The '8-Year Rule of Social Security' — A Retirement Rule

The '8-Year Rule of Social Security' holds that it's best to be like Ike — Eisenhower, that is. The five-star general knew a thing or two about good timing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

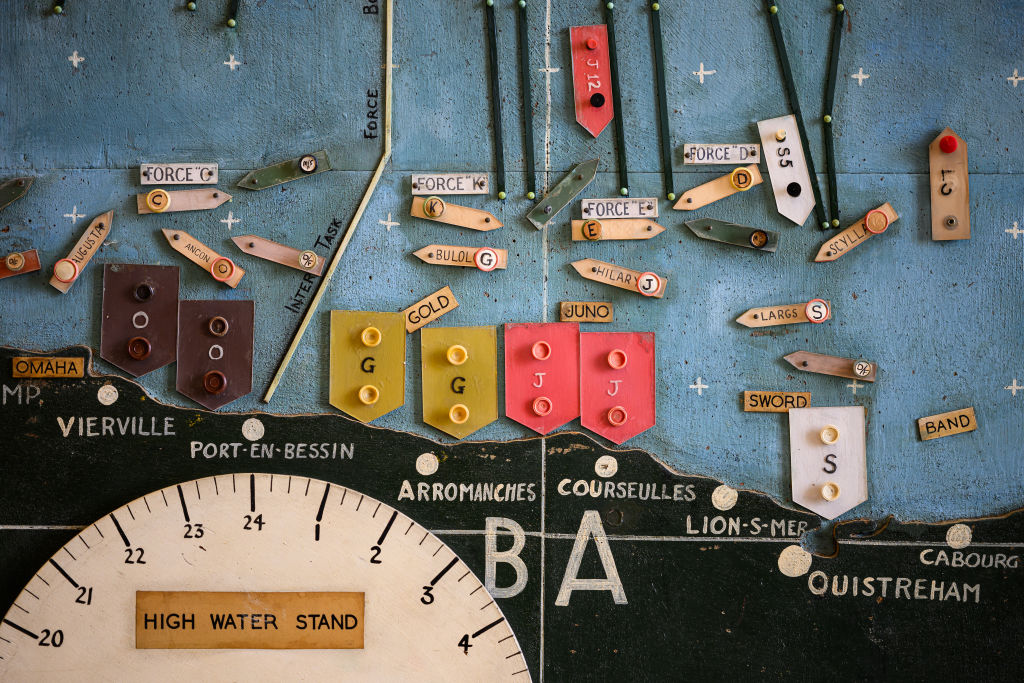

Sometimes, waiting feels like the wrong move. Until it proves to be your best one. For instance, on June 5, 1944, Allied troops were prepared to launch the largest military invasion in history. But when poor weather rolled in, General Dwight D. Eisenhower made the high-stakes decision to delay D-Day by 24 hours, despite enormous pressure to proceed.

That pause changed the course of history.

Sure, the fate of the world doesn’t rest on your decision to file for Social Security. But the quality of your retirement might. And, like Eisenhower’s call, it often comes down to timing.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While retirees draw income from various sources, Social Security remains the most commonly cited. According to the Transamerica Center for Retirement Studies, 91% of retirees expect to rely on it. When you file, anytime between ages 62 and 70, it can mean the difference between a smaller monthly check or a significantly larger one for life.

Think of it as the “8-Year Rule of Social Security,” a strategic window that determines your permanent benefit. Understanding it — and getting the timing right — can be one of the most valuable decisions you make in retirement.

What to know about the '8-year rule of Social Security'

Most people nearing retirement are aware that they can start receiving Social Security as early as age 62 or delay up to age 70. However, fewer people understand the significant impact this eight-year window can have.

Filing at 62 locks in a benefit that’s about 30% lower than what you’d get at full retirement age (generally 66 or 67). On the other hand, waiting until 70 increases your benefit by about 8% for each year you delay, up to about 132% of your full benefit. In dollar terms, if you’re eligible for $1,000 per month at a full retirement age of 66, delaying until 70 would raise your monthly check to $1,320.

