The 15 Best CEOs of the Bull Market

The Standard & Poor’s 500-stock index has gone a long way since hitting bottom in March 2009.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Standard & Poor’s 500-stock index has gone a long way since hitting bottom in March 2009. The index has raced from a low of 676.53 all the way to current highs near 2,670 over the past eight-plus years, and momentum still appears to be on the bull market’s side.

You could’ve built a profitable portfolio by throwing darts in that situation, but many of the investments that have stood out most during this bull market share at least one thing in common: They’re helmed by some of the best CEOs in the corporate world.

What separates many great CEOs from the pack is their ability to see around corners – to get in front of change, then lead it. It’s about seeing things such as “apps” or “cloud computing" as more than buzzwords. It’s about understanding how those and other new technologies and practices can transform entire industries, possessing the courage to invest in those changes, and having the perseverance to stay with a corporate vision in the face of skepticism.

Today, we’re looking at 15 CEOs that led their companies to greatness during the bull market – most of whom are still at the helm. They come from a diverse set of backgrounds, from innovational founders to someone who worked his way up from the company’s loading dock.

Data is as of Dec. 21, 2017. CEOs are listed in alphabetical order. Click on ticker-symbol links in each slide for current share prices and more.

Jeff Bezos – The World’s Richest Man

- Company: Amazon.com

- Age: 53

- Time as CEO: July 5, 1994-Present

- Quote: “A brand for a company is like a reputation for a person. You earn reputation by trying to do hard things well.”

- Amazon.com (AMZN, $1,174.76) founder Jeff Bezos is the greatest business legend of the past decade. Amazon stock made him the world’s richest man in October 2017, and in December, his fortune was estimated at roughly $95 billion. That’s thanks to a roaring run from about $35 per share during its bear-market lows to current prices near $1,200.

While Amazon began life as an online bookseller, Bezos has navigated the company into other waters, such as creating e-commerce infrastructure, warehouses and data centers, which it not only used to run its own business but rented out to competitors to expand into new markets.

It was the rental of its data center capacity, under the name Amazon Web Services, that today dominates the market for “cloud computing.” AWS itself had almost $4.7 billion in revenue during the third quarter of 2017, and operating income of $1.17 billion – four times more than the company’s entire net income of $256 million.

The next horizon for Amazon? Groceries. In August 2017, the company closed on its $13.7 billion purchase of Whole Foods Market. That not only gives Amazon a roughly 2% share of the U.S. grocery market – it gives Amazon physical distribution centers from which it can expand its grocery delivery service.

Phil Bak, CEO of ACSI Funds, which is responsible for the American Customer Satisfaction Core Alpha ETF (ACSI), says Bezos has a “customer obsession” he transmits to his team. “They’ve had three big ideas and that’s it: to put the customer first, to invent and to be patient.”

Tim Cook – The Successor Comes Into His Own

- Company: Apple

- Age: 57

- Time as CEO: Aug. 24, 2011-Present

- Quote: “You want to be the pebble in the pond that creates the ripple for change.”

Tim Cook became CEO of Apple (AAPL, $175.01) in 2011, just a few weeks before co-founder and legendary former chief Steve Jobs succumbed to pancreatic cancer.

At the time, many thought Apple’s best days were behind it. However, Cook has proven them wrong, at least from an investment standpoint. Since Cook became CEO, Apple’s stock has split 7-for-1 and gained 220%.

Critics say Apple continues to iterate products under Cook's watch, but not actually innovate – that the creative spark Jobs brought to Apple has been lost. The Apple Watch, for instance, has not been nearly the commercial success that the iPhone was, though at 41%, it’s still the global leader in wearables market share by a mile.

Where Cook has shined has been his ability to make money. He has turned the Services division – which includes Apple Music, the App Store and iCloud storage – into the second-largest Apple business, at $8.5 billion in revenues last quarter. And he has steered Apple to ludicrous gains, re-instated a regular dividend, repurchased $166 billion in shares and grown the cash hoard to nearly $270 billion.

As this was written, Apple was worth nearly $900 billion by market capitalization and well on its way to becoming the world’s first trillion-dollar company.

