The Best Emerging-Markets Stocks for 2019

If you think 2018 was a rough year for American stocks, take a look overseas.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you think 2018 was a rough year for American stocks, take a look overseas. Emerging markets were absolutely hammered last year.

The iShares MSCI Emerging Markets ETF (EEM), the most widely followed proxy for emerging-markets stocks, finished 2018 down 17%. Many individual developing countries fared even worse. The Xtrackers Harvest SCI 300 China A-Shares ETF (ASHR) – which tracks the performance of China’s largest domestically traded shares – lost 29% last year. The iShares MSCI Turkey ETF (TUR) shed 43%.

But as we jump into 2019, there are several reasons you might want to give EMs another look.

To start, emerging-markets stocks actually were less volatile than American stocks during the wretched final quarter of 2018. Three months isn’t a long enough period to draw any firm conclusions, but it’s starting to look like investors have already largely abandoned emerging markets and there’s “no one left to sell.” That could mean a relatively low-risk entry point for an investor looking to allocate new money to emerging markets.

Secondly – and perhaps most importantly – emerging markets also are wildly cheap relative to American stocks. Perhaps not surprisingly, the U.S. market is now one of the most expensive in the world, according to estimates by Star Capital, trading at a cyclically adjusted price-to-earnings ratio (“CAPE”) of 26.8. To put that in perspective, developed markets as a whole trade at a CAPE of 22.2, while emerging markets as a group trade at a CAPE of just 14.5.

Emerging markets can be a roller-coaster ride. The booms can make you wealthy, but the busts can be devastating. So don’t overload your portfolio in EM stocks. But at today’s prices, it makes sense to have a little skin in the game. With that said, here are five solid emerging-markets stocks to buy in 2019.

Data is as of Jan. 13, 2019.

Vale SA

- Country: Brazil

- Market value: $72.3 billion

If you have a history of heart problems, you probably shouldn’t trade Brazilian mining giant Vale SA (VALE, $14.11) because it’s the kind of stock that can quite literally give you a heart attack if you have a large chunk of your net worth in it.

As a case in point, Vale is up nearly 500% since its early 2016 lows. That’s a fantastic run, of course. But this also followed a 94% drop from the 2011 highs to the 2016 bottom.

Still, if you can handle the volatility, adding a small allocation to Vale could make a lot of sense. After years of political instability and corruption scandals, the incoming administration of Jair Bolsonaro would seem to offer a market-pleasing mixture of pro-business and pro-law-and-order policies.

Furthermore, after years of underperformance, commodities may be ready for another stretch of outperformance.

“We are generally pretty bullish on raw materials in 2019,” says Chase Robertson, Managing Partner of Houston-based RIA Robertson Wealth Management. “We would see a slowdown in China as a short-term risk, but we’d consider commodity producers to be a smart allocation for the next decade.”

As one of the world’s largest producers of iron ore and nickel, Vale is a sensible addition for anyone bullish on commodity producers and on emerging markets in general.

Cemex

- Country: Mexico

- Market value: $8.0 billion

Mexico did the unthinkable in 2018. After decades of being ruled by the centrist Institutional Revolutionary Party and the center-right National Action Party, the country elected a left-wing populist to the presidency in Andres Manuel Lopez Obrador (AMLO), who took office at the first of December.

At this stage of the game, it’s too early to say what kind of president he will be. His populist moves have thus far been mostly symbolic; he made Mexico’s extravagant presidential residence a public cultural center and lowered his own presidential salary, for example. But the worry is that AMLO will follow his worst instincts and push Mexico in the direction of Venezuela.

Only time will tell, but the uncertainty has led investors to dump Mexican stocks. The iShares MSCI Mexico ETF (EWW) is down about 22% since September.

If you want to make a bet that AMLO moderates and ends up being pragmatic, however, Mexican stocks might be worth a look. And one that might be interesting even if AMLO ends up being every bit as bad as feared is Cemex (CX, $5.24), the largest ready-mix cement maker in the world.

