7 Big Financial Risks That Paid Off

For the risk-averse, raiding your savings account or taking out a big loan to start a business or make a career change might seem like a fool’s game.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For the risk-averse, raiding your savings account or taking out a big loan to start a business or make a career change might seem like a fool’s game. A bird in hand, you know.

But, in the words of Italian philosopher Niccolo Machiavelli, "Never was anything great achieved without danger." So opportunity sometimes demands calculated risks in pursuit of your dreams, whether they be buying a lavish home, retiring early, giving generously to charity or family, or taking charge of your work environment.

If you’ve got a business idea or a professional passion to pursue, find inspiration from these seven entrepreneurs who put their financial well-being on the line in hopes of achieving even greater riches. Talk about going for broke. Take a look.

Borrow From Retirement Accounts

- Name: Sandy Smith

- Her big risk: Borrowed a total of $60,000 from her 401(k) to buy rental properties

- The payoff: Within two years, she had paid back the loan using the rent she had earned on the property. She took out a new $40,000 loan from her 401(k) in 2012 to buy a $36,000, two-unit house in Wilkes-Barre. When she lost her job -- and one of the risks of borrowing from a 401(k) became a reality -- she mortgaged the house to pay back her loan. Now, the $1,725 she gets each month in rent from her two properties easily covers the mortgage and gives her a stream of income. With the equity in the properties, she plans to buy another rental property.

In the aftermath of the Great Recession, Smith recognized that it was a great time to buy rental property at rock-bottom prices. (At the time, a Kiplinger’s Personal Finance article championed "Great Homes at Deep Discounts.") "I knew I wouldn’t get an opportunity again to buy as cheap and would regret letting the opportunity pass," Smith says.

A friend had told Smith, a New York City resident, about a small two-bedroom house in Wilkes-Barre, Pa., that the owner was eager to sell to avoid foreclosure. Problem was, Smith didn’t have enough cash to buy it. So in 2010 she took a $20,000 loan from her 401(k) to cover the $19,500 price of the house. She knew the risks: loss of compounded growth on her retirement savings and the prospect of having to pay it back in full within 60 days if she lost her job (see 4 Reasons It’s a Bad Idea to Borrow From Your 401(k)). "I thought it was risky," Smith says. "But I thought of the house as a long-term investment, much as I did my 401(k)."

Raid the Kids’ College Fund

- Names: Leigh Ann and Andrew Green

- Their big risk: Cashed out their kids’ college funds and took out a second mortgage to start a business

- The payoff: The Greens’ company, Twelve South, had revenues of more than $1 million after the first year, and revenues have grown every year since, Leigh Ann says (the company is privately held, so she wouldn’t disclose its most-recent year’s revenues). Its products -- which now include covers and stands for MacBooks, iPhones and iPads -- are sold on the Twelve South Web site, in Apple stores globally and through Apple resellers. They’ve paid off their second mortgage, refunded the kids’ college savings and are continuing to thrive, which Leigh Ann says they weren’t sure would be possible in 2009 when they took the risk to launch their company.

The Greens had a love of Apple devices and recognized that the company’s iconic products were missing something: great accessories. So, in 2009, the two left their full-time jobs and drew upon their experience in graphic design, marketing, wholesaling and merchandising to create prototypes for a stand to hold a MacBook upright and a shelf to hold portable hard drives for Macs. They arranged a meeting with Apple’s retail-store buyers and sold them on their accessory concepts. But then they had to come up with the money to manufacture their products and get them into Apple stores. To do so, they cashed out their three children’s college accounts and got a second mortgage to raise more than $500,000.

Go Unemployed to Make a Career Change

- Name: Kate Dore

- Her big risk: Left a job without another one lined up

- The payoff: In November 2014, Dore got a full-time job with a technology company as a social media marketing strategist. "It was the perfect chance to learn more about digital marketing and apply what I already had learned -- and get a 9-to-5 lifestyle," Dore says. To top it off, she’s making 25% more money now.

Dore, now 31, enjoyed working as a concert promoter in Nashville, Tenn., lining up talent from comedians to big-name country artists, then marketing and producing the shows. But seven years of frequent travel and working 60 to 80 hours a week had taken a toll on her. She realized she couldn’t sustain that lifestyle and knew it was time for a career change. "It was fun when I was younger," she says, "but I couldn’t do it at 40." Dore wanted to get into digital marketing but didn’t think she could make a switch while putting in so many hours as a promoter. So she decided to quit in August 2014 without another job lined up.

"My parents said I was crazy," says Dore. But in the year prior to quitting her job she had lowered her risk by dramatically cutting her spending (among other things, she ditched cable TV and reshopped her insurance). She set aside about $1,500 each month -- nearly $20,000 in all -- to sustain her while she looked for a new job. She had also launched a personal finance blog, Cashville Skyline, in 2013 to generate some extra money. And within a few weeks of resigning, she landed a part-time job with an online ticketing company to help make ends meet.