Kenneth Frazier – The CEO Who Stepped Forward

- Company: Merck

- Age: 63

- Time as CEO: Jan. 1, 2011

- Quote: “America’s leaders must honor our fundamental values by clearly rejecting expressions of hatred, bigotry, and group supremacy, which run counter to the American ideal that all people are created equal.”

Few people outside the investing world had heard of Kenneth Frazier before he left President Trump’s “manufacturing council” in August, which led to its being disbanded. Trump hit Frazier with a tweetstorm on his way out, but Fortune promptly called him “the strongest man in the world.”

Long before this, however, Frazier had the respect of his peers. He became CEO of pharmaceutical giant Merck (MRK, $56.60) in 2011, having previously been general counsel. Since then, the stock is up about 70%, which admittedly is less than the S&P 500’s 110% … but Frazier has been playing from behind.

Many Merck drugs, such as Singulair, have gone off-patent under Frazier – the company’s patents expired on several $500 million treatments in 2017 alone. However, Frazier has been working on refilling the pipeline with drugs such as Januvia for diabetes and Keytruda, a lung cancer treatment best-known for its use by former President Jimmy Carter.

Moreover, Frazier has resisted the temptation to send prices skyrocketing or move profits offshore – pharma trends Trump criticized in his tweetstorm. He even spurned the industry norm by publishing Merck’s company’s average list price increases for its treatments. Frazier’s long-term vision and efforts to keep Americans employed have made him influential, and Merck respected.

Gary Guthart – Leading the Robot Revolution

- Company: Intuitive Surgical

- Age: 51

- Time as CEO: Jan. 1, 2010-Present

- Quote: “We didn’t wake up yesterday and think, “Competitors are coming, we better do something.’”

Most robots perform rote tasks. They assemble cars, they clean carpets, they move things through warehouses. However, the da Vinci surgical system of Intuitive Surgical (ISRG, $366.31) will be your surgeon – or at least perform alongside your surgeon – providing precision never possible before.

Gary Guthart has been CEO of Intuitive Surgical since January 2010, and shares have galloped ahead by about 230% since then. The company is expected to surpass $3 billion in revenues this year, with roughly 25 cents of every dollar hitting the net income line. The company continues to lead its field despite increasing competition from companies like Alphabet (GOOGL) and Johnson & Johnson (JNJ), which are working together to make the robot surgeons that are less expensive and less dependent on human help.

Guthart’s contributions to this technology go way back. He helped create the technology for robot surgery at SRI, formerly Stanford Research Institute, and he has been with Intuitive Surgical since 1996. The key to selling million-dollar robots, he says, is “improving outcomes,” proving that their assistance delivers better results in specific areas of surgery, then training surgeons to work with them.

More than 1.75 million robotics-assisted surgeries have taken place between 2012 and 2016. ISRG has had to answer for the costs of the equipment, and for every mistake they make. Nonetheless, the number of robotics-assisted surgeries continues to rise each year as robots are approved for use in more specialties. One such specialty is diagnosis, where Guthart is working with a Chinese partner to produce devices that identify and treat lung cancer at a lower cost.

