Presidents and Social Security: How Presidents Have Impacted America's First Social Insurance Policy

Since its inception in 1935, Social Security has expanded its mission and reach. Here is how each president from Roosevelt to Trump has impacted Social Security.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Since President Roosevelt signed the historic legislation that created the Social Security program in 1935, almost every president has left his mark on a program that over 68 million retirees benefit from monthly.

Without Social Security benefits, 37.3% of older adults would have incomes below the poverty level, all else being equal; with Social Security benefits, only 10.1% fall below that level, according to the Center on Budget and Policy Priorities.

The first American to collect monthly retirement checks was Ida May Fuller of Ludlow, Vermont. She worked for three years under the Social Security program and paid a lifetime total of $24.75 in accumulated Social Security taxes on her salary. Her initial monthly check was $22.54. Fuller started collecting benefits in January 1940 at age 65 and lived to be 100 years old, dying in 1975. During her lifetime, she collected a total of $22,888.92 in Social Security benefits.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Over the next few years, we will have to grapple with how to shore up the Social Security trust fund as the insolvency date of the fund moves closer. The 2025 Trustees Report moved up the insolvency date by three quarters to early 2033 and increased the projected benefit reduction from 21% to 23%.

There are only a few ways to fix the shortfall, and all of them would require a certain financial sacrifice. Any proposal would either involve people paying more in taxes, receiving a smaller benefit, or qualifying for full benefits at an older age, or some combination of these.

Here's a look at how our nation's presidents have impacted Social Security.

1. Franklin D. Roosevelt

On August 9, 1935, The Social Security Bill (H.R. 7260) was sent to President Franklin Delano Roosevelt for his signature. An important part of the New Deal, it was the first national social insurance policy. It would help ensure that older Americans would have a stable source of income after retiring. This was a world before pensions, IRAs and 401(k) accounts.

Workers began paying into the system and accruing lifetime work credits on January 1, 1937, and payment of benefits commenced on January 1, 1940. The money collected prior to 1940 was used to help cover benefits for eligible workers aged 65 and older beginning Jan. 1, 1940.

When the bill was passed, there were approximately 7.5 million (6% of the population) men and women over 65 years of age in the U.S. Currently, we are riding a silver tsunami with around 4.1 million Americans expected to turn 65 in 2025. This translates to approximately 11,200 Americans turning 65 each day in 2025.

Report No. 615

The Social Security Bill April 5, 1935

"The need for legislation on the subject of social security is apparent at this time. On every hand the lack of such security is evidenced by human suffering, weakened morale, and increased public expenditures.

This situation necessitates two complementary courses of action: We must relieve the existing distress and should devise measures to reduce destitution and dependency in the future."

2. Harry S. Truman

Harry Truman, who would become the first Medicare recipient under President Lyndon B. Johnson, more about that later, expanded the Social Security program with the Social Security Act Amendments of 1950.

The Amendments Act became law fifteen years after FDR signed the original authorizing legislation for the Social Security program. Before its passage, millions of elderly, infirmed and indigent Americans were still excluded from Social Security and dependent on public charity. The amendments expanded the program to 10 million more people by including the non-farm unemployed, although certain occupations like doctors, engineers and lawyers continued to be excluded. It also expanded the program to cover the U.S. Virgin Islands and Puerto Rico.

Statement by President Truman Upon Signing the Social Security Act Amendments:

"The passage of this legislation is an outstanding achievement. In this act the 81st Congress has doubled insurance benefits and brought 10 million more persons under old age and survivors insurance--including those whose insurance rights were taken away by the 80th Congress. Millions of others will benefit from the new public assistance provisions giving help to the disabled and to dependent children. For the first time American citizens in Puerto Rico and the Virgin Islands will be covered under both the insurance and assistance programs. In addition, veterans of World War II will now receive wage credits for military service in computing their insurance benefits."

It should be noted that on December 29, 1951, President Truman created the President's Commission on the Health Needs of the Nation. The Commission was charged with determining the Nation's total health requirements and to recommend ways to meet those needs. President Johnson credited President Truman for planting the seeds for what would become Medicare, calling him "the father of Medicare."

3. Dwight D. Eisenhower

President Eisenhower signed two pieces of legislation that expanded the number of to people eligible to pay into the Social Security system and collect benefits.

