10 Warren Buffett Stocks With the Fastest-Growing Dividends

Many investors are familiar with some of the iconic businesses Warren Buffett’s Berkshire Hathaway (BRK.B) has held stakes in for many years, or even decades.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Many investors are familiar with some of the iconic businesses Warren Buffett’s Berkshire Hathaway (BRK.B) has held stakes in for many years, or even decades. From Coca-Cola (KO) to Wells Fargo (WFC), a lot of these dividend stocks have now reached a more mature stage in their lifecycle, providing predictable income, but far from stellar payout growth.

However, Berkshire Hathaway isn’t just invested in sleepy blue chips. It also holds a group of dividend-paying stocks that have potential to continue raising their payouts at a fast clip going forward.

These companies tend to have lower payout ratios (the percentage of earnings paid out as dividends), faster long-term earnings growth and management teams who are committed to returning higher amounts of capital to shareholders each year.

Let’s take a closer look at 10 Warren Buffett stocks with the fastest-growing dividends, many of which should continue rising at a double-digit pace.

Data is as of March 9, 2018. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Click on ticker-symbol links in each slide for current share prices and more.

Sirius XM Holdings

- Market value: $29.4 billion

- Dividend yield: 0.70%

- 1-year dividend growth rate: 10%

Berkshire Hathaway acquired its stake in Sirius XM Holdings (SIRI, $6.54) during the fourth quarter of 2016. Interestingly, Sirius XM announced it would start paying its first regular dividend during that same quarter.

Despite the company’s short track record paying dividends and its relatively low yield, Sirius XM’s business model is very conducive to predictable, generous long-term dividend growth. In fact, management most recently boosted the company’s dividend by 10% in November 2017.

Sirius XM is a satellite radio business with long-term distribution relationships with major automotive manufacturers. The company makes its money by charging subscription fees to its 32.7 million subscribers for access to its radio channels that cover everything from sports and music, to news and comedy.

The firm’s massive base of subscribers allows Sirius XM to leverage its fixed costs to achieve impressive profitability; the company’s free cash flow margin sits above 25%. Adding subscribers requires little incremental cost, so every dollar of higher revenue really contributes to the company’s bottom line.

With a payout ratio near 20% and management guiding for continued subscriber growth in 2018, Sirius XM is poised to continue rewarding dividend growth investors for the foreseeable future.

Southwest Airlines

- Market value: $35.1 billion

- Dividend yield: 0.8%

- 5-year annual dividend growth rate: 69%

- Southwest Airlines (LUV, $59.70) has been in business for more than 40 years and serves more than 120 million passengers annually. As the largest domestic air carrier, Southwest’s ascent to success has been fueled by a strong focus on customer service and low prices.

Chris Higgins, a senior equity analyst with Morningstar, notes that Southwest “obtained a cost advantage by flying one aircraft type (737s) with one-class cabins point to point to secondary airports, which allowed it to minimize costs and maximize aircraft utilization and employee productivity.”

Despite the airline industry’s notorious reputation for volatile earnings and bankruptcies, Southwest’s low-cost operations have helped the company remain profitable for 45 consecutive years. As a result, LUV has been able to pay uninterrupted dividends for more than 25 consecutive years, recording 21% annual dividend growth over the last 20 years, according to data from Simply Safe Dividends.

With a payout ratio below 15%, an investment-grade credit rating and an outlook for continued profitability, Southwest’s shareholders should see their dividend payments continue flying higher in the years ahead.

