20 Large-Cap Dividend Stocks With More Cash Than Debt

More than a decade of historically low interest rates has prompted companies to go on a borrowing binge.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

More than a decade of historically low interest rates has prompted companies to go on a borrowing binge. Although there's no sign of a debt bubble right now, market watchers are increasingly concerned about corporate indebtedness.

No surprise there. Excluding financial companies, U.S. corporate debt is at a record high.

Companies carrying excess debt are more vulnerable to rising interest rates, a global economic slowdown or an outright recession. Conversely, companies with more Benjamins in the bank than IOUs are fortified against many financial headwinds.

Large-cap dividend stocks can be a redoubt in times of market volatility. If they have rock-solid balance sheets and generate gushers of cash, so much the better.

We searched the major indexes for dividend payers with market values of at least $10 billion that have more cash on their balance sheets than total debt. And because dividends and interest payments come from free cash flow, we also limited ourselves to companies with ample FCF after paying interest on debt.

The result: Fewer than two dozen large-cap dividend stocks across all the large publicly traded companies in the U.S. Here, we look at 20 of the best.

Data is as of Oct. 23. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Nvidia

- Market value: $118.8 billon

- Dividend yield: 0.3%

- Difference between cash and debt: +$5.9 billion

Trade-sensitive semiconductor stocks such as Nvidia (NVDA, $195.09) have been volatile this year as the market rises and falls with every move in the U.S.-China trade spat.

Be that as it may, Nvidia shares have managed to outpace the S&P 500 by a wide margin so far in 2019, thanks to continued growth in gaming and artificial intelligence.

And it's just warming up, according to Bank of America Merrill Lynch, which rates shares at Buy. "(Nvidia's) data center growth is on the cusp of benefiting from the next-big (artificial intelligence) landmark – the ability to accurately listen, understand, speak and contextualize human speech," Merrill Lynch analysts say.

Nvidia is in a strong financial situation, with $8.5 billion in cash countering its $2.6 billion in debt several times over. And although Nvidia is hardly the highest-yielding name in the universe of dividend stocks, it has ample resources to continue to raise it. The company currently is only paying out 14% of its profits as distributions to shareholders.

Activision Blizzard

- Market value: $42.0 billion

- Dividend yield: 0.7%

- Difference between cash and debt: +$1.7 billion

Speaking of gaming, Activision Blizzard (ATVI, $54.80), perhaps best-known for the Call of Duty franchise, is another large-cap dividend payer with a more-than-solid balance sheet.

Activision finished the June quarter with roughly $4.7 billion in cash versus $3 billion in debt. And for the 12 months ended June 30, the video game company generated $1.8 billion in free cash flow (FCF) after paying interest on debt.

Sure, ATVI doesn't offer much in the way of yield on its dividend, which is paid annually. But it has hiked its payout for eight consecutive years, at a roughly 12% compound annual clip. Regular dividend increases are gold for truly long-term investors, who see yields grow sharply on their original investment.

Jefferies, which rates shares at Buy, has ATVI on its best stock picks list. Its analysts write that the upcoming Call of Duty: Modern Warfare 4 ranks as the "most highly demanded game within the fall/holiday content slate."

Intuit

- Market value: $66.6 billion

- Dividend yield: 0.8%

- Difference between cash and debt: +$2.3 billion

QuickBooks and TurboTax maker Intuit (INTU, $255.97) is another software company Jefferies happens to be bullish on. The investment bank calls INTU a Buy, thanks to a double-digit rate of revenue growth, with more than $7 billion coming from highly profitable software. It also helps that Intuit has a predictable business model in tax preparation.

The balance sheet is sound. INTU has just $436 million in total debt against $2.7 billion in cash. And with performances such as $1.7 billion in FCF generation over the 12 months ended July 31, Intuit's modest dividend should keep coming – and growing.

Although tech companies such as Nvidia, Activision Blizzard and Inuit don't blow income investors away with their dividend yields, they more than make up for it with the outsized profit prospects. In Intuit's case, analysts expect the firm to generate average annual earnings growth of more than 15% over the next three to five years.