On September. 1, 1954, Eisenhower, similar to Truman, expanded Social Security to include 10 million more Americans when he signed the Social Security Act Amendments of 1954. This legislation brought self-employed farmers and domestic employees, as well as other specific occupations into the Social Security program.

The 1954 expansion also included a disability freeze provision that protected the benefits of the disabled. One consequence of a period of disability is that the worker will have years of little or no earnings. These years, if taken into account in computing a retirement benefit, would reduce, and in some cases eliminate entirely, future potential retirement benefits. The disability freeze provisions allow the SSA to ignore periods of disability when computing a retirement or survivors benefit and remove the lowest-earning years from the records of beneficiaries.

In 1960, Eisenhower expanded the program yet again to allow disabled workers of all ages and their dependents to collect benefits when he signed the 1960 Social Security Amendments into law. The 1960 expansion also created the Kerr-Mills Act, which provided medical care for elderly people who were not receiving government benefits but who couldn’t afford to provide care for themselves. The 1965 Medicaid program would be modeled after this Act.

4. John F. Kennedy

On June 30, 1961, JFK signed Social Security Amendments of 1961, the amended Social Security program to allow workers to opt for early retirement at age 62 — but only men. The amendments also increased the minimum monthly benefit (from $33 to $40) and the minimum disability benefit. Benefit increases were extended to dependents and survivors as well, increasing the minimum benefit from 75% to 82% percent of the workers' retirement benefit.

The amendments made it easier to become eligible for the program. The new eligibility requirements brought an additional 160,000 new applicants onto the rolls in the first year.

Statement by the President upon signing The Social Security Amendments of 1961

"A nation's strength lies in the well-being of its people. The Social Security program plays an important part in providing for families, children, and older persons in times of stress. But it cannot remain static. Changes in our population, in our working habits, and in our standard of living require constant revision. I am pleased that the Congress has acted so promptly this year to modernize the program. It has done so with commendable regard for the sound principles on which social insurance must be based for the legislation is both financially sound and socially responsible."

5. Lyndon B. Johnson

President Lyndon Johnson expanded Social Security with the Social Security Act Amendments of 1965, known better as the Medicare and Medicaid Act. President Johnson signed Medicare into law at the Truman Library in Independence, Missouri to recognize Truman’s early effort to establish a national health insurance program.

President Truman and his wife Bess received Medicare registration cards numbers one and two. Johnson also signed Truman's application for optional Part B medical care coverage.

The law created two new health insurance programs. The first was a federalized health insurance program for people 65 and older; only about half of the country’s seniors were covered by health insurance before Medicare became law. The second program, Medicaid, was created for people of any age with limited income. Medicaid was to be funded by state and federal sources and administered by the states.

Statement by President Johnson on the Inauguration of the Medicare Program

"MEDICARE begins tomorrow.

Tomorrow, for the first time, nearly every older American will receive hospital care-not as an act of charity, but as the insured right of a senior citizen. Since I signed the historic Medicare act last summer, we have made more extensive preparation to launch this program than for any other peaceful undertaking in our Nation's history.

Now we need your help to make Medicare succeed."

.

6. Richard M. Nixon

The early 1970s was a period of stagflation marked by high inflation, high unemployment, energy price shocks caused by an oil embargo and deficit spending to pay for the increasingly unpopular Vietnam War. And prior to 1975, Social Security benefit increases were set by legislation.

President Richard Nixon is the COLA president. Major provisions of the 1972 Social Security Amendments included: a 20% increase in benefits in 1972, the creation of the automatic Cost-of-Living-Allowances (COLAs) to increase benefit amounts as the cost of living rises, and the creation of the Supplemental Security Income program, which federalized state welfare programs for the blind, disabled, and needy elderly.

Special message from the President to Congress on Social Security — September 25, 1969

"By acting to raise benefits now to meet the rise in the cost of living, we keep faith with today's recipients. By acting to make future benefit raises automatic with rises in the cost of living, we remove questions about future years; we do much to remove this system from biennial politics; and we make fair treatment of beneficiaries a matter of certainty rather than a matter of hope."

7. Gerald Ford

President Gerald Ford's impact on Social Security was focused on the well-being of children and not retired workers. In 1975, Ford signed into law the Social Service Amendments of 1974, which created Part D of Title IV of the Social Security Act.

