8 Facts You Need to Know About Stock Market Corrections

Scary as they are, drawdowns are a normal part of the investing process. Having a financial plan in place and sticking to it is every investor's best friend.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

An ugly start to 2025 has forced investors to reckon with the dreaded "C" word.

That's right: the benchmark S&P 500 is more than 10% off its most recent peak. And so it's only natural if investors are antsy, anxious and praying for the bloodletting to end.

Indeed, for the year-to-date through early April, the S&P 500 was off more than 12%, the tech-heavy Nasdaq lost 17% and the blue-chip Dow shed nearly 9%.

Rising interest rates and stagflation fears are largely to blame. Please remember that markets never move in a straight line. Drawdowns are a part of the process too. As cliched as it is, there really is no free lunch. Risk and return are inseparable.

Perhaps the most dangerous aspect of a prolonged selloff is that it can cause investors to lose sight of their plans and long-term goals. They panic and make mistakes. With that in mind, here are eight things you should know about corrections to help you better deal with them.

There Are Multiple Types of Declines

When your brokerage account is ablaze with the color red, it might not matter what terms the pros use to characterize falling share prices. But there are actually multiple types of market downturns, and they're based on how far the market has fallen from its recent high.

- A pullback is the least severe selloff. There’s no official definition, but many investors and traders will use “pullback” to describe a market decline of between 5% and less than 10% from a peak.

- Then comes a correction, which is a loss of 10% to less than 20% from a peak.

- Finally, and most severe, is a bear market, which represents a decline of 20% or more from a peak.

Whether the Nasdaq's correction spreads to the other indexes and then morphs into a full-blown bear market very much remains to be seen. However, it's important to know that corrections are not uncommon. We had seven of them between 2000 and 2020, according to Yardeni Research.

Bear markets, on the other hand, are relatively rare. Including the dot-com crash, we've had three since 2000.

