43 Companies Amazon Could Destroy (Including One for a Second Time)

You would think e-commerce and cloud computing giant Amazon.com (AMZN), after more than 20 years of unfettered growth, would have run out of room to expand.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

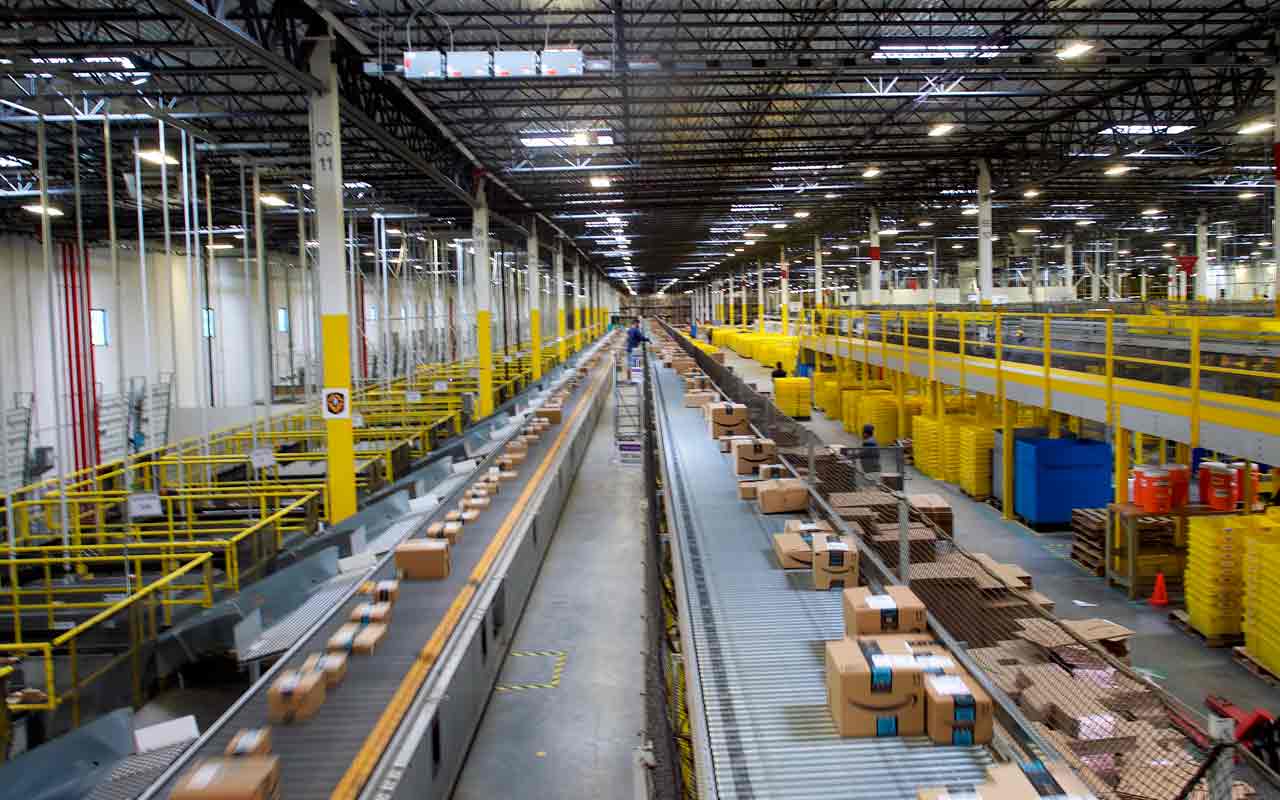

You would think e-commerce and cloud computing giant Amazon.com (AMZN), after more than 20 years of unfettered growth, would have run out of room to expand. But the company continues to scout new opportunities. Amazon will try its hand at almost any sort of business, does well at the bulk of them – and threatens to destroy dozens of other companies with its success.

The latest foray into unfamiliar territory? In September, Amazon announced a pilot program for a virtual medical clinic, which includes some in-home services, to be offered to its Seattle-area employees. The virtual clinic aspect would include video visits with doctors, nurse practitioners or registered nurses.

That's not Amazon's first venture outside its comfort zone, either. Amazon also is a grocer, a fashion venue, a peddler of handmade crafts and even its own delivery provider, just to name a few. Amazon has become at best a headache, and at worst a survival threat, for any rival in its path.

Here is a look at 43 companies that Amazon could kill. A year ago, we named 49 such businesses (as well as one it already knocked out). A handful of names dropped off the list – some successfully regrouped, while a few were officially knocked out. Others have been added as they've slipped into Amazon's warpath. Considering Amazon's ubiquitous presence, no company is ever truly safe.

Companies listed in alphabetical order. Please Note: Links to products and services mentioned in this feature may be affiliate links. These business relationships played no role in the independent judgments and recommendations of the Kiplinger editorial staff. For more valuable offers from our merchant partners, visit our Marketplace.

