10 Blue-Chip Stocks to Put on Your “Buy the Dip” List

The past 83 weeks have not only been quite rewarding for investors, they’ve been history-making.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The past 83 weeks have not only been quite rewarding for investors, they’ve been history-making. The Standard & Poor’s 500-stock index is now into its 83rd week without dishing out a 5% correction, gaining 32% since early November 2016. The blue-chip index’s return through the first few weeks of January 2018 was its best start to a new trading year in more than three decades.

This kind of move brings great risks, and sometimes, great opportunity.

Even the slightest hint of trouble could spark an avalanche of profit-taking by investors who already have big gains in tow. We’ve gotten a taste of that lately, with a couple of sizable setbacks reminding us that the market doesn’t always rise. On the flip side, for longer-minded investors, selloffs in quality blue-chip stocks could be viewed as an attractive buying opportunity.

Here, investors will get a look at some of the biggest near-term pullback risks among Wall Street’s most recognizable names. Each company is doing just fine, to be clear. In fact, most of these names recently have been touted as long-term bullish ideas by Kiplinger.

Those calls are based on each company’s merits, however. These 10 blue-chip stocks probably won’t be able to sidestep a short-term pullback if the recent rally’s weight simply becomes too much to shoulder. But that would be just fine for investors seeking better buy points.

Data is as of Feb. 1, 2018. Click on ticker-symbol links in each slide for current share prices and more.

Boeing

Aircraft maker Boeing (BA, $356.94) is among the Dow Jones Industrial Average’s best dividend growth stocks at the moment. The company has upped its payout for six consecutive years. And given its outlook that calls for the purchase of 41,000 new passenger jets over the course of the next 20 years, it’s one of those stocks you can comfortably buy into and let it simmer for years on end.

But right this second might not be the best time to board the Boeing plane. After rallying more than 100% over the past year and tacking on another 5% in the wake of its recent fourth-quarter report, the stock’s maximum altitude for this flight may have been reached.

Just make sure to get a ticket for the next flight. Boeing expects to deliver between 6% and 7% in 2018 than it did in 2017, driving revenue of between $96 billion and $98 billion, versus analyst expectations of just $93.6 billion.

Cowen & Co. analyst Cai von Rumohr is particularly bullish, recently giving his price target on BA a 30% boost to $415 per share, and that he “can envision a $455 potential valuation on 2019 cash flow.”

Nvidia

Kudos to Advanced Micro Devices (AMD) and even Intel (INTC) for taking aim at the dominance that Nvidia (NVDA, $240.50) enjoys in the graphics processor market. But it’s unlikely that any organization will dethrone Nvidia now that its GPUs has become the processor of choice for artificial intelligence computations, and now that cryptocurrency mining – best achieved using GPUs – has become an industry in and of itself.

That’s why NVDA shares have managed to rally 105% since this time last year.

If we’re calling a spade a spade, however, the big gains were driven by results and hype. Yes, the company is soundly profitable and throwing off strong top-line growth. But NVDA shares now trade at a lofty 50 times 2018’s expected earnings – a tough valuation to sustain no matter how bright the future seems.

Blockchain and cryptocurrencies may be here to stay, but the mania stage of their arrival seems to have run its course. We’ll still need graphics cards to find and process this coded representation of digital money, but the unbridled demand for GPUs to mine them has been tempered. Investors may come to their senses on NVDA soon, with the right nudge, and revalue the stock at a more palatable price.

That's a big part of the reason Goldman Sachs just took Nvidia off of its conviction list. It's still bullish on the company, but no longer sees it as a must-have. Goldman Sachs analyst Toshiya Hari explained, “While we continue to see meaningful upside to FY2019/2020 estimates and maintain our Buy rating, we believe a) the long-term secular growth angle in data center is now better understood and b) near-term dynamics in cryptocurrency demand may lead to increased earnings volatility."

AbbVie

Shareholders of pharmaceutical company AbbVie (ABBV, $116.34) likely enjoyed 2017, but things didn’t get heroic until late January. That’s when ABBV shares soared in response to the company’s fourth-quarter earnings and revenue beat. Its 2018 outlook was better than anticipated too, catapulting shares more than 13% higher in a single day.

