Five Ways the Election Could Change Your Retirement

From taxes to Social Security and beyond, the election could change your retirement depending on which candidate wins.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you're feeling anxious that the presidential elections could upend your retirement planning, take comfort in knowing that you are not alone. What drives the unease? Uncertainties as to which political party will wield power and potential policy changes that could impact 401(k) balances, tax bills, estate planning strategies, and retiree benefits.

Just three weeks before Election Day, angst over the 2024 election’s impact on retirement readiness is evident. Eight in 10 Americans expect the election to impact parts of their retirement plan, according to a study by investment firm Wealth Enhancement.

Pocketbook issues are a main source of voters’ apprehension. Four of 10 (42%) working Americans believe the election will have “a severe or major impact on their ability to save for retirement,” according to a Voya Financial survey. Many also fear market turmoil. Three-quarters of Americans worry that the election will cause more market volatility, according to an Allianz Life study.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So, how could the November elections affect retirement readiness? Markets tend to experience volatility around elections due to uncertainty. But the real financial impacts come from policy shifts and new laws that are enacted when there’s a power shift on Capitol Hill.

“It comes down to policies versus politics,” said Ayako Yoshioka, a portfolio consulting director at Wealth Enhancement.

Harris vs. Trump on the economy

The economic policies of Democratic nominee Kamala Harris and Republican candidate Donald Trump differ greatly.

Harris wants to increase income taxes on high-earners and corporations and raise capital gains taxes on those earning $1 million or more to 28% from 20%. The Democrat also vows to boost the middle class by pledging not to raise taxes on households earning less than $400,000, expanding child tax credits, offering down-payment assistance to first-time homebuyers, providing greater incentives for small businesses, and eliminating taxes on tips for hospitality workers.

Trump wants to fully extend his 2017 tax cuts, which expire at the end of 2025, and offer fresh tax cuts for individuals and corporations. The ex-president also wants to eliminate the tip tax. Trump also is proposing to make interest on auto loans tax deductible, end taxation of Social Security benefits, and raise the $10,000 cap on state and local tax deductions, which would benefit homeowners in high-tax states. Trump also vows to slap tariffs of 10-20% on all U.S. imports and increase tariffs on China-made goods to 60%.

These election-campaign promises, however, will be tough to deliver by either party unless there is a sweep at the ballot box, with one party capturing the White House and both chambers of Congress. If political gridlock persists, it will be more difficult for the new president to push through her or his legislative agenda.

“There’s a big gap between campaign rhetoric and what actually gets passed as law,” said Justin Waring, retirement specialist at UBS Global Wealth Management’s chief investment office.

Here are five ways the election outcome could affect your retirement.

1. Spike market volatility

Your 401(k) could face headwinds, as market turbulence often picks up around an election. But history shows election volatility is short-lived. The long-term direction of markets is driven less by politics and more by investment factors, such as corporate earnings, economic growth, interest rates, and inflation. As a result, market performance tends to smooth out over time, says Lisa Featherngill, national director of wealth planning at Comerica Wealth Management.

A presidential election year may not amount to much volatility.

The S&P 500 has posted positive returns in years one, three, and four of the four-year presidential term, with average gains of 10.2%, 17.2%, and 8.0%, respectively, according to Comerica Bank, citing Bloomberg data from 1961 through 2023. In year two of the presidential cycle, stocks suffered an average decline of 1%.

“The market response is usually agnostic to presidential election cycles because politics is just one of many variables that drive asset prices,” said Waring.

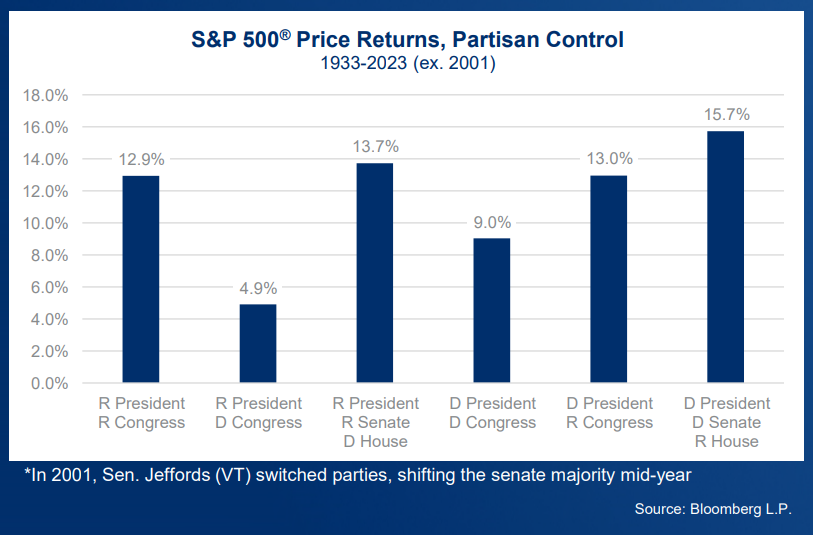

Gridlock and political sweeps can be good for markets.

The stock market also performs well in both unified and divided government scenarios. Gridlock is good for markets, as shown in the bar graph below. The best S&P 500 annual returns (15.7%) from 1933 to 2023 have occurred with a Democrat in the White House and a split Congress, according to Comerica. The second-best return: a 13.7% gain with a Republican president and a divided Congress. Political sweeps are bullish, too. Republican sweeps have resulted in average annual gains of 12.9%, while stocks have risen 9.0% per annum when Democrats win the White House and control both houses of Congress.

