10 Dividend Aristocrats Expected to Deliver Big Gains in 2020

Serial dividend raisers, such as the Dividend Aristocrats, are beloved by income hunters.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Serial dividend raisers, such as the Dividend Aristocrats, are beloved by income hunters. Remember: A steady payout is only half of the formula for successful income investing. The big returns come over time, from regular dividend increases, which lift the yield an investor receives on his or her original cost basis.

But while these dividend-hiking stalwarts usually aren't known for their hot growth prospects, a few are indeed poised to outperform in 2020.

To find price upside among dependable dividend stocks, we started with the Dividend Aristocrats. For the uninitiated, the Aristocrats are an index of 57 S&P 500 companies currently that have raised their payouts annually for at least 25 years.

Next, we calculated the implied upside for all 57 Aristocrats based on analysts' average price targets. A price target is the level at which analysts forecast a stock will trade at some point in the future, typically 12 months out.

After running the numbers, we were left with 10 Dividend Aristocrats that offered projected upside of at least 10% in the year ahead. Add in the contributions from their dividends, and these primarily defensive stocks may deliver significant offense in 2020.

Share prices are as of Nov. 12 unless otherwise noted. Price targets and other data are courtesy of S&P Global Market Intelligence. Companies are listed by expected share-price gains over the next 12 months, from lowest to highest. The list of Dividend Aristocrats is maintained by S&P Dow Jones Indices. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price. Dividend history based on company information and S&P data. Dividend-growth streaks include the current year if the company has announced a dividend hike in 2019.

General Dynamics

- Market value: $53.5 billion

- Dividend yield: 2.2%

- Implied upside: 10%

Generous military spending has helped fuel General Dynamics' (GD, $185.28) steady stream of cash returned to shareholders. One of its latest mega-deals came in August, when the Pentagon awarded General Dynamics subsidiary CSRA a 10-year cloud computing contract worth $7.6 billion.

The defense contractor is one of the newer members of the Dividend Aristocrats; it was added to the elite list of dividend growers in 2017. General Dynamics has upped its distribution for 27 consecutive years. The last raise was announced in March 2019, when GD lifted its quarterly payout by nearly 10%, to $1.02 per share.

Analysts see above-average price appreciation on the horizon. With an average price target of $203.79, Wall Street expects shares to rise 10% over the next 12 months or so. Cowen analyst Cai von Rumohr, who has a $202 price target, says recent weakness in the stock is a buying opportunity given GD's low valuation versus peers and its improving ability to generate cash.

Between share-price gains and the dividend, General Dynamics is set to outperform in the year ahead.

Roper Technologies

- Market value: $36.1 billion

- Dividend yield: 0.5%

- Implied upside: 10.4%

- Roper Technologies (ROP, $343.28) – an industrial company whose businesses include medical and scientific imaging, RF technology and software, and energy systems and controls, among others – was added to the Dividend Aristocrats in 2018. The diversified industrial company was tapped for the honor after it hiked its dividend for a 25th straight year at the end of 2017. It tacked on another 12%, to its current 46.25 cents per share, with its late 2018 announcement.

Analysts see good things ahead for Roper in 2020. Their average price target of $379.14 suggest the stock will rise more than 10% on a price basis alone.

The pros expect those gains will be driven by profit growth, which they believe will run at nearly 12% annually over the next half-decade. Some of that might be sparked by iPipeline, a life insurance software company that Roper acquired for $1.6 billion in August. RBC Capital analyst Deane Dray (Outperform, equivalent of Buy) praised the buyout, which he said was in the company's "wheelhouse."

And with a dividend payout ratio of just 14% of profits, Roper should have ample room to make generous hikes for many years to come.

