10 Roughed-Up Stocks to Buy for a Recovery Rally

A stock’s price can fall for many reasons.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A stock’s price can fall for many reasons. The company may no longer be performing as it’s expected to. The industry or sector could be temporarily out of fashion. Sometimes, a weak market simply pulls good stocks down with it.

As long as the issue isn’t fundamental (and long-term), you can still buy low and eventually sell high, even in a toppy market like today’s.

Today, we will look at 10 stocks with market caps between $10 billion and $200 billion that have fallen hard in the past year, but that some analysts think are poised for a bounce-back. These companies are in a variety of industries – everything from banking to pharmaceuticals to industrial products to consumer goods.

Clearly, each of these stocks comes with some risk given the bearish drivers that have dragged them down by 20%, 30%, even 40%. But investors should be less concerned about why these stocks fell in the past, and more concerned about whether they realistically can rebound from here. None of these stocks need to reach their old highs for investors to neatly profit – the underlying companies just need to follow through on proposed ways to increase shareholder value.

Here’s a look at 10 battered stocks to buy for their recovery potential.

Data is as of Aug. 14, 2018.

Allergan

- Market value: $62.3 billion

- 52-week loss: 20.6%

Just a few years ago, Dublin-based pharmaceutical giant Allergan (AGN, $184.46) had an agreement in principle to merge with American pharma blue chip Pfizer (PFE) in a $160 billion deal. But the U.S. government stopped that with new rules to limit inversions – deals based on companies moving overseas to get a better tax rate.

AGN shares have struggled since, including a 20% decline in the past year versus 14% gains for the Standard & Poor’s 500-stock index. But they might be ready to recover.

Allergan is best-known for Botox – a treatment for wrinkles that generated $3.2 billion in revenues last year for this $62 billion company. That very treatment is also a reason for bullishness among some of the 15 analysts who rate AGN a buy.

Dean Dillard, Senior Research Analyst at USAA in San Antonio, believes the long-term value of Botox and related treatments remains underappreciated, and that Allergan’s guidance for the rest of the year looks conservative. He also sees Allergan focusing on aesthetics, eye care, gastrointestinal diseases and central nervous system disorders, which “should drive better decision making and capital allocation.”

Richard Grasfeder, Senior Portfolio Manager at wealth manager Boston Private, also likes Allergan’s core business. Products such as Botox are bought directly by consumers, not insurance, “so it is less exposed to regulatory price pressures and constants.” He also sees a disconnect between Allergan’s current value and what he expects to see in future cash flows – “situations we like to take advantage of.”

“We believe the stock is well positioned to close the gap between sentiment and fundamentals to the upside over the next several years, particularly if some pipeline products surprise to the upside,” Grasfeder says.

Celgene

- Market value: $64.0 billion

- 52-week loss: 31.2%

- Celgene (CELG, $92.71) is best known for Revlimid (lenalidomide), a derivative of thalidomide that came on the market in 2004 as a treatment for the blood cancer multiple myeloma. Revlimid racked up $8.2 billion in sales in 2017, which was 17% better than in 2016.

Despite the success of its blockbuster drug, CELG shares have fallen by more than 30%. Most of that came last October, when a Crohn’s Disease drug candidate – that Celgene paid more than $700 million for – failed its Phase III stud, forcing Celgene to take hundreds of millions in writedowns. Moreover, sales of psoriasis drug Otezla disappointed.

Celgene has begun to turn things around of late, however, gaining about 7% over the past month versus a flat market.

USAA’s Dillard sees several “pipeline events” (late-stage drug trials) that could boost the stock later this year. This includes trials of luspatercept, a treatment for pre-leukemia syndrome; JCAR17, a hematology drug; and fedratinib, a myelofibrosis drug acquired earlier this year. He also thinks prescription data for Otezla looks robust and could lead to upward revisions to earnings estimates.

Sebastian Leburn, Senior Portfolio Manager at Boston Private, calls Celgene “a compelling investment at today’s prices” as the company moves beyond Revmilid, which had been 60% of sales. New drugs “should clear the pervasive negative sentiment that exists around the stock,” and it could gain 50% at “an undemanding multiple of 13 times next year’s earnings.”