Tip: “Reacting to election news in the near term is ill-advised,” the Voya Financial study concluded. If your party loses, don’t let the defeat cause pessimism or fear that could cause you to stray from your investment plan, adds Waring.

2. Changes in tax policy

Tax changes may be on the horizon after the election. That’s due largely to the pending expiration of the 2017 Tax Cuts and Jobs Act (often dubbed the “Trump tax cuts”) at the end of 2025. Congress must act to renew the TCJA tax cuts; if they do nothing, tax rates will revert to the higher 2017 tax brackets.

Nearly four of 10 Americans (39%) are apprehensive about how much they will pay in taxes after the election, according to Wealth Enhancement.

“The sunset of TCJA tax cuts is a really big deal,” said Featherngill. The reason: if taxes go up, it means Americans will have fewer after-tax dollars to spend, save, or invest for retirement. For example, for couples filing jointly, the largest tax bracket difference is for taxable income between around $235,000 and $385,000. Currently, these couples are in the 24% bracket, but they would move to the 33% bracket in 2026 if the Trump tax cuts sunset, notes Featherngill.

Tip 1. Prepare for all contingencies with proactive multi-year tax and financial planning, says Featherngill. If you think tax rates will revert back to the higher 2017 rates, check to see what your tax brackets might be after 2025 versus now to see how it will impact after-tax income and cash flow. You might consider accelerating income into 2024 and 2025 to shield yourself from higher tax rates in 2026. “You want to use up these lower tax brackets while you can,” said Featherngill.

Tip 2. Another strategy to consider if you think tax rates will rise is to convert traditional IRA dollars into a Roth IRA before 2026 to take advantage of today’s lower rates, says Yoshioka. Any dollar amounts you convert to a Roth are taxed as regular income, but the Roth gives you tax-free withdrawals in the future. It’s also prudent to diversify investment account types so you can benefit from different tax treatments, says Andrew Davis, head of macroeconomic research at Bryn Mawr Capital Management. Rather than have all your money in a traditional 401(k), it’s better to have a taxable account that gets preferential capital gains treatment, some money in regular 401(k)s and IRAs that offer upfront tax deductions, and Roth accounts that offer tax-free withdrawals. “A lot of time gets spent on asset allocation, but equally as important is asset location,” said Davis.

3. Potential changes to Social Security

Social Security, which replaces about 40% of a retiree’s annual pre-retirement earnings, is running out of money. Barring legislation to shore up Social Security, reserves that pay benefits will be depleted in 2033, according to the Center on Budget and Policy Priorities. So, after 2033, or nine years from now, Social Security would pay only about 79% of scheduled benefits using money it brings in from payroll taxes.

The next president and Congress could shape the agenda on how to fix Social Security, which gave benefit recipients a 2.5% cost-of-living-adjustment (COLA) for 2025. According to economists, steps to fix the funding shortfall range from cutting benefits to raising the retirement age to increasing Social Security payroll taxes.

In an online policy statement, Vice President Harris says she will strengthen Social Security for the long haul “by making millionaires and billionaires pay their fair share in taxes” and “fight to ensure Americans can count on getting the benefits they earned.” Former President Trump has said he won’t make cuts to Social Security or change the retirement age, and has proposed doing away with taxes on Social Security benefit. Trump, though, hasn’t laid out plans to how to stabilize the benefit program.

But despite the need to fortify Social Security, addressing the solvency issue is likely not on the horizon for the incoming Congress, many experts say. “It doesn’t appear to be a high priority for either party as we enter the later stages of the campaign,” said Yoshioka.

Tip. It still doesn’t hurt to be prepared for all future scenarios, “so you’re not caught off-guard,” advises Davis. One proactive step you can take if you think benefits will eventually be cut is to boost your personal retirement savings and invest for growth.

4. Shifts in Medicare coverage

The federal health insurance program for people 65 and older also faces financial challenges. Both presidential candidates say they’ll protect Medicare and oppose cuts to benefits. Vice President Harris recently proposed an expansion of Medicare to include in-home long-term care costs. Medicare doesn’t currently cover long-term care and limits in-hope coverage. Trump, who opposes cuts to Medicare benefits, also has said in-home care is a priority.

But change can’t be ruled out. The Biden administration, for example, was successful in 2022 in getting lower prescription prices for Medicare recipients after passing a law that gave Medicare the power to negotiate prices for expensive drugs covered by the program.

Tip. Stay abreast of any Medicare coverage changes that could benefit or harm you financially.

5. How estate planning might change

Probably the most significant thing for high-net-worth families to watch out for is the potential sunsetting of the estate and gift tax exemption passed in TCJA in 2017, according to Comerica Bank's Year End Report. This year, the exemption is $13.61 million per person, or $27.22 million per couple. But on Jan. 1, 2026, if the current rules expire, the exemption will drop to $7 million per person and $14 million per couple. “If that happens, it could lead to a significant increase in transfer taxes for high-net-worth families” who are leaving money to heirs, Comerica warned in its report.

Tip. Start planning for estate tax changes now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?

Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?Quiz If you are 50 or older and a high earner, these new catch-up rules fundamentally change how your "extra" retirement savings are taxed and reported.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.