Advance Auto Parts, AutoZone, O'Reilly Automotive

The unchecked growth of Amazon didn't faze auto-parts suppliers such as O'Reilly Automotive (ORLY), AutoZone (AZO) and Advance Auto Parts (AAP) for a long time. Car parts are too heavy, bulky and specialized to be handled like a consumer-centric commodity. And besides, when mechanics (DIYers or the real thing) need a part to use in a repair, they usually want it quickly. The big three names in the auto parts retailing game haven't needed to worry.

But times have changed, helped along by inventory-management technology and delivery networks that are willing and able to handle goods they simply couldn't before. That's why Amazon was willing to enter the fray in January 2017.

All three stocks have since recovered from their initial setbacks. The underlying companies have finally shrugged off their shock and figured out how to compete with a price-busting Amazon. Advance Auto Parts, for instance, has embraced the idea of in-store pickups of online orders, not unlike the option now offered by many grocery chains.

However, Amazon hasn't yet unleashed its full potential on this front. It's disrupting the auto parts retailing industry gradually, just as it has other consumer-facing markets. Give it time.

Albertsons, Kroger, Walmart Grocery

Amazon's purchase of Whole Foods Market sent shockwaves through the organic-grocery business. But just as vulnerable (albeit in a different way) are more conventional grocers such as Kroger (KR), privately owned Albertsons and the grocery arm of Walmart (WMT). In fact, a year ago, Amazon was technically the biggest online grocer of the United States, boasting market share of 18%.

That has changed in the meantime. Walmart stepped up its game by growing its curbside pickup option to 2,100 U.S. locations, while Instacart leveraged its relationship with Costco (COST) and Kroger to beef up its share of the market from 4% to 8% over the past couple of years. That business had to come from somewhere.

As the number of places and opportunities for more traditional brick-and-mortar grocers to expand their online-ordering business shrink, however, Amazon's relative retreat will cool and likely reverse. Remember: Amazon has always played the "long game," and it's still learning the business, too, with a relatively limited market of 90 metropolitan areas. But it's already going on the offensive, announcing free Amazon Fresh deliveries for Prime members that have previously used the service.

Audiobooks.com, Playster

Amazon is the owner of Audible, which boasts the largest audiobook library in the world. That makes it a direct threat to Audiobooks.com and Playster, among others.

Don't dismiss this market's importance. Although audiobooks only generated a little less than $1 billion worth of revenue in the United States last year, the size of the market is growing. In 2018, the industry's revenue was up 24.5% year-over-year, extending a longstanding hot streak.

What was largely missing from the audiobook landscape for a long time was a central name to mainstream audiobooks, similar to the role Netflix (NFLX) played within the streaming video arena.

Amazon largely has become that player.

Audible controls about 41% of the audiobook market, as of the most recent look. And, like Netflix, being the first to become the dominant force in a particular market leaves little room for a second or third player … which is all Playster and Audiobooks.com are in a position to enjoy from here. But playing second fiddle to Amazon in any business is a problem, especially when Audible can be sold as part of an Amazon Prime package.