Abbott Laboratories

- Market value: $148.4 billion

- Dividend yield: 1.5%

- Implied upside: 10.7%

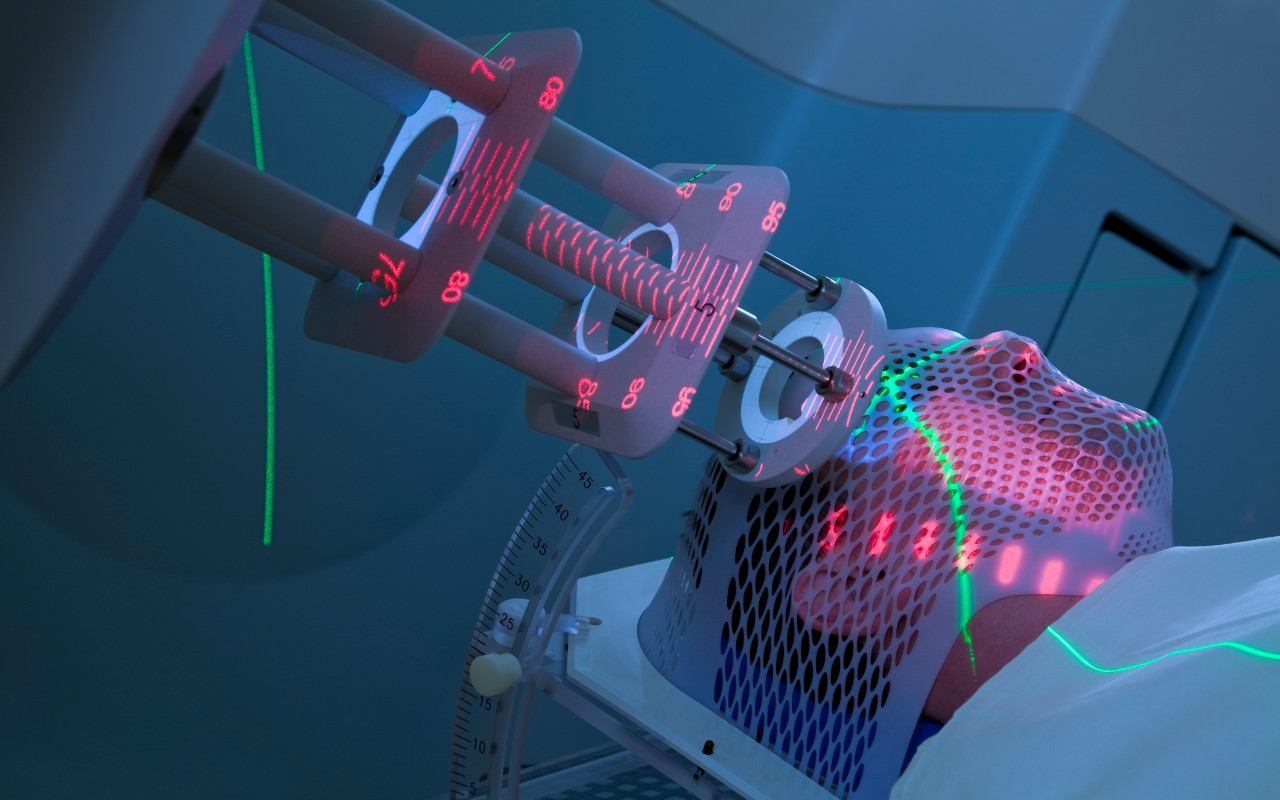

Following its 2013 spinoff of fellow Dividend Aristocrat AbbVie (ABBV), Abbott Laboratories (ABT, $84.34) focused on branded generic drugs, medical devices, nutrition and diagnostic products. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices.

The company had been expanding by acquisition for years, including closing on deals for medical-device firm St. Jude Medical and rapid-testing technology business Alere in 2017. After taking a year off, Abbott in January 2019 announced it had exercised an option allowing it to buy medical device company Cephea Valve Technologies, which is developing a heart valve replacement technology.

Abbott's earnings are forecast to grow at an average annual clip of 10.2%. The average price target of $93.39 gives ABT implied upside of nearly 11% over the next 12 months. That's roughly where Morgan Stanley analyst David Lewis (Overweight, equivalent of Buy) sees Abbott's shares landing in the next 12 months. Lewis sees big potential in mitral regurgitation treatment MitraClip, as well as its FreeStyle Libre line of continuous glucose monitoring systems.

Income investors can count on the dividend providing a boost to total returns. ABT, whose corporate history dates back to 1888, initiated its dividend in 1924. It has been growing that payout annually for 47 consecutive years.

