10 Money-Losing Stock Picks That Might Make You Money Anyway

Here are 10 stock picks that might be losing money today, but shouldn't be forever. It could be a bumpy ride until they get over that hump, but once they do, watch out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors spent much of 2019 gobbling up a healthy helping of recent initial public offerings (IPOs) and other companies that haven't made a penny in profits.

However, the rapid rise and fall of WeWork sobered up Wall Street and knocked many of these money-losing (yet nonetheless popular) stock picks back toward some semblance of reality.

A quick recap: WeWork, a privately held company that specializes in leasing office space to startups, freelancers, and employees of large companies, garnered a $47 billion valuation as recently as January 2019. But ahead of an expected September IPO, diligent investors and members of the media scrutinized the company's financials, revealing corporate governance issues and massive, growing losses that forced WeWork to shelve its offering. The company's valuation plummeted, CEO Adam Neumann was forced to step down and Japanese multinational SoftBank (SFTBY), which heavily invested in WeWork ahead of the offering, recently gave the company a $9.5 billion "rescue" package that valued it at less than $8 billion.

Before the anticipated offering, New Constructs Investment Research analyst Sam McBride called WeWork the "most ridiculous IPO of 2019." Technically, he was wrong – the IPO never happened. Spiritually, he was right on the mark.

WeWork's fall from grace has sent numerous recent IPOs and other net-income-deficient stocks lower. But don't give them up for dead. Unprofitable companies, once they reach a certain scale and their businesses evolve, can end up creating profits and rewarding shareholders with red-hot gains. Just ask longtime Amazon.com (AMZN) shareholders.

Here are 10 stock picks that might be losing money today, but shouldn't be forever. It could be a bumpy ride until they get over that hump, but once they do, watch out.

Data is as of Oct. 28.