Costco Wholesale

- Market value: $130.7 billion

- Dividend yield: 0.9%

- Difference between cash and debt: +$2.2 billion

Warehouse club Costco Wholesale (COST, $297.32) is a dependable dividend payer, having hiked its payout for 15 straight years. Even better, Stifel says "it is probable the company declares a special dividend in the next 1-2 quarters."

Special dividend or not, investors who like COST stock for the income potential can sleep well at night. With more than $2.6 billion in free cash flow fattening the coffers over the past four quarters, and a below-average payout ratio of 25%, Costco is well-positioned to keep hiking its dividend for years to come.

This dividend stock is on firm financial footing, too, with $2.2 billion more in cash than debt.

Costco delivered another earnings beat in October. On top of that, September comparable-store sales – or "comps," an important retail metric – had analysts bullish on the warehouse club.

"We view the September comp result as solid and an indication the company continues to gain share largely reflecting effective merchandising and a continual focus on enhancing the consumer value proposition (i.e., low prices and great selection)," write analysts at Stifel, who call Costco a "best-in-class" retailer and rate shares at Buy.

Expedia

- Market value: $20.3 billion

- Dividend yield: 1.0%

- Difference between cash and debt: +$598 million

- Expedia (EXPE, $138.31), the operator of online travel sites such as Hotels.com, Orbitz, Travelocity and its namesake site, is another low-yield, high-growth stock with better-than-average growth prospects.

Of the 34 analysts covering EXPE who are tracked by S&P Global Market Intelligence, 16 call it a Strong Buy, eight say it's a Buy and 10 have it at Hold. A long-term expected growth rate of almost 20% a year for the next three to five years is no doubt part of the appeal. Same goes for the solid balance sheet and heavy stream of cash.

Among the bulls is Argus, which believes the company's global bookings market share will grow from 6% back in 2016 to 8% to 9% by 2020.

Expedia generated $1.6 billion in free cash flow after paying interest on debt for the four quarters ended June 30. That helped tip the balance sheet in Expedia's favor. The company carries $4.9 billion in cash and short-term investments against total debt of $4.3 billion.

EXPE has a lean payout ratio of 31% and a seven-year track record of annual dividend hikes.

Jack Henry & Associates

- Market value: $10.7 billion

- Dividend yield: 1.2%

- Difference between cash and debt: +$94 million

- Jack Henry & Associates (JKHY, $138.49), a payments processor for enterprises in the financial services industry, among dividend stocks has a 15-year streak of payout growth under its belt, solid profit prospects and healthy balance sheet.

Analysts expect the firm to generate average annual earnings growth of almost 11% over the next three to five years, thanks to a number of factors.

"The company is benefitting from tailwinds including new core wins, fewer termination fees and healthy demand backdrop," say analysts at Cantor Fitzgerald, who rate shares at Overweight (equivalent of Buy). "The business appears to be on solid footing while making technological progress."

JKHY has only $94 million in cash and short-term investments in its coffers, but so what? It's on the small end of the large-cap spectrum (large-cap stocks start at $10 billion in market value), and it's the rare company that carries absolutely zero debt.

Free cash is encouraging, too. Jack Henry produced more than $200 million of it over the 12 months ended June 30.

Cognizant

- Market value: $33.3 billion

- Dividend yield: 1.3%

- Difference between cash and debt: +$1.3 billion

- Cognizant's (CTSH, $60.35) dividend is a young'un. The company initiated it in 2017 when it agreed to return $3.4 billion to shareholders after coming under pressure from an activist investor.

But to be fair, the provider of technology consulting and outsourcing services had an overabundance of idle funds. In fact, it still does.

Cognizant sported $3 billion in cash as of June 30, versus total debt of $1.7 billion. It also generated more than $2 billion in FCF for the four quarters ended June 30. Suffice to say, the $464 million it spent on dividends over the same time period didn't exactly make a dent in its liquidity.

Although CTSH is on solid financial footing, Wall Street's pros aren't particularly bullish on this stock over the next year or so. Their average recommendation comes to Hold, according to a survey by S&P Global Market Intelligence.

Argus analyst James Kelleher downgraded CTSH in May on weakness in its financial services and health-care verticals, which are the company's most important business drivers "by far," he writes. Barclays' Ramsey El-Assal (Underweight, equivalent of Sell) also warned about Cognizant's exposure to immigration reform.