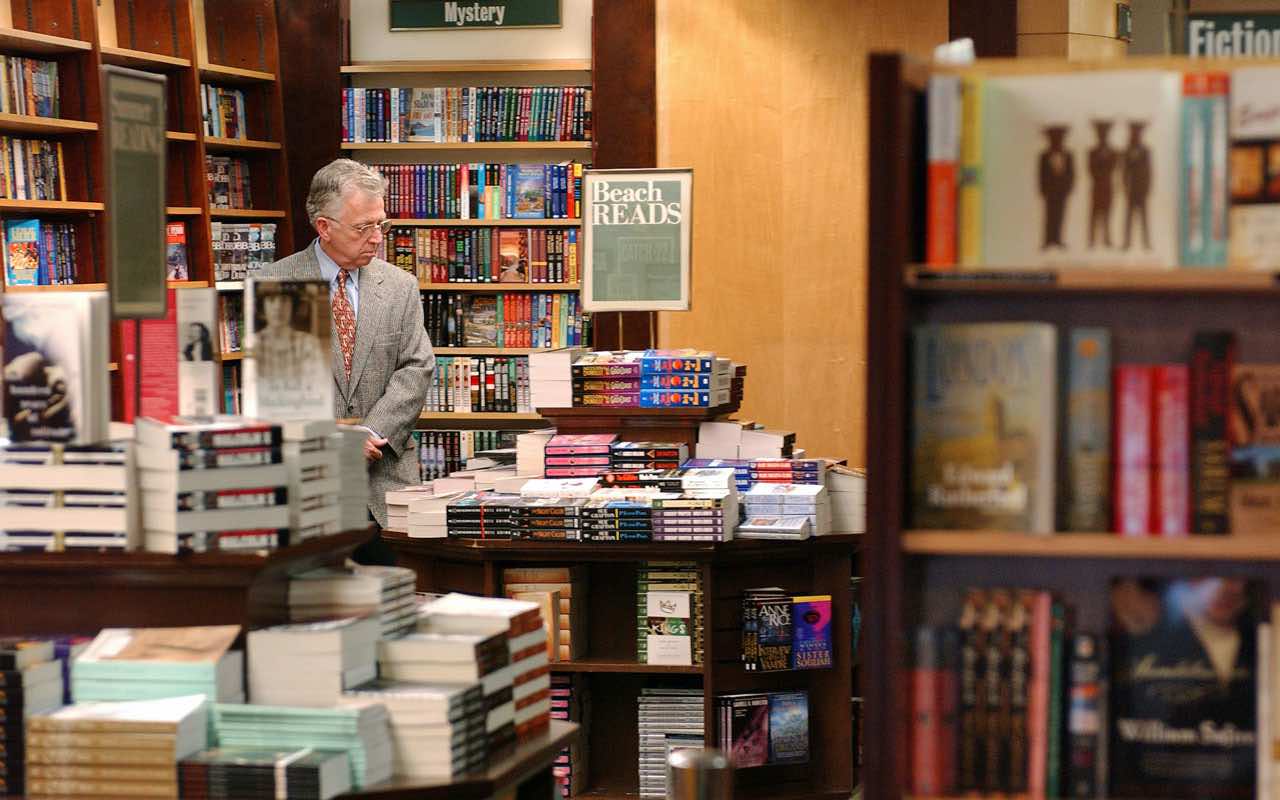

Barnes & Noble, Joseph-Beth Booksellers

Bookstore chain Barnes & Noble and Joseph-Beth Booksellers were the first major victims of the rise of Amazon. Remember: Initially, Amazon.com was an online bookstore, and the advent of e-readers – then tablets – made e-books commonplace, further displacing physical bookstores.

One end result for B&N is 12 consecutive years of declining sales, with a 13th likely underway. Another end result: 10 straight years of net store closures.

A glimmer of hope finally started to shine in June of this year, when hedge fund Elliot Management acquired the struggling chain of 627 bookstores in hopes of turning it around. The fund picked James Daunt, who led a successful turnaround of the U.K.'s largest book, to act as CEO of the now-privatized outfit.

The task ahead remains a monumental one though. As 1010data research analyst Brian Callahan opined on the buyout, "In our data sets, there is little indication that side of the business (books) has stopped the bleeding. They're just not getting people."

There's also little assurance that escaping the short-term-minded scrutiny of public investors is a surefire recipe for success. Toys "R" Us was privatized to no avail, as was RadioShack.

As for Joseph Beth, it's down to a handful of locations, though they're holding up. But it has a limited degree of much-needed scale, and scale is the key to surviving the Amazon juggernaut.

Dailymotion, Smashcast, Mixer, YouTube Gaming and More

There are a number of specific gaming companies that, with the exception of YouTube Gaming, won't ring any bells with investors. But within video gaming circles, Smashcast, Dailymotion, Mixer (formerly Beam) and a whole slew of other non-descript names are plenty familiar. All of these organizations have developed platforms that allow gaming fans pay to watch other people play video games.

Yes, that's a real thing. And yes, it generates revenue for the player as well as the platform owner. Last year, Google's YouTube supplied 50 billion hours' worth of video gaming content.

What does that have to do with Amazon?

Amazon.com is the owner and operator of Twitch, which is the world's most popular destination to watch other individuals play video games. The players who make the video and Amazon split any subscription revenue created by a particular gamer's channel, so that player has an incentive to do well and grow his or her audience.

It's the behemoth in the business. Whereas YouTube Live aired 651.1 million hours of video game play during the first quarter of the year, Twitch delivered a stunning 2.7 billion hours of live video game viewing action – up 33% year-over-year.

It's possible there's room for more than one player in the game-streaming space. It's unlikely there's room for more than one dominant player.

Best Buy

There's no denying that electronics retailer Best Buy (BBY) pulled off a miracle.

The deeper Amazon.com waded into the consumer electronics market, the more trouble Best Buy found itself in. By 2012, chatter about Best Buy's impending doom was common. Many presumed the company would follow in Circuit City's footsteps to bankruptcy, as Amazon was simply too competitive.

But a funny thing happened on the road to oblivion. Turnaround artist Hubert Joly took the helm in 2012 and began working on a turnaround plan. It worked, at least according to Joly. He flatly said last year, "We have turned around the business, it's about where we go from here. We have not only survived but thrived and I don't believe this is a winner-takes-all market."

Q2 numbers suggest there's some truth to the matter. Company-wide revenue was up a couple of percentage points, as were same-store sales. Earnings improved by nearly 19%.

But hold off on the victory lap. For one, the further Best Buy works its way into the turnaround, the more its progress slows. Its numbers are seemingly closer to reaching a plateau than not, with much if not all of its revenue growth being attributable to inflation. If Best Buy isn't taking business away from Amazon, the e-commerce giant remains in good position to push back and rekindle its market share growth.