Becton Dickinson

- Market value: $65.9 billion

- Dividend yield: 1.3%

- Implied upside: 11.3%

Medical-device maker Becton Dickinson (BDX, $242.36) has bulked up over the past few years. In 2015, it acquired CareFusion, a complementary player in the same industry. In 2017, it struck a $24 billion deal for fellow Dividend Aristocrat C.R. Bard, another medical products company with a strong position in treatments for infectious diseases. And in 2018, BDX bought out TVA Medical, which develops vascular access technologies.

Economies of scale and related cost-savings efforts have analysts bullish on the profit outlook. The Street expects BDX to generate average annual earnings growth of 11.2% for the next five years, according to S&P Global Market Intelligence.

Analysts have an average price target of $269.78 on the stock, implying upside of more than 11% in the next year or so. Piper Jaffray's William Quirk (Overweight) is aiming even higher, assigning a price target of $279. He believes Becton Dickinson's guidance for fiscal 2020 is too conservative.

BDX is a longtime member of the Dividend Aristocrats by virtue of its 47-year streak of annual dividend increases – a track record that should offer peace of mind to antsy income investors.

Chevron

- Market value: $228.6 billion

- Dividend yield: 3.9%

- Implied upside: 11.6%

Stable oil prices and cost savings are projected to help Chevron (CVX, $120.96) put up strong share-price gains in 2020.

The integrated oil giant, with operations in natural gas and geothermal energy, was forced to slash spending in the wake of the 2014 oil-price rout. But the strategy is paying off in today's steadier environment. Analysts forecast shares to hit $135.04 about 12 months from now, giving Chevron's stock implied upside of nearly 12%.

"CVX has an attractive global asset base with the potential for solid production growth and best-in-class cash margins versus global integrated peers," says JPMorgan analyst Phil Gresh, who rates the stock at Overweight and has a $139 price target.

A dividend yield of almost 4% will add juice to Chevron's outperformance.

With more than three decades of uninterrupted dividend growth under its belt, this Dow Jones stock has a track record that instills confidence. Chevron's most recent hike came in January, when the company boosted its quarterly payout by more than 6% to $1.19 per share.

Exxon Mobil

- Market value: $291.2 billion

- Dividend yield: 5.0%

- Implied upside: 11.8%

What goes for Chevron often goes for Exxon Mobil (XOM, $69.37).

Analysts are forecasting a similar share-price gain in XOM, also a Dow Jones component, of about 12%. That comes amid estimates for a 46% jump in adjusted earnings per share in 2020 – a rebound from what's expected to be a weak 2019.

"We believe ExxonMobil is poised for a relative recovery after several years of lagging performance," BofA Merrill Lynch analyst Doug Leggate wrote in November. He rates XOM a Buy and believes it will hit $100 per share within the next 52 weeks.

All that is before factoring in the truly generous dividend. Exxon, as one of the world's largest energy companies and the biggest oil company by market value in the U.S., is definitely good for the payouts.

Exxon and its various predecessors have strung together uninterrupted payouts since 1882. Heck, it continued to hike its payout even as oil prices declined in recent years. XOM has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6.2%.

Coca-Cola

- Market value: $224.1 billion

- Dividend yield: 3.1%

- Implied upside: 13.3%

- Coca-Cola (KO, $51.71) has long been known for quenching consumers' thirst, but it's equally effective at quenching investors' thirst for income. The company has delivered a quarterly dividend since 1920, and that cash payout has climbed annually for the past 57 years – one of the longest streaks among the Dividend Aristocrats.

In the more immediate term, the Dow stock is beginning to enjoy the benefits of its new strategy. With the U.S. market for carbonated beverages on the decline for more than a decade, Coca-Cola has responded by adding bottled water, fruit juices and teas to its product lineup to keep the cash flowing. In addition to the namesake Coca-Cola brand, KO also sports names such as Minute Maid, Powerade, Simply Orange and Vitaminwater.

Coca-Cola has ventured even farther afield of late. It completed its $5.1 billion buyout of London-based coffeehouse chain Costa Coffee in early 2019, then announced in October that it will launch a new energy-drink line, Coca-Cola Energy, in 2020.

The expanded portfolio of beverages is forecast to allow KO to post revenue growth of nearly 4% in 2020. That should help lift the stock by more than 13%, analysts reckon.