Expeditors International

- Market value: $12.8 billion

- Dividend yield: 1.3%

- Difference between cash and debt: +$706 million

Logistics services firm Expeditors International (EXPD, $74.97) has been hiking its payout annually for coming up on a quarter of a century and still has a skinflint payout ratio of just 26%.

Given the company's financials, the streak is safe.

Expeditors International has $706 million more in cash on its books than debt. Indeed, total debt amounts to just $377 million. The cash-flow situation is just fine, with $464 million to claim for the year ended June 30 – more than enough to cover the $163 million it spent on dividends.

The dividend may be a sure thing, but the U.S.-China trade war and synchronized slowdown of economies across the globe have analysts standing pat at best. Of the 17 analysts covering EXPD tracked by S&P Global Market Intelligence, 12 have it at Hold, three say Sell and two call it a Strong Sell.

Goldman Sachs recently cut estimates for transport companies, including EXPD, citing weakness in the industrial sector of the economy. Goldman's analyst arm initiated coverage of the stock earlier this year, starting it at Sell. That rating hasn't changed.

Microsoft

- Market value: $1.06 trillion

- Dividend yield: 1.5%

- Difference between cash and debt: +$62 billion

With a market cap in excess of $1 trillion, Microsoft (MSFT, $137.24) is essentially neck and neck with fellow Dow stock Apple (AAPL) as they compete to be the world's most valuable publicly traded company.

Microsoft's embrace of cloud computing has made it a Wall Street darling once again, but in addition to its sizeable growth prospects, the company also happens to be a cash cow. MSFT has $85 billion of cash – roughly the market value of CVS Health (CVS) – in its coffers against $23 billion in total debt. And over the past 12 months, it generated free cash flow of $33 billion for the 12 months ended June 30, which it used to pay out almost $14 billion in dividends.

The true marvel of Microsoft is its growth potential despite its already massive size. The pros expect MSFT to deliver average annual earnings growth of almost 13% for the next three to five years. Few mega-cap dividend stocks can claim that sort of long-term growth rate.

"With the unmatched depth and breadth of its technology portfolio, we believe the company has multiple levers to grow revenue, margins and its customer base over the next several years," write analysts at RBC Capital, who rate shares at Outperform (equivalent of Buy).