He enacted the Child Support Enforcement program, a federal/state initiative that made it much harder for non-custodial parents to evade their financial responsibilities to their children by moving out of state and beyond the reach of state social service agencies. The law gave the SSA the responsibility of tracking down parents who had abandoned their children and allowed for the garnishment of wages, including Social Security benefits, to collect child support.

8. Jimmy Carter

President Jimmy Carter, like Nixon, presided during tough economic times, and faced a Social Security trust fund that was faltering. By 1977, the long-range actuarial situation of the Social Security system was vastly out of balance and trust fund reserves were facing exhaustion within a very few years. The 1970s was a recessionary period and the idea of raising the Social Security tax was a nonstarter. The president and congress took the route of reducing future benefits to bring the system back into balance.

President Carter signed the Social Security Amendments of 1977 into law to shore up the program’s long-term financial solvency. This was done by creating a new benefit formula for retirees born after 1922 that generally lowered the amount that beneficiaries received. This is also referred to as the "notch" provision.

This legislation also included the introduction of the Government Pension Offset (GPO). Before its repeal in 2024, the GPO reduced spousal or widow(er) benefits by two-thirds of the monthly non-covered pension and could partially, or fully, offset spousal/widow(er) benefits, depending on the amount of the non-covered pension.

9. Ronald Reagan

President Ronald Reagan probably changed the Social Security program more than any other president that followed FDR. When Reagan took office, the program's insolvency issue was critical. As a result, in 1981, The National Commission on Social Security Reform (often referred to as the Greenspan Commission) was appointed by the Congress and the President to study and make recommendations regarding the crisis that Social Security funding faced.

The Commission's report was the basis of a number of changes and one that won't be fully phased in until 2027. These sweeping changes included: increasing the payroll taxes, gradually raising the full retirement age (FRA) from 65 to 67 and making 50% of Social Security benefit income taxable for recipients with overall incomes above $25,000 for an individual and $32,000 for a married couple filing jointly.

Hold on — there are still more changes. The self-employment tax was introduced, requiring people with self-employment income to pay both the employer and employee portions of the FICA for a total of 12.4%. This is also when the Windfall Elimination Provision (WEP) was introduced. Repealed in 2024 with the passage of the Social Security Fairness Act, the WEP reduced or eliminated the Social Security benefits for public sector employees who receive a pension based on work that was not covered by Social Security.

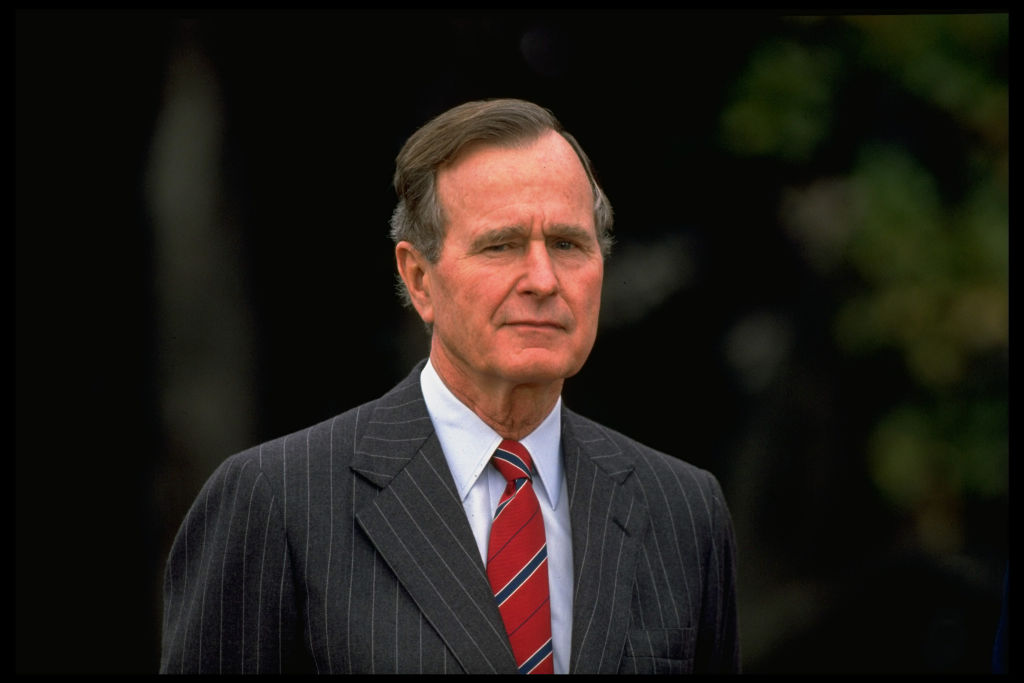

10. George H.W. Bush

President George H.W. Bush was the only president who didn’t significantly change the program. However, on November 5, 1990, he signed into law P. L. 101-508, Omnibus Budget Reconciliation Act of 1990.

