7 Energy Stocks to Buy for the Dividends

The U.S.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The U.S. is near full employment and global economies are in synchronized growth mode. That's going to make life trickier for income investors, as these trends will spark higher interest rates, which will weigh on bonds and classic dividend plays such as companies that sell toothpaste. Fortunately, there’s a fix: Buy energy stocks.

Many energy companies not only deliver sizable yields, but they now have potential to grow again as energy prices rebound, powered by these drivers:

Growing demand. Expanding economies use more energy. Americans are driving bigger cars. And in emerging markets, more people are joining the middle class. They’re naturally demanding energy-hungry basic amenities, such as cars and electric lighting.

Slowing supply growth. As oil wells age, production naturally declines by as much as 5% a year overall, says Jonathan Waghorn, who helps manage the Guinness Atkinson Global Energy Fund (GAGEX). This means energy companies must run hard just to stay in place. However, when oil plunged a few years ago, big energy companies pulled back investments in projects that take a few years to develop. The “air pocket” of missing wells in the pipeline will bite into supply growth soon. Meanwhile, U.S. shale production, while prolific, is growing less than expected, says Mike Breard, an energy analyst at Hodges Capital Management in Texas. Also, the Organization of the Petroleum Exporting Countries’ (OPEC) compliance on production cuts has been great, and that’s not likely to stop, Breard predicts.

Political instability. It’s no secret that oil comes from countries wrought with political instability – and not just Venezuela, Nigeria, Libya and Iraq. Oil recently jumped when Saudi Arabia’s Crown Prince Mohammad bin Salman (MBS) locked up rivals in a domestic power grab. Investors worried his maneuver could spill over into regional conflict. The MBS oil price move may fade a bit. But the risk of political conflict that disrupts supply won’t.

Here are seven energy stocks to buy that should benefit from these bullish oil trends, while paying you annual yields of between 2% and 9%.

Data is as of Nov. 13, 2017. Stocks are listed in alphabetical order. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Click on ticker-symbol links in each slide for current share prices and more.

Exxon Mobil

- Dividend yield: 3.7%

The starting point for anyone building an energy-sector dividend portfolio has to be Exxon Mobil (XOM, $82.89). This energy giant’s low cost of capital and savvy approach to building long-lived assets and reserves around the globe give it some of the best returns on capital in the business.

While Exxon Mobil lost its former CEO, Rex Tillerson, to the administration of President Donald Trump, it’s now in the capable hands of Darren Woods, who came up the ranks in the refining and chemical division. Under his leadership, Exxon Mobil recently announced it is spending $1 billion a year on green energy and biofuel research, though profitable breakthroughs may be years away.

More important to the here and now, Exxon has been investing more heavily “unconventional” shale plays in the Permian and Bakken, says Breard, of Hodges Capital Management. Since these wells can be brought online more quickly, this gives the company better flexibility to increase production when oil and gas prices rise. And unlike a lot of smaller exploration and production companies, Exxon Mobil isn’t just in upstream energy production – it has a huge presence in downstream refining and chemical manufacturing.

Together, these factors mean that Exxon Mobil generates strong and consistent cash flow even when oil falls – exactly what you want to see if you are investing in an energy company for dividends. Morningstar analyst Allen Good thinks Exxon can cover its dividend at oil prices as low as $40 per barrel. (However, a drop back to such levels seems unlikely.)

BP

- Dividend yield: 6%

- BP (BP, $39.88) has a lot of debt. It’s still paying billions of dollars each year in fines for the 2010 Deepwater Horizon oil spill disaster in the Gulf of Mexico. And it’s selling off the family jewels to help cover these payments.If all of this makes you question the safety of the company’s 6% dividend yield, however, stop right now. BP announced a share buyback at the end of October, which is all we need to know about the dividend’s security. Companies don’t buy back shares when they are in danger of cutting dividends.

Thanks to cost discipline and higher oil prices, BP’s free cash flow has been growing substantially. Production grew 11% in the third quarter. Barring a sharp decline in oil, the company’s rich dividend yield is safe. By its latest estimate, BP has enough cash to cover capital spending and dividends when Brent crude oil is as low as at $49 a barrel. It recently traded for around $63.50 a barrel.

As for those Gulf of Mexico oil spill payments, they’re going to drop sharply to $2 billion in 2018 and a little more than $1 billion in 2019, from around $5.5 billion this year.

BP investors have the option of accepting dividends in “scrip,” or shares. Whether you take shares or cash is a personal choice depending on your cash flow needs and tax planning. But for some perspective, only about 20% of shareholders take stock.

Royal Dutch Shell

- Dividend yield: 5.7%

Investor negativity on energy suggests money managers have vastly underweighted positions, says Jim Paulsen, chief investment strategist at the Leuthold Group. As fundamentals continue to improve, they’ll be forced to lift portfolio exposures, he says.

That will have them scrambling for the shares of companies like Royal Dutch Shell (RDS.B, $65.92).

