5 REITs You Can Buy and Hold for Decades

When it comes to your investments, a decade is a long time.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to your investments, a decade is a long time. Ten years ago, we were just recovering from the 2008 meltdown and the worst recession since the Great Depression. Investors were nursing catastrophic losses. For some, it felt like the world was ending.

Ten years before that, we were in the midst of dot-com mania and the biggest stock market bubble in history. Just a decade before that, no one had ever heard of the internet, and mobile phones were the size of a cinder block. We can only guess what the world will look like 10 years from now.

Real estate traditionally has been a stable store of value. But with the rate of change accelerating in recent years, even the stability of some real estate investment trusts (REITs) has come into question. Amazon.com (AMZN) is taking a wrecking ball to brick-and-mortar retail, Airbnb is turning every spare bed into a viable hotel competitor, and telecommuting is making the traditional office far less critical than it used to be.

For buy-and-hold investors, the key to making money in REITs over the coming decades will be to focus on properties that are as “future-proof” as possible. As fast as the world is changing, we’ll likely always need places to live, medical facilities, warehouses and other mission-critical properties.

Today, we’re going to look at five REITs to buy and hold for decades. After the recent run-up in REIT prices, you don’t necessarily need to run out and buy them today. But find somewhere to write each of these names down so you remember them during a dip. Because if you’re looking for a collection of real estate stocks to throw off the income you’ll need in retirement, each of these fits the bill.

Data is as of Sept. 8. Dividend yields are calculated by annualizing the most recent monthly payout and dividing by the share price.

Public Storage

- Market value: $45.0 billion

- Dividend yield: 3.1%

- Public Storage (PSA, $257.50) is the largest self-storage landlord in the world and benefits from multiple long-term trends.

“Right now, around 1 in 10 Americans rent space in a self-storage facility,” says Brad Thomas, editor of Forbes Real Estate Investor. “Approximately 30 million park their possessions in one of 50,000 self-storage facilities throughout the country.” Thomas adds that millennials represent nearly a third of storage demand and “tend to visit facilities far more frequently than older generations.”

For all the talk about millennials favoring experiences over things, it appears that they’ve managed to accumulate a lot of stuff in their short lives. Public Storage is there to store it for them.

As housing costs continue to rise, smaller urban homes are becoming more commonplace, as is renting. Add to this a long-term trend of downsizing by the baby boomers, and you have the pieces in place for a stable, long-term trend.

Public Storage, which recently hit new all-time highs, isn’t particularly cheap at current prices. But at a time when bond yields are hitting record lows, PSA, and its 3%-plus dividend yield, still has a place among REITs to buy and hold for the long haul. Better still: Over the past decade, Public Storage has raised its dividend a cumulative 264%, or roughly 30% annually on average.