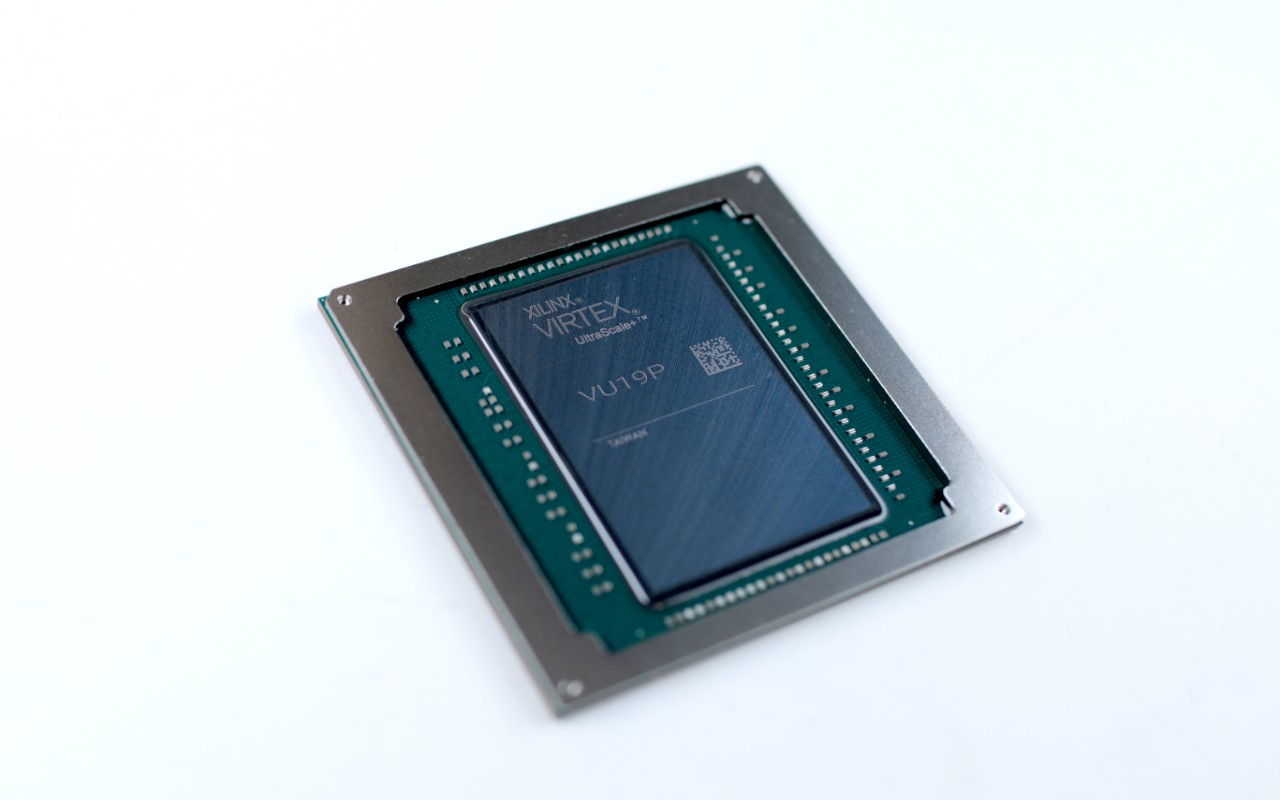

Xilinx

- Market value: $23.7 billion

- Dividend yield: 1.6%

- Difference between cash and debt: +$1.6 billion

Even in the best of times, semiconductor manufacturers such as Xilinx (XLNX, $93.83) are notoriously cyclical and sensitive to patterns in international trade. So it should come as no surprise that sluggish global growth and Washington's trade war with Beijing has some analysts choking up on their bats when it comes to Xilinx.

SunTrust Robinson Humphrey analysts lowered their rating on XLNX to Hold in early October. Although SunTrust praises Xilinx as an "excellent company" with high long-term profit growth, shares appear a bit pricey for this "downturn part" of the economic cycle.

Analysts surveyed by S&P Global Market Intelligence only mildly optimistic. While 11 analysts rate XLNX a Strong Buy or Buy, 15 have it as a Hold, and one believes the stock should be sold.

Investors needn't fear a threat to the dividend or any balance sheet weakness. XLNX has $1.6 billion more in cash than it does in debt. Free cash flow came to $900 million in the 12 months ended June 30; it paid out a little more than a third of that ($368 million) in dividends.

Skyworks Solutions

- Market value: $15.3 billion

- Dividend yield: 2.0%

- Difference between cash and debt: +$935 million

- Skyworks Solutions (SWKS, $89.29), which makes chips for the next-generation, high-speed networks, has a hot growth rate, a decent dividend yield and loads of liquidity.

Analysts forecast the semiconductor company's long-term growth rate at more than 17% a year for the next three to five years, thanks in part to the emergence of 5G wireless networks.

Cowen, which rates the stock at Outperform, expects Lam to benefit from the current sales ramp of Apple's iPhone 11. Cowen analysts also look for SWKS to dominate in smart-home applications as part of the spread of the Internet of Things. As a result, they recently upgraded their price target from $80 per share to $95.

The firm's balance sheet, meanwhile, is totally debt-free. SWKS has $935 million in cash and short-term investments. Moreover, the company generated free cash flow of $515 million for the year ended June 28.

Lam Research

- Market value: $33.8 billion

- Dividend yield: 2.0%

- Difference between cash and debt: +$936 million

With $5.4 billion versus $4.5 billion in total debt, Lam Research (LRCX, $233.18) is well fortified should the semiconductor industry take a turn for the worse.

Lam, which makes tools used in the manufacture of memory chips, has hiked its dividend for four years running. With levered free cash flow running at $1.8 billion in the year ended June 30, the company has ample financial resources to keep the streak alive. Over the past year, the company has returned $678 million in cash to shareholders in the form of dividends.

Analysts like Lam as a way to gain exposure to the broader chip industry for solid-state memory. Citigroup, which rates the stock at Buy, says LRCX is its top pick for exposure to the memory sector. Needham's N. Quinn Bolton raised estimates for Lam's next two quarters and hiked the price target on the company's shares to $250.