That might be as good as it gets for a while, though.

Leerink analyst Geoffrey Porges downgraded the stock to “Market Perform” (equivalent of “Hold”) the next day, believing all the upside had been factored in. “Naturally AbbVie’s stock could offer more upside if all of its mid-to-late-stage pipeline succeeds,” he wrote, “but we have significant revenue contributions in our model already for upadacitinib, risankizumab, Elagolix, and Rova-T.”

As analysts bow out of their bullish stances, it becomes easier for current owners to head to the sidelines, too. They already are, to a small extent. But expect a downturn to be just a temporary setback. In December, Dan Burrows deemed AbbVie one of his top health care picks, before the big bullish move. The stock’s price may have changed in the meantime, the longer-term bullish call hasn’t.

JPMorgan Chase

The past six months have been simply great for shareholders of megabank JPMorgan Chase (JPM, $116.87). The stock has rocketed 24% higher during the time frame, largely on the prospect of higher interest rates, which drive banking profits higher.

But it’s a very delicate balance. Rising interest rates tend to coincide with inflation, and if inflation grows at an out-of-control pace, the economy is stifled.

It remains to be seen whether the recent economic ramp-up is unfurling at ideal Goldilocks pace (meaning it’s neither too hot nor too cold). But ultimately, it may not matter. If the broad market is running into what’s only a short-term headwind, investors are likely to treat bank stocks as if we’re headed toward a nasty recession. JPM may be more sensitive to knee-jerk misperceptions right now than any other stock in focus here. Circumstances matter.

Make no mistake, though. Barring an entry into an actual, full-blown recession, any short-term dip from JPMorgan shares is a buying opportunity. Indeed, it’s UBS analysts’ only “Buy” rating among money-center banks at the moment.

Lowe’s

Like JPMorgan, home improvement retailer Lowe’s (LOW, $103.86) is particularly subject to pessimistic chatter. And like JPMorgan, the potential for continued interest-rate hikes this year – the pros are modeling three increases for 2018 – could be interpreted in two disparate ways.

On the one hand, higher rates could be seen as an indication of economic strength that induces investments in homes. On the other hand, they may bring about a quick end to the growing interest in home-buying and home-building.

Both interpretations are apt to materialize sooner or later, but the former could take shape if investors’ perception of the economy (prodded by a short-term pullback in stocks) goes sour. It’s a problem only because LOW shares have jumped 34% since early November, leaving many investors with profits that they could take off the table at a moment’s notice. Again, it’s a matter of getting the right nudge.

Just don’t sit out for too long if you’re a fan of Lowe’s or were waiting for an ideal entry point. Dan Burrows pointed out in January, Lowe’s boasts more than 50 straight years of increased dividends. The retailer knows how to make a buck, in good times and bad.