MORE FROM SIMPLY SAFE DIVIDENDS: Warren Buffett’s Top 10 Pieces of Investment Advice

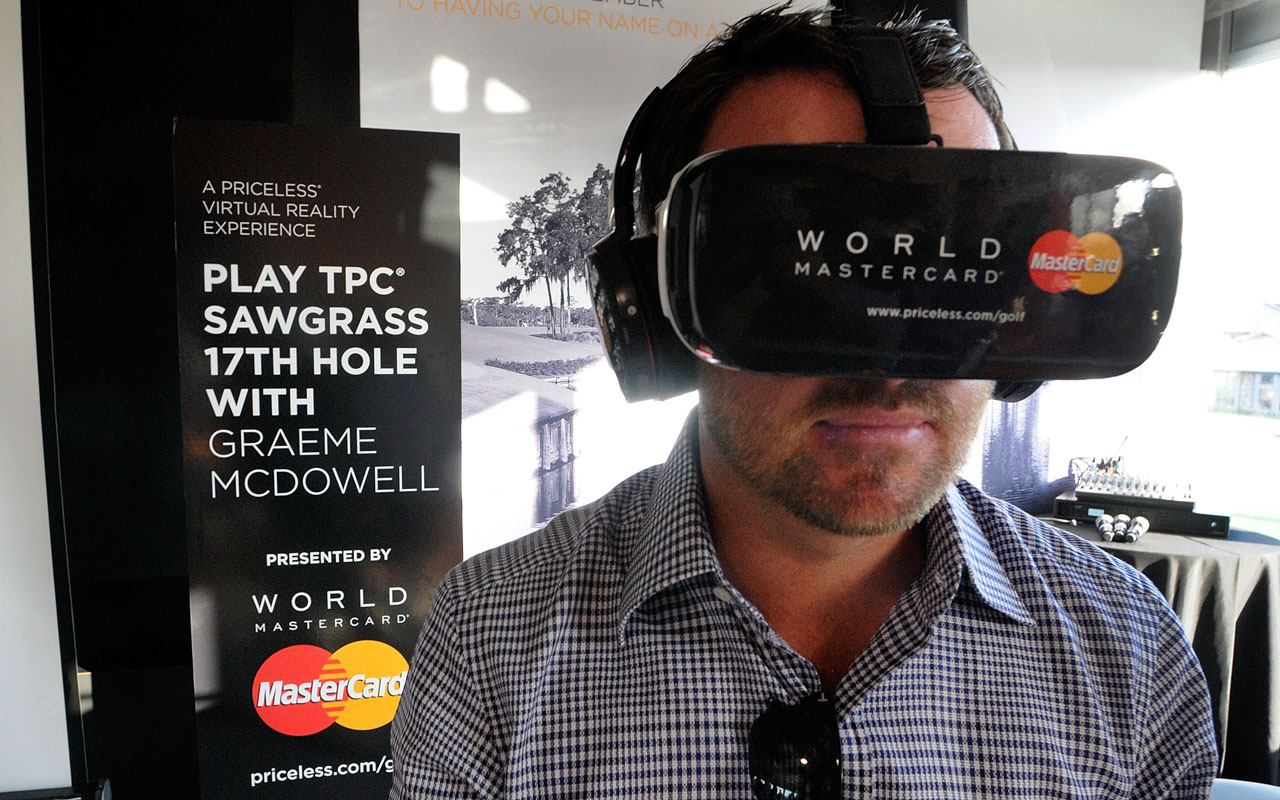

MasterCard

- Market value: $192.7 billion

- Dividend yield: 0.5%

- 5-year annual dividend growth rate: 50%

One of the qualities Warren Buffett looks for in a company is its ability to profitably grow for many years into the future.

In fact, one his famous quotes is that “time is the friend of the wonderful business, the enemy of the mediocre.”

When Berkshire Hathaway initiated a stake in MasterCard (MA, $183.24) in 2011, it probably was attracted to the long-term trend of consumers and businesses migrating away from cash and check transactions in favor of electronic payment forms.

MasterCard doesn’t issue credit cards or extend credit, which are riskier activities. Instead, the company provides transaction processing services, taking a slice of each sales dollar processed over its payment network.

The company estimates its total market opportunity for capturing payment flows is approximately $225 trillion, providing plenty of opportunity for growth despite MasterCard’s relatively large business today.

In fact, management expects the firm’s earnings per share to compound at a mid-20% range from 2016 through the end of this year. MasterCard should have little difficulty continuing to increase its dividend at a strong double-digit clip.