Deutsche Bank

- Market value: $22.8 billion

- 52-week loss: 35.7%

- Deutsche Bank (DB, $11.49), the largest bank in Germany with assets of roughly $1.8 trillion, is also one of the world’s most troubled. A series of scandals – including a Russian money laundering scandal that cost $630 million in penalties – forced Deutsche Bank to drastically shrink its U.S. investment bank in April. Shares have plunged 35% in a year as a result.

The company generated a little momentum in July thanks to a strong second-quarter report under new CEO Christian Sewing, but the stock has given up just about all its advances.

Still, some analysts think Deutsche Bank can claw its way back.

Daniel Milan, managing partner of Cornerstone Financial Services in Birmingham, Michigan, was among those impressed by the June quarter report. “If their financial performance has any legs, this stock could have runway to rebound through the remainder of the year,” he says. The optimism would be based “on the strategic turnaround plan” from Sewing.

Constantin Gurdgiev, a Russian economist and an adjunct professor of finance at Trinity College in Ireland, says Deutsche Bank is now “nearing a natural exhaustion of adverse news” and “pivoting toward lower-risk, higher-margin activities.”

Bulls are the minority here, however, with just three buys versus 11 holds and 13 sells. So if you believe Milan and Gurdgiev that DB can rally, and choose to buy in … well, you would be early to the party.

Dish Network

- Market value: $16.3 billion

- 52-week loss: 39.4%

- Dish Network (DISH, $35.64) has seen its stock fall by nearly 40% over the past year as investors – and consumers – sour on satellite TV. The company has been hoarding spectrum for years but hasn’t become a major wireless player, either. So why buy?

The answer lies in that spectrum.

Founder and CEO Charlie Ergen is asking for patience. That’s because DISH may invest up to $10 billion to build out a 5G network specifically aimed at connecting devices rather than people. He said at a recent event that because the company didn’t participate in networking earlier, it has “a clean sheet of paper.” Some financial analysts are questioning the value of that spectrum hoard, however, and asking whether DISH can still compete with incumbents.

To buy Dish today, you must either believe Ergen’s line or believe he might be willing to find another buyer for that spectrum – possibly a “cloud czar” such as Alphabet (GOOGL), which easily could swallow all of $16 billion Dish Network if it wanted too, not to mention the additional buildout investment.

Cornerstone’s Milan looks at Comcast’s (CMCSA) battle against 21st Century Fox (FOXA) for control of European media giant Sky (SKYYY), and he sees a potential catalyst for Dish. “Theoretically that would benefit DISH, due to them owning the streaming service Sling.” Much of the bidding was based on Sky’s European streaming assets, not its satellites.

Analysts of Dish Network are divided, with 11 calling it a buy and 10 calling it just a hold. The average rating, however, is overweight.

You may have to wait for this one to come good, but high-end spectrum is valuable.

General Electric

- Market value: $104.6 billion

- 52-week loss: 52.5%

- General Electric (GE, $12.35) has lost more than half its value over the past year, following a disastrous stretch that saw the fall of former CEO Jeff Immelt amid its disastrous 2015 acquisition of Alstom, once trumpeted as the company’s “best purchase ever.”

New CEO John Flannery tried to wrap his arms around the company’s problems, but not in time to save GE from being booted from the Dow Jones Industrial Average, where it had been a fixture since 1896, nor in time to save the dividend from a massive cut.

The plan now? GE will spin off GE Healthcare, cash out the company’s stake in Baker Hughes, a GE Company (BHGE) – the oil drilling company of which it owns 62% – shrink GE Capital and hope for a turnaround in GE Power, the unit that dragged the whole company down.

Gurdgiev, of Trinity College, believes the bad news might finally be baked into the shares, and that a case can be made to buy it based on the idea that the move down was overdone. “Buying stock in the company now means you believe GE can get more from the pieces it had than it was worth as a single entity,” he says.

If the best time to buy something is when there is “blood in the streets” – when everyone else is down on it – then now is a good time to buy GE.

Incyte

- Market value: $14.2 billion

- 52-week loss: 46.8%

- Incyte (INCY, $66.45) is a pharmaceutical company focused on treatments for cancer, with products such as Jakafi and Iclusig. Its business model is to find new drugs, and new uses for existing drugs, that can be patented and delivered to patients profitably.

INCY shares have fallen in value by about 47% over the past year, including a down-gap in March after its cancer drug epacadostat failed in a combination trial with Merck & Co.’s (MRK) Keytruda to extend the lives of late-stage melanoma patients.