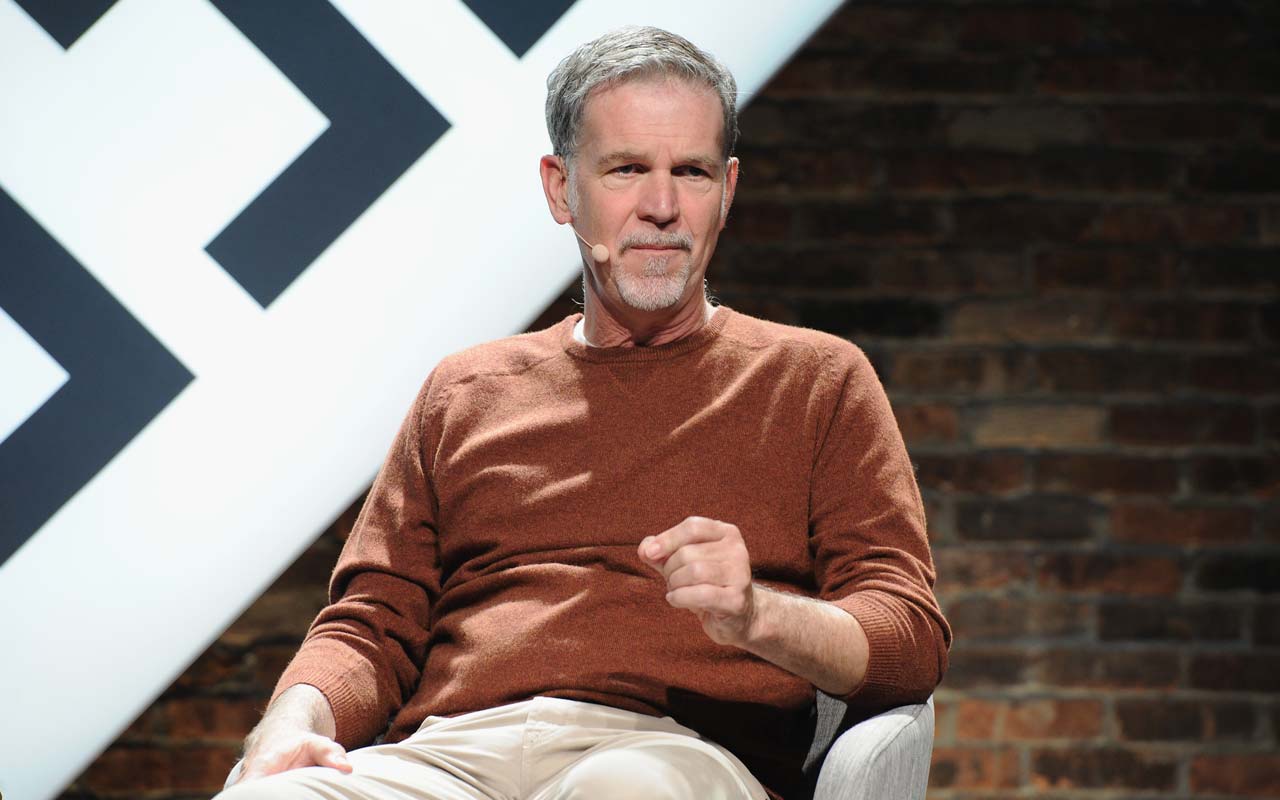

Reed Hastings – TV Becomes a Stream

- Company: Netflix

- Age: 57

- Time as CEO: September 1998-Present

- Quote: “Most entrepreneurial ideas will sound crazy, stupid and uneconomic, and then they’ll turn out to be right.”

No one has transformed entertainment in this decade more than Netflix (NFLX, $188.62) CEO Reed Hastings.

Serial entrepreneur Reed Hastings, who co-founded Netflix in 1997, launched his streaming service in 2007, emulating Google’s YouTube service but with a focus on movies and TV episodes he already had rights to through the DVD business. At the bottom of the bear market, Netflix still was a heavily DVD-lending library worth about $2.5 billion.

However, it’s now an $82 billion force in global streaming video, boasting its own content production arm and more than 100 million customers. Original shows such as House of Cards and Orange Is the New Black have gained critical acclaim and drawn audiences as large as TV networks.

Internally, Hastings is known for generous severance packages that encourage managers to let average performers go, and a PowerPoint deck describing the company’s corporate culture – a pre-employment screening tool that has been viewed millions of times.

Robert Lutts, President and Chief Investment Officer of Cabot Wealth Management, says Hastings applied a technology business model to entertainment. “Profits were secondary to developing market share,” he says. “That’s the new mantra in tech. Having scale gives you power that eventually gives you success.

Stephen Hemsley – Medicine’s Data Man

- Company: UnitedHealth Group

- Age: 65

- Time as CEO: Dec. 1, 2006-Sept. 1, 2017

- Quote: “In the longer term, policy changes that improve health care and the health system play to our strengths.”

