based on these scenarios, you can see that Social Security tax rates aren’t a prescription that applies to everyone on a uniform basis. Instead, like everything else, Social Security tax is dependent upon your total income picture.

When you plan ahead and have other sources of income, like Roth IRA distributions and cash in taxable investment accounts or bank accounts, you can take steps to potentially reduce taxes on your Social Security benefits and your overall retirement income.

Amy Buttell contributed to this article.

Investment advisory services offered through duly registered individuals on behalf CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Red Mountain Financial are unaffiliated entities. Licensed Insurance Professional.

This information does not necessarily represent the views of the presenting adviser. The statements and opinions expressed are those of the author and are subject to change at any time. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individualized tax, legal, fiduciary, or investment advice. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy.

Investing involves risk, including possible loss of principal. Insurance product guarantees are backed by the financial strength and claims-paying ability of the issuing company. We are not affiliated with any government agency.

Related Content

- Seven Ways to Reduce Taxes on Social Security Benefits in 2025

- Retirement Taxes: How All 50 States Tax Retirees

- Social Security Sent Out Billions in Back Payments in March. Here's What You Need to Know

- Five Changes to Social Security in 2025

- How to Calculate Taxes on Social Security Benefits in 2025

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Todd believes in providing clients with financial confidence. His goal is to offer his clients the confidence of knowing their financial lives are well cared for so they are free to focus on more important priorities such as family, supporting charitable causes or enjoying some well-deserved travel. He provides this confidence by embracing common sense, timeless principles and forward thinking. Todd delivers custom Total Retirement ℞ Income Plans® to help his clients achieve their goals.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.