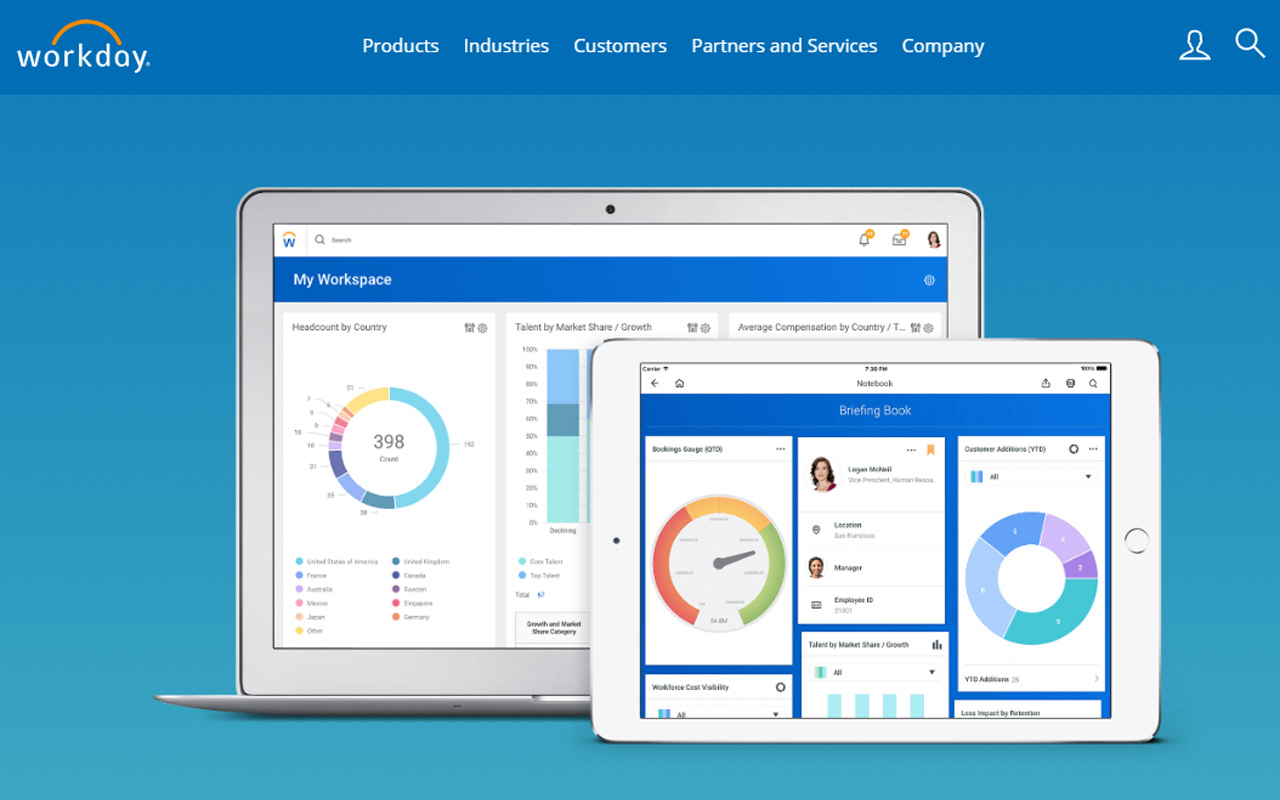

Workday

- Market value: $36.3 billion

It's no coincidence that many cloud-based technology startups typically are losing money when they go public. That's because in many cases, they have subscription-based business models that require economies of scale to be reached before making a profit.

Little by little, inch by inch, stock picks such as Workday (WDAY, $159.40) – which provides enterprise applications for human resources, financial management and business analytics functions – should secure enough customers paying for cloud-based services monthly to cover their expenses and deliver a profit.

Workday is hardly a recent IPO – it went public in October 2012 at $28 per share, and it's worth 470% more than that today. However, while the company regularly announces profits, those are on a non-GAAP (generally accepted accounting principles) basis that includes other factors. On a GAAP basis, its losses have widened from $80 million in fiscal 2012 to $418.3 million in fiscal 2019.

But that doesn't tell the whole story. That $80 million loss came on $134.4 million in revenue – about 60 cents of losses for every dollar in revenue. In fiscal 2019, Workday had narrowed that to 19 cents of losses for every dollar in sales – a reduction of 70%. At that pace, it should be profitable within the next few years.

Workday's most recent quarterly report (Q2 of fiscal 2020) was so positive that the company raised its subscription revenue outlook for the full year. It now anticipates a year-over-year increase of about 28%.

- Market value: $14.2 billion

Pinterest (PINS, $26.25), the social media app for visually sharing ideas and interests, went public on April 17, 2019, at $19 per share. It didn't have nearly the buzz as the 2017 IPO for Snapchat parent Snap Inc. (SNAP), another image-based social media company.

But long term, it does seem to have a better pathway to profitability.

On Aug. 1, Pinterest announced second-quarter results that were off-the-charts good. Revenues exploded by 62% year-over-year to $261.2 million. Its adjusted (non-GAAP) losses were $24.5 million, or 6 cents per share – 28% narrower than the year-ago quarter's losses, and 2 cents per share better than what analysts were expecting.

Pinterest also hit 300 million monthly active users (MAUs) during the second quarter, 30% higher than a year earlier. Of its 300 million MAUs, 28% were in the U.S., where average revenue per user (ARPU) is $2.80.

Its opportunity outside the U.S. is tremendous. While ARPU is just 11 cents, that's still 123% better than it was a year ago. Meanwhile, international revenues nearly tripled, while its monthly active user count outside the U.S. jumped by 38% year-over-year.

"We also continued to grow and diversify our advertiser base and improve advertisers' ability to measure the effectiveness of their ad spend," CEO Ben Silbermann said in the Q2 press release. "This is part of our larger and ongoing effort to create value for businesses on Pinterest."

Revenues could top $1.1 billion this year. And the company expects annual profitability by 2021.

Twilio

- Market value: $14.5 billion

Twilio (TWLO, $106.40) is a cloud communications company whose platform allows its customers to embed voice, messaging, video and email into their software applications so they can communicate more effectively with their customers. It's a leader in CPaaS (communications platform as a service), and Gartner projects that between 2016 and 2021, end-use spending on CpaaS infrastructure will grow by 50% annually, putting TWLO in the driver's seat for growth.