Visa

- Market value: $281.0 billion

- Dividend yield: 0.6%

- 5-year annual dividend growth rate: 23%

Morningstar senior equity analyst Jim Sinegal summed up Visa’s (V, $124.51) investment case in a recent note, writing, “As consumer spending around the world grows and digital methods continue to take share from cash, this wide-moat company should continue to flourish for years to come as an effective toll booth on global spending.”

Like MasterCard, Warren Buffett’s investment firm purchased a stake in Visa in 2011. The company continues to be a beneficiary of rising digital payments, recording double-digit growth in payments volume during the first quarter of its fiscal year 2018.

More than 3.2 billion Visa-branded cards are in circulation today, and that number continues to grow. The company’s scale and capital-light operations help generate an operating margin north of 60%, which has allowed Visa to compound its dividend by more than 20% annually over the last five years.

Mr. Sinegal believes Visa’s revenue growth will average 10% annually over the next five years, which, combined with Visa’s low payout ratio near 20%, should continue to support a robust outlook for payout growth.

Apple

- Market value: $913.2 billion

- Dividend yield: 1.4%

- 3-year annual dividend growth rate: 10%

Warren Buffett first bit into Apple (AAPL, $179.98) during the first quarter of 2016, acquiring a stake worth approximately $1 billion at the time.

Since then, Berkshire Hathaway has very aggressively added to its position. In fact, the firm’s stake in Apple is now valued at close to $30 billion, making it Berkshire’s most valuable equity stake.

Some Buffett disciples have been scratching their heads over this move, especially given the Oracle of Omaha’s general distaste for businesses operating in the fast-changing tech sector. However, Apple is a bit of a unique breed. Per Forbes, the company boasts the world’s most valuable brand, yet the stock’s price-to-earnings ratio trades at a discount to the Standard & Poor's 500-stock index's multiple.

Apple has created a unique ecosystem by tightly integrating its hardware and software offerings, resulting in a sticky and seamless experience for its customers. With a hoard of cash building, Apple reinstated its dividend in 2012 as part of its plan to return more capital to shareholders.

Thanks to tax reform, Apple plans to bring back most of the $252 billion in cash it holds overseas (minus about $38 billion after tax) to invest in new facilities and jobs. The company’s increased flexibility should also make it easier for Apple to continue returning generous amounts of cash in the form of dividends.

In fact, Morningstar analyst Brian Colello, CPA, wrote, “Given the firm’s whopping $163 billion of net cash today and high likelihood of strong free cash flow generation going forward, we can easily foresee Apple doubling its annual dividend and share repurchases over the next five years.”

Costco

- Market value: $82.8 billion

- Dividend yield: 1.1%

- 5-year annual dividend growth rate: 13%

- Costco (COST, $188.58) has never been a major holding in Berkshire Hathaway’s portfolio (less than 1% of its value today), but the company has been part of the portfolio since 2000.

As one of the largest membership warehouses in the world with a no-frills shopping experience, Costco focuses on offering lower prices and better values than its grocery and retail rivals. The company’s strategy has been a big success, with its more than 91 million cardholders paying Costco close to $3 billion in cash fees to access its warehouses, driving the bulk of the firm’s operating income.

Impressively, Costco enjoys a 90% renewal rate on its memberships, underscoring its unique shopping experience in an ever-competitive brick-and-mortar world.

Costco’s continued investments in organic grocery products and its company-owned Kirkland brand further increase its competitive advantages and the value it provides its members. As Argus analyst Christopher Graja, CFA, notes, “While Amazon is a threat to every retailer, we continue to like Costco based on its low prices and efficient operations. There is also a lot that Costco does that will be difficult for Amazon or anyone else to match on price and quality.”

Costco’s strengths have helped it compound its regular dividend by 13% annually over the past decade while also returning capital to shareholders through several large special dividends.

Restaurant Brands International

- Market value: $14.5 billion

- Dividend yield: 3.0%

- 1-year annual dividend growth rate: 26%

If you have ever eaten at Burger King, grabbed a coffee at Tim Hortons, or picked up some chicken at Popeyes, you have experienced part of Restaurant Brands International’s (QSR, $59.33) business. The company is one of the largest quick service restaurant businesses in the world, with more than 24,000 restaurants in over 100 countries.