"The company is effectively navigating aggressive U.S. price increases, digesting a transformational deal (Costa), completing a global refranchising and demonstrating strong innovation capabilities while reinvigorating growth in high-margin sparkling," writes UBS analyst Sean King. King recently upgraded KO from Neutral (equivalent of Hold) to Buy and lifted his price target from $55 per share to $63, implying upside of almost 22%.

Johnson & Johnson

- Market value: $345.2 billion

- Dividend yield: 2.9%

- Implied upside: 13.7%

Diversified health-care giant Johnson & Johnson (JNJ, $131.35) recently cut its previously reported third-quarter earnings by $3 billion to account for a proposed legal settlement over its role in disseminating opioids. That, among other issues, has frustrated shareholders, who have seen their stock appreciate by a mere 2% in the same year the S&P 500 has soared by 23%.

But analysts believe that putting this latest legal headache behind it will allow JNJ's stock to take off in 2020. With an average target price of $149.37, the Street expects price appreciation of almost 14% over the next 12 months.

As counterintuitive as it seems, the news that J&J agreed in principle to pay $4 billion to settle was viewed somewhat positively in the analyst community. Credit Suisse's Matt Miksic (Outperform) raised his price target after the announcement, from $158 per share to $163, writing that it "does ratchet down the uncertainty" and "may potentially help investors begin to price in a narrower range of potential liability for the company."

The Dow component, which was founded in 1886 and went public in 1944, hiked its payout by 5.6% in April, to 95 cents per share. That extended the Dividend Aristocrat's streak of consecutive annual increases to 57.

VF Corp.

- Market value: $34.1 billion

- Dividend yield: 2.3%

- Implied upside: 15.6%

- VF Corp. (VFC, $84.72) is an apparel company with a large number of brands under its umbrella, including Vans, Timberland and The North Face outdoor products. The company has been busy on a number of fronts, making major acquisitions, divestitures and relocating its headquarters.

As disruptive as all that has been, it also sets up the apparel maker for easier year-over-year comparisons for its 2021 fiscal year, which begins in April 2020. Between that and the long-term growth rate of 12.6%, analysts see VFC shares taking off across the next year. With a target price of $97.92, the Street forecasts price appreciation of nearly 16% in the next 12 months or so.

Indeed, even after a recent earnings miss, several analysts came out in support of the Dividend Aristocrat.

"VF Corp. has significant competitive advantages that include manufacturing nearly 33% of its product in its owned factories, and owning significant expertise in the supply chain, as well as management's focus on outdoor, active and work wear brands and ability to reinvest significant amounts of cash flow to innovate product and acquire deep knowledge of their core customer," wrote Cowen analysts, who rate the stock at Outperform with a $105 price target.

Suffice to say, with a 47-year streak of annual dividend raises, the income side of the equation appears safe. VF Corp.'s payout did shrink earlier this year, from 51 cents per share to 43 cents, but that was to reflect the spinoff of its Wrangler, Lee and other brands into a new company, Kontoor Brands (KTB). Investors' dividends weren't actually cut. And in October, the company announced an 11.6% boost to the payout, to 48 cents per share.

McDonald's

- Market value: $146.5 billion

- Dividend yield: 2.6%

- Implied upside: 15.7%

Among the 57 Dividend Aristocrats, none has more implied upside in 2020 than the Golden Arches. McDonald's (MCD, $193.28), a Dow component, has an average target price of $223.57. In other words, analysts are looking for the stock to rise almost 16% over the next 52 weeks.

What makes that feat more remarkable is that those estimates reflect a recent surprise shift in the C-suite. Analysts and traders were taken aback when the company fired CEO Steve Easterbrook in October for violating policy by having a relationship with an employee.

A few analysts reacted pessimistically on the news, but things calmed down once it became apparent that new CEO Chris Kempczinski plans to stick to McDonald's successful playbook. Credit Suisse's Lauren Silberman, who maintained an Outperform rating on shares with a $230 price target after the ouster, lauded the company's "talented" bench and said any pullback in MCD shares should be considered a buying oppportunity.

The world's largest hamburger chain's dividend dates back to 1976 and has gone up every year since. MCD last raised its dividend in September, when it lifted the quarterly payout by 8% to $1.25 a share. That marked its 43rd consecutive annual increase.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.