Twilio is one of the best-performing public offerings in recent memory. It priced at $15 per share in June 2016 and has soared nearly 610% since then.

But the company loses money. In fact, it loses a lot.

In the first six months of fiscal 2019, Twilio shed $129.1 million in red ink, which was 171% more than the $47.7 million it lost in the year-ago period. That's despite revenues that jumped 84% year-over-year to $508.2 million.

You can choose to see the glass as half-full. The company expects to earn a non-GAAP profit (after adding back stock-based compensation and other one-time items) of 17 to 18 cents per share this year. That follows an 11-cent non-GAAP profit in 2018, which flipped from a 19-cent loss in 2017. While the goal should be to invest in stocks that ultimately generate significant GAAP profits, the fact that Twilio has turned the corner and is making a growing non-GAAP profit is a big step in the right direction.

Twilio finished the second quarter with 161,869 active customer accounts compared to 57,350 a year earlier. Part of the increase includes customers acquired from its $3 billion acquisition of SendGrid in February 2019. SendGrid specializes in helping software developers with email communications.

And in August, Twilio launched Verified by Twilio, which allows companies to make phone calls that identify who's calling and the purpose of the call. The initiative is intended to improve the rate at which consumers answer calls. Approximately 70% of consumers won't answer a phone call from an unknown number.

Roku

- Market value: $17.1 billion

Netflix (NFLX) CEO Reed Hastings recruited Anthony Wood to build him a streaming player in 2007. Hastings decided to cancel the project – but not before giving Wood $6 million to create the first Roku (ROKU, $146.88) streaming player a few months later in 2008.

Wood has been Roku's CEO ever since.

In addition to the sale of streaming players, Roku generates revenue by licensing its Roku TV operating system to manufacturers of Smart TVs and by selling advertising on the Roku platform, which includes the Roku Channel that it launched in September 2017.

Recently, William Blair analysts suggested that Roku could be growing at a faster pace than Netflix at the same stage in its development.

"In our view, Roku will experience similar phased stages of international growth as Netflix did during its international expansion," analyst Ralph Schackart said in a note to clients Aug. 27. "Looking at Roku's most recent nine quarters against those of Netflix in the beginning stages of Phase II, Roku, on average, achieved 9% quarter-over-quarter growth, compared with Netflix's average of 8%."

Roku currently has 30.5 million active users. Schackart believes the platform will hit 80 million active accounts and $4.5 billion in revenue by 2025. The same analyst estimates that its ARPU will grow from $21.06 as of the second quarter of this year to $58 by 2025.

Roku itself expects annual revenue to hit at least $1.1 billion this year. It will lose money this year, though it expects adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) to be positive, in the realm of $30 million and $40 million. When you consider that Needham analysts expect Roku expected to capture a large piece of the $70 billion ad market in the U.S., the company is at least positioned to flip to a GAAP profit within the next few years.

Just be careful. Kiplinger recently cited Roku among several stocks to watch if the market trembles, and for good reason. The sellers knocked Roku down by as much as 44% in September amid streaming offerings by Apple (AAPL) and Comcast (CMCSA), though it has recovered much of that lost ground ever since, in part because Apple announced its new Apple TV+ streaming service would be available on Roku devices. Still, it's among the highest-priced of these stock picks at nearly 19 times sales, so it could face heavy downside pressure in a broader market dropoff.