Analysts as a whole, meanwhile, expect LRCX to generate average annual earnings growth of almost 13% for the next three to five years.

Accenture

- Market value: $117.2 billion

- Dividend yield: 2.0%

- Difference between cash and debt: +$6.1 billion

- Accenture (ACN, $184.07) – which provides consulting, strategy, technology and other professional services – is beating the broader market by 7 percentage points in 2019. The analyst community expects more outperformance to come. With an average target price of $201.67, the pros see upside of nearly 10% in ACN over the next year or so.

"Investors are demonstrating a willingness to pay a premium for ACN's quality and consistency," write analysts at Cowen, who rate shares at Outperform.

And that's not including upside from the dividend, which has more than ample backing. Accenture disbursed $1.9 billion in dividends over the four quarters ended June 30, while generating free cash flow of $5.4 billion. And Accenture has a considerable cash backstop of $6.1 billion versus a negligible $23 million in debt.

Analysts see good things ahead. They project profit growth of nearly 10% annually over the next three to five years.

Hormel

- Market value: $21.8 billion

- Dividend yield: 2.1%

- Difference between cash and debt: +$324 million

- Hormel (HRL, $40.78) is struggling with near-term uncertainty, such as the African swine fever that's sweeping the world's pork markets. Indeed, Stephens analyst Ben Bienvenu wrote in August that the current environment will likely cause HRL shares to underperform, at least in the near-term.

But the Spam purveyor's battleship of a balance sheet has kept the company afloat for decades.

Indeed, Hormel – also known for its Hormel-brand chili and meats, Dinty Moore stews and House of Tsang sauces – has raised its dividend every year for 53 years. If that weren't impressive enough, Hormel touts the fact that it has paid a regular quarterly dividend without interruption since becoming a public company in 1928. HRL is a member of the S&P Dividend Aristocrats, an index of dividend stocks with at least 25 years of consecutive dividend hikes.

HRL stock is underwater for the year-to-date, but investors can expect a 54th annual dividend hike to be announced in November – that's typically when the Dividend Aristocrat informs shareholders about its yearly increase. The packaged food company generated almost $600 million in free cash flow for the year ended July 28, paying out $425 million of that in dividends. So there's still room to grow.

Garmin

- Market value: $16.5 billion

- Dividend yield: 2.6%

- Difference between cash and debt: +$1 billion

With more than $1 billion in cash and just $61 million in debt, Garmin's (GRMN, $86.57) balance sheet is pretty clean. The maker of global positioning systems for the aviation, marine and consumer products industry also has a steady cash stream. Free cash flow came to $436 million for the year ended June 29.

That said, most analysts don't particularly like the stock – at least not at current levels. Their average rating is decidedly a Hold. Of the 11 analysts covering Garmin tracked by S&P Global Market Intelligence, one has it at Strong Buy, seven say Hold and three rate it at Sell.

However, in June, JPMorgan analyst Paul Chung upgraded Garmin to Neutral from Underweight, calling it a "relatively safer play." The risk-reward profile is more favorable, thanks in part to its diverse product lineup, as the stock climbs down from multiyear highs. (GRMN has gained 37% year-to-date versus 20% for the S&P 500.)

Garmin might be pricey at current levels. But investors needn't worry about what's underneath the hood.

Cisco Systems

- Market value: $199.7 billion

- Dividend yield: 3.0%

- Difference between cash and debt: +$8.7 billion

Goldman Sachs downgraded Cisco Systems (CSCO, $47.05) from Buy to Neutral in October, citing depressed spending by telecommunications companies and weak business investment.

"We believe that most of this weakness relates to a lack of business confidence at large enterprise driven by trade volatility as opposed to a broader macro slowdown," analyst Rod Hall writes.

Shares in CSCO are lagging the broader market by a wide margin in 2019, so Hall isn't alone in its concerns. Trade uncertainty and a broader macroeconomic slowdown are a headwind for this component of the Dow Jones Industrial Average.

Something investors needn't worry about is Cisco's ability to withstand whatever kind of downturn the economy throws at it. The maker of networking gear has a whopping $33.4 billion in cash against $24.7 billion in debt. That gives CSCO a net debt position of $8.7 billion.