Stephen Hemsley stepped down as CEO of UnitedHealth Group (UNH, $221.69) just a few months ago, though he still lives on as executive chairman. But under his guidance, UNH became America’s dominant health insurer. He was profiled by Fortune Magazine upon his retirement as “the most successful CEO of his generation.”

Hemsley, originally an accountant, learned the health insurance business under his predecessor, William McGuire, who was forced out in 2006 after a scandal over backdating options. He has refocused the company on technology and services, but in the only face-to-face interview of his tenure said he was proudest of being able to “humanize” the company, building a more collaborative corporate culture.

Hemsley has succeeded thanks in large part to Optum Group, a technology arm created in 1977, which he expanded rapidly through acquisitions. In addition to delivering electronic health records and performance reports, Optum boasts a health savings account and, since 2015, a pharmacy benefit manager that helps UNH control its costs and price group insurance competitively.

UnitedHealth roared out of the bear market under Hemsley’s watch, climbing nearly 900% from its early 2009 lows through Hemsley’s last day as CEO.

Marillyn Hewson – America’s Arms Merchant

- Company: Lockheed Martin

- Age: 63

- Time as CEO: Jan. 1, 2013-Present

- Quote: “My mother did what all great leaders do. She sparked the growth of future leaders”

Marillyn Hewson, a University of Alabama graduate, hasn’t helmed Lockheed Martin (LMT, $317.19) through the entire bull market, but has made noteworthy progress since becoming CEO in 2013. She was elevated to the role almost immediately after being named chief operating officer – then-CEO Christopher Kubasik was forced to resign for having a personal relationship with a subordinate.

Hewson has been with the company for more than three decades, climbing the ladder in a number of positions in integration, logistics and aeronautics divisions, as well as several vice president roles. She now ranks No. 3 on Fortune’s list of the most powerful women.

Under Hewson, the company has gone even further into defense equipment, buying Sikorsky Aircraft – which makes the Black Hawk helicopter – in 2015, and exiting government information technology. Hewson also has approved a move to invest more in start-ups, via Lockheed Martin Ventures, and less in later-stage companies.

LMT shares have roughly tripled the market under Hewson’s leadership, at 240% gains compared to about 80% for the S&P 500.

Kelly King – The King of Regional Banking

- Company: BB&T

- Age: 69

- Time as CEO: Jan. 1, 2009-Present

- Quote: “We have an educational divide that leads to an economic divide. If you can’t read, and you can’t do simple math, you can’t get a job.”

Ask people who the best banker is, and most will reply that it’s whoever’s in charge of the biggest bank.

That’s not always the case. America’s economic recovery has rewarded the smaller, regional banks that still can acquire small-town operators, and somehow leverage basic banking services (like deposits and loans) to beat the average return. No one better exemplifies this trend better than Winston-Salem, North Carolina-based BB&T Corp. (BBT, $50.39) and CEO Kelly King.

King inherited a reeling company that hit lows around $10 in March 2009, and one of his first major moves after taking over wasn’t a popular one – he cut the dividend from 47 cents quarterly to just 15 cents. However, he has since quintupled the share price, which sits around $50 currently, and has regrown the payout to 33 cents – which doesn’t even represent half the company’s per-share profits.

King led BB&T forward by simply following the old-fashioned method of borrowing deposits from consumers and making loans, as well as acquiring a few banks along the way. BB&T waived its mandatory retirement age in 2012 to keep him on board, and he eventually was named 2015 “Banker of the Year” by American Banker.

Doug McMillon – The World’s Biggest Retailer Fights Back

- Company: Walmart

- Age: 51

- Time as CEO: Feb. 1, 2014-Present

- Quote: “The world needs inclusive growth provided in a sustainable manner. People are demanding it.”

One of the greatest comebacks of the past decade is none other than Walmart (WMT, $98.06)? It’s humorous to think of the idea that the world’s largest retailer would need to come back from anything. But that’s just where Walmart found itself in late 2015/early 2016, a couple years after McMillon – a Walmart lifer who started with the company in 1984, unloading trucks at a Walmart distribution center – filled the role left behind by retired CEO Mike Duke.