Europe’s energy giant beat analyst expectations again in the third quarter, with a 47% increase in net profits to $4.1 billion. More importantly, for dividend investors, Shell continues to be a cash flow machine. Over the 12 months through the end of the third quarter, it produced $40 billion in operating cash flow (cash left over from operations, excluding capital expenditures and other investments). That was with Brent crude at an average of $51 per barrel – far lower than it is now. In contrast, dividends cost the company about $15 billion a year.

Shell also purchased energy firm BG Group in 2016, which gave it access to lower-cost assets, and the company subsequently targeted about $4.5 billion in merger-related savings.

Shell offers two share types: A-class American depository receipts, which fall under Dutch laws, or B-class ADRs, which fall under U.K. laws. Go with the B shares because you won’t have to pay Dutch withholding tax on the dividends.

PetroChina

- Dividend yield: 2.3%

- PetroChina (PTR, $70.20) is China’s state-owned exploration and production giant. The Chinese government owns 86% of its stock. For a lot of investors, that’s a show-stopper right there; they reason that PetroChina may exist to serve Chinese society as much as create shareholder value.

But there are advantages to being government-run. First off, PetroChina is a monopoly. The Chinese government restricts foreign companies from exploring inside its borders. This gives PetroChina an obvious leg up. Next, PetroChina owns the lion’s share of China’s oil and gas pipeline network, a cash machine. It’s spinning some of those pipelines off to raise capital, but maintaining a controlling stake. Abroad, PetroChina may get preferred access to energy reserves in countries where China’s government offers foreign aid, Breard says.

Besides, while investor sentiment on PetroChina has been negative – setting it up as a potential contrarian bet – there’s no reason to think it can’t benefit from higher oil prices as much as any company. To wit: PetroChina just posted a 291% increase in third-quarter profits at the end of October on a 17% increase in revenue, thanks to rising crude oil prices and cost controls. Despite the negativity surrounding this company, it’s reasonable to expect more of the same, if oil keeps moving higher.

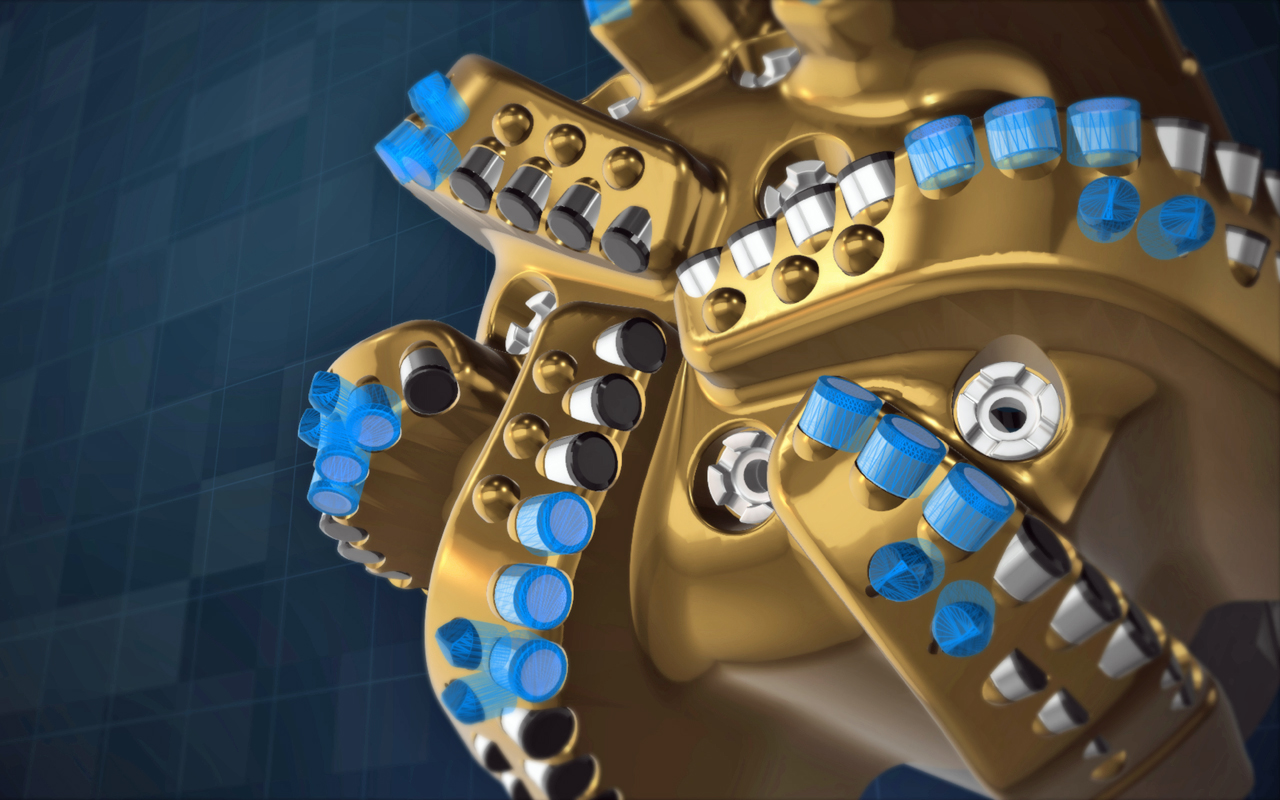

Baker Hughes, A GE Company

- Dividend yield: 2.3%

Energy services company Baker Hughes sure came up with a clunky name when it merged with a portion of General Electric’s (GE) energy business last July. But the resulting company – Baker Hughes, A GE Company (BHGE, $31.88) – should be great for shareholders.

