10 Commodities to Buy to Beat Back This Volatile Market

That bout of weakness in February turned out to be a lot more than just another little market hiccup to file away and forget.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

That bout of weakness in February turned out to be a lot more than just another little market hiccup to file away and forget. The market only partially recovered, then gave into additional weakness.

This may be the beginning of a major regime change. Thanks to a tight labor market, more fiscal stimulus layered on to an economy that doesn’t need it, and broad global economic strength, inflation could be on the way. That should mean higher interest rates, too.

This will change everything about the tone of the market, what assets do well, and which ones don’t. One good way to prepare is to own commodities now, and these are just a few reasons why:

- Rising rates hurt stocks and bonds but not commodities. They outperform all asset classes during rate hiking cycles, Goldman Sachs analyst Hui Shan says.

- Commodities provide good diversification at a time when you’ll need it, as the rate-hike-induced volatility continues. “The very best years for commodities have been the worst years for stocks and bonds,” says Larry McDonald of the Bear Traps Report.

- Commodities are out of favor. This makes them a nice contrarian bet. “Investors are still underinvested and will look to add on dips,” Goldman Sachs analyst Jeffrey Currie says. They have less than 1% of their portfolios in commodities, but that can rise to almost 10% during commodity bull markets, McDonald says.

- Synchronized global growth will continue to boost commodity demand.

- Commodities look very cheap relative to stocks on a historical basis, says Samuel Pelaez, who helps manage the U.S. Global Investors Global Resources Fund (PSPFX).

“The environment for investing in commodities is the best since 2004-08,” Currie says. Here are nine ways to get invested.

Data is as of April 2, 2018. Click on ticker-symbol links in each slide for current share prices and more. Michael Brush is the editor of the stock newsletter Brush Up on Stocks.

Broad Commodity Baskets

The commodities-based S&P GSCI Total Return Index trades at roughly the same value as the Standard & Poor’s 500-stock index, compared to an 8x multiple in 2008, says Jim Paulsen, chief investment strategist at Leuthold Group. This relative value metric puts commodities at close to a 50-year low. One way to take advantage of this deep discount relative to stocks is to just buy them all, or at least most of them.

You can do this by purchasing exchange-traded products (ETPs) such as funds (which actually hold assets) and notes (which are debt instruments that track an index and perform like a fund would). A popular product is the iShares S&P GSCI Commodity-Indexed Trust (GSG, $16.38). This gives you exposure to everything from energy and industrial metals, to precious metals, “soft commodity” agricultural goods and livestock, via futures contracts on the GSCI index mentioned above.

Other broad-commodity options to research further, to determine what strategy is best for you, include the GS Connect S&P GSCI Enhanced Commodity Total Return Strategy Index ETN (GSC, $24.83), iPath S&P GSCI Total Return Index ETN (GSP, $15.59), iPath Bloomberg Commodity Index Total Return SM ETN (DJP, $24.13) and Elements Linked to the Rogers International Commodity Index - Total Return (RJI, $5.45).

One risk with many commodity funds is that they get exposure by purchasing futures contracts, then rolling them over as they expire. Depending on how futures contracts are priced at the time, this can erode value.

“Soft” Commodities

While going with a broad basket of commodities makes sense, investors who want to be more tactical and select only one or two. McDonald from Bear Traps Report says it may be wise to focus on agricultural or “soft” commodities, and cites three catalysts.

First, there’s “La Niña,” a weather pattern marked by cooler sea surface temperatures in parts of the Pacific Ocean. This creates dry weather in the U.S., which can hurt corn, soybeans and wheat crop yields. Dry conditions in Argentina and Brazil can diminish corn and soybean yields there. Next, agricultural commodities benefit from a declining dollar. And finally, soft commodities are out of favor.

“We view this negative backdrop as highly unsustainable,” McDonald says.

You can get exposure to grains via the iPath Bloomberg Grains Subindex Total Return SM ETN (JJG, $26.17), which invests in five grains: corn, soybean meal, soybean oil, soybeans and wheat. Or you can invest in a broader basket of soft commodities via the PowerShares DB Agriculture Fund (DBA, $18.71), which includes grains, as well as sugar, cocoa, cattle and a few other commodities.

Another option is Mosaic (MOS, $23.67), a publicly traded company that sells fertilizers. When crop prices go up, farmers buy more fertilizer to maximize crop yields. Another plus for Mosiac: India, a big user of crop fertilizers, has low inventories and this could support demand, says Pelaez, from the U.S. Global Investors Global Resources Fund.

Oil

Oil shook off its slump to practically double between early 2016 and early 2018. The decline before this rebound was so quick and painful, many energy investors can’t believe the rebound will last. But the doubters will be proven wrong.

