Secure Your Social Security: The Essential Role of a Representative Payee

Even with a power of attorney or a joint bank account, the Social Security Administration may hamstring your financial representative without one of these.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

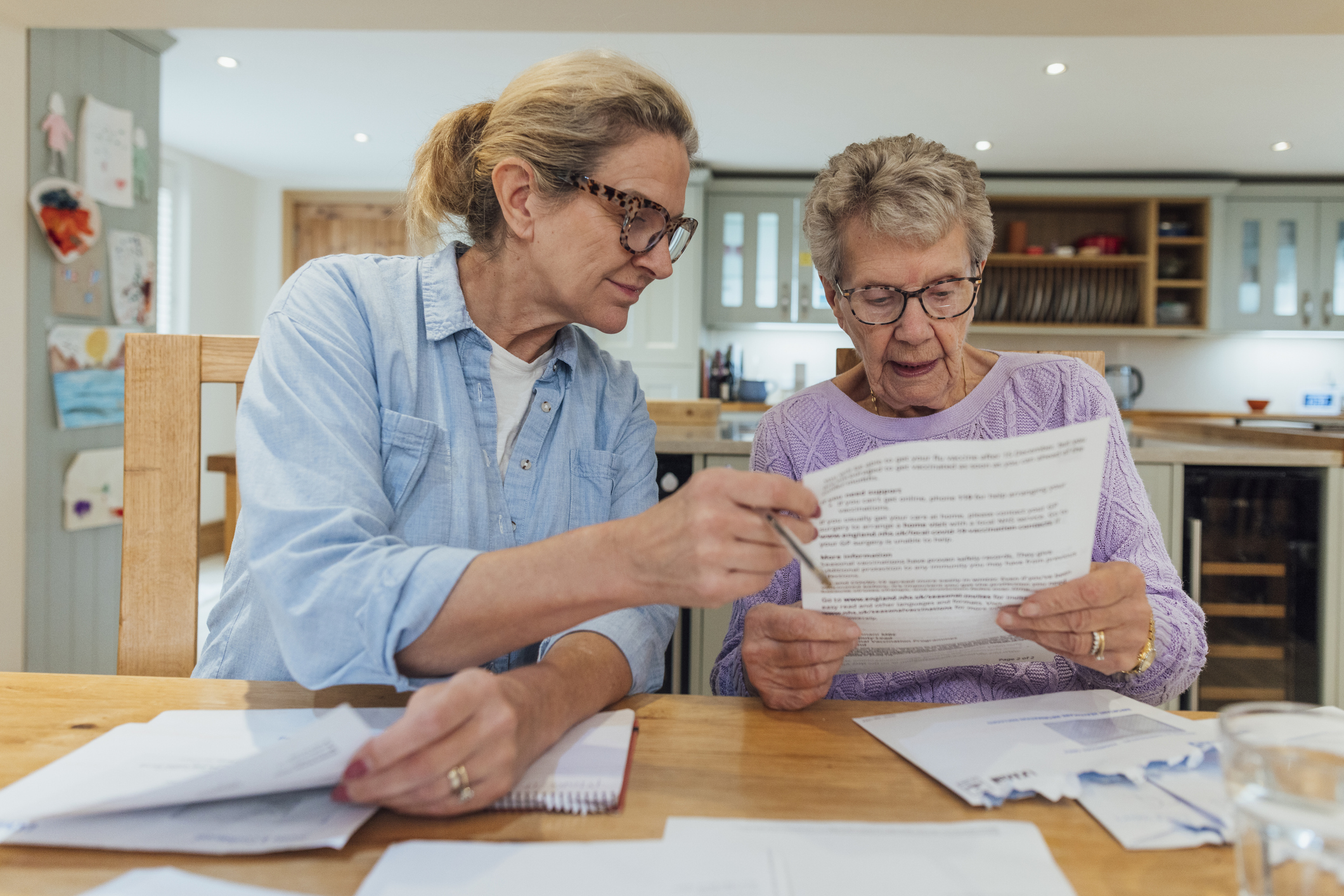

It's no secret that scammers target older adults, which is one reason the Social Security Administration (SSA) has safeguards to protect beneficiaries. However, those guardrails come at a cost for trusted people acting on your behalf if you can no longer manage your finances. Even if you have set up a financial or health power of attorney (POA) or share a bank account with a son or daughter, they may find themselves restricted when it comes time to help you.

Imagine your POA wants to change your Medicare Advantage selection after you move to a new state (as you might do if you move to assisted living or a nursing home). Your POA must change your Social Security address first, which may require them to visit an SSA office in person. This can't be accomplished unless your POA is also your representative payee.

Representative payee to the rescue

Whether you are in the throes of estate planning and picking POAs or currently caring for an older adult, it's worth setting up a Social Security representative payee. This program protects beneficiaries, ensuring their benefits are used to meet basic needs, such as housing, food and healthcare.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Although most people with representative payees are minors, our focus here is on managing Social Security payments for retirees. Unlike minors, retirees are presumed competent to manage their finances, so a representative payee is not required but is advisable. For most older adults, representative payees are necessary when they have advanced dementia or are in a coma, for example.

One study found that approximately 63% of retirees over 70 who also had dementia or mild cognitive impairment had a health power of attorney. But only about 9% with dementia and 2% with mild cognitive impairment had a Social Security representative payee assigned to them, according to the Congressional Research Service.

You can plan by exercising your option to advance designate a representative payee. Don’t worry about being locked into your decision; you can submit and update your advance designation request when you apply for benefits or after you are already receiving benefits.