Also, Joly is no longer at the helm. He stepped down in June 2019, and was replaced by Corie Barry, who previously served as CFO and strategic transformation officer.

Blue Apron, HelloFresh, Plated and Others

No one disputes Amazon.com has mastered the art of delivering anything and everything that isn't perishable, but what about pre-packaged meals?

Yep, it can do that too.

Amazon got into the business in 2017, and it has continued to improve its game ever since. Its entry into the race is a direct threat to the likes of rival meal kit outfits Blue Apron (APRN), HelloFresh and Plated.

The marketability and viability of the so-called "pure plays" in the business were never all that strong. They're all subject to the changing – usually rising – price of food, and it takes massive scale to make meal kits cost-effective enough to turn into a sustainable business. Blue Apron, for instance, is one of the biggest names in the business yet still hasn't recorded even a quarterly profit.

Another unsavory reality of the meal kit biz: Roughly three-fourths of Blue Apron's and HelloFresh's customers stop buying them (on a regular basis anyway) within about six months. The idea is creative, but it doesn't necessarily have longevity.

To the extent there is a viable meal kit market, however, Amazon has two advantages. One is that, on a global basis, almost 200 million people visit Amazon.com each month, and the company boasts an estimated 105 million Prime members in the U.S. alone. Amazon has mastered the art of keeping them lingering long enough that a wide swath of them will eventually give a meal kit a shot.

The other edge is that Amazon doesn't actually have to turn a profit selling those pre-packaged meals. It can extract a profit from those customers by selling them other products and services.

Duracell, Energizer Holdings

- Energizer Holdings (ENR), which of course is the name behind Energizer batteries, is one of the most recognizable names in the business. So is Duracell, which is held by Warren Buffett's Berkshire Hathaway (BRK.B).

Batteries currently sold under Amazon's "Basics" label don't exactly inspire deep brand loyalty. But don't dismiss the potential of Amazon's entry into the seemingly boring business. For whatever reason, batteries and diapers are the two big winners under the company's AmazonBasics umbrella. Amazon already outsells all other battery brands by commanding roughly one-third of that market. Energizer's market share, for reference, is a little better than 10%, while Duracell's piece of the market is closer to 20%.

The bigger concern for those rival brands is the fact that Amazon was able to enter the market and chip away some share for itself at all.

It's unlikely Duracell or Energizer will ever be wiped out completely. But Amazon doesn't even really promote its Basics battery other than as an add-on purchase at its website, and yet it already has proven disruptive to the two biggest brands in the business. The fact that it had a 97% share of online battery purchases in Q1 2019 means it's not going away.

Etsy

- Etsy (ETSY) was, and is, a brilliant idea.

Some things are just not meant to be made or sold in bulk. Handmade one-of-a-kinds still have a place in consumers' hearts, but makers of these goods are facing an increasingly tough time in just being able to show their wares to an increasingly distracted market. By bringing a huge number of artisans under one roof and promoting the entire collection, Etsy has successfully melded an old-school idea with the new.

But Amazon noticed, and responded. In 2015, the e-commerce giant launched Amazon Handmade, taking a stab at Etsy.

Credit must be given where it's due. Etsy has largely fended off the much bigger e-commerce rival, maximizing the value of featuring secondhand goods and handmade items, whereas Amazon's Handmade venue is mostly as cold and impersonal as the other channels of its e-commerce platform. CEO Josh Silverman, former eBay (EBAY) executive, led a 35.9% improvement in revenues for the first nine months of 2019.

Still, Amazon has time and size working in its favor, and it can slowly force its smaller rival into a corner. Etsy, in fact, took one step back in July of this year when it "encouraged" its sellers to offer free U.S. shipping on orders larger than $35. Storefront owners that didn't acquiesce wouldn't be featured as prominently as those that did. Some are complying, but others aren't. All of Etsy's sellers, however, are feeling a little more alienated after being sucker-punched by slightly higher transaction fees instituted in July 2018.

FedEx, United Parcel Service

While both Uber Technologies (UBER) and Lyft Inc. (LYFT) had opportunities to delve into the package delivery business, neither ride-hailing outfit is interested in going down that route. Perhaps it's more of a logistical headache than it's worth, interfering with their people-moving business models.

However, Amazon.com isn't merely keeping smaller, would-be competitors from entering the market. With a fleet of 42 delivery jet aircraft and plans to expand its fleet to 70 aircraft by 2021, Amazon is encroaching onto turf presently controlled by United Parcel Service (UPS) and FedEx (FDX). The e-commerce giant rounds out its total delivery capacity with Amazon Delivery Service Partners.

The intent hasn't been to put the more established logistics service providers on the defensive. Rather, Amazon.com has built and continues to grow its own delivery network as a means of saving money and improving its overall customer service. FedEx CEO Fred Smith, however, now deems Amazon a competitor. Amazon feels likewise, calling it and UPS competitors in its annual report.