The stock has recovered slightly since then, helped by March earnings that narrowed losses, and success by Jakafi in a combo trial for the treatment of patients with steroid-refractory acute graft-versus-host disease (GVHD), a post-transplant condition in which donor stem cells or bone marrow attack the patient.

Analysts have lately become very optimistic on Incyte, with 13 of 19 now calling it a buy, and none suggesting you sell it.

Newell Brands

- Market value: $9.7 billion

- 52-week loss: 59.1%

- Newell Brands (NWL, $20.65) lost half its value over the past year in the wake of its acquisition of Jarden Corp., which now appears to be a failure. The company tried to integrate disparate brands such as Elmer’s Glue and Yankee Candle, Rubbermaid containers and Jarden class rings. Martin Franklin, an investor who fathered the conglomerate strategy at Jarden, finally gave up and quit the board, which also sent the stock down.

The company announced poor cash flow in December, and the numbers didn’t improve during the March quarter, prompting Newell to announce plans to sell off about 10 of its businesses, including Rubbermaid Commercial Products, Goody headache powders and Rawlings sporting goods, cutting its manufacturing and warehousing ability in half.

Since that announcement the stock has recovered slightly. Milan of Cornerstone Financial notes that investor Carl Icahn recently got into the stock, and he is “historically good at squeezing short-term value” out of his investments. That, combined with stock buybacks, could increase the value of NWL shares.