This bill contained a policy change that mandatorily extended Social Security coverage to State and local government employees not covered by a retirement plan. Another significant feature of this bill was that it explicitly removed Social Security from the budget deficit calculations under Gramm-Rudman-Hollings (G-R-H). (This was legislation that aimed to cut the federal budget deficit). Under the prior law, it was 'out of order' to propose legislation that had the effect of violating the G-R-H limits that were in place to balance the federal budget. This budget quirk made it nearly impossible to introduce any legislation relating to the Social Security program.

11. Bill Clinton

President Bill Clinton built on Reagan's legacy and increased the percentage of Social Security benefits that can be subject to income taxes to 85% from 50% for taxpayers who earned higher incomes. The new income thresholds were $34,000 for single people and $44,000 for married couples. These thresholds are still in effect today and have not been indexed for inflation.

In 1996, President Clinton signed the Contract With America Advancement Act. The legislation denied Social Security disability benefits to people whose disabilities were related to alcoholism and/or drug addiction. Under this law, if someone is “only” an alcoholic or drug addict, they will not be approved for disability benefits. However, if they have related illnesses which are in and of themselves disabling, they can be approved on the basis of those illnesses.

In the last year of his second term, Clinton signed into law The Senior Citizens’ Freedom to Work Act of 2000, that eliminated the Retirement Earnings Test (RET) for beneficiaries at or above their full retirement age (FRA).

12. George W. Bush

President George W. Bush signed into law the Medicare Prescription Drug, Improvement and Modernization Act (MMA) of 2003. The new law amended Title XVIII, the Medicare provision of the Social Security Act, to create Medicare Part D, the first prescription drug benefit in the program’s history. This was the largest overhaul of Medicare in the program’s nearly 40-year history.

The act also redesigned Medicare Part C, which is the managed care portion of the program. Part C Medicare + Choice was renamed Medicare Advantage. The MMA expanded the number of plan options available to beneficiaries and increased the government payments to the Medicare Advantage sponsors.

Lastly, the Income Related Monthly Adjustment Amount (IRMAA) was introduced in 2003 as part of the Medicare Modernization Act. However, at this point, it only applied to Medicare Part B premiums.

13. Barack Obama

In December 2009, President Barack Obama signed into law the No Social Security Benefits for Prisoners Act of 2009. This law prohibited prisoners, parole violators, and those fleeing from prosecution where the punishable sentence is more than one year, from receiving Social Security benefits.

President Obama signed the Patient Protection and Affordable Care Act, also known as Obamacare, into law on March 23, 2010. The ACA contained a provision that expanded the IRMAA to include Part D enrollees as of 2011.

14. Donald Trump

President Donald Trump didn't introduce or sign any legislation to alter or expand the Social Security program during his first term in office. The only legislation that touched on Social Security was The CARES Act. This legislation was part of a Coronavirus relief package and sought to shore up the finances of the Social Security Trust Funds while the economy struggled through the shutdowns.

The Cares Act included one section that reduced FICA taxes owed by certain employers and delayed payment of FICA/SECA while ensuring the solvency of the Social Security Trust Funds. Another section suspended the recovery of student loan debt from Social Security benefits.