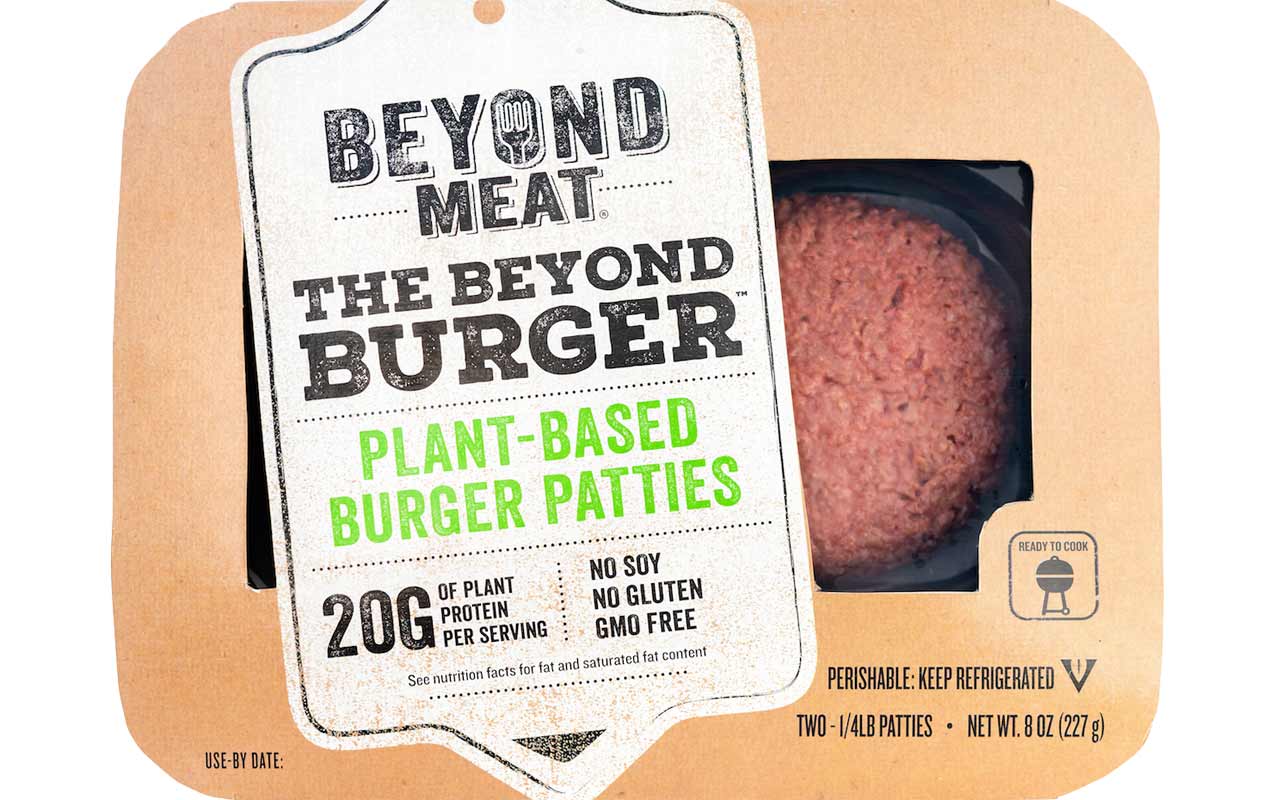

Beyond Meat

- Market value: $6.3 billion

Beyond Meat (BYND, $105.41), the manufacturer of plant-based meat alternatives, has helped spark a monumental change in the way people think about protein.

Five years ago, few had heard about the term "flexitarian" – people who normally go meatless, but occasionally will eat meat or fish. Now, people who practice this diet represent Beyond Meat's most important customers.

When Beyond Meat founder Ethan Brown started the company in 2009, his vision was to build meat products from plants to meet the global challenges of health, climate change, natural resource use and conservation, and animal welfare. While Brown was trying to save the planet, it would be hard to sustainably do so while targeting vegetarians and vegans, who account for 5% and 3% of America's population, respectively, according to a 2018 Gallup poll. But a 2018 OnePoll study shows that 38% of Americans consider themselves flexitarian.

So, Brown created plant-based products such as the Beyond Burger that are indistinguishable from their animal-based counterparts. Beyond Meat's sales have grown impressively, from $16.2 million in 2016 to $87.9 million in 2018. But most important is its most recent achievement. Late Oct. 28, BYND reported its first quarter of GAAP profitability – 6 cents per share worth of earnings, compared to a $1.45-per-share loss in the year-ago quarter – on revenues that shot 250% higher to $92 million.