That’s because the company is under new management – and the business has plenty of room to improve. Baker Hughes has a “very long history of running its business poorly,” Morningstar analyst Preston Caldwell says.

Now it’s in the hands of Lorenzo Simonelli, an alum of GE, which prides itself in developing some of the best management talent in the world. This signals there’s a good chance Simonelli will work some magic, cut costs and boost profits. “We believe the upside is considerable,” Caldwell says.

Baker Hughes serves the booming U.S. shale sector, where growth will continue to be hot – especially if oil prices go higher. The company’s high-tech drilling and completion equipment will be in demand because it can carry out complex tasks, faster. “We continue to believe that our advanced drilling capabilities will differentiate us in the marketplace,” Simonelli told investors in the most recent conference call.

As an added plus, an insider recently purchased shares not too far below current prices. And the new Baker Hughes just signaled that it wants to play nice with shareholders – by launching a massive $3 billion share buyback which could eventually sop up 8% of its outstanding shares. This suggests the company will hike dividends regularly, too.

Tallgrass Energy Partners

- Distribution yield: 8.6%

I love to follow insider buying to find ideas for my stock newsletter Brush Up on Stocks. Tallgrass Energy Partners (TEP, $44.19) first popped up in my system in May 2013, and I put it in my letter at $22.50. It now trades for more than $44. Nice returns, but there could be more to go because insiders still are buying.

CEO David Dehaemers Jr. has purchased $1.7 million worth of stock (technically called “units”) around current prices since August. CFO Gary Brauchle also was buying. In fact, insiders have done nothing but purchase shares all the way up since 2013. Continued buying on strength is a particularly bullish signal in insider analysis. Insider selling is less meaningful – and it’s not always a negative. But it’s worth pointing out there has been zero insider selling here in the past four years.

Tallgrass is an energy infrastructure company with two vast networks of pipelines called the Rockies Express Pipeline and the Pony Express spanning the country from Ohio to Colorado and Wyoming. They pipe energy from some of the most prolific oil and gas plays in the country, including the Marcellus, Utica Powder River, Bakken and Denver-Julesburg basins.

Tallgrass is a master limited partnership, which means there may be complications if you own it in tax-protected accounts. And MLPs definitely complicate matters at tax time. Technically, pipeline companies pay “distributions,” not dividends, because as MLPs, they are distributing profits to you without paying tax on them – one of the reasons yields are so high. As a result, investors who receive income from MLPs typically must deal with the additional K-1 form come tax time.

Plains GP Holdings LP

- Distribution yield: 5.8%

Pipeline companies pay such nice yields, it’s worth considering more than one for any energy sector dividend portfolio. Another one I’ve recently highlighted in my stock letter is Plains GP Holdings (PAGP, $20.88).

Investors soured on Plains GP this summer because it cut distributions due to problems in its supply and logistics business. But CEO Greg Armstrong, a director, and the general counsel were significant buyers in the weakness. They purchased $1.5 million worth of Plains GP units in August at around $21.50. Betting alongside insiders who challenge the market by buying weakness often is a winning tactic, and that should be the case here.

Plains GP may not get back to hiking distributions for a year or two. But it pays a nice distribution yield in the meantime, and you’re likely to see outperformance in its units as investors get more comfortable with the company again. That’s clearly what the insider buying suggests. The ace in the hole here: Plains operates pipelines and storage facilities that serve the Permian Basin – America's lowest-cost and most prolific shale basin, which should have years of growth ahead of it.

Brush has suggested TEP and PAGP in his stock newsletter, Brush Up on Stocks, as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market Today

Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market TodayAmazon lifted its spending forecast as its artificial intelligence (AI) initiatives create "a massive opportunity."

-

Stocks Close September on a High Note: Stock Market Today

Stocks Close September on a High Note: Stock Market TodayA little bit of late risk-on behavior was enough to lift stocks into the green on the last day of September.

-

How to Invest for Rising Data Integrity Risk

How to Invest for Rising Data Integrity RiskAmid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

Dow Dives 542 Points on Soft Jobs Data: Stock Market Today

Dow Dives 542 Points on Soft Jobs Data: Stock Market TodayThe last day of a busy week ends with the first greater-than-1% move in either direction in more than a month.