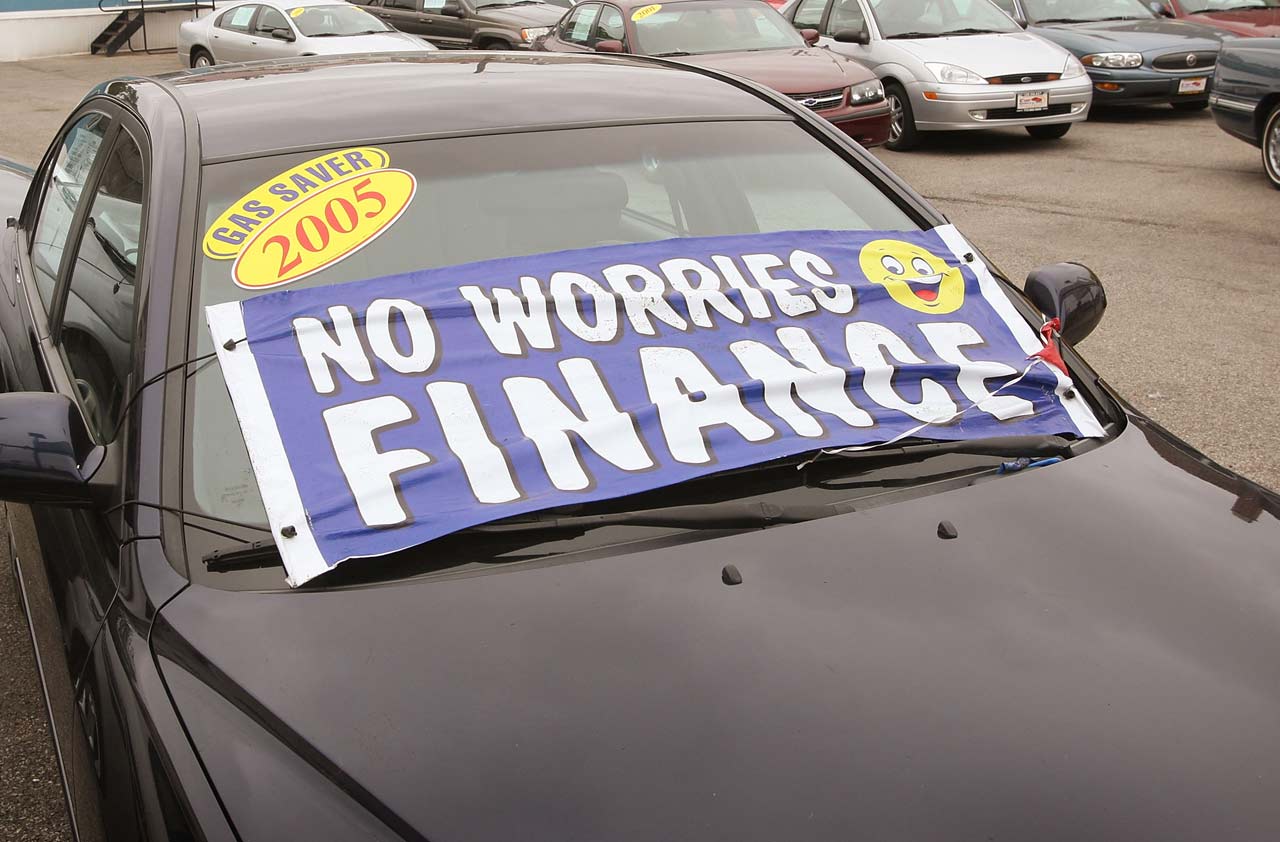

6 Things Car Dealers Never Want to Hear You Say

Most of us know that there are certain things you’re supposed to do and not do when buying a car, but it can still be a struggle to put those principles into words.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most of us know that there are certain things you’re supposed to do and not do when buying a car, but it can still be a struggle to put those principles into words. For the most part, car-buying remains a tough negotiation. And you’re at a disadvantage: The sales representative does deals every day, and you don’t. He knows what to say; you don’t.

Here are six lines you’re likely to hear from the friendly car salesperson—with our suggested responses, which will keep the conversation going the way you want and lead to the best price you can get.

"Is That Your Car Out There? We Can Give You $10K for It, Easy"

- Your answer? "Thanks, I may consider that. But that’s separate from how we’re going to price the new car."

You’ve probably been told not to discuss the value of a trade-in before you settle on a price for the new purchase, but that won’t stop the sales rep from trying. If you've done your research, you'll know what your car’s potential value is. Don't be lured in by a high offer by the sales rep: He might be willing to exceed your trade-in's book value, knowing he can make up for that on the purchase price of your new ride.

