4 Tips for Personal Finance Success from President Obama

On June 8, 2011, the White House invited 23 journalists from leading personal-finance sites for a first-of-its-kind summit.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

On June 8, 2011, the White House invited 23 journalists from leading personal-finance sites for a first-of-its-kind summit. The goal: translate important issues for the economy out of Washington-speak and into practical, pocketbook terms that everyday Americans who get their financial information online can understand.

Kiplinger.com asked President Barack Obama to reveal the one piece of personal financial advice that he had found most useful in his own life -- a question rarely, if ever, asked of presidents. Turns out the President has four pieces of financial advice that we at Kiplinger espouse all the time.

(Editor's Note: This slide show was originally published in June 2011. We like to refeature it on occasion for insight into the President's approach to money management. So, too, do other sites such as Business Insider, whose Jan. 17, 2013 article looked back at Kiplinger's personal question for President Obama.)

Invoke the Magic of Compounding

“Save a little bit out of whatever you earn, and the magic of compounding interest applies.”

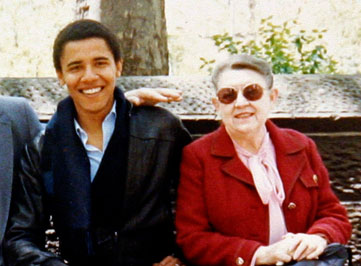

This one came from his grandmother, who worked her way up from secretary to a bank vice-president, Obama said. He quipped that he and First Lady Michelle had tried to apply this rule to their own personal finances, but “not always successfully.”

Beware of Debt

Student loans dogged the Obamas. Combined, they had $120,000 worth of debt upon graduation, “and it took us ten years to pay it off. And we were lucky, because we had gone to good law schools [and] we knew that we could earn it [back].”

He lamented the “quadruple whammy” that “a lot of young people are going through with college debt, and then to try to get your first home started, and then you immediately have to start saving for your kids’ college education, and you may have to also be helping out your parents in their retirement.”

Spend Less Than You Make

“Spending discipline is important.”

What Obama termed the “deleveraging” wrought by the 2008 financial meltdown “has been very painful. I think it woke everybody up, and our economy as a whole has to get back to producing more and not just spending more. And what applies to the nation as a whole I think could serve as good advice for individuals.”

Invest in Yourself

“Spend on things that are going to increase your productivity and your income over the long term,” the President said. “Our first starter home was a condo that cost $180,000, and we were able to comfortably make payments; that was still a good investment.\" So was law school, he added.

To those who say “investment is just another word for spending,\" he said. \"Well, no, actually, there is a distinction… between spending on things that are going to make you more competitive and over the long term increase your wealth, and spending on things that you’d like to have but aren’t really improving your life over the long term. And that’s an important distinction that we as a country have to make.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.

-

15 Ways to Prepare Your Home for Winter

15 Ways to Prepare Your Home for Winterhome There are many ways to prepare your home for winter, which will help keep you safe and warm and save on housing and utility costs.

-

Six Steps to Get Lower Car Insurance Rates

Six Steps to Get Lower Car Insurance Ratesinsurance Shopping around for auto insurance may not be your idea of fun, but comparing prices for a new policy every few years — or even more often — can pay off big.

-

How to Increase Credit Scores — Fast

How to Increase Credit Scores — FastHow to increase credit scores quickly, starting with paying down your credit card debt.