Global economies are in synch, which supports broad oil demand. Saudi Arabia, an OPEC lynchpin, needs high oil prices to fund its national budget and assure a successful flotation of part of its national oil company. Many U.S. shale producers suffered a near-death experience when oil prices plummeted; however, fears they will again borrow too much and flood the market are overblown. In the background, the Middle East remains a tinder box of geopolitical tensions that could flare up and drive oil higher at any moment.

Goldman Sachs predicts Brent oil will trade at $82.50 a barrel by July.

One way to play rising oil prices is to buy the SPDR S&P Oil & Gas Exploration & Production ETF (XOP, $34.03), which as the name implies holds roughly 70 companies focused on the exploration and production of oil and gas, including Callon Petroleum (CPE) and Whiting Petroleum (WLL). It also equal-weights these companies so that no single company has too large an effect on the fund’s performance.

For individual stocks, you can consider RSP Permian (RSPP, $43.90) and Continental Resources (CLR, $57.70). RSP Permian is a well-managed company that’s on the Credit Suisse list of top stock picks. Continental Resources is another quality producer run by industry veteran Harold Hamm. Management is definitely on your side, here. Hamm was recently buying a lot of stock, and his family owns over two thirds of the shares.

Natural Gas

Natural gas prices haven’t risen as much as oil, and it’s tougher to make a bullish case here. So much natural gas comes up as a byproduct of oil production that there’s an abundance of it. Still, natural gas producers are so out of favor, you might not need much of a price increase to see their stocks go up a lot. Low inventories and the coming summer cooling season could put a bid under prices.

This is what an insider at Range Resources (RRC, $13.74) seems to be telling us with his recent stock purchases. The buying makes sense, because Range Resources recently traded at a 20% discount to the company’s valuation of its assets. And this valuation excludes undeveloped well potential.

Range Resources is mostly in the Marcellus Shale in Pennsylvania, where it holds excellent properties. It also holds less attractive properties in the Lower Cotton Valley formation in Louisiana, where it is wisely winding down development to focus on Pennsylvania. Moreover, the company plans to sell assets to bring down debt levels.

On the growth front, production improved by 30% last year, and proved reserves increased 26%. The company turned profitable during the year, and cash flow grew 111% on 137% sales growth. Better still, RRC thinks it can grow production 11% a year over the next five years.

Liquefied Natural Gas

Natural gas may be cheap in the U.S., but it costs two or three times as much in a lot of the world, including Asia – where China is looking to use more to produce electricity. It wants to cut coal use to bring down pollution.

But how do you get natural gas to Asia from the U.S.? You freeze it, load it into tanks and ship it there so it can be warmed up again and used. This sounds simple, but it’s actually a complicated and capital-intensive process. So if you want to invest in this trend, it pays to go with an experienced management team.

That’s what you get at Tellurian (TELL, $7.08). This small-cap LNG startup is led by Charif Souki, who founded one of the giants in the space, or Cheniere Energy (LNG). Souki left that company a few years ago when activist Carl Icahn took a large position and edged him out in a dispute over how to use the corporate cash. Icahn preferred dividends, but Souki, the consummate entrepreneur, wanted to invest it.

Souki took a lot of his management team with him to his Tellurian startup. It’s a deep bench. Together, this team have created about 25% of the LNG capacity in the world. Tellurian has a novel “condominium” approach to raising capital. Instead of selling LNG, it’s selling two-thirds of its capacity to raise capital. This will help it avoid heavy debt. It’s keeping a third of the capacity to sell LNG itself. The company says it should sign partners to fund more than a third of capacity by year’s end. This could move the stock up a lot.

Sand

Sand is lying around for free in many places, so who would want to pay for it? Lots of companies, as it turns out – including producers of glass and chemicals, and above all, energy.

Sand plays a key role in fracking. Energy producers inject it into rock structures to stimulate production and hold fissures open so that energy can be extracted. A key supplier of this kind of sand is U.S. Silica Holdings (SLCA, $24.14). It mines, processes and sells more than a hundred different types of silica in various shapes, sizes and purity levels.

But it’s also a logistics company, in a way. That’s because sand must arrive on time, so as not to keep expensive rigs and crews waiting. U.S. Silica Holdings has been expanding via acquisitions in Texas and the Permian basin. By locating capacity in the Permian, the company is cutting transportation times and costs. Many sand suppliers ship from out of state.

The stock has recently been weak in part because U.S. Silica locked in a higher percentage of sales via medium-term contracts. This means it’s giving up a bigger piece of the spot market where prices are higher. Investors didn’t like this, but a cluster of insiders – including the CEO – thinks the selling in their stock is overdone. They were recently sizeable buyers.

