Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most of the time, you probably do fine managing your own finances -- that’s why you read Kiplinger’s in the first place. But every now and then, you may need help from a professional. Here are eight you should consider hiring.

It can be tough to turn over your money to someone else, so use our advice to vet each expert. Start with recommendations from people you already know and trust -- but don’t let that be the last word. Check credentials and interview a few candidates to find someone you’re comfortable with. After all, your money is at stake -- and so is your peace of mind.

Financial Planner

WHY YOU NEED ONE: Saving for retirement or some other long-term goal is a big reason. But there are hundreds of other reasons to seek help. You can go for a brief consultation or for a complete financial overhaul.

HOW TO FIND THE RIGHT ONE: The National Association of Personal Financial Advisors, or NAPFA, enrolls fee-only planners, who either charge by the hour or charge a percentage of assets under management. Two useful specialty groups are the Garrett Planning Network, all of whose members charge by the hour, and the Alliance of Cambridge Advisors, which emphasizes a holistic approach called life planning. Contact several candidates, fill out and return their questionnaires, and pay them a visit. Planners may need a couple of months after meeting you to create a proposal.

WHAT YOU’LL PAY: Costs are all over the place. You’re likely to lay out four or even five figures for comprehensive advice. Hourly rates commonly run $200 to $300.

Investment Adviser

WHY YOU NEED ONE: Most likely, you can get all the investment advice you need from a financial planner. But you may need an investment adviser (also called a money manager) because you want or need more-expert advice for a complex financial situation. Or you may want to invest in assets that don’t come in off-the-shelf products, such as venture capital, hedge funds or private equity.

HOW TO FIND THE RIGHT ONE: Tap the expertise of people who are familiar with financial professionals -- your financial planner, if what you want is beyond his area of expertise, or your accountant, estate attorney or even mutual fund company. Unless you live in a large metro area, the odds of finding a crack investment adviser nearby with the expertise you seek is slim. But for hard-core investing advice, you don’t need someone close by. Once you have several candidates, check their qualifications, background, strategies and fees. For credentials: The gold standard for investment advisers is Chartered Financial Analyst. However, there are more than 100 credentials (see them all).

WHAT YOU’LL PAY: To get the best deal from an investment adviser, you should be charged a percentage of assets managed. That way, there’s a direct incentive for the adviser to grow your portfolio. In general, the bigger your account, the lower the annual fee. Figure 2% on the high side and 0.5% on the low side.

Estate-Planning Attorney

WHY YOU NEED ONE: An estate-planning attorney will draft the documents that will smooth your way at the end of life and secure the well-being of those you leave behind. These documents include a will; a financial and a medical power of attorney, which let others make decisions for you when you cannot; an advance medical directive, which spells out your preferred end-of-life care; and in some cases, a revocable living trust, which lets your estate avoid probate.

HOW TO FIND THE RIGHT ONE: You can get referrals from your accountant, financial planner or investment adviser and from your state and local bar association, which may also post complaints made against local lawyers. Or visit the American College of Trust and Estate Counsel's Web site to find a member of this invitation-only organization in your area.

WHAT YOU’LL PAY: Fees range from as low as $250 an hour to as much as $1,000 an hour, depending on the firm and the location. Figure you’ll pay at least $1,000 for a will and end-of-life documents, and $3,000 for a plan that includes a trust; in high-cost areas, the total bill will likely be double those amounts.

Accountant

WHY YOU NEED ONE: There’s tax planning and your annual return, of course. But some accountants will also take a big-picture view of your finances and set up a system for managing and reviewing them. Specific areas accountants may cover range from managing retirement accounts to saving for college to estate planning.

HOW TO FIND THE RIGHT ONE: In most states, anyone who calls himself an accountant must pass the rigorous certified public accountant exam and be licensed with the state. If you’re focused on tax prep, note that all tax preparers must be enrolled with the IRS and have a Preparer Tax Identification Number, or PTIN. Ask for referrals from people in financial situations similar to yours and from professionals such as your attorney or financial adviser. If referrals don’t turn up someone who fits the bill, you can search for certified public accountants at www.aicpa.org and www.cpadirectory.com.

WHAT YOU’LL PAY: Prices vary considerably by region and by the type of work. In 2011, the average price to have a tax preparer or accountant fill out an itemized Form 1040 with Schedule A and a state tax return was $233, according to the National Society of Accountants.

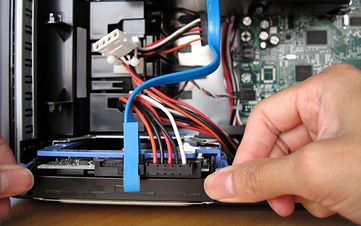

Computer Geek

WHY YOU NEED ONE: Whether you've got a virus that's resulted in the blue screen of death on your PC or are having trouble networking your home computers, a techno-geek can come in handy. They can restore lost files, set up an external hard drive to back up your machine or simply install new software.

HOW TO FIND THE RIGHT ONE: Because training and credentials for computer troubleshooters vary so much, your best bet is a referral from a friend who has used one successfully. If you don’t have a referral, check out Best Buy’s Geek Squad or Geeks On Call.

WHAT YOU’LL PAY: When you call a firm, the technician should be able to give you a quote for remote help, whether by the hour (rates are typically around $100 per hour) or for a specific service. House calls cost extra. Geek Squad offers wireless networking help starting at $90 online or in-home.

Career Coach

WHY YOU NEED ONE: If no one is responding to your résumé, or you land interviews but not offers, you may want to enlist the help of a career coach or counselor. There is a difference between the two -- anyone can be a coach; counselors must be licensed -- but either may be able to aid in your quest.

HOW TO FIND THE RIGHT ONE: The best way to find one is through a referral from a satisfied customer, but you can also start by searching through the National Career Development Association or the International Coach Federation. Liz Ryan, founder of career coaching service AskLizRyan (and a Kiplinger.com columnist), recommends interviewing prospective coaches and asking for examples of how they helped someone in your shoes.

WHAT YOU’LL PAY: Counselors and coaches typically charge about $100 an hour, or they may offer a la carte pricing -- say, $300 for a résumé.

Geriatric Care Manager

WHY YOU NEED ONE: Whether you are a retiree with a few health issues or you have aging parents who need a hand with their health care, a geriatric care manager can help. Care managers assess needs as you (or family members) age, identify resources in your community and create care plans.

HOW TO FIND THE RIGHT ONE: Start your search with the National Association of Professional Geriatric Care Managers. Using the Find a Care Manager tool, you can narrow the list by credentials -- for example, a certified GCM, licensed clinical social worker or registered nurse -- and areas of practice, such as guidance for adults with disabilities or home care.

WHAT YOU’LL PAY: An initial consultation typically costs $100 to $200 but may be as much as $500. Ongoing care runs $75 to $150 an hour, depending on your location.

Professional Organizer

WHY YOU NEED ONE: From a messy closet to unorganized digital photos to piles of paper, professional organizers can help you put your life in order.

HOW TO FIND THE RIGHT ONE: Start your search with the National Association of Professional Organizers. Look for a certified professional organizer (CPO) with a Golden Circle designation -- these pros have completed training and exams to get certified, and the Golden Circle means they’ve been in the business for more than five years.

WHAT YOU’LL PAY: Experienced organizers will likely be able to move faster than someone who is new to the business. Hourly rates run from about $50 to $150 an hour.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

Older Investors: Boost Your Savings and Retire Earlier

Older Investors: Boost Your Savings and Retire EarlierThis one measure can help older investors retire up to two years earlier and potentially double their retirement savings.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?