Cisco is a cash cow, too, with 12-month free cash flow of $11.5 billion. Suffice to say CSCO's comparatively generous dividend has plenty of juice behind it.

Bristol-Myers Squibb

- Market value: $89.6 billion

- Dividend yield: 3.0%

- Difference between cash and debt: +$3.6 billion

The market hasn't responded all that favorably to Bristol-Myers Squibb's (BMY, $54.77) $74 billion deal to merge with Celgene (CELG). And that's even after BMY agreed to sell blockbuster drug Otelza for $13.4 billion, the proceeds of which will be used to pay down debt. Bristol-Myers' shares are up only 4% year-to-date.

But as big as these deal numbers may be, BMY's financials are ample enough to carry the load. The pharmaceutical giant has $29.4 billion in cash on hand against $25.8 billion in debt. That gives the company a net debt profile of $3.6 billion.

"With a growing late-stage pipeline as well as increasing balance sheet capacity over the next 2 to 3 years, we expect the company to have an extended window of robust organic growth," say analysts at JPMorgan, who rate shares at Overweight.

Dividend stocks in the health-care sector tend to offer defense in volatile markets.

Maxim Integrated Products

- Market value: $15.3 billion

- Dividend yield: 3.4%

- Difference between cash and debt: +$906 million

- Maxim Integrated Products (MXIM, $56.50) has a generous yield and nine consecutive years of dividend growth under its belt, but global economic sluggishness is hampering its price performance.

The company – which supplies chips to smartphone giants Apple, Samsung and Huawei – earns an average rating of Hold from Wall Street analysts. Of the 24 analysts covering MXIM tracked by S&P Global Market Intelligence, four have it at Strong Buy, one says Buy, 17 rate shares at Hold and two say Sell.

Revenue is forecast to decline nearly 11% this year to $2.2 billion, but MXIM's balance sheet will see it through any slowdown.

MXIM has $906 million more in cash than it does in debt, in part because it paid down a healthy $500 million chunk over the past year. And during the four quarters ended June 29, the chipmaker earned roughly $575 million in free cash flow, spending $506 million of it on dividends.

NetApp

- Market value: $13.3 billion

- Dividend yield: 3.4%

- Difference between cash and debt: +$1.8 billion

Weaker demand for data storage is pressuring shares of cloud-based data services provider NetApp (NTAP, $56.01). Indeed, Morgan Stanley's Katy Huberty reiterated her Sell rating at the end of September after early channel checks suggested weak broader demand, and indicated that NetApp stepped up its discounting.

Goldman's Rod Hall recently downgraded NTAP from Neutral to Sell over the same general pullback in enterprise spending, driven by uncertainty created by the U.S.-China trade dispute, that he dinged up Cisco for.

Although analysts don't expect much from NTAP stock in the nearer term – the Street's average rating is Hold – NetApp's financial foundation is solid.

NTAP's cash haul outstrips its debt load by $1.8 billion. Furthermore, the tech company generated free cash flow of $807 million for the 12 months ended April 26, which was twice as much as it needed to pay out $403 million in dividends.

Gilead Sciences

- Market value: $84.3 billion

- Dividend yield: 3.8%

- Difference between cash and debt: +$1.7 billion

- Gilead Sciences (GILD, $66.58) has a new chief financial officer, and analysts believe the move signals that the biotechnology giant is souping up its mergers and acquisitions (M&A).

"The fact that not only is Gilead moving someone from (business development) into the role, but that he will also still maintain his responsibilities running corporate development, we believe highlights the crucial importance that M&A and partnerships likely have in GILD's capital allocation strategy," say analysts at RBC Capital Markets, who have a Buy rating on the stock.

GILD certainly has the resources and balance sheet to beef up its pipeline. Gilead generates a river of cash every year. For the four quarters ended June 30, the biotech delivered $5.7 in free cash flow after paying interest on debt. It spent $3.1 billion on dividends, leaving plenty left over.

Gilead has plenty of cash ($28.4 billion) to pursue deals, and that cash outstrips debt of $26.6 billion. Meanwhile, its FCF ensures it should be able to keep ramping up the payout, which has grown 47% since the company initiated its dividend in February 2015.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.