11 Defensive Dividend Stocks for Riding Out the Storm

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Remember when 1,000-point moves in the Dow where a big deal?

Lately, they've become almost commonplace. The Dow fell by just shy of 1,000 points on March 3 after rallying by more than 1,200 points on March 2. This follows a week in which the Dow closed down by more than 1,000 twice and down 879 another day.

That's some monster volatility. Yet despite the market turmoil, a handful of defensive dividend stocks are keeping their heads above water. It's an eclectic group, but you do see some common threads. Many are in basic industries that aren't particularly sensitive to economic growth or virus fears, such as packed foods and grocery stores. Many are low-beta stocks – shares that are less volatile than the broader market. And most pay above-average dividends, which helps to smooth out the ups and downs of the share price swings.

These survivors also are a little off the beaten path and don't have much representation on the major stock indexes. That matters because when investors dump index funds, the mega-cap stocks that dominate the Dow, S&P 500 and Nasdaq often get hit hard.

"Aggressive selling in the indexes can translate into aggressive selling in historically strong stocks such as Apple (AAPL), Microsoft (MSFT) and the other trillion-dollar names," says Mario Randholm, portfolio manager at alternative investments firm Randholm & Co. "It's hard to picture a scenario in which all these dominant names will continue to outperform during a broad-market selloff."

Today, we're going to take a look at 11 low-beta, defensive dividend stocks that have been keeping their heads above water. As of the time of this writing, all were not only outperforming the market since the correction began Feb. 19, but most were clinging to at least modest gains. Those gains might prove to be tenuous if the market takes another leg down. But at the very least, these stocks seem better-positioned to sustain less damage than most of their peers.

Data is as of March 3. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Flowers Foods

- Market value: $4.8 billion

- Dividend yield: 3.3%

We'll start with Flowers Foods (FLO, $22.88), a packaged bakery goods company selling its wares under Nature's Own, Wonder, Dave's Killer Bread, Sunbeam and other brands. The company is headquartered in Atlanta and operates 47 bakeries spread across the country.

Consumption of bread, snack cakes and tortillas isn't much of a concern during a recession. Indeed, stressed consumers often trade down to cheaper options and succumb to eating comfort food.

"Flowers Foods has been a staple in our all-weather portfolios for months," according to Sonia Joao, a Registered Investment Advisor (RIA) based in Houston, Texas. "Our clients appreciate the fact that it's a sleep-at-night investment that won't give them heartburn."

Flower Foods' status among defensive dividend stocks garnered it a place among our best retirement stocks to buy in 2020. It's a low-volatility play with a beta of just 0.33. The benchmark beta is set against (in this case, the S&P 500) is 1, so this effectively means FLO is approximately one-third as volatile as the broader market.

Flowers not only has survived the market's turbulence so far, but has put up a small gain since the start of the correction. It pays a nice 3%-plus dividend to boot.

B&G Foods

- Market value: $1.1 billion

- Dividend yield: 11.5%

Along the same lines, we have B&G Foods (BGS, $16.53), a provider of frozen vegetables, canned goods and other processed foods. The company has a portfolio of more than 50 brands, including Green Giant, Skinnygirl, Snackwell's, Molly McButter, Mrs. Dash and a host of others. It even makes Ortega-brand taco shells and hot sauce. The company's strategy has long been to buy familiar brands that have fallen somewhat out of favor, then reposition them.

The story here is a familiar one: Demand for basic consumer staples stocks doesn't change much regardless of the state of the economy. And because B&G Foods isn't a major holding in most investors' portfolios, there aren't a lot of people dumping it to raise cash. B&G is up a whopping 21% since Feb. 19.

Just keep your eye on this one. Since 2016, B&G's stock has dropped from more than $50 per share to just $16.53 at time of writing. So, while the recent strength has been refreshing, this is a stock that has taken its lumps. Wall Street has pushed back against the company's high debt load and its exceptionally high dividend yield of over 11%.

B&G's earnings currently aren't enough to finance its dividend. However, management confirmed in its recent quarterly conference call that it was a priority to keep the dividend at its current levels and that it expected cash flows (which is what dividends are actually paid out of) to be more than sufficient to cover it.

That remains to be seen, of course, and a deeper dive into the dividend is beyond the scope of this article. But even if BGS halved its dividend to pay off its debt, you'd still be getting a 5%-plus yield on a company trying to improve its financial foundation. If nothing else, B&G is worth consideration as a short-term trade to buck the trend of a down market.