Borrow From Family

- Name: Chris Huntley

- His big risk: Took a $50,000 loan from a family member to invest in his insurance Web site

- The payoff: Huntley’s blog now averages 20,000 to 25,000 visitors and more than 1,000 quote requests each month. Within a year after investing the $50,000, he was paying himself a salary of $150,000 a year, had brought on a partner, earned licenses to sell insurance in 48 states, and moved out of his home office. "It actually was one of the best returns on investment I’ve ever gotten," Huntley says. He has since paid off the loan, hired four full-time agents and two part-time agents, and launched three more sites that specialize in life insurance for individuals with high-risk medical conditions.

Unlike many insurance agents who get their start working with an established company, Huntley decided to sell insurance on his own, doing business as Huntley Wealth & Insurance Services, when he got his license in 2004. But drumming up business was difficult, and he racked up $50,000 in credit card debt to make ends meet. "I really stunk," he says. Things started to turn in late 2008, when Huntley launched a blog that generated leads and enabled him to offer insurance quotes.

After six months, he was getting one or two leads a day for new clients. By the end of 2010, he had made about $27,000 through policies sold to visitors to his blog, InsuranceBlogByChris.com. But greater growth required investments in telephone technology and the content and design of his Web site. He borrowed $50,000 in 2011 from a family member with a signed agreement to pay it back in 30 months (see Smart Ways to Loan Money to Family Members).

Quit a High-Paying Job

- Name: Matt Watson

- His big risk: Left his job as an attorney to launch an online apparel shop

- The payoff: Although Watson still isn’t making as much as he did as a lawyer, he says the risk he took is paying off because his company is growing, he has more flexibility, and he’s calling the shots. Sales from the site topped $5 million in 2014. It sells more than 180 brands, both on CountryClubPrep.com and through Amazon, and there are now two brick-and-mortar Country Club Prep stores (in Charlottesville, Va., and Lexington, Ky.).

While working at Bryan Cave LLP, a firm of 1,400 attorneys, Watson feared that his chances for advancement were slim. So in 2010 he turned to law-school friends Stephen Glasgow and Toby Mergler to brainstorm business ideas. They drew upon what they had in common -- a fondness for preppy clothes -- and decided to create a Web site that offered their favorite brands without shipping costs.

They paid $3,000 to build a site, started working out of Watson’s basement, persuaded brands to sell their products to them at wholesale prices and opened a few credit card accounts to cover costs. By March 2012, they launched Country Club Prep. They had about $200,000 in sales the first year, then made $1.3 million in sales in 2013. Watson left his job with the law firm in 2014 to manage the business with Glasgow and Mergler full-time.

Start a Company Without Loans

- Name: Steve Stengell

- His big risk: Cashed out $300,000 in savings to launch his own company

- The payoff: Stengell has earned almost as much as he withdrew from his savings, although he has reinvested much of it in the company. The drop in oil prices is helping Encore grow because mineral-rights leases have become cheaper to acquire, Stengell says. "What we buy now will be worth more when oil prices are back strong," he says.

After seven years as the CEO of Allied Energy, an oil-and-gas drilling-and-production company, Stengell was voted out of his position by the board of directors in 2011. Rather than look for a leadership position with another firm, he decided to use his experience -- and his savings -- to launch his own company to broker deals between landowners and oil and gas companies. With an eye toward attracting private investments in his new venture, Stengell eschewed loans: "Debt is unattractive to the investment community," he says. Instead, he pulled about $300,000 from retirement and investment accounts to get Encore Energy up and running.

Two years in, the company took off when Stengell decided to acquire mineral-rights leases for Encore Energy to do its own oil-and-gas drilling, rather than just broker deals for other companies to drill. With funding from investors and Stengell’s own contributions, Encore Energy was able to drill 16 oil wells in Kentucky in 2014 and is now selling oil each month from those wells.