Prologis

- Market value: $53.5 billion

- Dividend yield: 2.5%

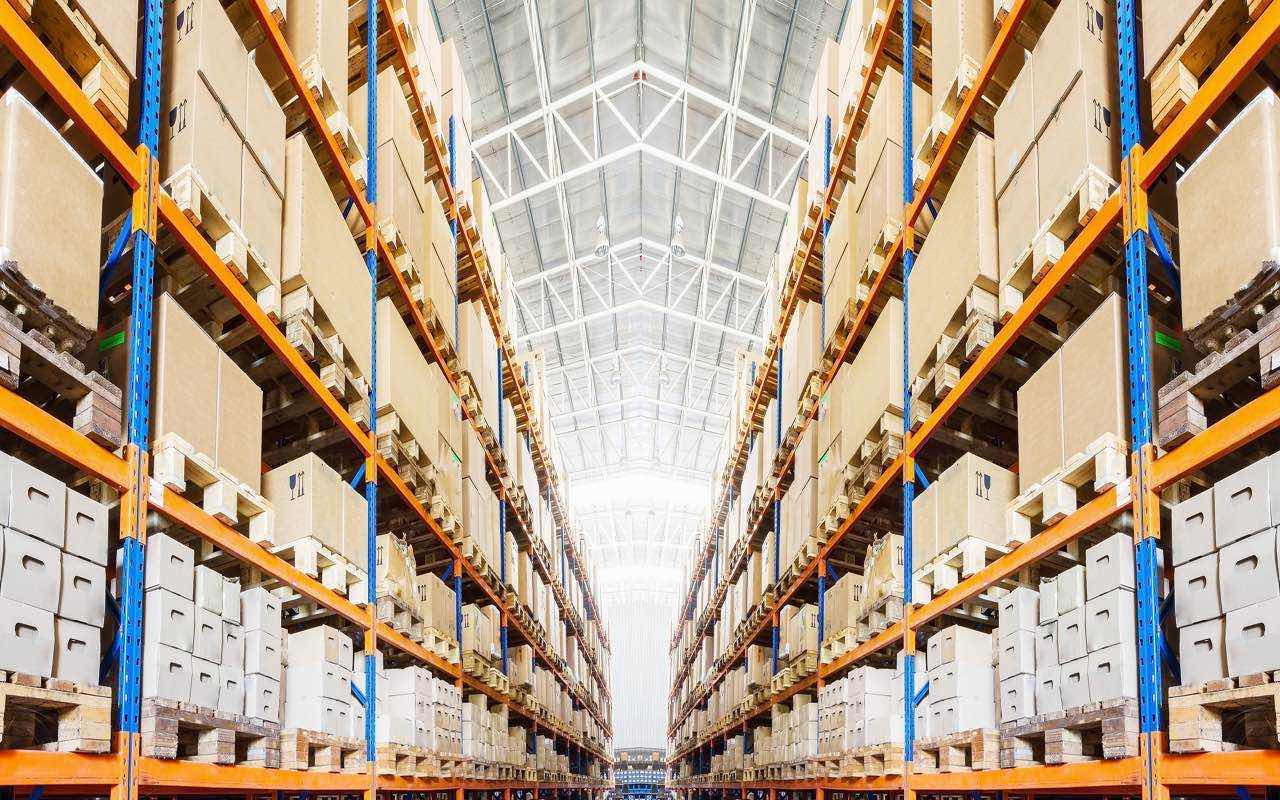

Real estate doesn’t have to be flashy or beautiful to be attractive. In fact, boring is often better. Some of the best deals come from industrial properties far away from the posh parts of town. And while trendy retail centers may rise and fall, one thing is certain: Continued growth in internet commerce will mean strong demand for logistics and distribution centers.

“Industrial real estate tends to be off the radar of most investors because it isn’t sexy,” says Ari Rastegar, founder and CEO of Austin-based real estate developer Rastegar Property. “We have had success with this strategy specifically in Round Rock, Texas, on an industrial redevelopment project. Logistics facilities and warehouses require very little capital spending and, if bought at the right prices, can be wildly profitable.”

To get a piece of this lucrative market, consider shares of Prologis (PLD, $84.79). Prologis is the world’s largest logistics REIT. As of June 30, 2019, the REIT owned or controlled 786 million square feet in 19 countries.

If you believe that Amazon.com is taking over the world, then Prologis – who counts Amazon among its largest tenants – is one way to play that trend indirectly. The REIT isn’t shy about the idea that the e-commerce boom is helping its own growth spurt, typically highlighting some facet of internet retail in its investor presentations to stir up excitement.

Prologis isn’t the highest-yielding REIT to buy out there, as its dividend is a rather modest 2.5%. But if you’re looking for an income stock you can potentially hold for decades, there aren’t too many better positioned than Prologis.

Ventas

- Market value: $28.0 billion

- Dividend yield: 4.2%

Up next is diversified healthcare REIT Ventas (VTR, $75.23). Ventas is one of the largest REITs in the world by market cap and is the second-largest healthcare REIT, behind $37 billion Welltower (WELL).

Ventas has actively managed its portfolio over the years, shifting out of skilled nursing and increasing its presence in senior housing and medical office buildings. Approximately 56% of Ventas’ portfolio is invested in senior housing, with another 19% in medical office/outpatient buildings. The remaining 25% of the portfolio is invested in loans, health systems, research centers and other health-related properties.

It’s easy enough to understand Ventas’ concentration on senior living facilities, as the aging of the baby boomers will create massive opportunities for operators in that space. But contrary to popular opinion, most boomers still are quite young. The largest cohort of the boomers is just now turning 60. Approximately half of the REIT’s senior residents are over the age of 85. This means Ventas still is decades away from seeing the peak in this market.

Meanwhile, investors can be paid handsomely to wait. At current prices, Ventas yields a very decent 4.3%, and the REIT has a long history of raising its dividend.

LTC Properties

- Market value: $2.0 billion

- Dividend yield: 4.6%

On the theme of aging boomers, LTC Properties (LTC, $49.94) also is among REITs to buy and hold for decades.

If you want to know what LTC does, look no further than its ticker symbol. “LTC” is short for “long-term care.” LTC is not a long-term care provider itself, of course. That’s its tenants’ job. LTC Properties simply manages its portfolio, which consists of more than 200 healthcare properties spanning 28 states. The portfolio is divided about 50/50 between senior housing facilities and skilled nursing facilities, with a handful of “other” healthcare properties.

Importantly, about 56% of LTC’s total portfolio is invested in properties that depend on private-paying clients rather than on Medicare or Medicaid. Unfortunately, that still leaves 44% that is dependent on the government.

But remember: LTC isn’t the one operating the facilities; it’s just the landlord. So, even if stingy government reimbursements continue to crimp the industry’s profitability, LTC should be able to keep cashing its rent checks indefinitely.

LTC yields a healthy 4.6% at the moment. And an interesting quirk: It’s a monthly dividend stock, rather than quarterly. That’s nice for aligning your dividend income with your monthly expenses. Or, if you’re reinvesting your distributions, it allows you to compound them just that much faster.

STORE Capital

- Market value: $8.7 billion

- Dividend yield: 3.5%

Amazon.com really is that proverbial bull in a china shop. Along with its e-commerce peers, the company has utterly gutted traditional brick-and-mortar retail.

But remember, not all retail properties are created equal. We might have less need to browse clothing or electronics in a mall or big-box retail shop. But until Amazon finds a way to deliver dentists and barbers to your door, we’ll still need service-oriented retail.

And this is precisely the specialty of STORE Capital (STOR, $37.68).

Store Capital holds a diversified portfolio of 2,389 properties scattered across all 50 states with a weighted-average remaining lease term of 14 years. Around 15% of its portfolio is invested in restaurant properties, but preschools, gyms, auto shops and medical and dental centers all make up significant allocations. Service-oriented properties account for nearly two-thirds of the base rent, with the remaining third divided roughly evenly between retail and manufacturing properties.

Store Capital might not be 100% Amazon-proof. But it’s about as close as you can get while still being in the retail brick-and-mortar space. Better still: It has the faith of legendary investor Warren Buffett.

Charles Sizemore was long VTR as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Municipal Bonds Stand Firm

Municipal Bonds Stand FirmIf you have the cash to invest, municipal bonds are a worthy alternative to CDs or Treasuries – even as they stare down credit-market Armageddon.

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.