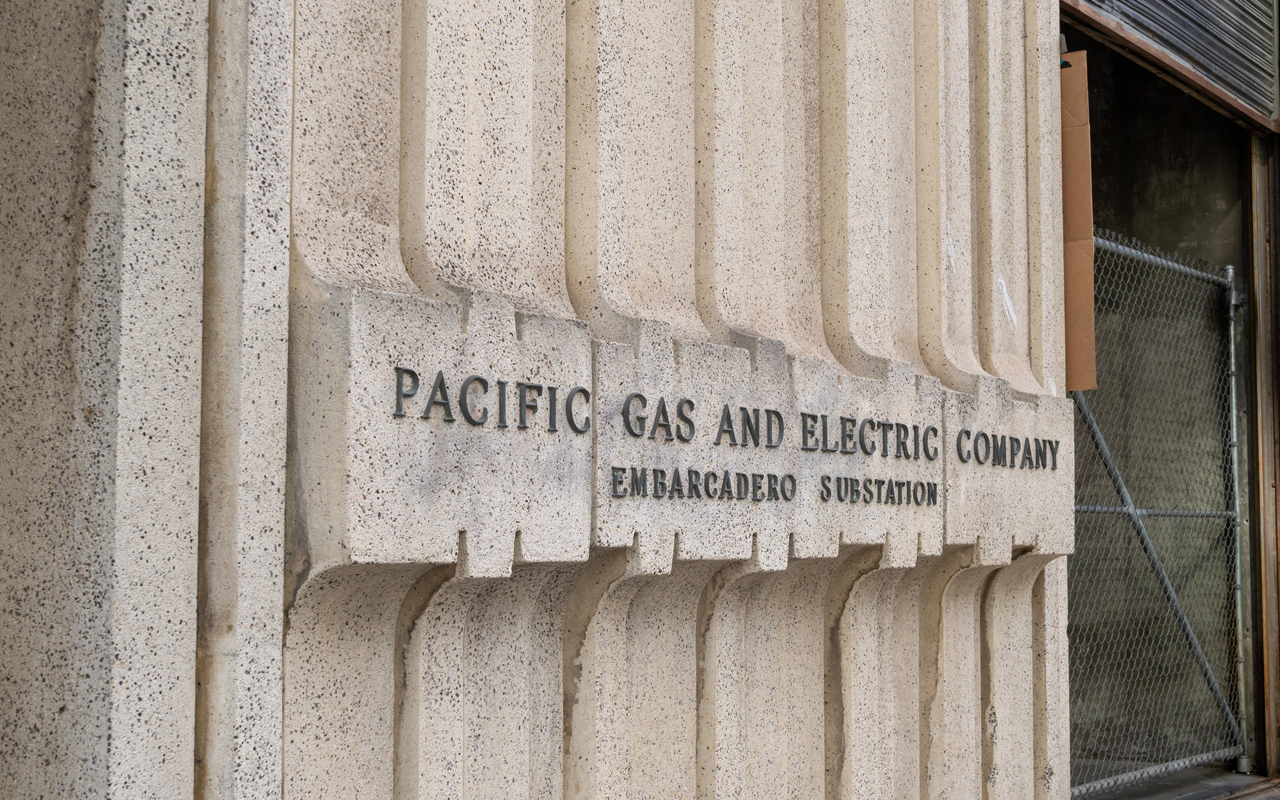

Pacific Gas & Electric

- Market value: $22.6 billion

- 52-week loss: 36.6%

- PG&E (PCG, $42.84) fell hard in October, and again in January, making this one of the most volatile – but perhaps bargain-priced – utility stocks around. The stock has dropped 36% over the past year, versus a small gain for the Dow Jones Utility Average.

The reason for the fall: October wildfires in Napa County’s wine country, which eventually were blamed on the company. The company took a $2.5 billion charge on that in June, and more pain may be ahead. A bill in the California legislature aimed at limiting its damages has yet to pass, and the company’s liabilities for the fires may top $10 billion.

The $10 billion bill, on top of $17 billion in existing debt, could hold the stock back for years to come. But capping those losses would result in a snapback.

Bob Schwartz, of Ave Maria Mutual Funds, says PCG appears to have assumed a worst-case scenario, saying, “the shares are unduly depressed and have substantial recovery potential.”

Trinity College’s Gurdgiev says the legal issues still loom large but are partially offset by lower natural gas costs. He believes the fire damage risk will be priced into the stock by September, and the stock could then rise, “assuming input costs do not reverse,” meaning assuming natural gas prices don’t increase.

Regeneron Pharmaceuticals

- Market value: $39.6 billion

- 52-week loss: 22.3%

- Regeneron Pharmaceuticals (REGN, $366.23) is a pharmaceutical company that both is apt at finding new drugs, and has a special method for developing them.

This helped the company to two great peaks, in late 2015 and June 2017, when it sold for more than $500 per share. After that second peak, however, prices fell to below the $290 level before its more recent rise. Still, it remains more than 20% lower during the past year.

Regeneron lives and dies by its ability to create new drugs through its Velocisuite, a set of tools for quick genetic manipulation and testing.

But the company is best-known for Eylea, used to treat macular degeneration that can cause blindness, and it is now testing cemiplimab – an immunotherapy that operates against cancer and could compete with Merck’s Keytruda and Bristol-Myers Squibb’s Opdivo.

Cornerstone’s Milan thinks further gains could be coming. “While not as cheap as it once was, it still looks like it could be a buy with both short and long-term growth potential,” he says.

Zachary Mannes, lead analyst with StockWaves at ElliottWaveTrader.net, said in May he began looking for confirmation of a long-term technical bottom, and that it could now head toward new highs.

Symantec

- Market value: $11.4 billion

- 52-week loss: 35.2%

Computer security, the business of Symantec (SYMC, $18.66), is the bleeding edge of software technology. Cops must protect every door into software, while hackers only need open a single window to access your secrets.

Symantec is best-known for consumer products like Norton Security, but the company lately has focused its efforts on the more lucrative area of securing corporate data, where competition is fiercest and the state of the art changes regularly.

The stock is down a little more than 35% since this time last year, and most of that plunge occurred in May, after the accuracy of its results was challenged by S&P Global Market Intelligence. An internal audit followed, but the company’s past results still are under a cloud as of this writing.

Auditors will be looking closely at companies Symantec has bought over the last two years, including Blue Coat Systems, Lifelock, Fireglass, Skycure and SurfEasy, on which it has spent more than $6.5 billion. If the audit finds few real problems “the stock could rise significantly,” Milan says.

Boston Private’s LeBurn is avoiding SYMC until the audit but likes its “endpoint” products for PCs and phones, as well as its cloud access security broker capabilities, which are valued by enterprises. These “have the potential to drive some share gains in cybersecurity spend,” he says.

If Symantec can get through the audit with minimal damage, SYMC looks attractive. But you have to contend with that “if.”

Dana Blankenhorn was long REGN as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Bond Basics: Zero-Coupon Bonds

Bond Basics: Zero-Coupon Bondsinvesting These investments are attractive only to a select few. Find out if they're right for you.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

What's the Difference Between a Bond's Price and Value?

What's the Difference Between a Bond's Price and Value?bonds Bonds are complex. Learning about how to trade them is as important as why to trade them.