The 10 Best Chinese Stocks You Can Buy

China is long past the 'smokestack' stage of development. The best Chinese stocks to buy now are firmly planted in the technology of tomorrow.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

This a precarious time to be investing in China. But many Chinese stocks, particularly in the technology and service sectors, look attractive if you're willing to deal with some volatility.

Even before the coronavirus outbreak, which originated in Wuhan province, relations between China and the West were strained. The U.S. and China have been engaged in a tit-for-tat trade war for most of the Trump presidency, and there is widespread fear in Western capitals that 5G telecom equipment manufactured by Huawei is capable of state espionage.

Trade tensions alone were reason enough to make many investors wary of Chinese stocks. Then the COVID-19 pandemic happened, exposing the risks of a globalized supply chain.

Consider Apple (AAPL). The world's leading consumer electronics maker has been reporting supply disruptions since February stemming from Chinese factory closures, and JPMorgan recently estimated that the launch of the new iPhone, which usually comes out in September or October, might be delayed by a few months.

Going forward, a lot of companies might be reconsidering the merits of cheap Chinese manufacturing and opt to stay closer to home. But the truth is that China has long evolved past the smokestack stage of development. The country is a major technology and digital entertainment hub, even if the vast majority of its products and services are destined for domestic use.

You have to be careful when investing in Chinese stocks, as shareholder protections aren't quite up to Western standards. Already this year, major accounting scandals have upended iQIYI (IQ) and Luckin Coffee (LK). But that's a risk you take when you invest in emerging markets, and that's why it's important to diversify and avoid heavy concentration in any single stock.

Here are 10 of the best Chinese stocks on the market right now. Each is poised to do well no matter what happens next in the coronavirus and trade war sagas.

Data is as of April 28.

JD.com

- Market value: $64.0 billion

- Industry: E-commerce

Coronavirus lockdowns have eviscerated traditional retail, but online merchants such as Amazon.com (AMZN) have been enjoying a sales bonanza. Some of this is due to pure necessity and won't last. But you can bet that some of the sales boost will be permanent. Online retailers have been gaining ground on traditional retailers for more than two decades. The virus lockdowns only accelerated the process.

If you like Amazon's business model, you should like JD.com (JD, $43.58), which is essentially China's home-grown version. JD.com boasts 32 million active users and sells virtually everything under the sun: electronics, clothes, appliances, food and more.

If you can think of it, it's likely JD.com sells it.

Furthering the comparisons to Amazon, JD.com is a pioneer in rapid delivery, offering next-day and often same-day shipping for many of its products. And via its JD Logistics arm, the company allows outside companies to piggyback on its sprawling empire of fulfillment centers and state-of-the-art warehouses.

The coronavirus started to really wreak havoc on China early this year, but you'd never know it by looking at JD.com's stock price. JD, which we called one of the top tech stocks for 2020, is up 24% year-to-date and at its highest level since 2018. Much like Amazon continues to be one of America's top investments, JD.com should continue to be one of the best Chinese stocks you can own.

ZTO Express

- Market value: $22.9 billion

- Industry: Shipping and delivery

If you like the idea of owning China's Amazon, it only makes sense that you would also like the country's version of United Parcel Service (UPS). Greater demand for e-commerce means greater demand for shipping and delivery services. It really is that simple.

This brings us to ZTO Express (ZTO, $29.17), the largest player in Chinese express parcel delivery with a market share of 19.1% as of last year. The company has a fleet of more than 7,350 line-haul vehicles serving approximately 30,000 pick-up and delivery centers throughout China.

Like many Chinese stocks over the past few years, ZTO's growth rates boggle the mind. Parcel volume jumped by 42% last year after jumping by 37% and 38% in 2018 and 2017, respectively. First-quarter 2020 volume figures aren't available yet, but it's likely that widespread lockdowns only made ZTO's services all the more essential. Just understand ZTO might see activity similar to UPS in which a shift in consumer and product mix hamper profits in the short term.

China probably will record its first true recession in decades this year, but you'd never know it by looking at ZTO's stock price. The shares have continued to push higher all year and are currently at all-time highs.

We don't know a lot about what comes next in the post-coronavirus world. But it's safe to assume that in any reality, ZTO and its peers deliver more parcels.

Alibaba Group

- Market value: $529.6 billion

- Industry: E-commerce

No listing of the best Chinese growth stocks would be complete without Jack Ma's Alibaba Group (BABA, $201.15), China's largest company by market cap with a valuation of more than half a trillion dollars.