Populist politics often means additional infrastructure spending, which helps cement makers like Cemex. And the stock is currently trading near five-year lows and at a very reasonable forward price-to-earnings ratio of less than 10 times next year’s estimates.

Grupo Televisa

- Country: Mexico

- Market value: $7.2 billion

For another play on the Mexico story being less bad than feared, consider leading Mexican broadcaster Grupo Televisa (TV, $12.30).

Televisa is one of the largest media companies in Latin America, and is the leading producer of Spanish language content in the world, dominating both broadcast and paid TV. It also has a large ownership interest in Univision, the U.S.-based Spanish-language broadcaster.

Apart from its media empire, Televisa is also a major player in the cable and satellite TV market and in high-speed internet.

One nice aspect of Televisa’s business is that, as a media company, it’s largely immune from trade-war concerns. An economic slowdown in Mexico could hurt ad revenues and subscriber growth, but that is nothing out of the ordinary. Importantly, unlike a manufacturer, Televisa doesn’t have to worry about an errant presidential tweet blowing up its stock price.

At just $12.30 per share at time of writing, Televisa is trading at prices not seen since 2009. As in, following the 2008 meltdown and Great Recession. Televisa’s stock price has dropped to those levels.

Televisa’s revenue growth, translated into dollars, has been somewhat flat over the past six years; revenues over the trailing four quarters are at roughly 2012 levels. Some of this is due to currency fluctuations, of course. In peso terms, however, Televisa’s revenues have grown at a compound annual rate of a little more than 6% per year.

Longer-term, Televisa faces the same competitive threats from cord cutting and streaming services such as Netflix (NFLX). But for now, TV would seem like a solid way to play the Mexican stock market without explicit trade-war risk.

Tencent Holdings

- Country: China

- Market value: $396.2 billion

Chinese stocks took their licks in 2018, as did most global tech stocks. So, perhaps it is no surprise that Chinese tech powerhouse Tencent Holdings (TCEHY, $42.11) has gotten beaten up particularly badly this year and is down by nearly 40%.