Time and opportunity will only encourage AMZN to monetize its delivery infrastructure even more than it already has – cutting out FedEx and UPS in the process.

GameStop

- GameStop (GME) historically has made its money by serving as the middleman, but the game publishing industry's move toward downloads and away from discs and cartridges is increasingly making the venue less of a destination for gamers.

Its August-quarter results underscore that idea. Global sales fell 14.3% to $1.29 billion, versus analyst estimates of $1.34 billion. The loss of 32 cents per share was far worse than the 21 cents the pros were modeling. The total adjusted loss of $32 million more than tripled the $10.2 million loss booked in Q2 2018. Perhaps worst of all, the retailer warned that same-store sales would likely fall by the low teens for fiscal 2019.

Don't misunderstand. GameStop also sells game downloads via its own website. Amazon does too. Neither venue is completely out of the loop when it comes to this paradigm shift underway within the gaming business.

But Amazon.com induces 2.6 billion unique visits every month now, and that figure just continues to swell. It draws a bigger crowd, and the gamers among them know they can buy downloads via the site. GameStop's website simply doesn't attract nearly as many people.

To its credit, activist investment fund Scion Asset Management has taken on a $10.6 million, 3% stake in the company, and has encouraged GameStop to use its healthy balance sheet to continue repurchasing stock. Lead investor Michael Burry believes next year's launch of new Microsoft (MSFT) Xbox and Sony (SNE) PlayStation consoles will drive much-needed traffic. But both companies continue to move in a manner that negates the need for any game retailer other than Amazon.

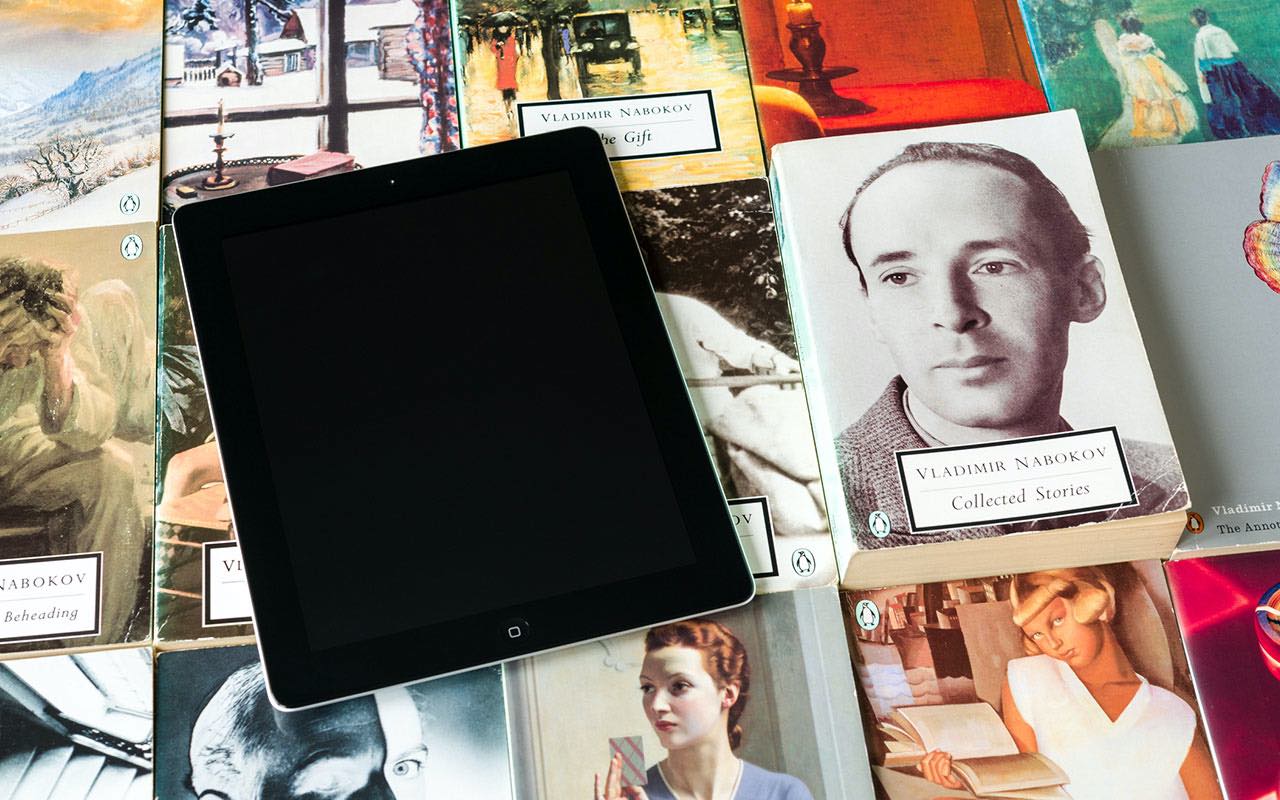

Hachette Book Group, Penguin Random House

Initially, the rise of Amazon.com wasn't only not a threat to book publishers – it was a benefit, making it easy for consumers to purchase a book rather than require a visit to an actual bookstore.