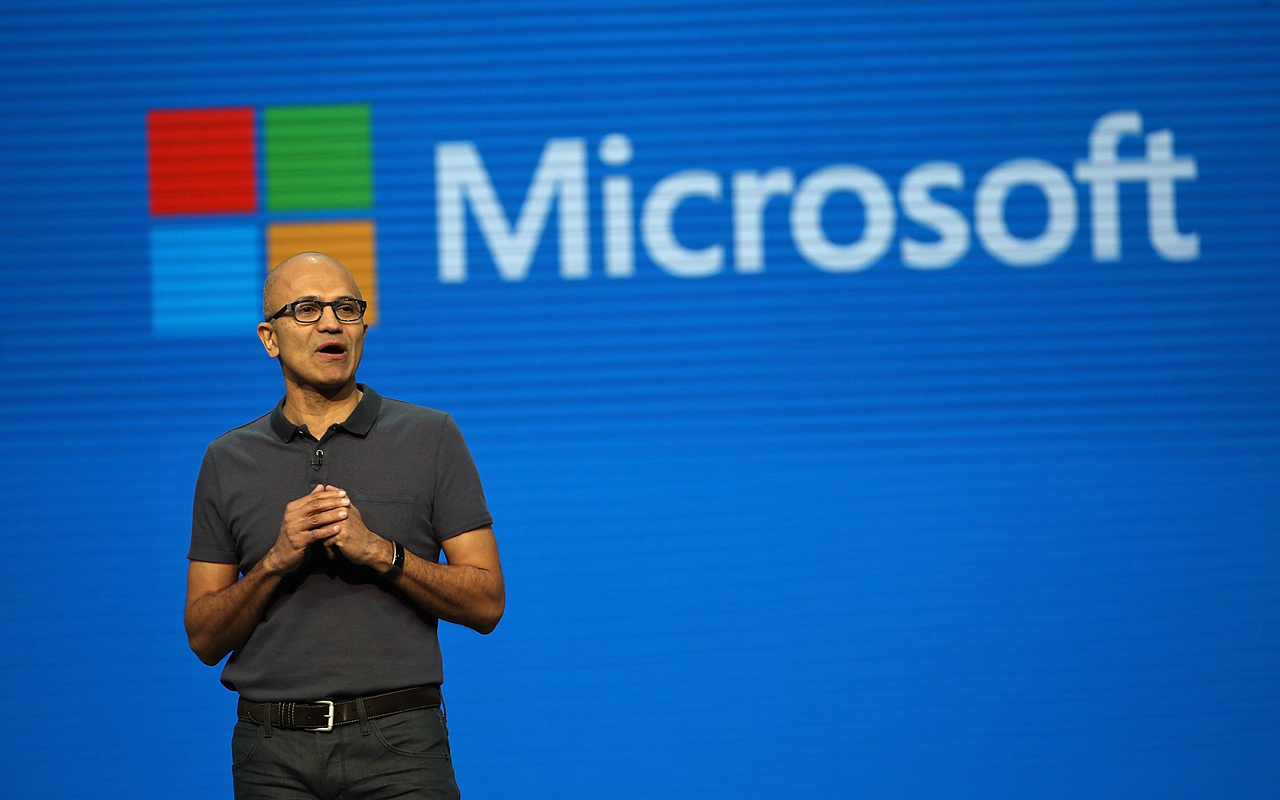

Microsoft

For the record, I was the one to suggest software giant Microsoft (MSFT, $94.26) was one of the top Dow Jones stocks to buy for 2018. I stand by that assessment, too. CEO Satya Nadella is making major headway into the cloud computing market, and the company is redefining technology as a business tool. MSFT has deserved most of the 230% advance it has dished out over the past five years.

All the same, shares are up 45% over the past 12 months and nearly 25% since the end of September. It has been a rewarding ride, but a lot of nervous investors already have their finger on the “sell” button.

The big red flag here is the response to Microsoft’s recently reported fiscal Q2 results. The company beat both sales and earnings estimates for the quarter in question – news that normally would push the stock higher. However, MSFT shares have peeled back a bit. Investors may just see the glass half-empty rather than half-full as long as the market is this toppy.

Recent changes in the way Facebook (FB, $193.09) displays stories, posts, videos and news in users’ main news feed has made the social networking site less of a draw. Collectively, the 1.4 billion daily Facebook users that are now spending 50 million few hours on the site every day.

Shares had mustered a 43% advance in the 12 months prior to Wednesday’s earnings report. That was bolstered a couple more percentage points the day following Facebook’s release … but the initial response was a knee-jerk selloff. That may have been a subtle sign that some shareholders are ready to lock in some gains. Investors can be fair-weather friends.

A closer look at the results reveals more promise, however. Facebook may be struggling in terms of quantity, but it’s making up for it in quality. Last quarter’s revenue was up 47% year-over-year thanks to a breakout in ad prices and a strong performance in the growing mobile ad market.

KeyBanc Capital Markets analyst Andy Hargreaves is on board, saying about last quarter’s numbers: “News Feed changes do not impair the power of the platform. Facebook offers reach, targeting, and ad-unit quality that is difficult to match, and they are the underlying drivers of its growth.”

Ultimately, a pullback is merely a chance to scoop up more FB shares on the cheap.

Walmart

- Walmart (WMT, $105.52), the world’s biggest retailer, has been a busy beaver of late. Between the acquisitions of Jet.com, as well as higher-end online apparel retailers Moosejaw and Bonobos, newfound success in growing its e-commerce revenue – it grew 50% year-over-year during the third quarter – and making the tough decision to close several stores that were beyond rehabilitating, investors have had plenty to think about.