Despite the upside, many retirees still claim early. A 2022 Congressional report found that age 62 was the most common age to file, with 29.3% of new retired-worker beneficiaries doing so. The next most popular age was 66 (24.7%), while fewer than 10% waited until age 70.

But the “8-Year rule of Social Security” isn’t just about filing earlier or later, but also understanding how it affects your overall retirement income. Preston Cherry, founder of Concurrent Wealth Management, explains it this way: “Filing at 62 gives you a longer runway, but with smaller checks. Waiting until 70 gives you a larger monthly income, but requires you to bridge the gap. That bridge, how you cover the years between, is where the strategy lives.”

Why timing isn't just about the math

Yes, delaying your benefit results in a bigger monthly check, but that doesn’t always translate into the highest lifetime payout. If you don’t expect to live very long due to health concerns or family history, claiming earlier could make more financial sense.

“It is difficult to provide a rule of thumb since individuals’ situations are so different,” says certified financial planner Clark Randall, director of financial planning at Creekmur Wealth Advisors. “Having said that, there is a general trend that the longer one’s life expectancy, the later he or she should file for Social Security, all things being equal.”

Elizabeth Scheiderer, principal and financial advisor at Signal Tree Financial Partners, puts it more directly: “If you need the cash flow and are retired, then collecting at 62 is the ‘easy’ button. Other than that, it gets complicated.”

And it does get complicated. Timing affects more than just your benefit amount — it also influences tax planning, spousal benefits and how other income sources are coordinated. “Can we use brokerage assets or Roth dollars to cover the gap in a tax-smart way?” asks Cherry. “Will delaying Social Security reduce the chance of big RMDs later or help avoid IRMAA surcharges? Does the break-even age line up with realistic health and longevity expectations?”

Your break-even age is the point at which the total value of delayed, higher payments exceeds the total value of earlier, smaller payments. It’s a key factor in the decision, especially when considering longevity and cash-flow needs.

Plans are worthless, but planning is everything. - Dwight D. Eisenhower

Working longer may also affect your filing decision. Randall points out that “claiming prior to full retirement age while still working will cost $1 of benefit for each $2 of earned income over $23,400 in 2025.” There’s also the Medicare impact, as higher income today could push you into IRMAA territory later, increasing your future Part B premiums.

“There’s a lot of noise out there,” Cherry adds. “Some say, ‘You should always wait until 70.’ Others say, ‘Only take it at 62 if you’re desperate.’ Neither is completely right, and that mindset puts unnecessary pressure on people. We need to normalize choosing what’s best for the individual, not what sounds smartest on paper or what someone heard incorrectly on a podcast.”

President Dwight D. Eisenhower at the United Nations.

How to make the most of the eight-year rule

The biggest mistake people make isn’t necessarily filing too early or too late; it’s making the decision in a vacuum. In fact, 53% of Americans report having limited knowledge of Social Security or how it fits into their retirement plan, according to a survey by Allianz Life.

Financial advisors emphasize that Social Security shouldn’t be treated as a standalone choice. It’s a crucial component of your overall retirement strategy.

That’s especially true for married couples. Scheiderer notes that “If you are married, having one spouse collect early and one collect at 70 can ‘hedge’ the decision.” Planning for spousal and survivor benefits can have ripple effects on your household income for decades. When one spouse passes away, the lower of the two benefits disappears, so delaying the higher earner’s claim can make sense for long-term security.

For those who’ve already filed but are second-guessing it, there are “do-over” options. If you claimed early, you can potentially suspend benefits once you reach full retirement age to allow them to grow again. And if you filed within the last 12 months, you can withdraw your application and repay benefits, essentially resetting your claim.

Ultimately, the best way to make the most of the "8-Year Rule of Social Security" is to be intentional. Understand the trade-offs, plan your cash flow, and factor in your health, taxes and partner’s benefits. And then, like Eisenhower, accept the weight of your decision.

Because, as Scheiderer reminds us, “The only certainty is you may never know if you made the right decision. If we had a crystal ball on life expectancy, you would know the exact month you should start to collect. If only!”

We curate the most important retirement news, tips and lifestyle hacks so you don’t have to. Subscribe to our free, twice-weekly newsletter, Retirement Tips.

More Retirement Rules

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.