Alibaba is a little hard to define. Its namesake Alibaba.com is the largest online wholesale market for importers and exporters. Its core Taobao site is similar to eBay (EBAY) in that it primarily serves as a platform for individuals and smaller merchants to sell their wares. Its Tmall site serves as a marketplace for major brands and retailers. And Alibaba Cloud is the largest cloud services provider in China, as well as one of the largest in the world. The company is also active in digital payments and micro lending.

It's a diverse set of businesses. But they all have one thing in common: They're essential to the modern economy.

Because of Alibaba's focus on foreign trade and wholesale commerce, its earnings might take a nasty tumble over the next several quarters due to the collapse in global trade. But these losses would be at least partially offset by growth in its cloud businesses and other digital services. Remember: The cloud powered Microsoft's (MSFT) renaissance and transformed Amazon.com from a retailer to a technology (and profit) powerhouse.

It's also worth noting that Alibaba's revenues actually grew the last time global trade ground to a halt, during the 2008 meltdown and Great Recession.

Tencent Holdings

- Market value: $510.5 billion

- Industry: Conglomerate

If you had to choose one stock, anywhere in the world, to be the one stock you owned for the next 20 years, Tencent Holdings (TCEHY, $53.44) – one of the largest social media, streaming video and video-game companies in the world – should at least be in the discussion.

If tomorrow, China and the U.S. fall into a legitimate cold war and trade between the countries really takes a hit, Tencent is going to take a lot less damage than the vast majority of Chinese companies. Chinese consumers aren't likely to stream less video or play fewer mobile video games even during a deep recession.

Tencent's social media and gaming revenues have continued to grow at a healthy clip. But the explosive growth has come from its investments in fintech and mobile payments, primarily via its Weixin and WeChat apps.

Ask yourself a very simple question: Five years from now, do you expect to see more people paying with their phone or fewer people? Regardless of what happens over the coming months following the coronavirus scare and any long-lasting hostility to China, that trend would appear to be safe.

Tencent's market cap, at $511 billion, is slightly smaller than that of Alibaba. It will be interesting to see which of these top Chinese stocks crosses the trillion-dollar mark first.

Tencent Music Entertainment

- Market value: $18.2 billion

- Industry: Streaming music

Streaming music services such as Spotify (SPOT) have had a hard time maintaining profitability in their core U.S. markets. But Tencent Music Entertainment (TME, $10.87), China's leading music streaming service, has been profitable for years and has grown its revenues by more than a factor of five since 2016.

For those not familiar with the business model, streaming music services can be thought of as a "smart" radio that learns what you like and adapts your playlist and makes suggestions accordingly. Because as the system studies your listening patterns, its recommendations progressively get better over time. This keeps its listeners "sticky"; less likely to wander.

Tencent Music Entertainment isn't simply a Spotify copycat, either. It has a distinctly Chinese personality, including local favorites such as online karaoke and group singing via its WeSing, Kugou Live and Kuwo Live platforms.

As its name suggests, Tencent Music Entertainment is a subsidiary of Tencent Holdings, meaning it has the backing of one of the most powerful tech firms in the world.

