Transform Your Retirement Plan With This Powerful Combo

If you're a retiree looking for the trifecta of income, liquidity and legacy in your retirement plan, consider combining a QLAC and an HECM.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Let’s talk about how nature inspires planning for retirement income.

Somewhere in the primordial past, hydrogen and oxygen atoms came into being. They were fine as stand-alone elements, but they really showed their value when they combined as H2O to become the useful substance we know as water.

In the same way, combining seemingly unrelated retirement products that come on the market at different times may produce some surprising results.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The retirement big bang

First, Congress in 1987 created the HECM, for home equity conversion mortgage, which enables homeowners 62 and over to create additional income and liquid savings from the value of their home.

Second, the IRS adopted regulations in 2014 to permit a type of deferred income annuity called a QLAC, which enables IRA holders to defer required minimum distributions (RMDs) from their accounts, and therefore defer taxes, while providing guaranteed lifetime income starting no later than age 85.

Despite the tax and product feature advantages, neither has attracted a large share of retirement planning interest when offered on a stand-alone basis.

However, when HECM is combined with QLAC, a transformation occurs that, while not the stuff of life-preserving water, could provide the income and financial liquidity to make the difference in a retiree’s retirement finances. We call it H2I, for HomeEquity2Income.

How HECM and QLAC work separately

A QLAC, in addition to the tax savings of deferring RMDs, provides guaranteed lifetime income and the flexibility to select the date annuity payments begin and the income pattern you want. For example, our sample investor (female, age 70) can use the maximum QLAC amount of $200,000 and purchase $70,000 per year of lifetime income starting at age 85. (Visit our QLAC calculator to get a free quote to evaluate these options.) While QLAC provides substantial longevity protection, purchasers give up access to the QLAC reserve. In other words, they can’t access the money they spent to purchase the QLAC and have to wait for annuity payments.

A HECM gives homeowners 62 and over access to the value of their home in the form of regular tax-free income and a line of credit, without selling or renting the house they’ve lived in for years. While there is no requirement to repay the mortgage loan balance or even loan interest, too much borrowing can reduce the line of credit later in retirement, when there could be significant long-term care costs and a reduction in any legacy from the house passed on to heirs. HECM rules prohibit using the amounts borrowed to purchase an annuity product.

HECM and QLAC could have continued in their own orbits, except conditions here on Earth have changed over the past decade or two, bringing a perfect opportunity for the combination of the two products.

During the period from the launch of HECM:

- Home values increased by nearly 300%

- Longevity increased by 2.5 to 4.5 years (pre-COVID)

- Cost of long-term care insurance increased by up to 400%

- Pensions mostly disappeared, now covering only 15% of private-sector workers

- Higher Social Security benefits created higher tax rates

How to think about a combination

When QLACs came on the scene in 2014, they appeared to be a natural addition to retirement income planning, and we figured that there’d be a meet-up with HECM during this process. However, the industries of mortgages (HECM) and annuities/insurance (QLAC) work in silos. They don’t see each other or talk about how they might together benefit the consumer. Unlike with H2O, though, we didn’t need an asteroid to crash into Earth to bring about change.

The way to combine is more art than science. It starts with meeting retiree objectives around income, liquidity and legacy. And income is further defined by lifetime payments, low taxes and low risk. Liquidity is defined by the ability to have access to savings to cover unplanned expenses. For retirees, that’s likely to be expenses related to long-term care or modification of your home for those who want to age in place. Legacy is self-explanatory — it’s what you leave to a spouse or beneficiaries after loans are paid off.

Importantly, the HECM/QLAC combination must be aided by a planning methodology that looks at all major asset classes while attempting to make planning understandable to investors and planners alike. In our case, we began to look at how best to include the equity in the home with savings from a rollover IRA to meet these retiree objectives.

What are the considerations in designing H2I?

While you might adopt different criteria in defining the combination, here are the ones we used:

- Meet governmental regulatory constraints

- Make it understandable to the market

- Deliver outcomes matched to retiree objectives

The first challenge is that the regulatory world wants to keep certain products separate — for various reasons — while a real-life person wants to see a total plan and not one made of two or more components separately managed. The answer comes through a planning method that combines these components and an implementation that is, unfortunately, separate.