Lumber

Lumber prices have been rising sharply for months. One risk ahead is rising interest rates, which could cool off housing demand by driving up mortgage rates.

But interest rates might rise only gradually. And they’d still have to go up a lot to get back to historical levels. Mortgage rates would have to double to hit highs last seen in 2000, according to data from Freddie Mac.

Besides, one of the best predictors of housing demand is job market strength. With unemployment near historic lows, you can check that box. Over the next few years, lumber will see increased demand as the rebuilding continues in communities hit by hurricanes in Houston, Florida, and Puerto Rico.

Infrastructure spending programs from Washington, D.C. will also support demand, says Pelaez, from the U.S. Global Investors Global Resources Fund. Behind the scenes, pine beetles have been eating into supplies, he notes. A company he likes as a lumber play is West Fraser Timber (WFTBF, $66.45). The company, based in Vancouver, expanded last year by purchasing another mill business.

Emerging Markets

Developing countries have come a long way in terms of bringing more value-added businesses into their economies. But many of them still export lots of natural resources, which means they still win big when commodity prices go up. So it makes sense to invest in them now.

“Commodity-rich countries will once again outperform, and we are overweight resource-heavy emerging markets,” says McDonald, of the Bear Traps Report.

Here are a few more reasons to favor emerging markets. Most foreign economic recoveries are relatively young compared to the U.S. recovery, says Paulsen, of Leuthold Group. So there’s more room for positive surprises in GDP growth, job creation and earnings growth. “They also face less overheat pressures and enjoy more accommodative policies,” he says. And their markets are cheaper. Yet they still remain under-owned. They are not a crowded trade.

You can get broad exposure via the Vanguard FTSE Emerging Markets ETF (VWO, $46.29) and the iShares MSCI Emerging Markets ETF (EEM, $47.41), two of the classic ETFs in the space. VWO and EEM both invest different amounts in stocks from countries such as China, Taiwan, Russia, Brazil and India, but the main difference is that EEM also invests in South Korea, where VWO does not.

McDonald favors natural resource- and commodity-rich countries where central banks are still easing, such as Russia and Brazil. “Brazilian equities look poised to outperform in 2018,” he says. Investors can get focused exposure to each of those countries via the iShares MSCI Brazil ETF (EWZ, $34.03) and VanEck Vectors Russia ETF (RSX, $22.48).

Gold and Silver

Beside benefitting from a weak dollar, gold is a classic inflation hedge because investors perceive it is a store of value. It also will get support from emerging-market economic strength since that drives up gold demand, says Goldman Sachs analyst Michael Hinds. One of the most direct ways to get exposure is via ETFs such as the iShares Gold Trust (IAU, $12.89), which moves with the price of gold and is backed by real, physical bullion stored in vaults. Pelaez, at U.S. Global, favors companies that own royalty streams backed by mine production, such as Franco Nevada (FNV, $69.59).

But silver may be a better bet here, says McDonald, because gold trades at such a big premium to silver. The gap between the two is one of the widest in 15 years. “Gold’s richness to silver is highly unsustainable,” he says. “In a risk-off ‘buy metals’ move, silver tends to widely outperform gold. Likewise, as an industrial metal, silver is cheap relative to the global economic backdrop.”

You can get similar exposure to the IAU gold ETF via the iShares Silver Trust (SLV, $15.65). Pelaez, at U.S. Global, likes SSR Mining (SSRM, $9.72), which has a diversified asset base in the U.S., Canada and Argentina.