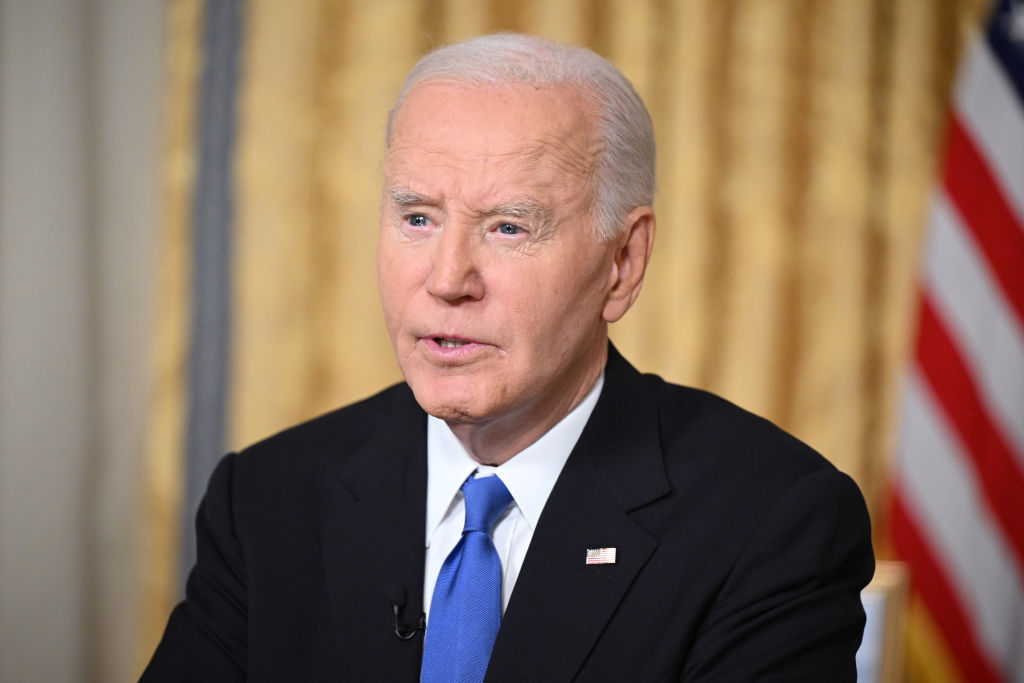

15. Joe Biden

On January 5, 2025, President Joe Biden signed the The Social Security Fairness Act (SSFA) into law. This legislation repealed both reductions, the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These provisions previously reduced or eliminated Social Security benefits for many public sector retirees and spouses that collect a 'non-covered' pension based on work that was not covered by Social Security.

Now, public sector retirees will be able to collect their non-covered pension and full Social Security benefits. As of January 2025, SSA says about 3.2 million individuals had their Social Security benefits reduced or eliminated by the GPO, the WEP, or both. Under the SSFA, affected beneficiaries are eligible to receive an increase in their monthly benefits and may also receive retroactive payments for benefits payable dated back to January 2024.

16. Donald Trump

As far as President Trump's plans for the Social Security Administration during his second term, we can look at what he said on the campaign trail and who he has appointed to run Social Security and Medicare to get an idea of what the next few years will have in store.

Back in 2024, when speaking to a crowd of supporters in Doral, Florida, then presidential candidate Trump vowed not to cut the safety-net programs many older Americans rely upon. "I will not cut one penny from Social Security or Medicare," he said. "And I will not raise the retirement age by one day."

President Trump repeatedly called for the end of taxing Social Security benefits on the campaign trail. He made the same calls in the lead-up to the passage of the recent tax and spending law, the One Big Beautiful Bill. In the end, the current tax regime of tiered taxation of benefits based on income will continue without any change. That said, the legislation passed in July did create a new deduction for taxpayers aged 65 and over with income under a certain threshold.

Why did Congress implement a new 'senior deduction' instead of repealing existing taxes on Social Security? It's a matter of rules and how bills get passed. Kiplinger tax expert Joy Taylor explained, "...the process that Republican lawmakers used to pass the OBBB while circumventing the 60-vote filibuster rule in the Senate didn’t allow this income tax change [repeal of current tax] to Social Security benefits. So lawmakers found an alternative means of tax relief for seniors in the OBBB."

For a deep dive into the new deduction, read Questions on the $6,000 Senior Deduction to understand who can take the deduction and how to file for it next year when you report your 2025 income.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna joined Kiplinger as a personal finance writer in 2023. She spent more than a decade as the contributing editor of J.K.Lasser's Your Income Tax Guide and edited state specific legal treatises at ALM Media. She has shared her expertise as a guest on Bloomberg, CNN, Fox, NPR, CNBC and many other media outlets around the nation. She is a graduate of Brooklyn Law School and the University at Buffalo.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.