The second challenge is to make that plan understandable. While different approaches are possible, our view is to share easy-to-understand graphics, based on deterministic assumptions, and focus on retiree objectives, rather than focusing on product components. In addition to all the technical questions being answered by product experts, the planning should answer this question: “What does it do to my plan for retirement income?”

The third challenge is meeting the retirement objectives and to recognize how they change based on life stages. As we said above, the basic retiree objectives include:

- Income. Meet budget, be predictable and last a lifetime

- Liquidity. Focus on larger amounts in middle stages of retirement

- Legacy. Provide funds for surviving spouse and then for beneficiaries

Meeting retiree objectives

Set out below is the plan presented to our sample investor, a 70-year-old female, with $1 million in the value of her home and $1 million in her rollover IRA. She wants more income plus liquid savings to address long-term care costs. She considers an H2I plan but is also aware of her option to subsequently insert H2I into a Go2Income plan.

1. Income objective

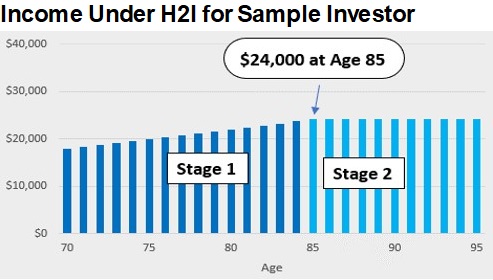

Her income from H2I comes from two sources:

- During Stage 1, she is drawing tax-free amounts from her HECM line of credit.

- During Stage 2, her income comes from QLAC annuity payments, after paying tax-deductible interest on HECM.

H2I planning creates a seamless income connection between Stages 1 and 2. She can spend this income any way she wants, add to her investments, or use it to buy health, LTC or life insurance as part of her planning.

2. Liquidity objective

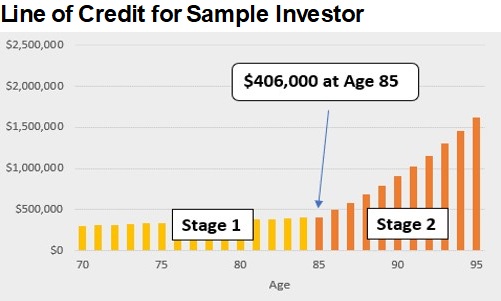

During Stage 1, her liquidity in the form of a line of credit (LOC) starts at $330,000, grows with a HECM interest rate, and then is reduced as her loan balance grows from her drawdowns and interest.

After Stage 1, the LOC grows dramatically when drawdowns stop and interest is being paid via QLAC payments.

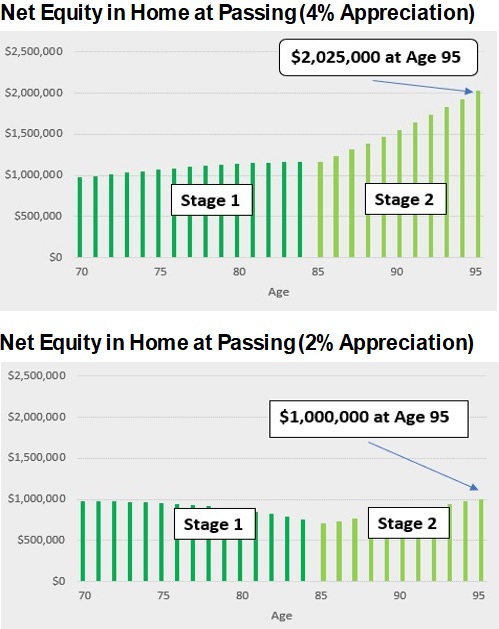

3. Legacy objective

Her legacy from H2I is the value of her home less the loan balance on the HECM. The gain or loss vs. the original value of the home is the market appreciation less the loan balance. In Stage 2, with interest being paid, the legacy grows dramatically. If the appreciation is reduced by half, however, the amount passed at 95 will be reduced from $2 million to $1 million.