If the Social Security Administration (SSA) thinks you need assistance with your benefits, it will initiate the process of putting a representative payee in place. Under these circumstances, the SSA can appoint a relative, friend, or other interested party as your “representative payee.” The SSA thoroughly investigates potential representative payees to protect the interests of beneficiaries. This is because a representative payee receives the beneficiary’s payments and is given the authority to use them on the beneficiary’s behalf.

How to advance designate a representative payee

If you want to have every base covered in your estate plan or anticipate needed assistance with managing your social security benefits in the future, you can advance designate up to three people to receive and manage your payments. However, you may not designate an organization to be your advance designee.

The SSA only contacts advance designees if they need to find a representative payee to assist you. They will first consider your advance designees but will still fully evaluate them to determine their suitability when you need one.

You can change your mind. If you choose to appoint an advance designee, the SSA will send you a notice each year listing your advance designees for your review. The use of a advance designation is optional, and you can update or withdraw your advance designation at any time.

How do you make an advance designation of a representative payee? The easiest way is to by direct electronic submission through your personal my Social Security account. Otherwise, you initiate by contacting the SSA via telephone at 1-800-772-1213 (TTY 1-800-325-0778 if you are hearing impaired) or at your local SSA office.

What do you need to tell the SSA about your representative? You will need to provide your designees' names, telephone numbers, and, if you choose, their relationship to you. The SSA will send you a notice each year listing the names of the people you have chosen to advance designate, along with reminders about how to withdraw or update your selection(s).

What happens when the SSA agrees you need a representative payee?

Needing help as we age is inevitable. More than eight million people, who get monthly Social Security benefits or Supplemental Security Income (SSI) payments, need help managing their money. If you need help managing your Social Security benefits, the SSA may step in and start the process of finding a representative payee.

Simply moving to a nursing home isn't a triggering event for coming under the 'protection' of a payee. The SSA looks at more indicators, such as your medical condition and interactions with social services and if trusted family/friends raise competency issues.

If the SSA determines that you need a representative payee to use your SSA benefits in your best interests, it will act based on a combination of medical and social service evidence and statements from relatives, friends, or others in a position to observe your behavior.

The SSA will first look for family or friends to serve as payees. If friends or family members are not able to serve as payees, they look for a qualified organization to fill that role.

What a representative payee can and should do:

The duties listed below are what the SSA expects a representative payee to do for you. Before advance designating anyone as your representative payee, consider if you can realistically see them performing these tasks with care and diligence. Do they attend to their own needs and financial obligations in a timely manner? Are they forgetful or fail to take deadlines seriously?

Don't appoint someone out of a sense of obligation or to spare someone's feelings. You should appoint people who will work in your best interests, care for your needs regularly, be willing to ask for help when needed and be honest.

- Determine the beneficiary’s needs and use his or her payments to meet those needs. A representative payee must ensure that Social Security funds are spent on the beneficiary’s basic needs, such as housing, food, dental, health care and personal items, such as clothes, before using funds for other needs or wants. After these essentials are covered, the remaining funds can be used for different purposes such as personal items or recreation, or saved for the future.

- Save any money left after meeting the beneficiary’s current needs. Representative payees are responsible for maintaining the beneficiary’s funds securely. You must set up a dedicated bank account specifically for SSA benefits to avoid mixing with other funds. The SSA recommends an interest-bearing checking account and savings bonds for the beneficiary’s future needs.

- Keep records of all payments received and how they were spent and saved. All representative payees are required to keep detailed records of how benefits are spent or saved, and they must make all records available for review if and when requested by SSA. You can use the Income and Expenses Worksheet in the SSA publication, A Guide for Representative Payees.

- File an annual Representative Payee Report. The request for the report will arrive by mail. After completion, it can be submitted online or by mail. Some representative payees are selected for an educational visit or representative payee review, which is a more in-depth review to confirm you are doing your duties.

- Help the beneficiary get medical treatment when needed. Provide benefits information to social service agencies or medical facilities that serve the beneficiary.

- Report any changes that could affect the beneficiary’s eligibility for benefits or payment. Representative payees must notify the SSA of any significant changes in the beneficiary’s circumstances, such as a change in income, living arrangements, or health status that could impact the beneficiary’s eligibility or benefit amount.

What a representative payee cannot and should not do:

I don't want to confuse anyone who has selected a designee and has also given them a power of attorney. The list of what a representative payee can not do reflects the limits of the scope of authority and responsibilities a representative payee is granted when approved by the SSA. If they also hold a power of attorney, your designee may have the authority to perform some, if not all of the tasks listed below. Otherwise, these limits apply.

- Sign legal documents, other than Social Security documents, for a beneficiary.

- Manage earned income, pensions, or any income from sources other than Social Security or SSI.

- Oversee other liquid assets. As a representative payee, you are not authorized to manage earned income, pensions, or any income from sources other than Social Security or SSI.

- Failing to prioritize basic needs. You can not use a beneficiary’s money for your personal expenses or to spend funds in a way that would leave the beneficiary without necessary items or services such as housing, food or medical care.

- Co-mingling funds. You can not put a beneficiary’s Social Security or SSI funds into an account you or another person own.

Peace of mind: priceless

The advance designation of a representative payee is another way to protect yourself if you become incapacitated or are judged to be incapable of managing your Social Security benefits. In the event you become unable to manage, or direct others to manage your benefits in the future, you will have peace of mind and security of knowing that someone you trust may be appointed to manage your benefits for you.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna joined Kiplinger as a personal finance writer in 2023. She spent more than a decade as the contributing editor of J.K.Lasser's Your Income Tax Guide and edited state specific legal treatises at ALM Media. She has shared her expertise as a guest on Bloomberg, CNN, Fox, NPR, CNBC and many other media outlets around the nation. She is a graduate of Brooklyn Law School and the University at Buffalo.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your Retirement

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your RetirementTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.