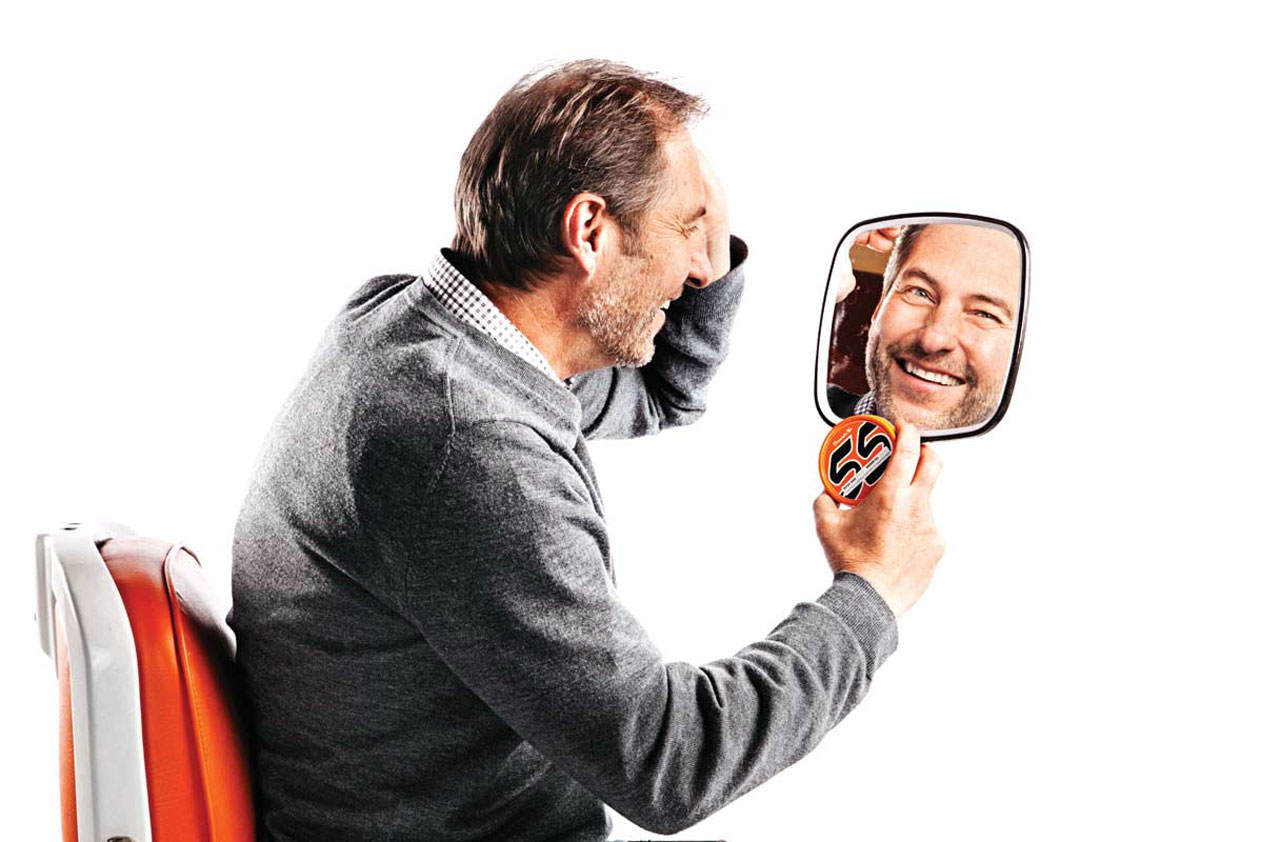

Open a Home-Equity Line of Credit

- Name: Anthony Full

- His big risk: Took a $150,000 home-equity line of credit to open a barbershop

- The payoff: Rock Barbers now employs eight other barbers and four front-desk staff, and it grossed more than $400,000 in sales in 2014. Soon, Rock Barbers will launch its own line of hair-care products called Rock Tools for Men with funding from a Kickstarter campaign, Full says. Although he’s still earning less than half of what he did as staff barber, and he’s traveling monthly to do demonstrations at trade shows with hair-care product line American Crew, Full says "it’s the happy sacrifice you make to build a business."

After working for about 30 years in hair salons and barbershops, Full wanted to start his own business. He saw a need for a place that would cater exclusively to men, who feel conspicuous in hair salons, he says. So he came up with the idea of an old-school barbershop designed for masculine comfort and modern times. As he saw it, the real risk wasn’t leaving his job but rather not acting on his idea.

Using a home-equity line of credit, he launched his shop, Rock Barbers, in 2010. That first year, when he was the owner and sole employee, Rock Barbers grossed $50,000 in sales. He and his wife, who is a hair stylist, lived modestly and reinvested profits into the business so it could grow.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Award-winning journalist, speaker, family finance expert, and author of Mom and Dad, We Need to Talk.

Cameron Huddleston wrote the daily "Kip Tips" column for Kiplinger.com. She joined Kiplinger in 2001 after graduating from American University with an MA in economic journalism.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Back‑to‑School Tax‑Free Deals Hit Walmart & Apple This Summer: States, Dates and Limits

Back‑to‑School Tax‑Free Deals Hit Walmart & Apple This Summer: States, Dates and LimitsSales Tax Select states host sales tax holidays during the summer. Here’s what you can purchase.

-

AI-Powered Smart Glasses Set to Make a Bigger Splash

AI-Powered Smart Glasses Set to Make a Bigger SplashThe Kiplinger Letter Meta leads the way with its sleek, fashionable smart glasses, but Apple reportedly plans to join the fray by late 2026. Improved AI will lure more customers.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

New Apple iPhone Update Helps Protect Your Security

New Apple iPhone Update Helps Protect Your SecurityThe new Apple iPhone update that hit phones recently helps protect yourself with security fixes.

-

New Phones Get All the Hype, but Consumers Still Love Old Models

New Phones Get All the Hype, but Consumers Still Love Old ModelsThe Letter Even as flashy artificial intelligence features drive sales of new smartphones, used phones continue to fetch big bucks as demand outstrips supply.

-

Apple’s Strong Start in Virtual Reality

Apple’s Strong Start in Virtual RealityThe Kiplinger Letter Apple’s first year in the VR market sets it up for long-term success. The tech giant’s vision will take years to pay off, though.