The End of Retirement as We Know It

Baby Boomers face a retirement like no generation before them, and rather than being the 'beginning of the end,' it's the beginning of a new life phase.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As the largest cohort of Baby Boomers start turning 65 this year, a point when most people traditionally stop working for a living, they will experience “a retirement” unlike any other generation.

For starters, they will be happier than previous generations of retirees, and rather than sit on a porch gazing at sunsets and looking backward, they want to do more, according to researchers. They will also live longer and have more energy thanks to advances in medicine, technology and living healthier. Significantly more people say they will work into their 70s than any prior generation. While many will struggle financially to live comfortably throughout their retirement, no generation has retired with as much money saved as the Boomers.

They will also experience changes they had not anticipated.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As an executive life coach who has traveled more than 2 million miles around the world, meeting and talking with people confronting the end of their normal work life, I am a professional listener. And what I have heard loud and clear from people is this refrain over and over: “This isn’t what I was expecting!”

For some, it’s a divorce or the beginning of a new relationship. Many thought they would still be working, only to unexpectedly lose their job, while others surprised themselves by starting a new business. Rather than preparing for a traditional retirement, many are facing periods of multiple changes and transitions, unprecedented in previous generations.

It’s what I call the “new life phase” — a time for facing new opportunities and challenges that seem to come out of nowhere, and for stretching out the productive, creative and purpose-driven peak of life.

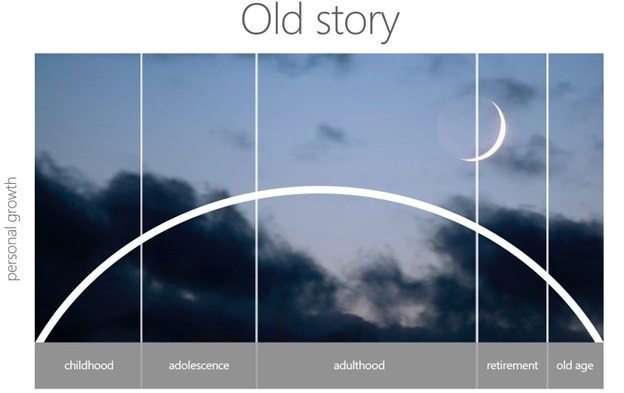

A new life chart for a new life phase

For earlier generations, this time of challenge and opportunity and the need for having to keep figuring things out well beyond the normal retirement age, was not an option or necessary. Instead, society considered people at this stage to be “over the hill.” A popularly used life chart was shaped like an arc, rising through childhood, adolescence and part of adulthood, which was the so-called learning and earning phase of life. Then having reached a peak, the life chart went into steady decline through retirement and old age.

That chart was based on assumptions that are no longer true, such as people grew old in their 40s and 50s and died in their mid-60s, which was the case in the middle of the last century. Even now, as life expectancy has risen, people often are mistaken about where they are on the life chart. A recent economic study about retirement-aged Boomers by economist Robert Shapiro on behalf of the Retirement Income Institute noted that people in their 50s and early 60s underestimate their likelihood of living until just 75 by an average of 25%.

The best way to illustrate the change in aging is a new chart showing a steady rise into early adulthood and then a leveling through middle age until we reach another rise past middle age that stretches into a new peak, which represents the new life stage. Psychologists worldwide have found that well-being follows a U curve, and that happiness is at its lowest level when people are in their 30s and 40s and then increases steadily starting at age 50. This happiness trajectory aligns with research that finds our lives continue to evolve positively in our later years.

Start the new phase by talking it over with someone you admire and trust

This new phase of life can feel a little bit like a second adolescence. We find the structures we fit into comfortably a decade ago — socially, professionally, relationally — start to feel like a poor fit. We need a new purpose, a new vision, encouragement and a personal plan to make this newly available phase of life our best life.

The plan should be shared with others. When I tell people about my studies and interviews with older people about “aging with purpose,” they often give me examples of more people I should interview. Their instinct to keep talking about this change is right, because turning to those you admire is a great starting point for any new adventure.

The new phase of life involves having a purpose in life, whether it is a job, being a mentor, having connection to others or a spiritual connection. The new life phase can take on a whole new dimension when you discuss it with partners, friends, family and colleagues. In a variety of ways, we feed off one another’s ideas, stories and insights. The results benefit everyone.

Related Content

- Your Retirement Reckoning: Four Questions to Ask

- Is 100 the New 70?

- The Five Stages of Retirement (and How to Skip Three of Them)

- Nervously Nearing Retirement? Four Do’s, Four Don’ts and One Never

- Being Rich vs. Being Wealthy: What’s the Difference?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Richard Leider is an Education Fellow with the Alliance for Lifetime Income’s Retirement Income Institute and Founder of Inventure – The Purpose Company, a firm created to guide individuals to live, work and lead on purpose. He is ranked by Forbes as one of the “Top 5” most respected coaches and is a contributing author to many coaching books. He is one of a select few coaches who have been invited to work with over 100,000 leaders from over 100 organizations such as AARP, Ameriprise, Blue Zones, Ericsson, Habitat for Humanity, Lifespark, Mayo Clinic, Modern Elder Academy, National Football League, Outward Bound, United Health Group and the U.S. Department of State.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.