But technology never stops marching forward. The development of e-books and e-readers has quelled the need for printing and shipping while simultaneously positioning Amazon.com as an e-book hub. For the crowd that still prefers the feel of paper and the look of a volume on a bookshelf, Amazon's CreateSpace can arrange for a book to be printed on-demand – even just one at a time.

With that option on the table, traditional book publishers such as Penguin Random House and Hachette Book Group are struggling to justify their new role as middlemen that don't bring much value to the table. Amazon can do the marketing job too, or at least offer a platform that will allow an author to promote a book as effectively as a publishing house often does.

The results speak for themselves. In 2017, Jeff Bezos disclosed that more than a thousand independent authors using the Kindle Direct Publishing platform earned more than $100,000 apiece. Meanwhile, e-books drove roughly $12 billion in revenue last year. That's only a small fraction of the total publishing market's collective top line, but that tally is spread out among a huge number of publishers. At least two-thirds of all e-book revenue is generated via an Amazon digital publishing service.

The numbers prompt one key question: Who needs an old-school publisher?

InterActiveCorp, Yelp

Most consumers have heard of online business directory and review repository Yelp (YELP). Ditto for Angie's List, which InterActiveCorp (IAC) has some control of via its 84% stake in ANGI Homeservices (ANGI). What most consumers don't yet realize, however, is that Amazon is quietly encroaching into that market.

It's called Amazon Home Services, and it looks a lot like Angie's List. Homeowners looking for anything ranging from tech support to housecleaning services to yardwork can browse Amazon's curated list of service providers and read reviews regarding their previous work. Angie's List and Yelp offer similar information. And while Yelp also serves up information about a variety of other consumer-facing businesses such as restaurants or retail stores, there's no denying that Amazon Home Services is a viable alternative source of information on many fronts.

Given that Amazon already connects with so many consumers in so many ways, adding reviews to the mix wouldn't be a major technical hurdle.

Yelp doesn't appear to be on the defensive just yet ... at least not given its most recent quarterly earnings report that saw revenues improve by 9% year-over-year. But the headwind is brewing. Its Q2 top line was up 5%, versus 12% sales growth for the same quarter year earlier. Margins improved with expanding scale, but were it not for stock buybacks, per-share profit growth would have cooled too. InterActiveCorp is slowing down as well, and Amazon hasn't even yet applied its full-court press.

Jo-Ann Fabrics

Even something as mundane and common, yet garment-specific, as fabric could be upended by Amazon.

At first glance, it doesn't appear Amazon has given its fabric and material business any particular special attention. Many of the sewing and craft supplies the website offers are featured on the same basic page used to sell all sorts of other goods. And the featured seller, Fabric.com, appears to be the beneficiary of the usual handoff Amazon makes when a customer needs something that can't be sold en masse.

But take a closer look at the website that Amazon.com redirects you to when you click on the sizeable at the top of the "Fabrics" page. You're buying fabric by the yard from Fabric.com, but Fabric.com is wholly owned by Amazon.

It's a very un-Amazon-like business, though the company knows something most consumers and investors don't: The fabric and sewing supply retailing market is worth about $4 billion per year, and globally, the textile market is expected to be worth more than $1 trillion by 2025.

That's more Amazon-like! Amazon's edge in the arena is that it has the much-needed scale that most textile outlets and retailers don't. That's a problem for Jo-Ann Fabrics.

Lululemon Athletica, Under Armour

If you own any activewear sporting the Goodsport, Rebel Canyon or Peak Velocity labels, you're actually wearing one of Amazon's homegrown house brands. The company got into the business for itself in late 2017.

The foray was a modest one – more of an experiment than something meant to make a splash. It largely was meant to fill gaps left unfilled by the athletic apparel names that weren't offering the entire breadth of their lineup at Amazon.com. Most everything Amazon does, however, starts small and eventually gets big enough to become disruptive.

It's a shot at names such as Lululemon Athletica (LULU) and Under Armour (UAA), which are well-recognized brands but fiscally struggling companies. Under Armour has been saddled by (admittedly shrinking) debt, while Lululemon is finding that an increasingly competitive environment isn't driving profits any higher despite rising revenue.

Nike (NKE) is vulnerable too, but being the biggest and most respected name in the business, it could just as easily benefit from the fact that Amazon has put other activewear manufacturers on the defensive. And in fact, Nike moved to cut any reliance on Amazon by taking its wares off the site, which will allow it to focus on its direct-to-consumer business.

It wouldn't be a stretch to think Amazon could wreak significant havoc in the semi-specialized apparel arena. Internet Retailer's report for 2019 indicates that U.S. online sales of apparel improved more than 18% last year, and now make up 34.4% of all U.S. clothing sales. That's up from 30.6% the year before, playing right into Amazon's expansive reach. In fact, Coresight Research reported in March that the e-commerce giant eclipsed Walmart and Target to become the world's biggest clothing retailer.