McMillon has been willing to try out new ideas, and kill them if they don’t work. For instance, a move toward smaller “Neighborhood Market” stores lifted the stock in 2015, but eventually had to be cancelled.

However, McMillon has made his mark with an aggressive M&A campaign aimed at retooling the company’s e-commerce operations. Over the past couple years, Walmart has spent $4 billion to snatch up properties including ModCloth, Moosejaw and Bonobos. But most importantly, it bought online retailer Jet.com for $3.3 billion and put CEO Marc Lore in charge of Walmart.com.

Since that deal closed in September 2016, Walmart has added nearly $70 billion in market cap. That’s thanks in large part to massive growth in online sales, including a 50% year-over-year spike in its fiscal third quarter. For the first time in years, analysts see Walmart as a feisty underdog – one that stands a chance against the e-commerce behemoth Amazon.com.

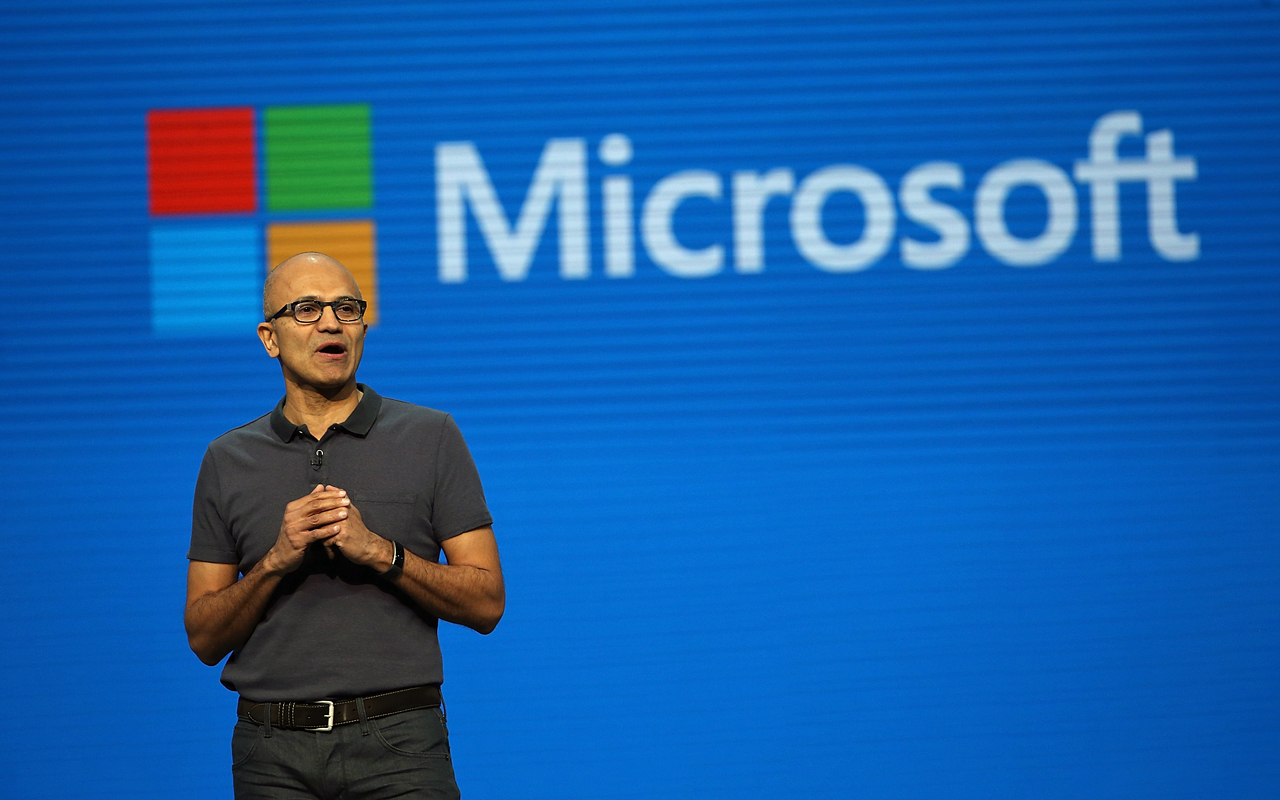

Satya Nadella – The Softer Side of Microsoft

- Company: Microsoft

- Age: 50

- Time as CEO: Feb. 4, 2014-Present

- Quote: “Ultimately it’s not going to be about man vs. machine. It is going to be about man with machines.”