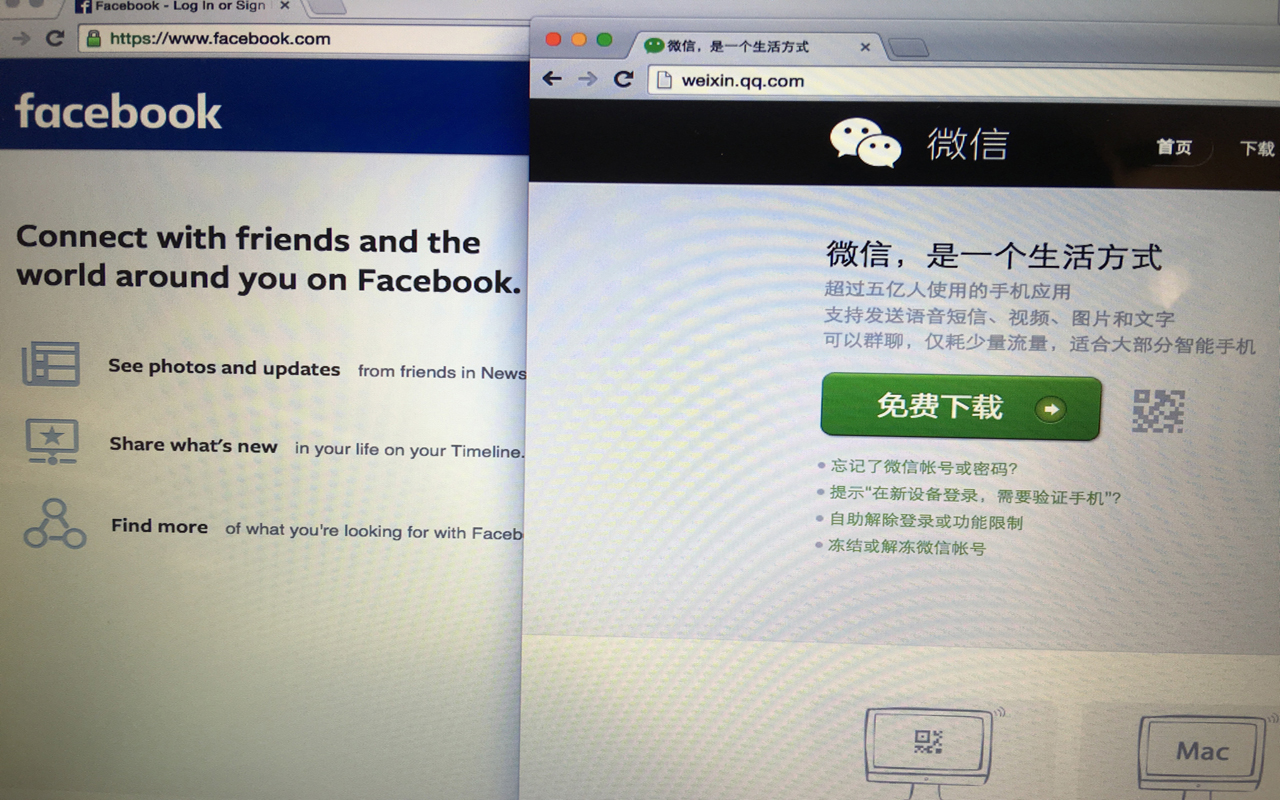

It’s hard to really define Tencent, as it doesn’t have a real equivalent in the U.S. market. It has elements of Facebook (FB) with its social media and messaging. But it also has streaming video like Netflix and is a world leader in mobile gaming.

But the jewel in Tencent’s crown is WeChat, a texting service that is China’s answer to Facebook’s WhatsApp. Except it does a lot more.

WhatsApp is a relatively simple messaging and voice app. WeChat, on the other hand, will pretty much run your life, as it handles everything from messaging your friends to booking a dinner reservation. It’s called China’s “app for everything,” and that’s not speaking in hyperbole. It’s quickly emerging as one of the dominant payment vehicles in the world, and Charlie Munger, Warren Buffett’s longtime partner at Berkshire Hathaway (BRK.B), specifically identified WeChat as a legitimate competitive threat to Visa (V) and MasterCard (MA) at the 2018 Berkshire Hathaway annual meeting.

If China has a true hard landing because of the trade war or to other factors, Tencent may fall a little further. But if you’re looking to pick up shares of a truly transformative company after a serious price correction, Tencent is a fine option.

Creditcorp

- Country: Peru

- Market value: $18.3 billion

Peru is a real mess these days. Due to a corruption scandal that started in Brazil then spread across national borders, literally every living ex-president or significant political figure of the past 20 years is either in jail, under house arrest, under investigation or actually in hiding. That’s no exaggeration.

But moments like these can be major turning points in a country’s history, and this could be the moment that Peruvians take control of their country, purge the system of the petty corruption that has held it back for decades, and create the foundations for durable growth.

If you like the idea of making a long-term investment in the development of Peru, consider banking leader Credicorp (BAP), Peru’s largest home-grown banking group.

Creditcorp’s Banco de Credito del Peru is the largest retail bank in Peru, offering mortgages, personal and commercial loans, investments and other financial services. Creditcorp also is active in microfinance, lending to small entrepreneurs that have traditionally been excluded from the formal banking sector.

As an unfortunate byproduct of the corruption purge, many construction projects have ground to a halt, and the property sector is looking a little sluggish. This has helped to keep a lid on Creditcorp’s stock price over the past year. Creditcorp’s stock price has been trading in a relatively tight range for the past 15 months.

If you believe in the long-term growth potential of Peru, buying Creditcorp at today’s prices makes sense.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

White House Probes Tracking Tech That Monitors Workers’ Productivity: Kiplinger Economic Forecasts

White House Probes Tracking Tech That Monitors Workers’ Productivity: Kiplinger Economic ForecastsEconomic Forecasts White House probes tracking tech that monitors workers’ productivity: Kiplinger Economic Forecasts

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?