Office Depot, Staples

Reminder: Office Depot (ODP) and OfficeMax are now one and the same company, having merged back in 2013 as a means of defending itself from the slow disintegration of the office supply business.

Amazon.com – and Amazon Business in particular – put that disintegration into motion.

It still wasn't enough. That's why Office Depot and privately held Staples sought a merger of their own a couple of years later, explaining that unless the two retailers worked as one, neither would survive. The Department of Justice didn't buy into the argument, however; it feared that whittling down the number of large brick-and-mortar office supply outfits would harm consumers.

Little has changed since then. Office Depot managed to top its second-quarter earnings estimates, catapulting ODP shares higher, but a closer look at the Q2 report reveals that not all of the tepid growth was even organic. It was driven by acquisitions and new initiatives. And there was no sales growth in Q3 – revenues declined 4% year-over-year.

Staples doesn't have to disclose its quarterly results, but it's difficult to see how it could be faring much better than ODP. Neither can compete with Amazon's prices, and low prices are everything to business customers.

Pandora

Satellite radio company Sirius XM (SIRI) threw Pandora a much-needed lifeline in early 2019, acquiring the struggling company for a modest $3.5 billion. But the online music platform still faces a steep uphill battle. Shortly after the Pandora/Sirius deal was consummated, eMarketer projected that Spotify's growth trajectory and Pandora's deteriorating membership would continue to dwindle. By 2021, Spotify's (SPOT) subscriber base should be larger than its rival's. If Sirius can't stop that bleeding, it might throw in the towel on Pandora altogether.

But Spotify isn't guaranteed to be a thriving survivor, either. It's also fighting a tough battle against a much bigger Apple (AAPL) and a much deeper-pocketed Amazon.com, which offers Amazon Music in several different packages. Amazon is able to leverage its Echo smart speaker line too. It recently offered an Echo Dot for a mere 99 cents to consumers who have a subscription to Amazon Music, which costs a modest $8 per month.

Whatever Amazon is doing, it's working. The e-commerce giant isn't forthcoming about its music subscriber numbers, but it was estimated in that by the middle of 2019, Amazon's music services grew 70% year-over-year, outpacing the growth Apple and Spotify mustered.

There's only room for so many music-streaming platforms in the marketplace. And while Amazon isn't the market leader – that's still Spotify – the presence of a disruptive Amazon Music could still be enough to displace Pandora.

Rite Aid

- Rite Aid (RAD) has been on its last legs for a while. Indeed, truth be told, it's surprising the pharmacy chain still is around in a recognizable form. Rivals CVS Health (CVS) and Walgreens (WBA) both enjoy scale that Rite Aid simply doesn't have, and Rite Aid's sale of nearly 2,000 of its stores by early 2018 only exacerbated the problem. It needs to improve relative profitability, which is more difficult to do – not easier – the smaller an organization becomes.

It might be Amazon that ultimately deals the proverbial death blow to the drugstore market's third-place player, however.

Amazon's 2018 purchase of online pharmacy PillPack is one reason. CVS and Walgreens can hold their own against the digitally operated rival, but Rite Aid doesn't have a solid enough foundation to do the same. The fact CVS and Walgreens are now in a heated tiff with Amazon's pharmacy operation underscores the depth of the threat. The two brick-and-mortar names are suggesting that PillPack hasn't secured the proper customer consent to transfer a doctor's prescription to the alternative provider.

Meanwhile, Rite Aid is increasingly facing off against Amazon with items sold on its store floors. Amazon's home-grown brand of consumables sold under the AmazonBasics label includes goods like hearing-aid batteries, light bulbs and plastic cups just to name a few.

Sears, JCPenney

In all fairness, Amazon has been making things tough for all brick-and-mortar retailers.

- Sears (SHLDQ) was the wounded and sickest member of the herd, though, finally forced into bankruptcy protection a year ago ... and even then its ultimate survival remains in question. Meanwhile, it looked for a while like JCPenney (JCP) would be able to keep its head above water while former Home Depot (HD) Marvin Ellison led the retailer through a turnaround. His exit in early 2018, however, might be a not-so-subtle hint that it's only a matter of time before this ship sinks, too.

Amazon competes with both iconic retailers on most fronts. The e-commerce giant, for instance, also offers Maytag appliances, and may have been the driving force of the severed relationship between Sears and Whirlpool. As for JCPenney, hosting Sephoras within its stores has been one of its few recent success stories, but those goods also are available at Amazon.com.

Where Amazon has and continues to hit Sears and JCPenney hard, however, is in the apparel arena. As mentioned above, Amazon has become the country's largest clothing seller. Apparel is a huge category for JCPenney and Sears, and the fact that more than one-third of all apparel sales are now done online largely leaves both players on the outside looking in.