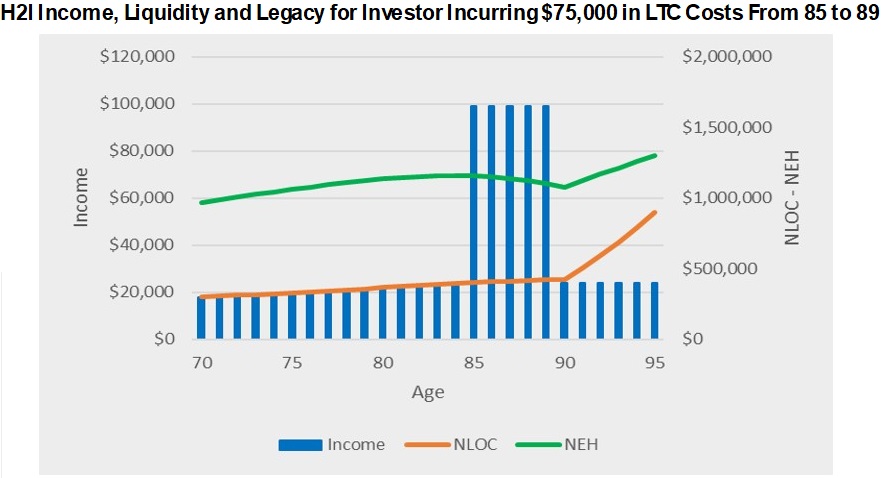

4. Long-term care objective

Like a lot of retirees, our investor hasn’t purchased LTC insurance and is relying on her retirement savings to cover the cost of nursing or other costs. She is thinking she might have to downsize or sell her home. With H2I, she may be able to avoid that. To illustrate, if she needs an additional $75,000 per year for nursing care starting at age 85 and continuing for 5 years, she can pull that from H2I and still pass $1 million to her heirs at age 95 — and have a line of credit if costs are higher. All the while, she can be aging in place. See the example below that captures income, liquidity and legacy in one graph, while also reflecting home care costs.

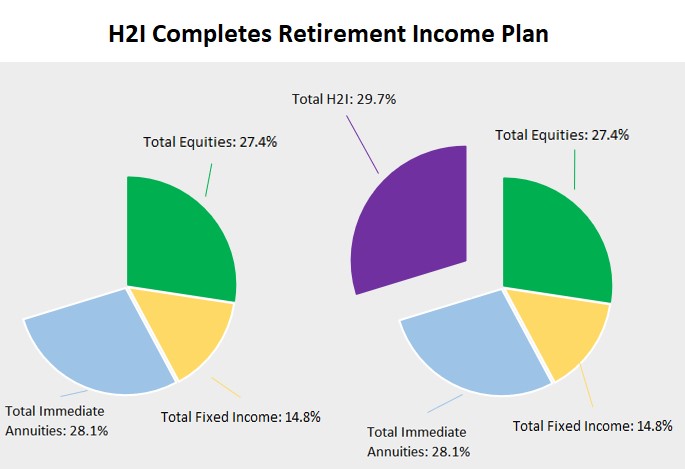

H2I as part of a complete retirement income plan

H2I is an approach that helps retirees access the 25% to 40% of their net worth that homes in many cases represent. That’s an asset that can allow you to stay in your home, even when the cost of long-term care for a married couple might average as much as $750,000.

You won’t hear about HECM and QLAC from most financial advisers or planners. That’s because they focus on splitting retirement assets among different buckets, like stocks, bonds and cash. If they consider equity in your house, it’s the cash you get after selling it.

Your next step could be just to consider how H2I might benefit you and your family. It could also become a core component of a holistic retirement approach (Go2Inome) that considers all your assets and how they best fit together. As we pointed out in our previous article, Things Change: Is It Time to Update Your Retirement Plan?, here’s how H2I could fit into your plan.

In the grand scheme, H2I is not more important than H2O. But for retirees, it’s a pretty good leap forward. We know that most retirees want lifetime income, liquidity and legacy. Combining two products — QLAC with HECM — can provide that retiree trifecta.

Visit Go2Income Personal Planning to start a plan risk-free. You can ask one of our analysts to help you make adjustments, and then decide whether you want the peace of mind that lifetime income and greater liquidity can provide.

Related Content

- Is Your Retirement Solution Hiding in Plain Sight?

- How to Add Home Equity to Your Retirement Income Planning

- How Your Home Can Fill Gaps in Your Retirement Plan

- Annuities and Tax Planning Boost Retirement Income and More

- How a Fixed Index Annuity Can Manage Retirement Income Risks

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.