BYND shares responded Oct. 29 by dropping as much as 24% in midday trading, which goes to show you there's more to stock performance than just profitability. In Beyond Meat's case, its lockup period – an amount of time after an IPO during which employees and certain pre-IPO investors can't sell their shares – expired, allowing these people to finally cash in their stock.

Like Roku, Beyond Meat is among the more vulnerable stock picks out there because of its still-lofty valuation. Moreover, it remains to be seen whether this quarterly profit is just a one-off blip. But clearly, its operations are pointed in the right direction.

Dropbox

- Market value: $8.3 billion

Cloud-based file-storage company Dropbox (DBX, $20.07) reported Q2 2019 results on Aug. 8. Unimpressed investors sent the stock down by 13% in response, but Canaccord Genuity analyst Richard Davis had a hard time understanding the reaction.

"All relevant forward-looking metrics for Dropbox were favorable this quarter, highlighting a revenue beat, upside to margins and operating cash flow, better-than-expected ARPU and a raised revenue forecast," Davis wrote in a note to clients. "Ah, but the cup is 1/8th empty, and yes indeed Dropbox sinned against the Excel orthodoxy of unguided expectations."

Davis is referring to the company's second-quarter ARPU of $120.48, which was just 3.3% higher than the year-ago period's $116.66 ARPU and slightly off last quarter's $121.04.

However, Dropbox CFO Ajay Vashee attributed the decline to currency movements and said it should recover during the second half of the year. As the company continues to roll out the Dropbox app, which will completely change the user experience for the better, Dropbox's ARPU should rise.

"With the new Dropbox, you have a dedicated app. It's much more of a workspace instead of just a static list of files," CEO Drew Houston said during the earnings call. "You see people and you see comments, and you see activity and all the things you'd expect in a real-time collaborative app. We think it is a generationally different experience from what other folks have."

Dropbox's redesigned product will continue to make its way into the hands of clients over the remainder of 2019. You can expect there to be a few bumps in the road. But the company has produced positive quarterly net income, and long term, it should become consistently GAAP-profitable for years to come.

Medallia

- Market value: $3.6 billion

San Francisco-based Medallia (MDLA, $28.20) is a leader in experience management (XM) software – a disruptive type of business analytics that helps companies interpret data signals from its customers to improve the overall customer experience.

Medallia went public on July 18 at $21 a share, but while its current price is 34% higher than that, you can thank a massive first-day pop. Shares have lost a third of their value since peaking on July 26.

While it's early in the development of experience management, Medallia's SaaS (software-as-a-service) platform uses deep learning-based artificial intelligence technology to help its customers understand the end buyer. In the process of capturing experience data, Medallia analyzes more than 4.9 billion experiences annually while performing more than 8 trillion calculations daily to help its customers make better business decisions.

Wells Fargo's Philip Winslow was among the analysts to weigh in on Medallia early after the offering. He initiated the stock at Outperform (equivalent of Buy) and a $45 target price.

"The XM market remains early in its adoption lifecycle, as enterprises are only beginning to value the importance of … incorporating experience data ('X-data') with operational data ('Odata') to improve their businesses," Winslow wrote in a note to clients. "We believe Medallia is well positioned to capture the growing interest in XM with its holistic enterprise-grade solution."

Medallia's prospectus says that the total addressable market of its experience management platform is $68 billion. That means its $246.8 million in revenues for the fiscal year ended Jan. 31, 2019, were roughly three-tenths of a percent of its addressable market. If that's not potentially lucrative enough, Medallia recently broadened its focus from large enterprises to also solicit business from midsize companies.

Thus, the fact that MDLA lost $82.2 million in that same fiscal year shouldn't be a concern for a business that's on the ground floor of a burgeoning opportunity.

Freshpet

- Market value: $1.8 billion

Some stock picks, such as Freshpet (FRPT, $50.50), offer products that are so good, it seems impossible for them to remain in a sea of red ink on a permanent basis.

Freshpet got its start in Secaucus, N.J., in 2006. Its mission was to deliver real, fresh food to dog and cat owners. A note from the author: I'm a cat owner who has experienced firsthand how Freshpet's products kept my skinny, geriatric cat from starving to death. She wouldn't eat anything. Then Freshpet came along, and she couldn't stop eating. She's gone now, but the product extended her quality of life for at least two years.