Kroger

- Market value: $23.5 billion

- Dividend yield: 2.2%

Grocery store chain Kroger (KR, $29.34) has been something of a comeback kid of late. Between the end of 2015 and the third quarter of 2017, the stock lost more than half its value. Investors fretted that Amazon.com's (AMZN) aggressive entry into the grocery market would destroy traditional grocers like Kroger.

Well, no one wants to compete with Amazon. But Kroger hasn't been sitting around waiting for Jeff Bezos to show up with a steamroller to run over their business. The company has made major investments in technology. Kroger has introduced automated warehouses and massively upped its game in online grocery ordering. It also has gone head-to-head with Amazon's Whole Foods Market by aggressively rolling out its own organic lines.

Furthermore, Amazon's ability to take the grocery world by storm was never entirely realistic. Building out the infrastructure to deliver and store perishable fresh foods that require refrigeration was never going to be cheap or easy, and existing players such as Kroger already have that infrastructure in place.

Kroger hasn't turned into a juggernaut, but it's becoming quite the defensive dividend play. At time of writing, KR, which yields a modest 2.2% dividend, is essentially flat since the selloff started on Feb. 19.

Weis Markets

- Market value: $1.0 billion

- Dividend yield: 3.3%

Another grocery chain doing a fine job of keeping its head above water is Pennsylvania-based Weis Markets (WMK, $37.36). Weiss owns and operates 200 retail food stores in Pennsylvania, Maryland, Delaware, New Jersey, New York, Virginia, and West Virginia. The company has been in business since 1912.

There's honestly not that much to say about Weis Markets. It's a regional grocery chain catering mostly to small- and medium-sized towns in the northeast. Nothing more, nothing less.

But this lack of excitement is a desirable trait in defensive dividend stocks, and what makes WMK interesting in this environment. Whether the economy booms or busts this year, Americans will still depend on their neighborhood grocery store for their basic necessities, and Weis will be there to serve them.

Weis Markets pays a respectable dividend yield at 3.2%, and the payout ratio of 53% shows that there is plenty of room for modest income growth going forward. It's also a remarkably low-beta stock with a mere 0.05 reading.

WMK shares are mildly positive since the selloff began on Feb. 19 and are more or less flat since June 2019. You won't get rich on Weis Markets. But it's not a bad place to hide out during an exceptionally rough stretch in the broader market.

Core-Mark Holding

- Market value: $1.2 billion

- Dividend yield: 1.7%

Food seems to be a recurring theme among the survivors of this volatility, and Core-Mark Holding (CORE, $27.22) is no exception. Core-Mark sells and distributes food products to convenience stores.

Calling it "food" might be generous, as we're talking mostly about convenience-store junk food. But these are precisely the kinds of purchases that people tend to make regardless of the health of the economy. And in fact, junk food is what economists call an "inferior good," meaning that consumers tend to buy more of it as their incomes fall.

Core-Mark serves a diverse base of customers scattered across 43,000 locations, of which 55% are chains and 45% are independents. The company counts 7-Eleven, Circle K, Shell (RDS.A), Murphy USA (MUSA) and even Walmart (WMT) among its customers.

Interestingly, convenience stores are a highly fragmented industry. Core-Mark estimates that 63% of all convenience stores are single-store operators. In a fragmented space like this, it pays to have Core-Mark's economies of scale.

The stock's dividend is nothing to write home about at 1.7%, but that's still better than what most bonds pay these days. Its beta of 0.78 is low, too, though not exceptionally so.

Core-Mark's shares are up about 18% since Feb. 19, however, owing to a nice earnings surprise in its most recent quarterly results. Longer term, CORE shares have been trending lower since mid-2019 and have been mostly rangebound for the past five years. Translation: This stock might hold up well in a correction or bear market, but you might not want to hold onto it for a full cycle.

Federal Agricultural Mortgage Corporation

- Market value: $805.1 million

- Dividend yield: 4.3%

The Federal Agricultural Mortgage Corporation (AGM, $75.16), or "Farmer Mac," might not be in the food business, per se, but it helps to finance it.

Farmer Mac can be thought of as a farm-financing equivalent to Fannie Mae or Freddie Mac. It's a government-sponsored enterprise (GSE) formed in 1987 and it operates in the secondary markets. AGM doesn't make agricultural loans directly, but rather it buys the loans from financial institutions and repackages them into bonds and bond derivatives. Fannie Mae and Freddie Mac do the same thing with mortgages, buying them from banks and packaging them into bonds for investors.

Thus, it's immediately noting though that, like Fannie Mae and Freddie Mac, Farmer Mac got into financial trouble during the 2008 financial system meltdown.