Sprouts Farmers Market, The Fresh Market, Trader Joe's

It's not exactly a secret that people across the U.S., and around the world for that matter, are increasingly concerned about what they're eating. Chemicals and pesticides are completely out of fashion, as is genetically modified produce. En vogue are organic goods, and where at all possible, locally sourced foods.

It's a trend that initially sprang life for outfits such as Sprouts Farmers Market (SFM), The Fresh Market and Trader Joe's, which historically have been the go-to options for health-conscious consumers. Now that rival grocer Whole Foods Market is an Amazon holding, it can benefit from Amazon's strong marketing reach.

That's not the only edge Amazon has on its organic-grocery rivals, however.

Unlike Trader Joe's and Sprouts, Amazon doesn't necessarily have to turn a profit in the grocery biz anytime soon. As long as it can break even and/or be subsidized by the company's e-commerce operations, AMZN can win the organic grocery wars by attrition, and then focus on profits. The fact The Fresh Market announced more than a dozen store closings were in the works as of the middle of 2018 – and a handful more locales were added to the closure list this year – suggests the plan may be working.

The kicker: Amazon is no longer limiting itself to higher-end organic and whole-foods fare. The company announced in mid-2019 it was planning to build a chain of more conventional grocery stores. That's a threat to Kroger and Walmart, to be sure. But it could also peel off some less-than-completely loyal customers of Sprouts, TFM and Trader Joe's, too.

Teachers Pay Teachers

- Teachers Pay Teachers is an unconventional, though brilliant, business idea. Rather than proverbially re-create the wheel, teachers can produce structured classroom handouts and materials, then sell them to other (often overworked) teachers who might not have the time to do so for themselves.

It's not exactly clear how big the market is. It's estimated that Teachers Pay Teachers – the biggest name in the business – generates just a little less than $10 million in annual revenue. It splits revenue with its participants on a 50/50 basis, so the teachers selling lesson plans are also effectively pocketing another $10 million per year, give or take. But for perspective: The market size for K-12 curriculum materials in the U.S. is estimated to be $8 billion per year. Less and less of that is being directed toward traditional providers, as teacher-made materials gain popularity.

Amazon's increasingly disruptive role in the middle of that melee is its relatively new Amazon Inspire site, which is "an open collaboration service that helps teachers to easily discover, gather, and share quality educational content with their community."

The problem for Teachers Pay Teachers and its peers? Amazon Inspire is free to use.

That might not always be the case, but as long as it's free, it's a threat to for-profit sites in the same arena. Conversely, should Amazon eventually opt to make it a profit center, it's apt to turn up the heat on promoting Amazon Inspire. Either way, it's already racked up a couple of victims: Educents and Teacher's Notebook, both of which had to shut down in 2018.

W. W. Grainger

When Amazon officially entered the B2B (business-to-business) market in 2012 with what was then called AmazonSupply, few heads turned. It's not a scintillating market – particularly the maintenance and repair sliver of it – and it wasn't clear how well the company would be able to stand up to localized specialists like W. W. Grainger (GWW).

Investors should have given Amazon more credit. Although it has been a slow burn, the e-commerce behemoth might be prompting Grainger to make moves that often signal the advent of considerably tougher times.

The biggest of those red flags is price cuts Grainger has made, following Amazon's lead. The impact of those cuts, however, have yet to take shape. Bloomberg Intelligence analyst Christopher Ciolino explained in July, "W.W. Grainger's strategy of lowering prices to grab market share has spurred better than expected volume, yet growth is poised to moderate in 2019-20 amid a slowing industrial economy. An increasingly competitive market, including a growing threat from online rivals, may result in structurally lower prices and gross profit across the industry."

This doesn't suggest that the coming year will mark the end of Grainger. But it could be another slow step in that direction.

Toys "R" Us … Again

In last year's rundown of companies that Amazon could end, Toys "R" Us was already a confirmed kill. The toy retailer never really worked its way out of its 2017 bankruptcy, so by March 2018, the organization finally decided to shutter all of its remaining stores for good.

Now it's back ... sort of.

Earlier in 2019, a consortium of private equity outfits purchased the still-loved toy retailer and is attempting to rebuild the Toys "R" Us chain in a much different way. While no new stores will be set up in time for this year's holiday shopping season, the brand's new owners seem to understand that a modern-era toy story has to offer immersive experiences. They also need to be smaller and feel less like a warehouse.

The effort will be interesting. But the kind of stores being planned are expensive and labor-intensive, and will require a re-training of consumers that have now become accustomed to purchasing toys from Target, Walmart and … Amazon.

Then there's the not-so-small reality that once again a brick-and-mortar retailer could provide free "showrooming" services for Amazon. That's where consumers visit a physical store location to learn more about a particular product, then go online to make the purchase from Amazon at what's sure to be a lower price.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

Santa Claus Rally at Risk as Tech Stocks Slump: Stock Market Today

Santa Claus Rally at Risk as Tech Stocks Slump: Stock Market TodayThe Nasdaq Composite and Dow Jones Industrial Average led today's declines as investors took profits on high-flying tech stocks.