Pets are a massive market, and it's only getting bigger. The global pet-care market reached $125 billion in 2018 and is expected to expand to $203 billion by 2025. It has grown every year since 2001, including during the Great Recession. These are all reasons that even the exchange-traded fund (ETF) industry has gotten involved, with the ProShares Pet Care ETF (PAWZ) launching in late 2018.

Freshpet's revenues for the second quarter increased 26.1% year-over-year to $60.1 million. The company expects revenues to exceed $244 million for the full year, which would be an increase of more than 26%. The company hasn't provided net income guidance for the full year, but it does expect adjusted EBITDA to exceed $29 million, for 43% year-over-year growth. The analyst community sees the company flipping from a non-GAAP loss of 15 cents per share last year to a 5-cent profit in 2019.

As it continues to execute its Feed the Growth strategy, Freshpet will continue to expand its distribution in the U.S., Canada and U.K. Slow and steady wins the race.

Trupanion

- Market value: $810.6 million

Trupanion (TRUP, $23.30) is another under-the-radar play on the pet economy. It has been providing monthly medical plans for cats and dogs in the U.S., Canada and Puerto Rico since 2000.

The knock against stock picks such as Trupanion is that the payouts for insurance claims often end up being much higher than the subscription revenues received by the company. Thus, the business model is inherently flawed.

"What's really, really problematic for them is that it's a grand exercise in adverse selection," PAA Research founder Bradley Safalow said back in August. "They are acquiring their pets at the vet. So you're already acquiring pets that in a lot of cases already have health problems."

However, the argument does fail to recognize that many pet owners take their animals to the vet to ensure they remain in perfect health. Much like humans go to the doctor for an annual physical or the dentist for routine cleanings.

Also, the company's business model is extremely close to making money. The analyst community sees Trupanion slipping from a 3-cent-per-share loss in 2018 to a 13-cent deficit this year, but they project a 2-cent profit in 2020.

Trupanion's total subscription pets enrolled during the second quarter (461,314) has climbed by 60,281 pets over the past 12 months. That's an additional $41.3 million in annual sales based on the monthly average revenue per pet of $57.11. If it continues to grow total subscription pets enrolled by 15% a quarter, Trupanion's scale will eventually work for it, not against it.

LendingClub

- Market value: $1.2 billion

LendingClub (LC, $13.23) got its start in 2006 as an online lending marketplace that brings borrowers and investors together to facilitate affordable credit. Today, it originates $1 billion in loans each month and has become a leader in the $130 billion personal loans industry.

It has been frustrating, from a profitability standpoint. After 13 years in business, including five as a publicly traded company, it's still not generating positive earnings. But in the three years since Scott Sanborn has become CEO, the company's losses have dropped dramatically as it achieves scale and finds ways to operate more efficiently.

LendingClub receives anywhere from 0% to 6% of the initial principal amount of a loan it originates for participating banks. In the second quarter, it originated $3.13 billion in loans, up from $2.73 billion in the first quarter and $2.87 billion in the fourth quarter. It also purchases some of the loans.

LendingClub expects to generate between $765 million and $795 million in net revenues this year, after $694.8 million in 2018 and $574.5 million in 2017. Meanwhile, it expects an adjusted loss of between $20 million and $5 million, down significantly from an adjusted loss of $32.4 million in 2018 and $73.6 million in 2017.

"Since I took over as CEO three years ago, we have increased originations by 60% while tripling contribution dollars," Sanborn told investors during its August conference call about earnings. "We are leveraging our data, scale and marketplace model to execute with discipline and compound our competitive advantages."

Should it continue on this improvement, LendingClub could be making money by sometime in 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Stock Market Today: Stocks Fall as Bitcoin Booms

Stock Market Today: Stocks Fall as Bitcoin BoomsWhile the main indexes retreated ahead of tomorrow's inflation data, Bitcoin hit its highest level in two years.

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?