Nonetheless, Farmer Mac pays a nice yield at 4.3%, and the shares have enjoyed a fantastic run since the third quarter of 2015, tripling in value. AGM also has been doling out massive dividend increases over the past half-decade, which is what you want to see out of defensive dividend stocks.

Farmer Mac's shares are essentially flat since Feb. 19, which is encouraging. It's important to note that the daily trading volume on these shares is relatively low, so be careful placing any large orders.

Public Storage

- Market value: $38.0 billion

- Dividend yield: 3.7%

There are few stocks that are as conservative and bond-like as self-storage real estate investment trust (REIT) Public Storage (PSA, $217.72). As the largest self-storage landlord in the world, Public Storage owns more than 170 million rentable square feet of storage facilities.

Self-storage is not only a recession-resistant industry; it's actually counter-cyclical, as unemployed or underemployed workers are often forced to downsize during recessions. Moving to a smaller home often means needing a place to store furniture and other belongings.

Simplicity is what makes this such a nice business. Unlike apartment or office tenants, who are constantly on-site and regularly need face time with the property manager for repairs and other concerns, self-storage tenants rarely visit the property. They also tend to be sticky. Once you've taken the trouble to move your belongings, you're not likely to take the trouble to move them out, even after regular rent increases.

Public Storage, a popular retirement stock pick, doesn't have an exceptionally high yield, but at 3.7%, it's definitely respectable. The shares haven't rallied during this period of volatility, but they haven't cratered either; they're virtually unchanged since Feb. 19.

Come what may in 2020, Public Storage would seem like a reasonably defensive dividend stock to use for parking cash.

CubeSmart

- Market value: $6.1 billion

- Dividend yield: 4.2%

Along the same lines, CubeSmart (CUBE, $31.50) has managed to weather the storm. Like Public Storage, CubeSmart is a self-storage REIT. The company, which owns a portfolio of 1,172 properties, has a strong presence in the top 25 U.S. metro areas by population and is the largest self-storage operator in New York City.

If you like Public Storage, you should like CubeSmart, too. What it might lack in Public Storage's history and larger name recognition, it makes up in higher yield and faster growth rate. CubeSmart sports a dividend yield of 4%-plus and has been growing that payout at a healthy clip. Since 2015, the REIT has increased its dividend at a 16.9% annualized compound growth rate, which was more than enough to double it over that period.

More growth is likely to come, as CubeSmart pays out only 76.3% of its funds from operations (FFO) as dividends. FFO is a measure of earnings for REITs that accounts for the high depreciation and other charges typical for real estate, and 76.3% is a relatively low payout ratio. Better still, CUBE holds a place among truly low-beta stocks with a reading of just 0.25.

CubeSmart is up slightly since February 2019, and while continued buoyancy isn't guaranteed, there aren't too many safer corners of the market.

Safehold

- Market value: $2.8 billion

- Dividend yield: 1.1%

During times of rampant fear, who wouldn't want to own a company with "safe" in its name?

- Safehold (SAFE, $58.40) is another REIT, but one with a quirky business model. The company allows property owners to separate the more lucrative building lease from the generally less lucrative ground lease. Essentially, a building owner can sell the land under the building to Safehold as a way of unlocking capital while continuing to collect rent on the building itself.

Arrangements like these can often be tax-efficient ways to raise capital.

As far as REITs go, Safehold's yield of 1.1% is paltry. But the stock has been a growth machine over its short life, nearly tripling in value since its 2017 launch. Shares are up about 10% since Feb. 19 and show no sign of slowing down.

Virtu Financial

- Market value: $3.9 billion

- Dividend yield: 4.7%

If there was a major market rout happening, you'd never know it from looking at the shares of Virtu Financial (VIRT, $20.53). The shares are up 16% since Feb. 19 and have shown no signs of slowing down.

Virtu provides market making and liquidity services to the financial markets worldwide. In plain English, that means they create trading volume when it's needed. Remember: Every seller needs a buyer to make a transaction. And the biggest impediment to the proper functioning of the market is a liquidity drought. We saw it in 2008 and again during the 2010 and 2015 flash crashes.

When liquidity dries up, the wheels on the market machine grind to a halt. You can think of Virtu as the grease that keeps the wheels moving smoothly.

Over the past five years, Virtu's share price hasn't moved much. But the shares have been showing a lot of momentum in 2020 and pay an attractive dividend of 5.1%. So, even if the share price gains taper off a little, you're still getting a very attractive income stream at current prices.