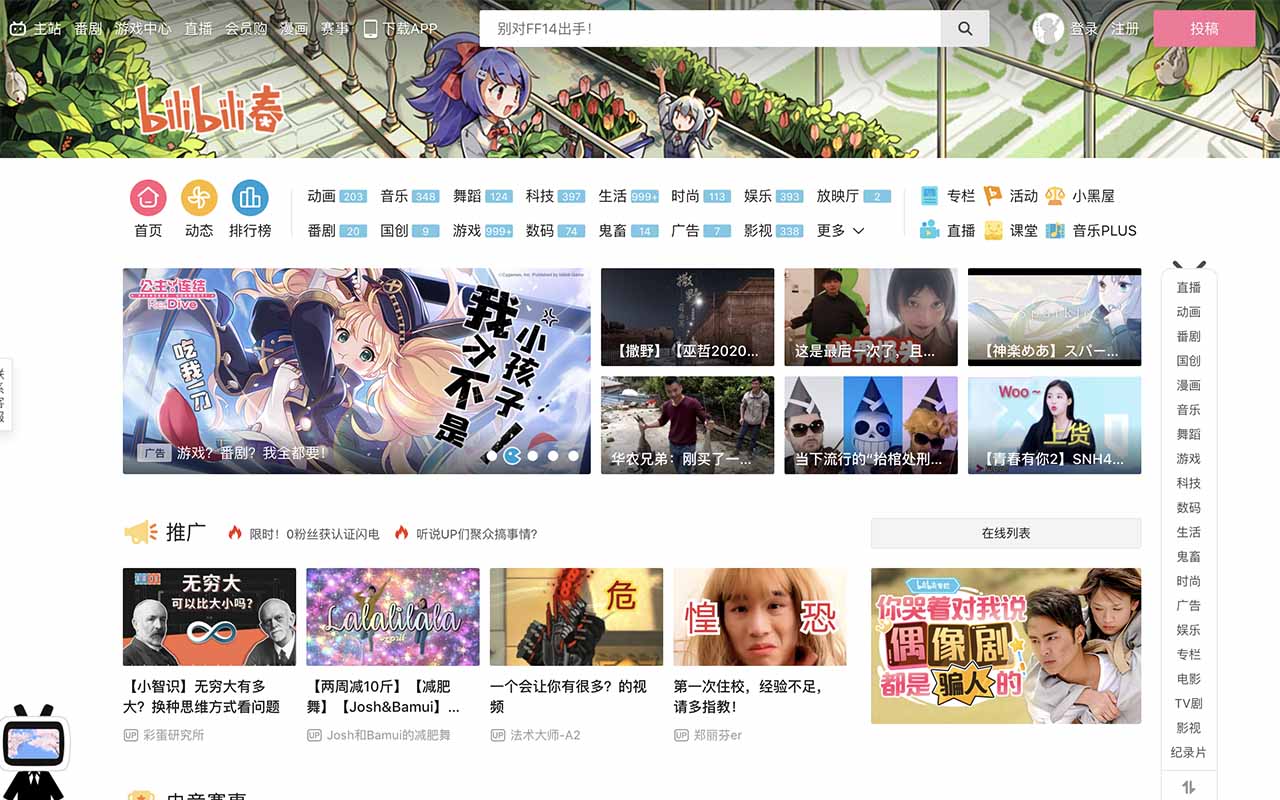

Bilibili

- Market value: $9.3 billion

- Industry: Online video

Along the same lines, Bilibili (BILI, $26.96), an online entertainment company targeting China's youth. Its core market are young adults born between 1990 and 2009, and the company's services include streaming video, live broadcasts and mobile games.

While Bilibili doesn't have the name recognition of some of China's larger tech companies, it has a long history (at least for a gaming and streaming video firm). The company was founded in 2009 and has strategic content partnerships with Tencent Holdings and other players in mobile gaming.

It's also worth noting that Sony (SNE) made a major investment in Bilibili earlier in April, taking a 5% ownership interest in the company.

Bilibili is a lot more speculative than some of the other names on this list because it has never turned a profit in its publicly traded life. But it's a growth story – and money-losing stock picks can do all right for themselves, as long as they eventually figure out profits.

Revenues have exploded higher over the past five years. In 2015, the company brought in a scant $15 million in sales; over the trailing 12 months, that number has grown to roughly $960 million.

Given its shakier profit outlook. you'd probably want to consider making BILI a smaller position than some of the more established Chinese stocks on this list. But if you're wanting to make a direct bet on China's Gen Z, this is it.

- Market value: $8.2 billion

- Industry: Social media

Most western tech and social media companies have rough equivalents in China. Well, Twitter's (TWTR) closest Chinese equivalent is microblogging service Weibo (WB, $36.65). Interestingly enough, "Weibo" actually translates to "microblog" in English.

While Twitter is Weibo's closest equivalent, the service also has elements of Facebook's (FB) Instagram. It's Weibo Stories functions very similarly to Instagram Stories.

One major difference between Weibo and Twitter is that, due to China's strict censorship laws, Weibo doesn't turn into a political troll smackdown quite the same way Twitter does. Its content tends to be fluffier and more focused on entertainment. Also, with a market cap of just $8 billion, Weibo is a fraction of the size of Twitter, which is worth about $24 billion.

The risk on a stock like WB is that fickle app users move on to the "next thing." But it's worth noting that the company has managed to grow its revenues from just $656 million in 2016 to nearly $1.8 billion in 2019. Over the same period, earnings have jumped from 48 cents per share to $2.18.

Weibo was a bona fide bubble stock that maxed out at more than $142 per share back in 2018. The air has certainly come out of the bubble, as the shares fetch about $36 at time of writing. Now, however, WB appears ready to trade more on its fundamentals.

Huya

- Market value: $3.4 billion

- Industry: Video games

The world of electronic sports (e-sports), or competitive video gaming for public viewing, will probably be foreign to most readers. Yet it's a huge business, generating more than $1 billion in revenues in 2019. An estimated 443 million people watched competitive gaming last year. To put that in perspective, the Super Bowl had 102 million viewers this year.

