The 80% Rule of Retirement: Should This Rule be Retired?

The 80% rule promises a comfortable lifestyle in retirement. Does it deliver?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The 80% rule of retirement planning promises to keep you living in the manner to which you are accustomed after you've given up a paycheck. Retirement used to mean stepping away from the hustle and settling into a quieter, more predictable lifestyle. Finances were expected to follow suit, with lower spending as a hallmark of this new phase of life.

Not anymore.

People today have a very different vision for their golden years. According to an Edelman Financial Engines report, more than a third of Americans (37%) want a retirement unlike that of previous generations. Instead of slowing down, many envision a lifestyle that’s more “active/athletic” (42%) and “adventurous” (39%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But this shift comes with tradeoffs. An active retirement often requires higher spending, whether for travel, hobbies or pursuing long-postponed goals. Add in rising costs — everything from groceries to healthcare — and the reality of longer retirements due to increased lifespans, and the price tag can quickly climb.

That raises an important question: Are traditional retirement planning rules, like the 80% rule, still enough to meet modern needs?

What is the 80% rule of retirement?

For decades, the 80% rule has been a cornerstone of retirement planning advice. The idea is simple: You should aim to have enough savings to replace 80% of your pre-retirement income. This assumes that some expenses — like commuting, clothing and retirement contributions — will drop after you leave the workforce, making 80% sufficient to maintain your lifestyle.

This rule has been supported by solid data. For instance, Fidelity Investments analyzed national spending patterns and found that most retirees need somewhere between 55% and 80% of their pre-retirement income.

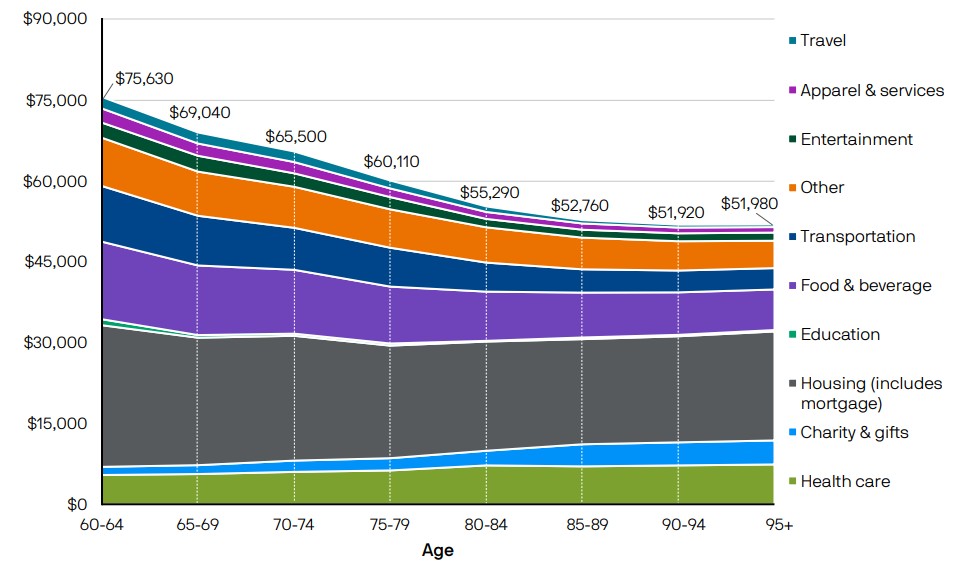

Similarly, research from J.P. Morgan Asset Management highlights a “spending curve,” where total retirement spending gradually declines over time. The chart below shows the average household spending for retired or partially-retired households with $250k-$750k investable wealth.

So, on paper, the 80% rule seems reasonable. But does it hold up in practice?

Why the 80% rule may not be enough

The reality is that retirement spending doesn’t move in a straight line, despite what the chart above may imply. According to the J.P. Morgan study, spending varies from year to year and is far from predictable for most retirees. Some retirees experience a “retirement spending surge” during the early years when they’re eager to enjoy life and tackle their bucket lists, or at the very end of life when they require more medical care.