Berkshire Hathaway’s stake arose when Burger King and Tim Hortons merged in 2014, granting Buffett warrants to purchase stock in the combined entity.

These businesses collectively enjoy impressive global scale, have well-known brands, and generate excellent cash flow thanks to their franchise-heavy focus. As a result, Restaurant Brands International has been able to increase its dividend every quarter since going public. Management more than doubled the company’s quarterly payout earlier this year, pushing QSR’s yield over 3% to provide a nice combination of current income and growth.

MORE FROM SIMPLY SAFE DIVIDENDS: Warren Buffett’s Complete Dividend Portfolio

Phillips 66

- Market value: $48.1 billion

- Dividend yield: 2.9%

- 3-year annual dividend growth rate: 13%

ConocoPhillips (COP) spun off Phillips 66 (PSX, $95.91) in 2012. Berkshire Hathaway had owned a stake in ConocoPhillips, which he sold to increase his stake in Phillips 66 after the dust had settled.

Phillips 66 is a diversified petrochemical business with operations spanning chemicals, refining, midstream energy services, and retail gas stations.

Argus analyst Bill Selesky notes “this diversification has proven very valuable in different commodity price environments over the years, and, despite weak refining margins, we believe the company's cash flow is less volatile than that of most pure-play refiners.”

Phillips 66 is increasingly investing in its midstream and chemicals business, which should provide further cash flow stability as the firm’s business mix gradually shifts away from refining.

Despite operating in the cyclical energy sector, Phillips 66 has rewarded its shareholders with regular dividend increases since trading as a standalone company, recording a 30% dividend compound annual growth rate since September 2012.

Management last raised the company’s dividend by 11% in June 2017, and if Argus’ projections for double-digit earnings growth in 2018 and 2019 play out, income investors should be in for continued gains.

Bank of America

- Market value: $335.2 billion

- Dividend yield: 1.3%

- 3-year annual dividend growth rate: 48%

Berkshire Hathaway bought $5 billion of Bank of America’s (BAC, $32.72) preferred stock in 2011 and received warrants for 700 million shares. Buffett exercised the firm’s warrants during the third quarter of 2017, resulting in a BofA stake worth approximately $20 billion today.

Bank of America has come a long way from the financial crisis, and Buffett’s capital infusion in 2011 helped the company deal with a growing pile of fines and lawsuits. The bank has aggressively cut costs, focused more on less risky lending businesses, and significantly improved its financial strength since then.

As a result, Bank of America has received the Fed’s blessing to boost its dividend significantly, including a 60% jump last summer.

Should economic growth and interest rates continue rising, the bank’s profitability and dividend will likely follow suit.

American Express

- Market value: $85.2 billion

- Dividend yield: 1.4%

- 5-year annual dividend growth rate: 11%

- American Express (AXP, $99.05) has paid uninterrupted dividends for more than 20 consecutive years, compounding its payout by 8% annually over the past two decades, according to data from Simply Safe Dividends.

Founded in 1850, American Express is one of the oldest companies in the market and one of Berkshire Hathaway’s oldest investments. The firm initiated a position in the 1960’s when American Express shares plunged more than 50% as it dealt with the infamous salad oil scandal.

Today, American Express is a diversified financial services company that is perhaps most known for the credit card products and travel-related services it provides to consumers and businesses.

Morningstar’s Sinegal believes American Express’ primary competitive advantages remain intact and include “a reputation for superior service, a network of attractive customers and merchants, and a corporate business with high switching costs.”

Sinegal says American Express can grow its income at a 5% clip starting in 2021, which, combined with the firm’s healthy payout ratio near 20%, suggests dividend growth investors can expect at least mid-single-digit payout growth over the medium-term.

Brian Bollinger is long AAPL, COST, MA, SIRI and V.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Brian Bollinger is President of Simply Safe Dividends, a company that provides online tools and research designed to help investors generate safe retirement income from dividend stocks without the high fees associated with many other financial products.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.