Pullbacks and Corrections Are Common

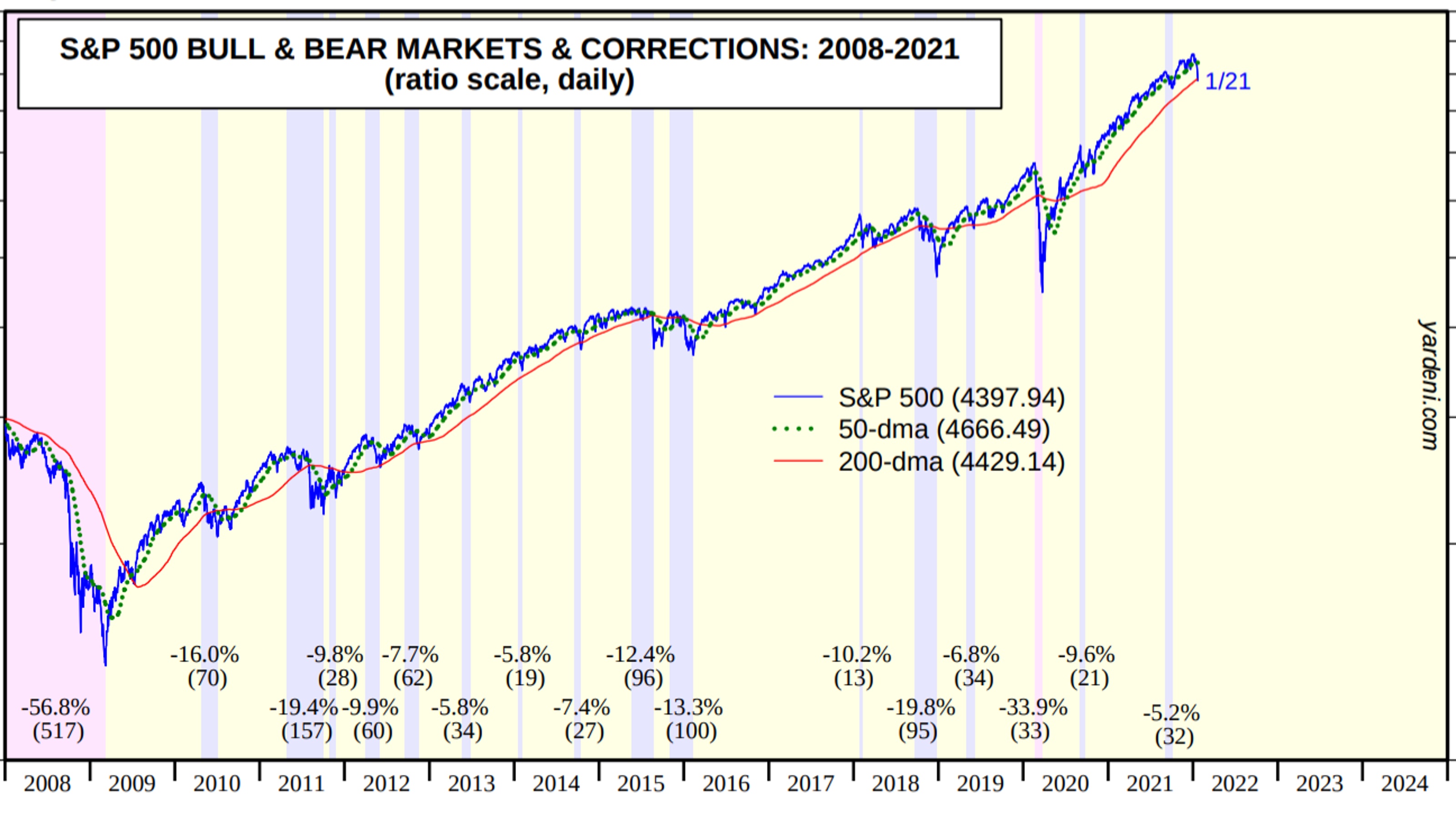

Between 2008 and 2021, the S&P 500 suffered through nine pullbacks, ranging from -5.2% to -9.9%, per Yardeni Research.

Over that same period, the market entered correction territory five times. The worst correction occurred as recently as the fourth quarter of 2018, when rising interest rates and trade war tensions caused the S&P 500 to retreat 19.8% – or just short of a bear market.

Other triggers of corrections in the past decade include an economic slowdown in China in 2011, the downgrading of the U.S. credit rating in 2011, rising oil prices, the devalued yuan, Brexit and fears that Greece would leave the European Union.

The key takeaway?

"Pullbacks and corrections are a normal part of investing," says Michael Sheldon, chief investment officer at RDM Financial Group, a Westport, Connecticut-based wealth management firm.

Stock Market Corrections Can Happen Really Fast

As anyone who has ever dieted knows, it's a lot easier to put on weight than it is to take it off. The stock market kind of works the same way, but in reverse: Share prices take their own sweet time on the way up, but if the market slips into a correction (or even a bear market), look out below.

"Corrections are vicious and they are fast," says Anthony Denier, CEO of Webull Financial, a commission-free trading platform with more than 7 million account holders. "They catch everyone off guard. Just a couple of days before the markets dropped 1,000 points, everyone is on CNBC cheering all-time highs."

Part of that comes from stop-loss orders that automatically trigger a sale if a stock breaks below a pre-determined price level. Some of it comes from margin calls, where individuals and institutions are forced to liquidate stocks in order to meet the cash collateral requirements on their brokerage accounts.

And part of it is just good ol' fear and greed: When the market is at historic highs, it's only natural for some investors to take any sign of weakness as reason to take profits.

"All of a sudden, it becomes its own beast and starts feeding itself," Denier says. "A selloff is always much more vicious and much faster than a rally."

Corrections Often Are Driven by Fear and Speculation

When you look at stock market corrections over the past decade, few are purely organic in nature. Corrections don't often happen because some indicator, such as interest-rate spreads or market valuations, get out of whack.

It's much more common for a correction to happen because investors are trying to predict future events and hedge their bets against what might happen, rather than looking at what is currently going on.