Huya (HUYA, $15.71) is at the center of this trend. Huya operates live streaming platforms, including its popular Nimo TV service, which is similar in concept to Amazon's Twitch. As with Twitch, Huya depends on user-generated content, which is often free or extremely cheap to source. Unlike Netflix (NFLX) or Disney's (DIS) Disney+, there is no production budget to speak of.

Huya is one of the more speculative names on this list of the market's best Chinese stocks, as it has a market cap of $3.6 billion and a relatively short trading history. But if you believe in the future of gaming as a spectator sport, it's one of the few pure plays out there.

New Oriental Education & Technology Group

- Market value: $19.1 billion

- Industry: Online education

As we're still in the midst of a pandemic, schools and universities are learning to live with long-distance learning. For a lot of classrooms, it's as simple as having the teacher deliver the lecture over Zoom Video Communications (ZM) and hoping for the best.

But for New Oriental Education & Technology Group (EDU, $120.29), distance learning has been the reality for years. The company provides private educational services in China, primarily language training and test preparation courses. For Chinese parents trying to get their kids' English language skill or SAT scores up to U.S. university standards, New Oriental is lifeline.

Of the best Chinese stocks out there, New Oriental is among the oldest; the company was founded back in 1993. Yet the company is far from stodgy, as revenues have more than tripled since 2014.

For the quarter ended Feb. 29, New Oriental reported 15.9% year-over-year revenue growth and a 41.4% hike in profits. That's actually a slowdown from its prior growth, and the company expects more near-term pain for the current quarter as China continues to feel an economic pinch.

However, once the pandemic finally blows over, e-learning will be even more entrenched, and New Oriental will have a dominant position in the Chinese market.

China Mobile

- Market value: $165.0 billion

- Industry: Telecommunications

The majority of the best Chinese stocks to buy now are software-based, and most have at least some element of social media in their business model. But we're going to wrap this up with something a little stodgier but still very tied into the Chinese domestic market: Chinese mobile carrier China Mobile (CHL, $40.28).

China Mobile isn't a sexy growth stock. In fact, it's not particularly interesting at all. It's China's equivalent to AT&T (T) or Verizon (VZ) – effectively a boring but stable utility stock. The company serves 946 million mobile customers and 191 million wireline broadband customers.

Stop and think about that for a minute. China Mobile's mobile user base is nearly three times bigger than the entire population of the United States.

Given that China is already near the saturation point for mobile penetration, the company isn't likely to see its user base move much in the coming years. Indeed, China Mobile actually recorded a decline in mobile users from January to February as China battled with the coronavirus. That's OK. CHL can still realistically squeeze more revenue out of existing users as they upgrade to more expensive data plans and expand services.

It's also worth noting that China Mobile is largely recession-proof. It's just about impossible to live in China today without a mobile phone, and come what may in the post-coronavirus world, that's not going to change.

You're not going to get explosive growth in CHL, but the 5.7% dividend is competitive and higher than what you'd get in Verizon these days.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Stocks Slip Ahead of July CPI Report: Stock Market Today

Stocks Slip Ahead of July CPI Report: Stock Market TodayThe latest inflation updates roll in this week and Wall Street is watching to see how much of an impact tariffs are having on cost pressures.

-

Nasdaq Ends the Week at a New High: Stock Market Today

Nasdaq Ends the Week at a New High: Stock Market TodayThe S&P 500 came within a hair of a new high, while the Dow Jones Industrial Average still has yet to hit a fresh peak in 2025.

-

Stocks Swing Lower as Eli Lilly, Fortinet Spiral: Stock Market Today

Stocks Swing Lower as Eli Lilly, Fortinet Spiral: Stock Market TodayThe main indexes finished well off their session highs after a disappointing batch of corporate earnings reports.

-

Stocks Rally on Apple Strength: Stock Market Today

Stocks Rally on Apple Strength: Stock Market TodayThe iPhone maker will boost its U.S. investment by $100 billion, which sent the Dow Jones stock soaring.

-

The Best Stocks of the Century

The Best Stocks of the CenturyAs we near the 25-year mark, we looked at which stocks have returned the most. Here are the 10 best stocks of the century so far.

-

Stock Market Today: Nasdaq Hits a New High as Nvidia Soars

Stock Market Today: Nasdaq Hits a New High as Nvidia SoarsA big day for Nvidia boosted the Nasdaq, but bank stocks created headwinds for the S&P 500.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?