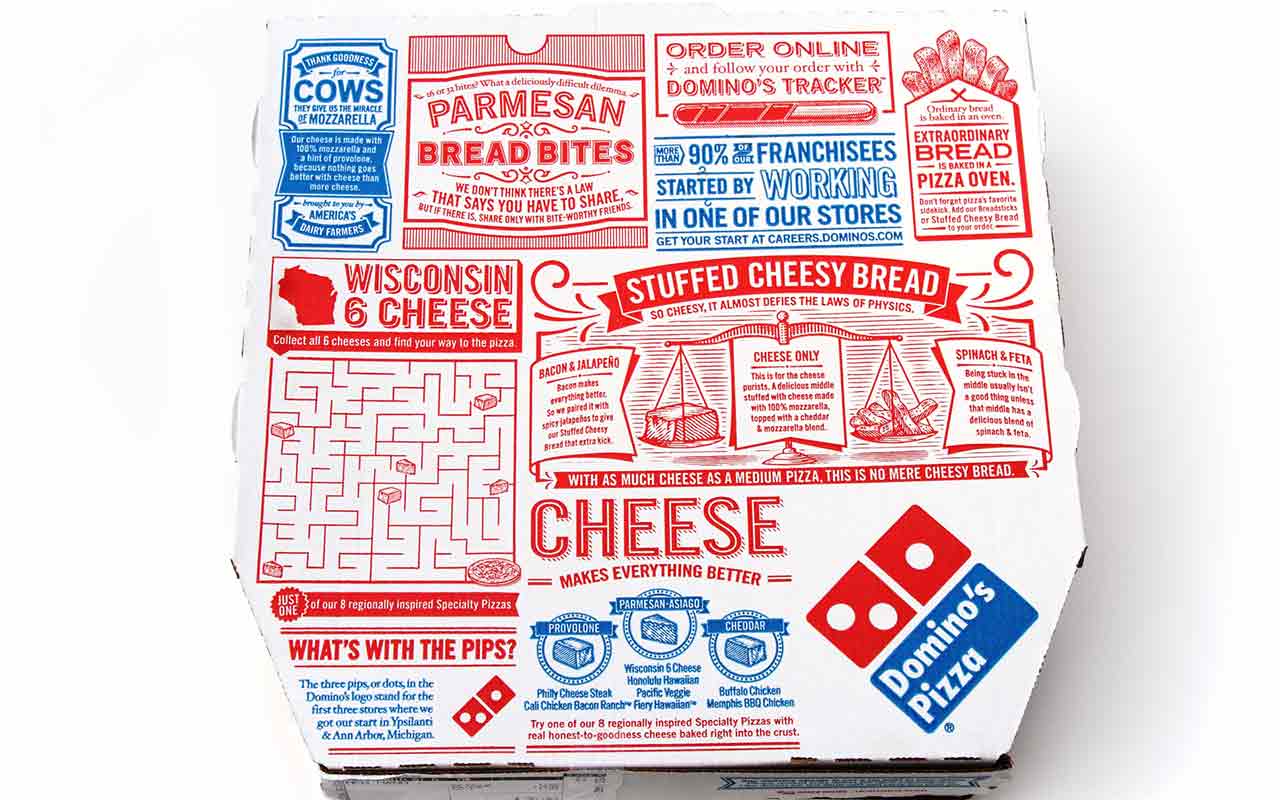

Domino’s Pizza

- Market value: $13.1 billion

- Dividend yield: 0.9%

Lastly, we'll look at pizza delivery chain Domino's Pizza (DPZ, 339.47), which has been popular among the Wall Street crowd for some time.

Domino's has been a king among defensive dividend stocks and growth stocks alike. It was the best stock of the 2010s. And it has held up well since we highlighted it among stocks that could benefit from the COVID-19 coronavirus scare. At a time when people are reluctant to spend time in public places, having a hot pie delivered to your door seems like a reasonable choice.

Of course, there is a lot more to the Domino's story than just coronavirus avoidance. Pizza is one of those guilty little pleasures that people are unlikely to forgo during hard economic times. In fact, with the growing trend of health consciousness, you could argue that pizza joints fit the profile of classic sin stocks such as tobacco or booze. During recessions, consumers tend to use victimless vices like these as escapes.

Furthermore, Domino's has been a tech leader within the food services industry, which is part of why its stock has enjoyed such an epic run. DPZ shares have shot roughly 2,300% higher over the past decade. That includes a 14% return since Feb. 19.

Domino's is the lightest dividend on this list, at just 0.9%. But it's a stock doing phenomenally well at a time when the rest of the world is hanging on for dear life.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.