Satya Nadella has only been CEO of Microsoft (MSFT, $85.50) since 2014 – well into the bull market that began in 2009 – but has made one of the clearest impacts in technology during his short time at the helm.

Microsoft went through a long, arduous selection process before choosing Nadella as the company’s third chief. He won the job by suggesting the company focus its money, and attention, on its Azure cloud. His hiring became one of the great business insights of the past decade.

Microsoft’s market cap has more than doubled under Nadella, who has transformed the company from one that sold software on CDs to one that rents its iconic Office productivity suite and other offerings through its cloud. Meanwhile, Microsoft’s Azure cloud computing platform is actually outpacing the growth of Amazon Web Services. Microsoft also is expected to open a data center in South Africa within a few months – once it does, it will have a cloud presence on every continent.

In addition to committing to the cloud, Nadella has committed to openness in software development, a reversal of past policies emphasizing Microsoft’s proprietary technology.

Nadella – a native of Hyderabad, India – graduated from the University of Wisconsin-Milwaukee, and worked at Sun Microsystems before joining Microsoft in 1992. In his autobiography Hit Refresh, he said his biggest challenge was changing Microsoft’s cutthroat corporate culture into something more collegial. He brought CEOs of newly acquired companies to the company’s corporate retreat, then have cross-business teams meet real customers.

Shantanu Narayen – Leading Apps Into the Cloud

- Company: Adobe Systems

- Age: 55

- Time as CEO: Dec. 1, 2007-Present

- Quote: “Preserving the status quo is just not a business strategy.”

Shantanu Narayen has been CEO of Adobe Systems (ADBE, $174.56) since December 2007. Like Nadella, he’s from Hyderabad, India, and he came to the U.S. to earn an MBA from the University of California-Berkeley. Narayen then worked at Apple and co-founded a picture-sharing company called Pictra before joining Adobe in 1998.

When he took over as CEO, Adobe was known for selling packaged graphics software such as Photoshop. It had invented the PDF format for displaying print pages online, and created Flash for displaying complex graphics online. ADBE shares were trading in the low $40s – they now go for nearly $175.

In between, Narayen led Adobe forward. Most notable was the company’s 2012 move to the “Creative Cloud,” offering Photoshop, InDesign, Illustrator and other programs on a subscription basis – about a year after Microsoft did the same with Office 365. Since then, the company has entered new markets such as marketing intelligence and artificial intelligence. Today, most analysts continue to support buying ADBE shares.

Michael Neidorff – King of Managed Care

- Company: Centene

- Age: 74

- Time as CEO: May 1996-Present

- Quote: “We strive to be a responsible partner with the state.”

The passage of the Affordable Care Act in 2010 delivered new demand to the health care system, but also created intense pressure on providers. Much of the new money coming into the system would be for Medicare and Medicaid patients, or strapped middle-income families using the “Obamacare” exchanges.

Under Michael Neidorff, CEO since 1996, Centene (CNC, $102.59) offered a solution. Its managed care system employs doctors, owns facilities and uses technology extensively. It quickly gained market share in serving Medicare and Medicaid contracts, fulfilling them at a profit with a focus on prevention and compliance with doctor instructions. It then entered the ACA markets under the name Ambetter.

While insurers wait for people to become sick, many managed care patients already are suffering from chronic conditions such as diabetes, heart disease, or simple aging. By focusing on preventive care, assuring compliance with doctors’ orders and having doctors on salary, Centene was able to make a profit on the new business.

Centene also has grown through acquisitions, such as its 2016 merger with Health Net – creating the largest Medicaid managed service provider – and its 2017 buyout of Fidelis Care in New York. Neidorff also bought AcariaHealth, a specialty pharmacy, in 2013, and that same year took a majority stake in home health care provider U.S. Medical Management, giving it even more control of costs.