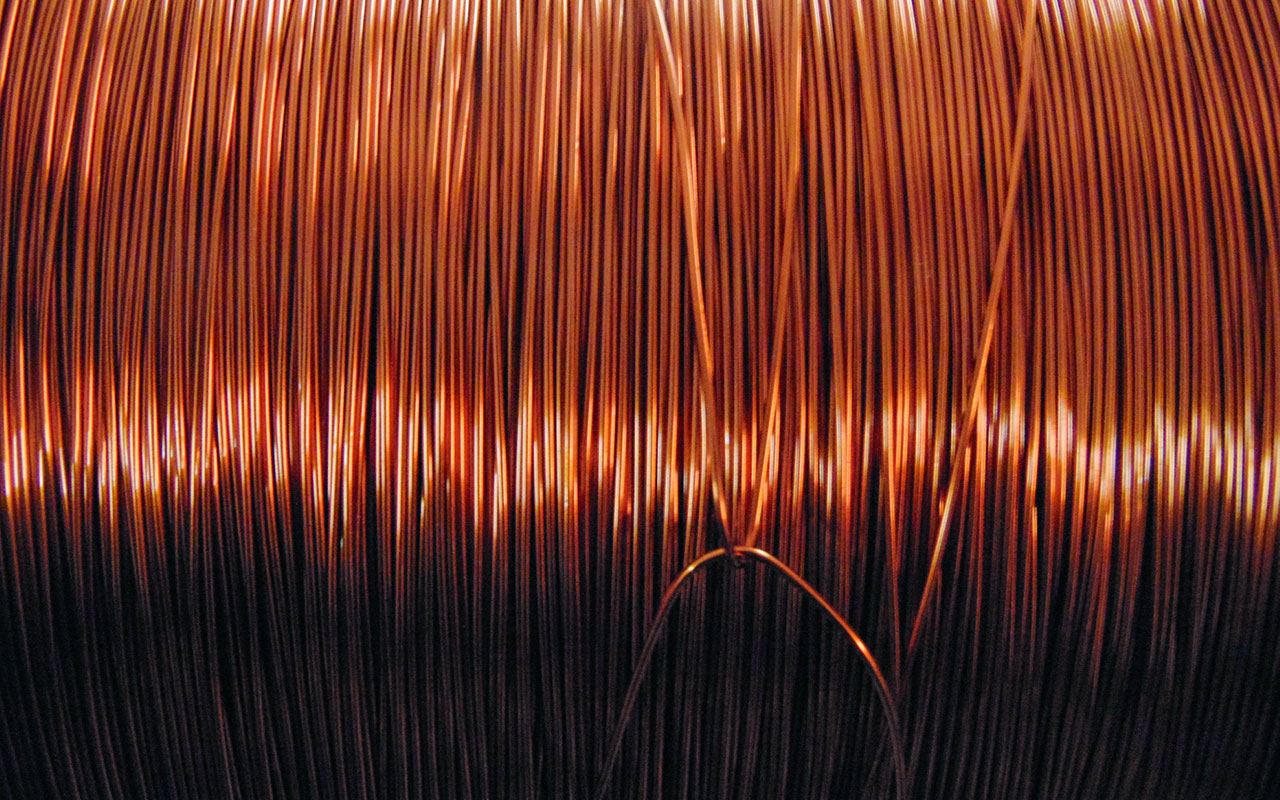

Copper

Economists like to call this metal “Dr. Copper.” It’s used in so many things, from industrial wiring, and mobile phones, to new homes, that economists think its price does a great job of forecasting economic trends – so much so that they’ve granted it an honorary Ph.D. in economics.

Given that virtually all of the global economies are synchronized in growth mode, copper should trend higher medium term. In particular, copper is a play on continued solid growth in China and India, two very large global copper consumers. China’s copper imports in January were strong, says Goldman Sachs’ Currie, despite concerns about government deleveraging cooling off growth. Copper prices also will get a push from increased infrastructure spending in the U.S.

- Southern Copper (SCCO, $54.23) and Freeport-McMoRan (FCX, $17.14) are two of the largest copper plays, as measured by reserves and production. If you’re merely looking to track the metal rather than use indirect plays such as stocks, you can consider exchange-traded products such as the United States Copper Index Fund (CPER, $19.41).

Michael Brush owned TELL as of this writing. Brush has suggested RRC, RSPP, SLCA and TELL in his stock newsletter Brush Up on Stocks. Brush is a Manhattan-based financial writer who has covered business for the New York Times and The Economist group, and he attended Columbia Business School in the Knight-Bagehot program.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

Stock Market Today: Powell Rumors Spark Volatile Day for Stocks

Stock Market Today: Powell Rumors Spark Volatile Day for StocksStocks sold off sharply intraday after multiple reports suggested President Trump is considering firing Fed Chair Jerome Powell.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Is Goldman Sachs Stock Still a Buy After Earnings?

Is Goldman Sachs Stock Still a Buy After Earnings?Goldman Sachs stock is struggling for direction Tuesday even after the financial giant beat expectations for its third quarter. Here's what you need to know.

-

Ford Stock Is Rising After Getting a Big Upgrade at Goldman Sachs

Ford Stock Is Rising After Getting a Big Upgrade at Goldman SachsFord stock has struggled in recent months, but Goldman Sachs is upbeat about improving profitability. Here's what you need to know.

-

Goldman Sachs Reports Q2 Earnings Beat, Dividend Hike

Goldman Sachs Reports Q2 Earnings Beat, Dividend HikeGoldman Sachs stock finished higher Monday after the big bank beat expectations for its second quarter and raised its dividend. Here's what you need to know.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.