"Everyone Pays the Vehicle-Preparation Fee. It Makes Sure Your Car Is Ready"

- Your answer? "Let me see the invoice, please."Legitimate fees are listed on the factory invoice, which the dealer should always share with you. Verifying that the fees on your dealer's bill of sale are also on the invoice shows you're paying attention. It’s not the end of the story, however. Some fees inhabit a gray area—you'll likely have to pay them, but you might be able to negotiate. An example is the so-called document fee. Some states, such as California, regulate this fee, setting it at a flat $80. Most don't regulate them at all, and they can run several hundred dollars. In these states, find out what other lots charge; the dealer may reduce its fee to match the local competition. The auto site Edmunds has published a great guide to these fees.

But whatever you do, don't pay to have the dealer pull plastic off your new car, see if it has oil in it or perform other mundane acts—vehicle-preparation fees, these are often called. The clothing store doesn't charge you to take the jacket off the hanger, right?

"So, What Do You Feel Comfortable Paying Each Month?"

- Your answer? “We can talk about that later. I want to focus on the price you can get me on the car."

The sales rep is not offering you credit counseling here. He wants to sell you a more expensive car, by extending the loan term and lowering your monthly payments, or by switching to a lease. That could add hundreds or thousands of dollars in lifetime interest charges.

Don’t go to the dealership until you have lined up backup financing at your bank or, even better, your credit union. You'll be in the driver's seat during negotiations. But once you have a settled price, see what your dealer might have to offer for financing. It might be able to offer you rates that are quite low, if you have good credit. And leasing may be the right path for you, too: Just keep your eye on the total cost, not the lower monthly payment.

"Isn’t That Beautiful? Window Etching Adds Only a Few Dollars to Your Payment"

- Your answer? This one's simple: "No, thank you."

You are going to be offered all kinds of products and services in your dealership's financing and insurance office. Mud flaps, rust-proofing and paint sealants make the dealer a lot of money, but you can get them for less—often much less—elsewhere. Look at a catalog such as AutoSport for accessories or your local detailing shop if you want your paint sealed. So hold your ground at the dealership.

"You Want It in Black? We Can Get You One in Black"

- Your answer? "We're going to settle on a price and get it in writing before any cars move."

If your salesperson (let’s call him Chuck) doesn't have exactly what you want, Chuck may be willing to look around for a car that more precisely matches what you're looking for from another dealership, then have that car delivered to his location. Dealer B gets a car in exchange from Chuck’s dealership, either now or later. It's called a dealer swap or trade, and is only available with new cars.

So, what’s the problem? It costs money to flatbed or drive new cars back and forth. You might end up eating some of that cost if you stick with Chuck. In theory, you really should have located the vehicle in the color you want at dealership B and negotiated there.

Understand that Chuck may want a deposit or even an agreement that you're going to buy the car coming in from dealer B.

"We're $4,000 Below the Sticker Price. We Can’t Go Any Lower"

- Your answer? “Actually we’re not yet at the fair price I expect to pay.”The point here isn't $4,000—it could be $400 or $14,000. The problem is that the dealer is negotiating from the sticker price down. We're often tethered to the first piece of information we hear, a phenomenon known as the anchoring bias. In this case, the sales rep wants to take that sticker, inflated with all kinds of fees, and offer you a bargain relative to it.

If you've done your research, you can beat dealers at their own game by dropping your own anchor initially. With car-buying, the key is finding the real cost of the vehicle to the dealer before you start negotiating. Services such as TrueCar.com provide incredible detail on what cars are being sold for in your area. Bring a printout from the service you've used to find the dealer cost, so the salesperson knows you're not blowing smoke.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In his former role as Senior Online Editor, David edited and wrote a wide range of content for Kiplinger.com. With more than 20 years of experience with Kiplinger, David worked on numerous Kiplinger publications, including The Kiplinger Letter and Kiplinger’s Personal Finance magazine. He co-hosted Your Money's Worth, Kiplinger's podcast and helped develop the Economic Forecasts feature.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

10 Things You Should Know About Buying a Car Today, Even if You've Bought Before

10 Things You Should Know About Buying a Car Today, Even if You've Bought BeforeIf buying a car is on your to-do list, and it's been a while since you went shopping for a new one, this guide will help avoid any nasty shocks in the showroom.

-

Get the Best Car Deal in Retirement: Here's the Trick

Get the Best Car Deal in Retirement: Here's the TrickPlanning on shopping for a new car this Labor Day weekend? Here’s how to haggle for a better price, even though you're retired.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.

-

15 Ways to Prepare Your Home for Winter

15 Ways to Prepare Your Home for Winterhome There are many ways to prepare your home for winter, which will help keep you safe and warm and save on housing and utility costs.