That has paid off in spades for investors holding the stock long-term. CNC shares have split 2-for-1 and reached $100 per share from bear-market lows of $7 on a split-adjusted basis.

Indra Nooyi – The Symbol of Success

- Company: PepsiCo

- Age: 62

- Time as CEO: Oct. 1, 2006-Present

- Quote: “We need to empower women by providing them with the support they need to do their jobs and care for their families.”

Indra Nooyi has been CEO of PepsiCo (PEP, $118.26) since 2006, and was listed as the second-most powerful woman in the world by Fortune in 2015.

Born Indra Krishnamurthy in Chennai, India, she began her career there with Johnson & Johnson, then graduated from the Yale Business School in 1978 – where they will name the deanship of the school after her thanks to a generous endowment – and has remained in the U.S. since.

Before becoming CEO, Nooyi led the spinoff of Pepsi’s restaurants division, now known as Yum! Brands (YUM), and the acquisition of both Tropicana and Quaker Oats. Since PepsiCo bottomed in early 2009, the stock has more than doubled – as has the company’s dividend. Both have outpaced rival Coca-Cola (KO).

Facing growing health concerns, Nooyi split her product lines into products that were “fun for you,” like soda and Lay’s potato chips, “better for you,” such as the low-fat and low-sugar versions of those products, and “good for you,” like oatmeal. She also moved corporate spending into healthier versions of Pepsi products, removing aspartame from Diet Pepsi in 2015.

Nooyi also has used her rising public profile on behalf of her native India, as chair of the India Business Council; for the rule of law, as honorary chair of The World Justice Project; and women’s rights.

Howard Schultz – The Coffee Man Can

- Company: Starbucks

- Age: 64

- Time as CEO: 1987-2009, Jan. 7, 2008-April 3, 2017

- Quote: “You walk into a retail store, whatever it is, and if there’s a sense of entertainment and excitement and electricity, you wanna be there.”

Howard Schultz began his second stint as CEO of Starbucks (SBUX, $57.58) – which he had built from a single shop called Il Giornale – in 2008 as the company was in the early throes of the Great Recession. He made a second legend for himself during his tenure before “retiring” to the position of executive chairman in April 2017.

Schultz’s first move upon rejoining in 2008 was to close all the stores for an evening to focus on training and rebuilding morale. That – and his other initiatives – worked, with the stock up 1,200% since its bear-market lows. The company also was able to reinstitute a dividend that now stands at 30 cents quarterly.

Not everything Schultz tried turned to gold. His attempt to launch a tea shop line, buying Teavana for $620 million in 2012, ended in the closure of all 379 stores in 2017. Starbucks also sold Tazo Tea – a brand it had owned since 1999 – for $384 million this year. The $100 million purchase of San Francisco chain La Boulange in 2012 also was dubbed a failure; the company is now launching its own bakeries in the Roasteries.

Nonetheless, Schultz became known for an “employees-first” culture that’s unusual in the fast food industry. He also helped Starbucks blur the lines between being a food company and a “technology company” – what Schultz dubbed Starbucks because it was among the first retailers to experiment with apps, online payment and coffee reservations. Schultz also launched a series of high-end Reserve Roastery stores, some as large as 15,000 square feet, offering things such as “coffee flights” and coffee poured over locally made ice cream.