They’ve interpreted the vast majority of this news as bullish. Walmart shares have advanced 55% over the course of the past year, and are up 34% just since the end of September.

But there is such a thing as news fatigue. We may be near or at that point with Walmart. That is, investors soon may be immune to more good news, and therefore unwilling to continue the buy-in that’s driven the impressive move we’ve seen over the last few months. A 4% drop in just four days is a potential signal of exactly that.

Once the rally stops, and if the overall market weakens, that could create just enough doubt to pull the rug out from underneath WMT. But such a pullback likely would be just a short-term affair. In the end, any dip may be viewed as a chance to step into a new position.

Arista Networks

Networking newcomer Arista Networks (ANET, $275.00) shares may have gotten off to a slow start after their mid-2014 initial public offering. But they made up for lost time, soaring more than 360% over the course of the past couple years thanks to explosions in both revenues and earnings. ANET’s up 17% in just the past four weeks, in fact.

That’s an exciting move. But as a result, Arista’s shares trade at a frothy forward-looking P/E of 44 – rich even by tech-newcomer standards.

Deutsche Bank analyst Vijay Bhagavath recently wrote, “There is little room for error at current elevated levels,” but the vulnerability isn’t merely value-based. Bhagavath also wrote that a “resurgent Cisco is starting to make ‘strategic inroads’ into major cloud and content providers.”

There’s enough networking business to go around for Cisco Systems (CSCO) and Arista, to be sure. But that’s not the point. If Cisco is even viewed as a potential threat to Arista’s rapid growth rate, nervous shareholders could easily decide now’s the time to walk away, figuring it’s better to be one of the first ones out than the last.

However, such a pullback would be an opportunity to buy a promising computer networking company at a more reasonable price.

Amazon.com

Last but not least, while it has led the charge of the so-called FAANG stocks, which in turn has led the broad market’s amazing rally, shares of Amazon.com (AMZN, $1,390.00) may be on the verge of a sizable downturn.

Dan Burrows recently pegged Amazon.com as one of the best stocks to own for the next decade, and for good reason. It’s the world’s most recognizable e-commerce company, and it has successfully navigated its way into a variety of offline businesses. A decade is a long time too, to be sure. Shares are getting even toppier, too, with the stock jumping nearly 5% in response to its impressive fourth-quarter earnings report.

However, the choice now is this: Do you buy shares in the wake of the 75% gain they’ve dished out in the past year? Or do you wait for a healthy pullback that could ensue should things get ugly for the market?

If your time frame isn’t measured in decades, you may want to consider locking in some of your profits right now. If it is, you can wait – just don’t sit on the sidelines too long. Stifel analysts recently referred to Amazon.com as the “TB12 of the internet,” referring to New England Patriots quarterback Tom Brady.

It just keeps on winning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

Stocks Bounce Back With Tech-Led Gains: Stock Market Today

Stocks Bounce Back With Tech-Led Gains: Stock Market TodayEarnings and guidance from tech stocks and an old-school industrial lifted all three main U.S. equity indexes back into positive territory.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Nvidia Earnings: Updates and Commentary November 2025

Nvidia Earnings: Updates and Commentary November 2025Nvidia reported fiscal 2026 third-quarter earnings and the leader of the AI revolution delivered the goods once again.

-

Dow Adds 300 Points, Ends Losing Streak: Stock Market Today

Dow Adds 300 Points, Ends Losing Streak: Stock Market TodayThe Dow, the S&P 500 and the Nasdaq head into the weekend on high notes after posting gains for the first time since Monday.

-

I'm 55 With 10 Years Until Retirement, and I've Made $2 Million on Nvidia Stock. What Do I Do with It Now?

I'm 55 With 10 Years Until Retirement, and I've Made $2 Million on Nvidia Stock. What Do I Do with It Now?What do you do with all that appreciated Nvidia stock? We asked a financial expert for advice.

-

Trump's Economic Intervention

Trump's Economic InterventionThe Kiplinger Letter What to Make of Washington's Increasingly Hands-On Approach to Big Business