Daniel Forbes, CFP® Ambassador and owner of Forbes Financial Planning, explains, “Several expenditures, such as health insurance and retirement plan contributions, might go away in retirement. Other expenses, such as travel and hobbies, may increase.”

Beyond personal spending patterns, broader economic factors are straining retiree budgets. For example, health care costs continue to rise faster than general inflation. Fidelity estimates that a 65-year-old retiring today will need $165,000 for medical expenses alone. That excludes long-term care, which can add a significant burden later in life and isn’t covered by Medicare.

Brenton Harrison, CFP® Ambassador and founder of New Money New Problems, notes, “While rules of thumb like the 80% rule can be a good starting point, rising costs of food, housing and healthcare may make it difficult to significantly reduce expenses in retirement.”

Social Security uncertainty also complicates planning. A Gallup poll shows that while 58% of current retirees rely on Social Security as a major income source, only 35% of nonretirees expect it to play a significant role in their retirement. As confidence in Social Security wanes, many Americans anticipate relying more heavily on personal savings.

If that wasn’t enough, societal shifts can add to the challenge. Generation X retirement savers often find themselves sandwiched between supporting aging parents and helping adult children, creating financial pressures that derail traditional retirement plans.

“It’s hard to know with certainty how much you need to save to cover an unknown expense that may occur years from now,” Harrison adds.

Alternatives to the 80% rule

Instead of relying solely on a rule of thumb, finance experts suggest tailoring your retirement plan to your unique needs and goals.

Therefore, it may make sense to aim beyond the 80% rule by planning for 100% income replacement, which provides a cushion for rising costs or unexpected expenses. A good starting point is looking at how much you currently need to spend each month.

Forbes advises, “Review your bank statements monthly to see what’s coming in and going out. This gives you a clear picture of your household’s net deficit or surplus.”

Once you have a number, consider the “rule of $1,000.” This back-of-the-envelope calculation estimates how much you’ll need to save to generate a desired monthly income in retirement. The rule states that for every $1,000 in monthly income you want, you’ll need $240,000 saved, assuming a 5% withdrawal rate and a 5% return. For example, withdrawing 5% of $240,000 provides $12,000 annually, or $1,000 per month.

Another popular strategy is the “4% rule” (So. Many. Rules.), which suggests withdrawing 4% of your retirement savings annually, adjusted for inflation, to fund a 30-year retirement. However, this rule has also come under scrutiny. While it provides a useful guideline, some retirees may need to withdraw less, while others could safely withdraw more, especially during market upswings.

As Harrison explains, “The 4% rule may be too conservative. Retirees could be free to spend more after years of strong market performance.”

For a more tailored strategy, Harrison suggests dividing expenses into “need-to” and “want-to” categories. “Start with your ‘need-to’ living expenses — like housing and food — and then list your ‘want-to’ items, such as travel or luxury purchases,” he says. “Use your assets to build a spending plan for the essentials, even during down years. When markets are strong, buy your ‘want-to’ items — or even work part-time to fund them.”

The rule of one for retirement

Ultimately, retirement planning comes down to “the rule of one.” That is, your retirement plan should be specific to one person: YOU.

Forbes emphasizes the importance of personal planning: “We prefer to create a side-by-side comparison of a budget during working years and a projected budget during retirement.” The goal, he says, is to “save enough money to create enough after-tax income to close the gap between projected expenses and what we refer to as ‘foundational income,’ such as Social Security and pensions.”

Everyone’s costs, lifestyles and goals are different, which is why a one-size-fits-all rule like the 80% rule for retirement just may or may not be the best fit.

Want more guidance on retirement savings? Sign up for Kiplinger's six-week series, Invest for Retirement.

Read More About Retirement Planning

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.