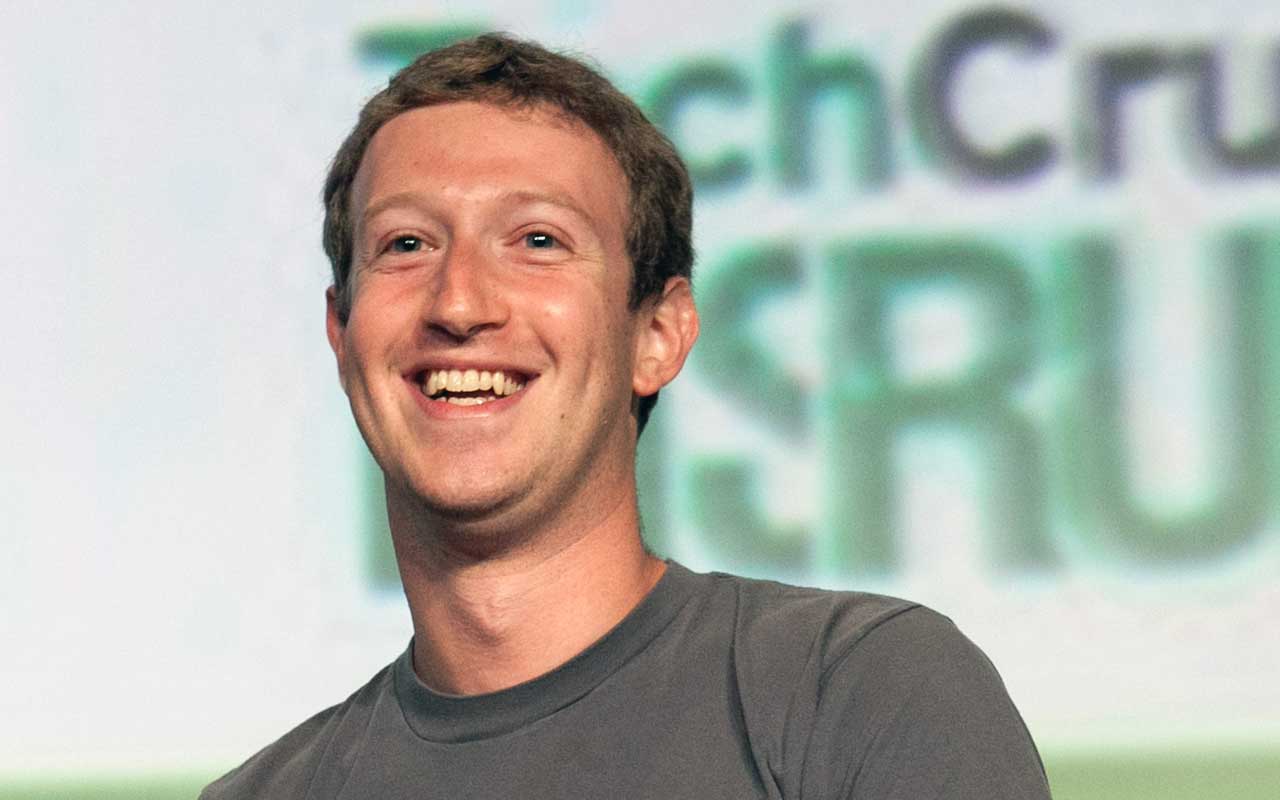

Mark Zuckerberg – Avatar of a Generation

- Company: Facebook

- Age: 33

- Time as CEO: Feb. 4, 2004-Present

- Quote: “The biggest risk is not taking any risk. In a world that's changing really quickly, the only strategy that is guaranteed to fail is not taking risks.”

No one better represents the online revolution of this decade than Facebook (FB, $177.45) founder Mark Zuckerberg, who is at age 33 the world’s fifth-richest person, worth more $56 billion.

The Facebook social media site was founded in 2004 as a way to connect Harvard students with one another. It eventually became a massive enterprise that went public in 2012 at what seemed like an extremely high price of $35 per share. However, by December 2017, shares had reached nearly $180 per share – and the core service boasted more than 2 billion users across the world. Facebook’s reach extends even farther than that, though, when you consider its 1.3 billion MAUs on WhatsApp, 1.3 billion MAUs on Messenger and 800 million MAUs on Instagram.

Facebook, combined with its Instagram and Messenger services, is now a money-making machine, with revenues that have more than tripled since 2013, and should grow by another one-third in 2017, while bringing more than one-third of that money to the net income line.

Zuckerberg also has committed Facebook to building its own cloud networks in 2011, creating the Open Compute Project to keep costs down, building multiple centers in multiple locations and launching an early move toward high-power chips for artificial intelligence applications in 2017. Moreover, Zuckerberg is attempting to bring virtual reality to the mainstream following his 2014 purchase of Oculus VR.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.