"A lot of it is fear of the unknown," says Dwain Phelps, founder and CEO of Phelps Financial Group, a wealth management firm in Kennesaw, Georgia. "I always talk about two emotions in investing: fear and greed. Depending on the situation, one of those emotions will always be prevalent."

Indeed, much of the current pullback has come amid inflationary pressures and rising interest rates. But the Federal Reserve has been explicit about its rate-tightening policy, giving the market ample opportunity to adjust. Meanwhile, five-year inflation expectations have actually fallen sharply. The market should have digested these developments by now, and yet stocks continue to weaken.

A Selloff Can Be "Healthy"

Just as broccoli, Brussels sprouts and carrots are good for your health, sometimes a dose of market reality in the form of a correction can be constructive for stocks in the longer run.

After all, nobody can survive forever living on a sugar high. The same goes for a market that is overstimulated by easy monetary policy and blind bullishness, notes Phelps.

"In my opinion, I think corrections are needed at times in the market," the financial planner says. "I do feel there are in particular times stocks that are overvalued, so having a healthy correction that brings value to the market would be beneficial to investors."

As an example of a "healthy" correction, Phelps points to the presidency of George W. Bush and the quantitative easing policies that drove the market.

"We were printing money and we were dropping interest rates, and what we did from the economic standpoint was that instead of allowing things to organically materialize, we were kind of producing it ourselves," he says. "Stock prices would go up because things appear that they are operating organically, but they are not. It's kind of being manufactured."

A re-evaluation of what investors are willing to pay for future corporate earnings can actually set stocks up for their next leg of growth.

Corrections Are an Opportunity to Buy Stocks at a Discount

Investors with long horizons should view corrections – and especially bear markets – as an opportunity to buy good stocks at even better prices.

Take Apple (AAPL) as an example. Shares in the world's largest publicly traded company plunged more than 30% from peak to trough in the COVID-19 market crash.

Guess what? They went on to nearly triple since hitting their March 2020 bottom.

Investors who maintained their convictions about the iPhone maker's fundamentals – and had the guts to buy shares at the point of maximum pessimism – have thus far been rewarded with a price gain of 193%.

"Longtime investors understand that it goes with the territory," Phelps says. "They look to take advantage of things that are on sale. Your inexperienced investor who has only been in the market for a couple of years, they are the ones that you have to kind of talk to and walk them through what's going on."

As Warren Buffett likes to say, "Price is what you pay; value is what you get."

Market Corrections Are Challenging for Retirees, However

What happens when you don't have a long time horizon?

It can be downright scary to see your investment savings take a hit when your working years are behind you.

"The most challenging time for baby boomers is as they get close to retirement or if they're just starting retirement, and the uncertainty that comes with the drawing down of their wealth that they've accumulated over time," says RDM Financial's Michael Sheldon.

Making things even more difficult is that bond yields remain near historic lows, and life expectancies continue to rise. Although bonds have offered some protection in 2022, some retirees might need to keep a significant portion of their portfolio in equities. It's possible the classic 60/40 allocation (60% stocks, 40% bonds) that planners have traditionally recommended might not be aggressive enough.

"Volatility at that time can be more challenging and make someone question if they should continue to have the asset allocation they have," Sheldon says.

A Financial Plan Helps in a Stock Market Correction

Having a plan for dealing with market declines is the best way to navigate troubled times. Indeed, allowing emotions to dictate your moves is every investor's greatest enemy. That goes for retirement savers and hedge fund managers, alike. v

Put your portfolio through a series of stress tests, calculating how it would respond to various market scenarios, and make sure that your risk tolerance is in line with your goals.

"When a client comes in we create a financial plan," Sheldon says. "Based on that plan, we can figure out the correct asset allocation and the appropriate risk/reward that the client should have to meet their long-term investment goals."

The basic foundation of every financial plan is a tailored asset allocation that helps the client ride out the inevitable ups and downs that come with investing.

"The most difficult thing for investors is to experience a pullback or correction," Sheldon adds. "It can lead to an impulsive reaction to sell stocks or raise cash at inappropriate times, which can affect long-term performance."

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.